W9 Printable Form 2024: A Comprehensive Guide for Understanding, Completing, and Utilizing

Navigating the complexities of tax forms can be a daunting task, but understanding and utilizing the W9 Printable Form 2024 is crucial for businesses and individuals alike. This essential document serves as a vital tool for reporting income and ensuring compliance with tax regulations. In this comprehensive guide, we will delve into the purpose, significance, and intricacies of the W9 form, providing step-by-step instructions for its completion and exploring its various applications. By equipping you with the necessary knowledge and resources, we aim to simplify the process and empower you to confidently manage your tax responsibilities.

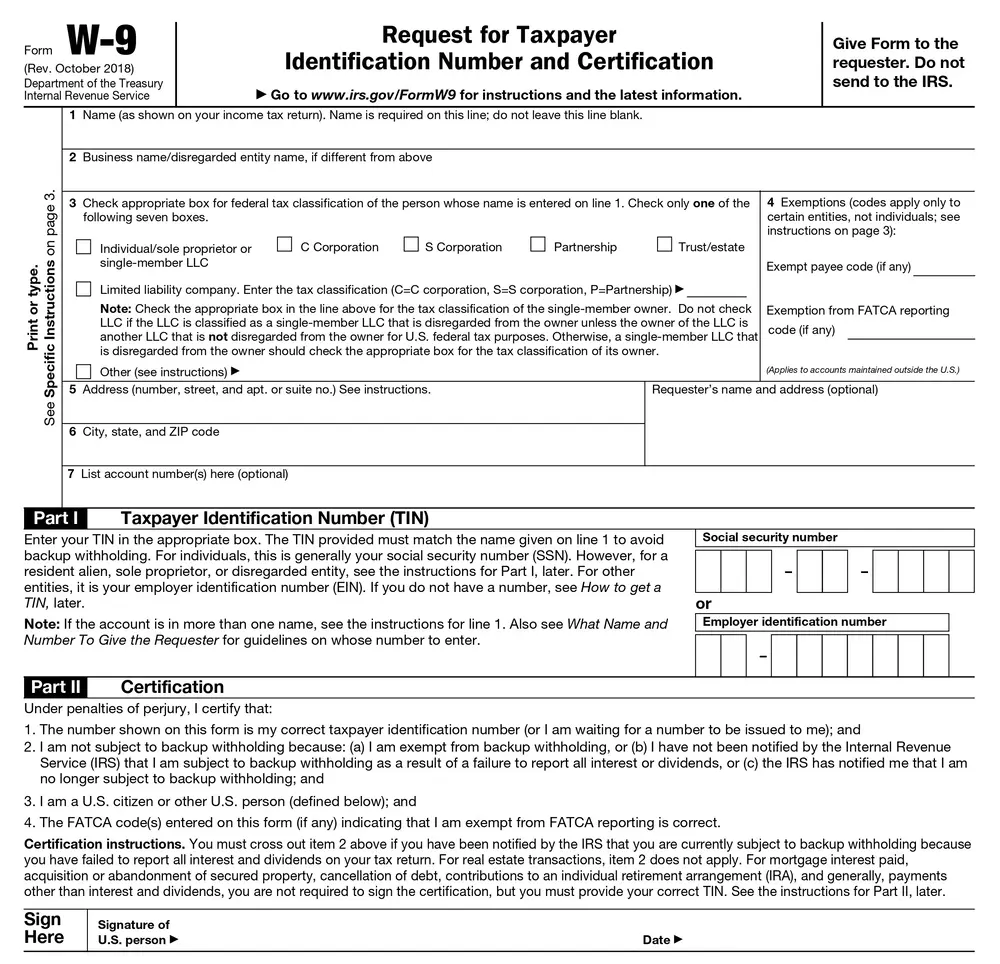

The W9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a standardized document used by businesses and individuals to collect essential information for tax reporting purposes. It plays a pivotal role in ensuring accurate tax withholding and reporting, facilitating smooth interactions between payers and recipients of income.

Understanding W9 Printable Form 2024

The W9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used for tax purposes in the United States. It enables businesses to collect essential information from individuals or entities providing services or goods, ensuring compliance with tax reporting requirements.

Key Components of a W9 Form

A W9 form typically consists of several sections, each requesting specific information. These sections include:

- Name and Address: The legal name and address of the individual or entity providing services or goods.

- Taxpayer Identification Number (TIN): This can be either a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

- Certification: The individual or entity certifies under penalty of perjury that the TIN provided is correct and that they are not subject to backup withholding.

Completing the W9 Printable Form 2024

Filling out a W9 form is a breeze, mate. Just follow these easy steps and you’ll be done in no time.

Before you start, make sure you have your Social Security number or Employer Identification Number (EIN) handy, along with your business name and address.

Section 1: Name and Address

In this section, you’ll need to provide your business name and address. If you’re a sole proprietor, use your own name. If you’re a company, use the company’s name.

Make sure to write your address clearly and legibly. The IRS needs to be able to reach you if they have any questions.

Section 2: Taxpayer Identification Number

This section is where you’ll provide your Social Security number or EIN. Your SSN is a 9-digit number that you can find on your Social Security card. Your EIN is a 9-digit number that you can find on your IRS letter.

If you’re not sure which number to use, check with the IRS.

Section 3: Certification

In this section, you’ll need to certify that the information you’ve provided is true and correct. You’ll also need to sign and date the form.

Make sure to read the certification carefully before you sign it. By signing the form, you’re swearing that the information you’ve provided is accurate.

Common Errors to Avoid

Here are some common errors to avoid when completing the W9 form:

- Using the wrong type of taxpayer identification number

- Providing an incorrect address

- Signing the form before you’ve completed all the information

By avoiding these errors, you can make sure that your W9 form is processed quickly and accurately.

Using the W9 Printable Form 2024

Blud, the W9 form’s like a boss when it comes to tax. It’s the go-to for anyone who’s self-employed or runnin’ a business and needin’ to get paid. It’s like a passport for your income, showin’ the taxman who you are and where your bread’s comin’ from.

Now, listen up, the W9 ain’t just a piece of paper. It’s got some serious legal clout. If you don’t fill it out right, you could end up in the doghouse with the taxman. You might have to pay extra tax or even get fined. So, don’t be a donut, make sure you’re givin’ the taxman the right info.

Storing Your W9s

Once you’ve got your W9s sorted, don’t just chuck ’em in a drawer and forget about ’em. Keep ’em safe and sound like your granny’s jewels. Store ’em in a locked cabinet or use a secure online storage service. That way, you won’t have to worry about ’em gettin’ lost or nicked.

Resources and Support for W9 Printable Form 2024

Navigating the intricacies of the W9 form can be a breeze with the wealth of resources available at your fingertips. From official sources to expert assistance, we’ve got you covered.

To ensure you’re working with the most up-to-date version of the W9 form, head over to the official IRS website. There, you’ll find the latest form and instructions, keeping you in the loop with any changes or updates.

If you’re looking for a helping hand with completing the W9 form, professional services and online tools are here to guide you. These services offer expert advice, ensuring your form is filled out accurately and efficiently.

Connecting with others who have been in your shoes can also be incredibly valuable. Forums and support groups provide a platform for you to share experiences, ask questions, and learn from others who have successfully navigated the W9 form.

Questions and Answers

What is the purpose of the W9 Printable Form 2024?

The W9 Printable Form 2024 is used to collect essential information from individuals or businesses receiving payments for services or goods. It enables the payer to report the income accurately to the IRS and withhold the appropriate amount of taxes.

Who is required to complete a W9 form?

Individuals or businesses who receive payments for services or goods that are not subject to backup withholding are required to complete a W9 form.

What information is required on the W9 form?

The W9 form collects information such as the recipient’s name, address, Taxpayer Identification Number (TIN), and certification regarding U.S. citizenship or residency.

Where can I find the latest version of the W9 form?

The latest version of the W9 form can be downloaded from the official IRS website.

What are the consequences of not completing a W9 form accurately?

Failing to complete a W9 form accurately can result in backup withholding, which involves the payer withholding a higher percentage of taxes from your payments.