Where Can I Get Printable Tax Forms?

Filing taxes can be a daunting task, but having access to printable tax forms can make the process a bit easier. Whether you’re an individual, a business owner, or an organization, there are various sources where you can obtain printable tax forms to help you fulfill your tax obligations.

In this comprehensive guide, we’ll explore the different ways to get printable tax forms, the types of forms available, their benefits, and provide tips and instructions on how to access, print, and use them effectively. So, let’s dive in and simplify your tax preparation journey.

Printable Tax Forms Sources

Get your hands on printable tax forms, no hassle, no stress! We’ve got you covered with the lowdown on where to score these forms for free.

The interweb is a treasure trove for printable tax forms. Check out these top websites:

- IRS.gov: The official website of the Internal Revenue Service, where you’ll find every tax form you can imagine.

- TaxACT.com: Another reliable source for a wide range of tax forms, both federal and state.

- FreeTaxUSA.com: As the name suggests, this site offers a bunch of free tax forms for your convenience.

Government websites are another solid option for printable tax forms:

- USA.gov: The official website of the US government, with a comprehensive collection of tax forms.

- State government websites: Many state governments provide printable tax forms specific to their state.

Last but not least, your local library might also have a stash of printable tax forms. It’s worth giving them a ring or popping in to check.

Types of Printable Tax Forms

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at9.44.37AM-f619eccef6a84e3ab500003fcc088ce8.png?w=700)

Navigating the complex world of taxation can be a daunting task, especially when it comes to finding the right tax forms. Fortunately, a wide range of printable tax forms is available to cater to various needs and circumstances. These forms are essential for individuals, businesses, and organizations to accurately report their income, expenses, and other financial information to tax authorities.

Printable tax forms are typically categorized based on their relevance to specific entities, such as individuals, businesses, and organizations. Each category encompasses a range of forms designed for different purposes, from reporting income and deductions to calculating taxes owed and filing returns.

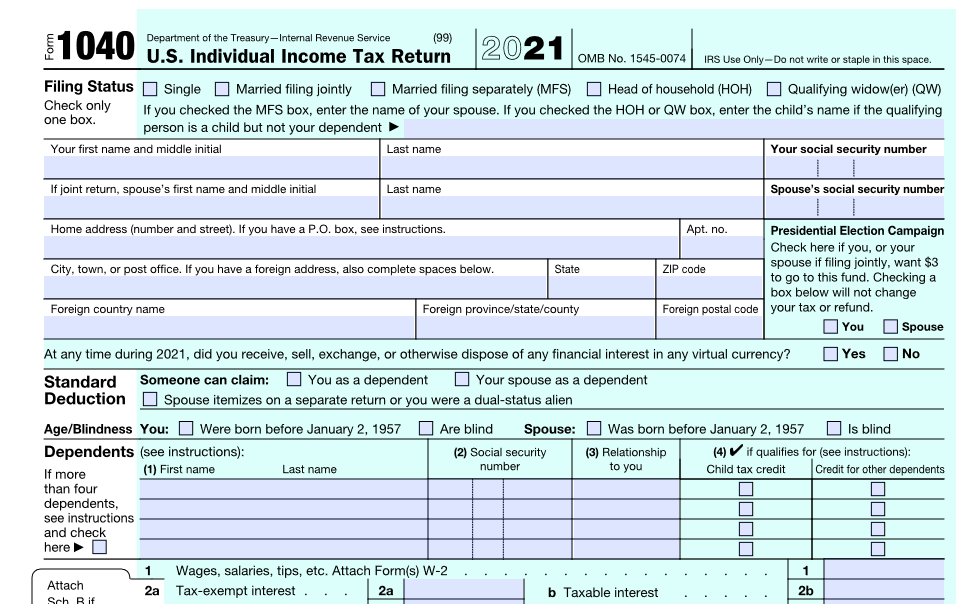

Forms for Individuals

- Form 1040: The primary tax form for individuals, used to report income, deductions, and credits.

- Form 1040-EZ: A simplified version of Form 1040 for individuals with straightforward tax situations.

- Form 1040-A: A tax form specifically designed for individuals who itemize deductions.

- Form W-2: A form provided by employers to employees, summarizing wages and taxes withheld during the year.

- Form 1099-MISC: A form used to report income received from non-employee sources, such as self-employment or contract work.

Forms for Businesses

- Form 1120: The primary tax form for corporations, used to report income, deductions, and credits.

- Form 1120-S: A tax form for S corporations, which pass through income and losses to shareholders.

- Form 1065: A tax form for partnerships, which also pass through income and losses to partners.

- Form 941: A form used to report quarterly payroll taxes for businesses.

- Form 940: A form used to report annual unemployment taxes for businesses.

Forms for Organizations

- Form 990: A tax form for non-profit organizations, used to report income, expenses, and other financial information.

- Form 1023: A tax form used by non-profit organizations to apply for tax-exempt status.

- Form 5500: A tax form for employee benefit plans, such as 401(k) plans and pension plans.

- Form 990-T: A tax form for educational institutions, used to report unrelated business income.

- Form 990-PF: A tax form for private foundations, used to report investment income and other financial information.

Benefits of Using Printable Tax Forms

Printable tax forms offer numerous advantages, making them a convenient and cost-effective option for individuals and businesses alike. These forms are readily accessible online, allowing taxpayers to download and print them at their convenience. This eliminates the need to visit tax offices or wait for forms to arrive in the mail, saving valuable time and effort.

Convenience and Accessibility

Printable tax forms provide unparalleled convenience. Taxpayers can access these forms from anywhere with an internet connection, 24 hours a day, 7 days a week. This flexibility allows individuals to complete their tax returns at their own pace, without the constraints of office hours or postal delays.

Cost-Effectiveness

Printable tax forms are free to download and print, eliminating the costs associated with purchasing pre-printed forms or using professional tax preparation services. This cost-effectiveness is particularly beneficial for individuals with simple tax returns or those on a budget.

Flexibility and Control

Printable tax forms offer taxpayers complete control over the tax preparation process. They can take their time completing the forms, refer to supporting documents as needed, and make corrections or revisions without having to start over. This flexibility allows individuals to ensure accuracy and minimize the risk of errors.

s for Printing Tax Forms

Accessing and downloading printable tax forms is a straightforward process that can be completed in a few simple steps. To begin, navigate to the official website of the relevant tax authority. Once there, locate the section dedicated to printable tax forms. This section typically offers a comprehensive list of all available forms, organized by category or type. Select the specific form you require and click the download button.

After the download is complete, you can proceed to print the tax form using your preferred device. If using a computer, open the downloaded file and select the print option from the file menu. Ensure that your printer is properly connected and has sufficient paper and ink. Alternatively, if using a mobile device, you can transfer the downloaded file to a USB drive and connect it to a compatible printer. Follow the on-screen prompts to print the tax form.

Common Issues Encountered While Printing Tax Forms

Occasionally, you may encounter certain issues while printing tax forms. One common issue is incorrect printer settings. Ensure that the printer is set to the correct paper size and orientation. Additionally, check if the printer driver is up to date and compatible with your operating system. Another potential issue is a lack of available ink or toner. Replace empty cartridges promptly to avoid interruptions during printing.

Tips for Using Printable Tax Forms

Getting your taxes done can be a daunting task, but using printable tax forms can make the process a little easier. Here are a few tips to help you organize, complete, and store your printable tax forms:

Organize Your Forms

- Gather all of the tax forms you need. This includes federal forms, state forms, and local forms.

- Create a system for organizing your forms. You can use a folder, a binder, or even a digital filing system.

- Keep your forms in a safe place where you can easily access them.

Complete Your Forms Accurately

- Read the instructions carefully before you start filling out your forms.

- Use a pen to fill out your forms. This will help to prevent errors.

- Double-check your work before you submit your forms.

Store Your Forms Safely

- Keep your completed tax forms in a safe place for at least three years.

- You can store your forms in a fireproof safe, a lockbox, or a digital filing system.

- Make sure to back up your digital files in case of a computer crash.

FAQ Corner

Can I download printable tax forms from the IRS website?

Yes, the IRS website provides a wide range of printable tax forms and instructions for both individuals and businesses. You can access them at www.irs.gov.

Where can I find printable state tax forms?

State tax forms can usually be found on the official website of your state’s department of revenue or taxation. You can also visit the Federation of Tax Administrators website at www.taxadmin.org for links to state tax agencies.

Is it safe to use printable tax forms?

Yes, as long as you obtain the forms from official sources such as the IRS or your state’s tax agency. These forms are regularly updated to reflect any changes in tax laws and regulations.

Can I print tax forms on any type of paper?

It’s recommended to use high-quality paper specifically designed for printing tax forms, as some forms may require specific paper weight or dimensions. Check the instructions on the form for any specific requirements.

What should I do with completed printable tax forms?

Once you’ve completed the forms, make copies for your records and mail the originals to the appropriate tax authorities. Keep the copies in a safe and organized manner for future reference.