What Is A W0 Form? A Comprehensive Guide to Its Definition, Structure, and Importance

In the realm of finance and legal compliance, the W0 form stands as a crucial document that plays a significant role in various contexts. Whether you’re an individual managing your finances or an organization navigating tax reporting, understanding the intricacies of the W0 form is essential.

This comprehensive guide will delve into the definition, structure, and importance of the W0 form, providing you with a thorough understanding of its purpose and significance. We will also explore the process of completing and submitting the form, addressing common errors and pitfalls to ensure accurate and efficient processing.

Definition of W0 Form

A W0 form, also known as a Waiver of Deductions and Allowances form, is a document used by employees to inform their employers that they wish to claim zero allowances on their tax code. This means that they will not receive any tax-free personal allowance, and all of their earnings will be taxed at the basic rate.

Claiming zero allowances can result in a higher tax bill, but it can also lead to a larger refund at the end of the tax year. This is because the more allowances you claim, the less tax you will pay each month, but the less you will receive back when you file your tax return.

There are a number of reasons why an employee might choose to claim zero allowances on their W0 form. Some of the most common reasons include:

* They have other sources of income that are not taxed, such as savings interest or dividends.

* They expect to earn more than the personal allowance in the current tax year.

* They want to receive a larger refund at the end of the tax year.

It is important to note that claiming zero allowances is not a decision that should be made lightly. It is important to weigh the pros and cons carefully before making a decision. If you are unsure whether or not you should claim zero allowances, you should speak to a tax advisor.

Legal and Financial Implications of the W0 Form

Claiming zero allowances on your W0 form can have a number of legal and financial implications. Some of the most important implications include:

* You will pay more tax each month.

* You may be eligible for a larger refund at the end of the tax year.

* You may be liable to pay penalties if you do not pay enough tax during the year.

* You may be more likely to be audited by HMRC.

It is important to be aware of the legal and financial implications of claiming zero allowances before you make a decision. If you are unsure about the implications, you should speak to a tax advisor.

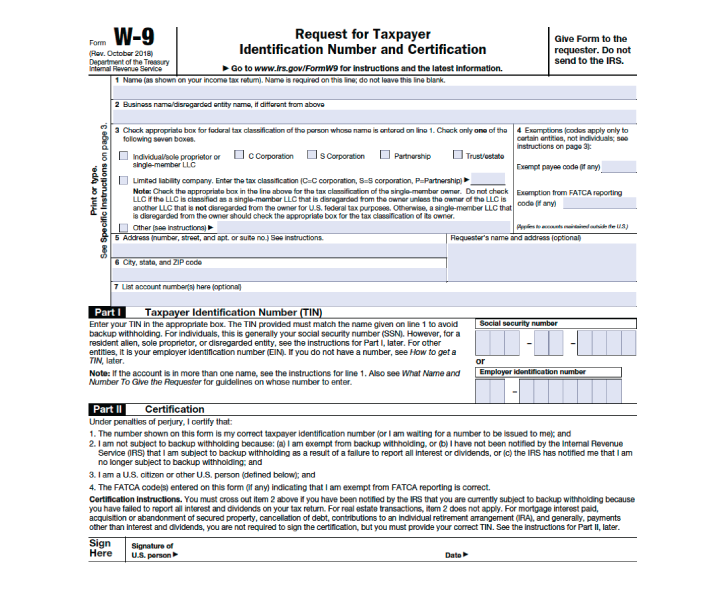

Structure and Contents of the W0 Form

The W0 form is a structured document with specific sections and fields designed to gather relevant information. Understanding the organization and completing each section accurately is crucial for a successful application.

Key Sections and Fields

The W0 form consists of several key sections, including:

- Personal Information: This section collects basic personal details such as name, address, contact information, and date of birth.

- Educational Background: Here, you provide details of your educational qualifications, including degrees, diplomas, and certifications.

- Work Experience: This section Artikels your professional history, including job titles, employers, and responsibilities.

- Skills and Abilities: Showcase your skills and abilities relevant to the role you’re applying for, such as technical expertise, communication skills, and problem-solving abilities.

- References: Provide contact information for individuals who can provide professional references.

Completing each section accurately and thoroughly is essential for several reasons. It ensures that the hiring manager has a clear understanding of your qualifications and experience. It also demonstrates your attention to detail and commitment to providing accurate information. By taking the time to fill out the form carefully, you increase your chances of making a positive impression and securing an interview.

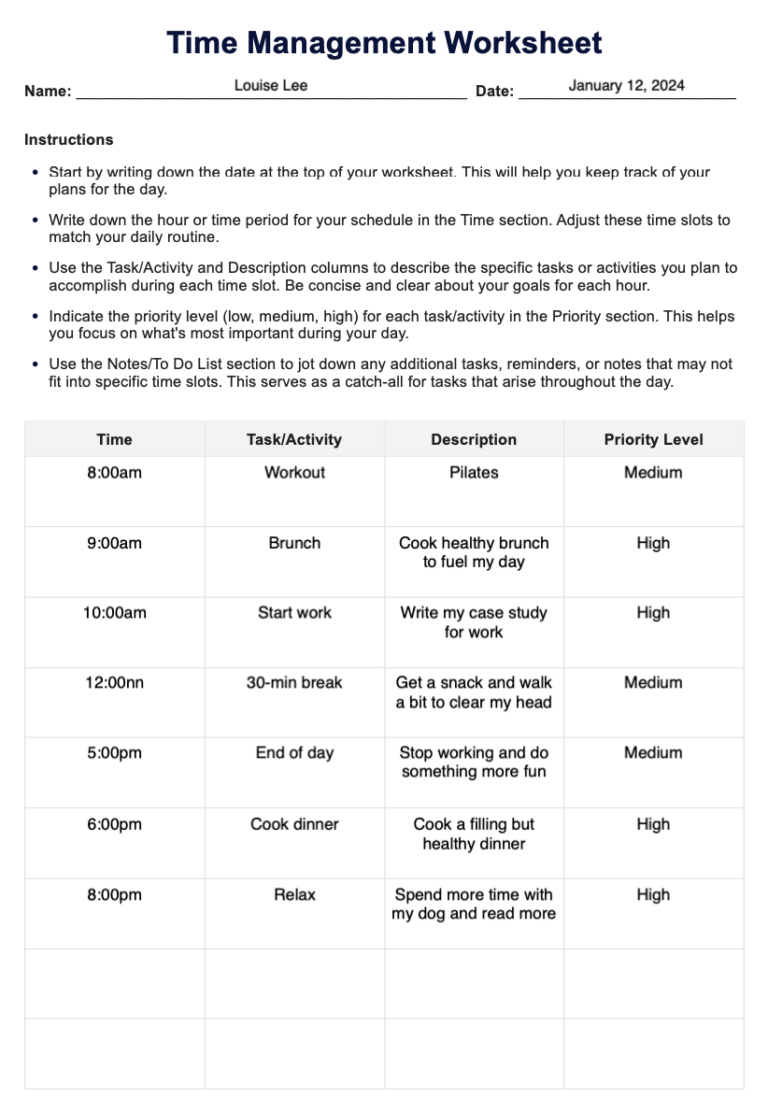

Completing the W0 Form

Filling out the W0 form can be a breeze, fam. Just follow these easy steps, and you’ll be sorted in no time.

Before you start, make sure you’ve got all the info you need. This includes your personal details, your employer’s info, and details of your income and expenses.

Gathering the Necessary Information

- Your full name, address, and contact details

- Your employer’s name, address, and contact details

- Your National Insurance number

- Details of your income from employment, self-employment, and other sources

- Details of your expenses

Step-by-Step Guide to Completing the W0 Form

- Section 1: Personal Details – Fill in your name, address, and contact details.

- Section 2: Employment Details – Enter your employer’s name, address, and contact details.

- Section 3: Income – List all your income from employment, self-employment, and other sources.

- Section 4: Expenses – List all your expenses that are related to your employment.

- Section 5: Declaration – Sign and date the declaration at the bottom of the form.

Common Errors and Pitfalls to Avoid

- Leaving sections blank – Make sure you fill in all the relevant sections of the form.

- Entering incorrect information – Double-check all the information you enter to make sure it’s accurate.

- Missing deadlines – Make sure you submit your W0 form by the deadline.

Submission and Processing of the W0 Form

Submitting the W0 form is straightforward and can be done through various channels. The most common method is to submit the form online through the official government website. Alternatively, you can also submit the form in person at a designated government office or by post.

Once submitted, the W0 form undergoes a processing timeline that involves several stages. Initially, the form is reviewed for completeness and accuracy. If any discrepancies or missing information are identified, the applicant may be contacted for clarification or additional documentation.

Approval or Denial

Upon successful review, the W0 form is then assessed based on the eligibility criteria and supporting documentation provided. The outcome of the submission can be either approval or denial.

- Approval: If the form meets all the requirements and the applicant is deemed eligible, the W0 form will be approved, and the applicant will be granted the necessary benefits or services.

- Denial: If the form does not meet the eligibility criteria or if the supporting documentation is insufficient, the W0 form may be denied. The applicant will be notified of the reasons for denial and may have the opportunity to appeal the decision.

Importance and Applications of the W0 Form

The W0 form plays a crucial role in various financial and legal contexts, making it an indispensable document for individuals and businesses alike.

Financial Planning

- The W0 form provides a comprehensive overview of an individual’s income and expenses, enabling them to make informed financial decisions.

- It assists in budgeting, tax planning, and investment strategies.

Tax Reporting

- The W0 form is a key document for tax reporting purposes, as it serves as the basis for calculating income tax liability.

- It ensures that individuals and businesses meet their tax obligations accurately and on time.

Legal Compliance

- The W0 form is a legal requirement for certain transactions, such as obtaining a mortgage or applying for government benefits.

- It helps prevent fraud and ensures that individuals and businesses are acting in accordance with the law.

Industry-Specific Applications

- In the insurance industry, the W0 form is used to assess an individual’s income and risk profile.

- In the banking sector, it is utilized for loan applications and creditworthiness evaluations.

- In the real estate market, the W0 form is required for mortgage applications and property transactions.

Frequently Asked Questions

What is the purpose of the W0 form?

The W0 form is primarily used to report income and expenses related to self-employment or business activities. It serves as a crucial document for tax purposes, providing the necessary information for calculating tax liability and determining eligibility for various tax deductions and credits.

Who is required to complete the W0 form?

Individuals who earn income from self-employment or business activities, such as freelancers, contractors, and small business owners, are required to complete the W0 form.

What are the key sections of the W0 form?

The W0 form consists of several key sections, including income, expenses, deductions, and credits. Each section requires specific information to be accurately completed, ensuring a comprehensive overview of your financial activities.

What are common errors to avoid when completing the W0 form?

Common errors to avoid include mathematical errors, incorrect reporting of income or expenses, and missing or incomplete information. Careful attention to detail and thorough review of the form before submission can help prevent errors.

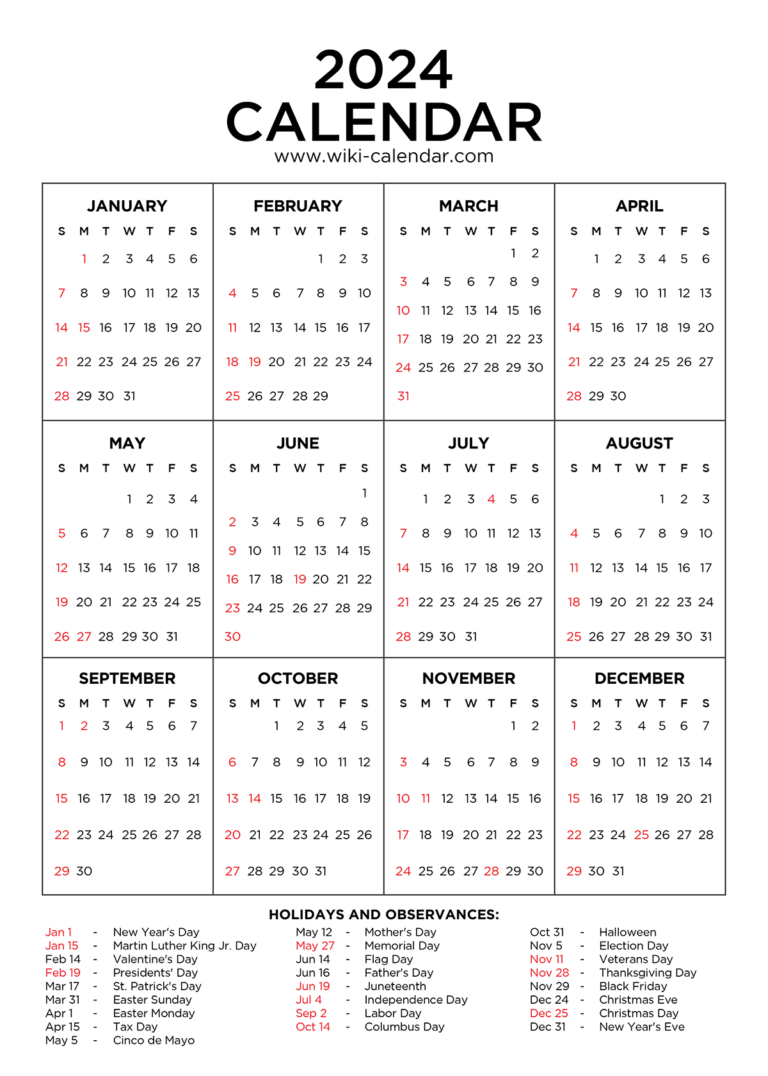

What is the deadline for submitting the W0 form?

The deadline for submitting the W0 form varies depending on your country or region. It is crucial to check with your local tax authorities to determine the specific deadline applicable to you.