W9 Printable Form: A Comprehensive Guide to Understanding, Completing, and Submitting

In the realm of taxation, the W9 Printable Form stands as a crucial document, facilitating seamless information exchange between taxpayers and recipients of payments. This comprehensive guide delves into the intricacies of the W9 Printable Form, providing a clear understanding of its purpose, structure, and significance in the tax filing process.

Whether you’re an individual navigating the complexities of self-employment or a business seeking efficient payroll management, this guide will equip you with the knowledge and tools necessary to effectively utilize the W9 Printable Form, ensuring accurate and timely tax reporting.

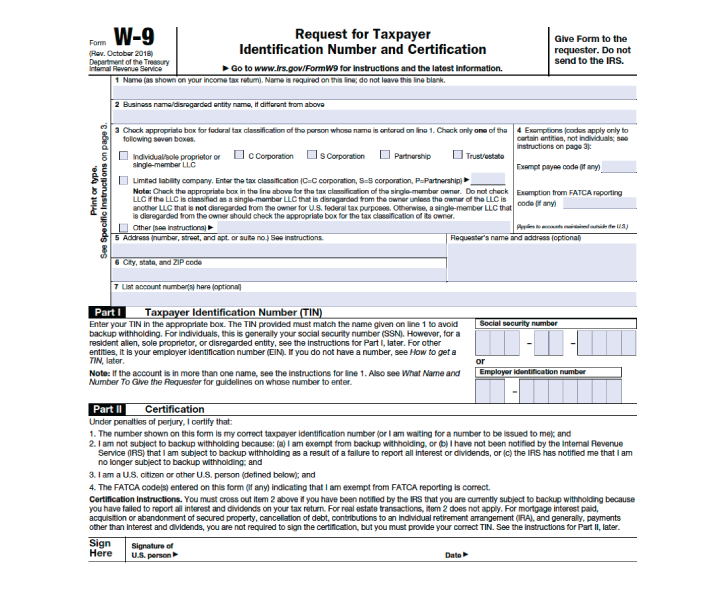

W9 Printable Form Overview

The W9 Printable Form is a vital document for businesses and individuals who need to collect taxpayer information for tax reporting purposes. It is a standardized form used by the Internal Revenue Service (IRS) to gather information such as name, address, and taxpayer identification number (TIN) from individuals or entities who are receiving payments for services rendered. The W9 form is essential for ensuring accurate tax reporting and compliance with tax regulations.

Target Audience

The W9 Printable Form is primarily used by businesses, including sole proprietorships, partnerships, corporations, and LLCs, to collect taxpayer information from individuals or entities they are making payments to. These payments may include wages, commissions, rents, or other forms of compensation. The form is also used by individuals who need to provide their taxpayer information to businesses for tax reporting purposes.

Understanding the W9 Printable Form

The W9 Printable Form is a crucial document that verifies a taxpayer’s identity and ensures accurate tax reporting. It comprises several key sections, each playing a vital role in its completion.

Basic Information Section

This section captures essential details like the taxpayer’s name, address, and contact information. Accuracy is paramount, as this information forms the basis for tax reporting and communication.

Taxpayer Identification Section

The Taxpayer Identification Section requires the taxpayer’s Social Security Number (SSN) or Employer Identification Number (EIN). This information is essential for the Internal Revenue Service (IRS) to identify and track tax-related activities.

Certification Section

The Certification Section requires the taxpayer’s signature and date. By signing, the taxpayer certifies that the information provided is true and correct. This section is crucial as it holds the taxpayer legally responsible for the accuracy of the form.

Backup Withholding Section

The Backup Withholding Section is applicable if the taxpayer is subject to backup withholding. This withholding is a precautionary measure taken by the IRS to ensure tax collection from taxpayers who may have underreported income in the past.

Exemptions Section

The Exemptions Section allows the taxpayer to claim exemptions for various tax purposes, such as personal allowances or dependents. Claiming the correct number of exemptions helps ensure accurate withholding and reduces the likelihood of overpayment or underpayment of taxes.

Completing the W9 Printable Form

Filling out the W9 Printable Form is straightforward and can be completed in a few simple steps. By providing accurate and complete information, you can ensure that you receive timely and accurate payments.

Follow these step-by-step instructions to complete each section of the form:

Section 1: Name and Address

- Enter your legal name (or the name of your business) in the “Name” field.

- Provide your complete address, including street address, city, state, and zip code.

Section 2: Taxpayer Identification Number (TIN)

- Enter your Social Security Number (SSN) if you are an individual taxpayer.

- Enter your Employer Identification Number (EIN) if you are a business or organization.

Section 3: Certification

Review the certification statement carefully and sign and date the form.

Section 4: Optional Information

- Provide your phone number and email address for communication purposes.

- Indicate if you are exempt from backup withholding.

Submitting and Using the W9 Printable Form

Submitting the W9 Printable Form is a crucial step in ensuring compliance with tax regulations. It’s a legal document that provides the necessary information for the payer (individual or business) to report payments made to the payee (freelancer, contractor, or vendor) to the Internal Revenue Service (IRS). By understanding the various submission methods and the importance of timely submission, you can ensure the smooth processing of your tax returns.

Submission Methods

There are several ways to submit the W9 Printable Form:

- Online: Submit the form electronically through the IRS website or authorized third-party platforms.

- Mail: Send the completed form by post to the IRS or the payer’s address provided on the form.

- In-person: Submit the form directly to the payer or at an IRS office.

Importance of Timely Submission

It’s essential to submit the W9 Printable Form promptly to avoid penalties and delays in processing your tax returns. The IRS requires payers to report payments made to payees within a specific timeframe. If the W9 Form is not submitted on time, the payer may be subject to penalties and the payee may face delays in receiving tax refunds.

Tips for Effective Use

To use the W9 Printable Form effectively for tax purposes, consider the following tips:

- Keep accurate records: Maintain a copy of all submitted W9 Printable Forms for your records.

- Review the form carefully: Ensure all information provided on the form is accurate and complete.

- Use the correct version: Make sure you’re using the most up-to-date version of the W9 Printable Form from the IRS website.

Troubleshooting W9 Printable Form Issues

Completing the W9 Printable Form can occasionally present challenges. To ensure a smooth process, it’s crucial to address common problems that may arise and find effective solutions.

By understanding potential errors and implementing the appropriate remedies, you can avoid delays or rejections and streamline the form submission process.

Identifying Common Errors

When completing the W9 Printable Form, several common errors can occur. These include:

- Inaccurate or incomplete personal information (e.g., name, address, SSN/EIN)

- Incorrect tax classification (e.g., individual vs. business)

- Missing or invalid signature

- Illegible handwriting

- Incomplete or incorrect certification

Resolving Errors

To resolve these errors, consider the following steps:

- Inaccurate or incomplete personal information: Double-check the information provided, ensuring it matches official documents (e.g., ID card, tax returns).

- Incorrect tax classification: Determine the correct tax classification based on your business structure and consult with a tax professional if necessary.

- Missing or invalid signature: Ensure that the form is signed by an authorized individual, typically the business owner or a designated representative.

- Illegible handwriting: Rewrite the form legibly or use a computer to fill it out.

- Incomplete or incorrect certification: Review the certification section carefully and ensure that all required information is provided accurately.

Error Examples and Solutions

| Error | Solution |

|---|---|

| SSN/EIN not provided or incorrect | Verify the SSN/EIN using official documents and ensure it is entered correctly. |

| Business name not matching official records | Check the business name against official documents and update the form accordingly. |

| Missing signature | Obtain a valid signature from the authorized individual. |

| Illegible handwriting | Rewrite the form legibly or use a computer to fill it out. |

| Incorrect certification date | Update the certification date to the current date. |

Additional Resources and Considerations

This section provides additional resources and important considerations related to W9 Printable Forms.

For further information on W9 Printable Forms, you can refer to the following resources:

- IRS website: https://www.irs.gov/forms-pubs/about-form-w-9

- W9 Printable Form PDF: https://www.irs.gov/pub/irs-pdf/fw9.pdf

Legal and Compliance Considerations

It’s crucial to be aware of the legal and compliance requirements associated with W9 Printable Forms. Failure to comply with these regulations may result in penalties or other legal consequences.

Here are some key legal considerations to keep in mind:

- Taxpayer Identification Number (TIN): The TIN is a unique identifier assigned to individuals and businesses for tax purposes. It’s mandatory to provide a valid TIN on the W9 Printable Form.

- Backup Withholding: Payers are required to withhold a percentage of payments made to certain individuals and businesses who fail to provide a valid TIN or who provide an incorrect TIN.

- Penalties: There are penalties for both payers and recipients who fail to comply with the W9 Printable Form requirements. These penalties can range from fines to criminal charges.

Frequently Asked Questions (FAQs)

Here are some frequently asked questions (FAQs) related to W9 Printable Forms:

- Q: Who needs to complete a W9 Printable Form?

A: Individuals and businesses who receive payments for services or goods from a payer are required to complete a W9 Printable Form. - Q: When do I need to submit a W9 Printable Form?

A: You should submit a W9 Printable Form to the payer before receiving any payments. - Q: What information do I need to provide on the W9 Printable Form?

A: You need to provide your name, address, TIN, and certification under penalties of perjury.

Questions and Answers

What is the purpose of the W9 Printable Form?

The W9 Printable Form, also known as the Request for Taxpayer Identification Number and Certification, is used to collect essential information from individuals or entities who receive payments for services rendered. It enables the payer to report payments accurately to the Internal Revenue Service (IRS) and to the recipient.

Who needs to complete a W9 Printable Form?

Any individual or entity that receives payments for services rendered, such as independent contractors, freelancers, and small businesses, is required to complete a W9 Printable Form.

What information is included on the W9 Printable Form?

The W9 Printable Form collects the following information: taxpayer name, address, taxpayer identification number (TIN), certification, and signature. The TIN can be either a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

When is the W9 Printable Form due?

The W9 Printable Form should be completed and submitted to the payer before or at the time of receiving payments. Timely submission ensures accurate reporting and avoids potential penalties.

What are the consequences of not completing a W9 Printable Form?

Failure to complete a W9 Printable Form may result in backup withholding, which is a flat 24% tax withheld from payments made to non-compliant recipients. This can lead to additional tax liability and penalties.