W-4v Printable Form: A Comprehensive Guide for Accurate Tax Withholding

Navigating the complexities of federal income tax can be a daunting task, but the W-4v printable form serves as a crucial tool to ensure accurate withholding and avoid potential tax surprises. This guide will provide a comprehensive overview of the W-4v form, its significance, and how to complete it effectively to maximize tax savings while fulfilling your tax obligations.

Understanding the W-4v form empowers you to tailor your tax withholding to your specific financial situation, considering factors such as income, dependents, and deductions. By investing a small amount of time in completing this form accurately, you can streamline your tax filing process and optimize your financial well-being.

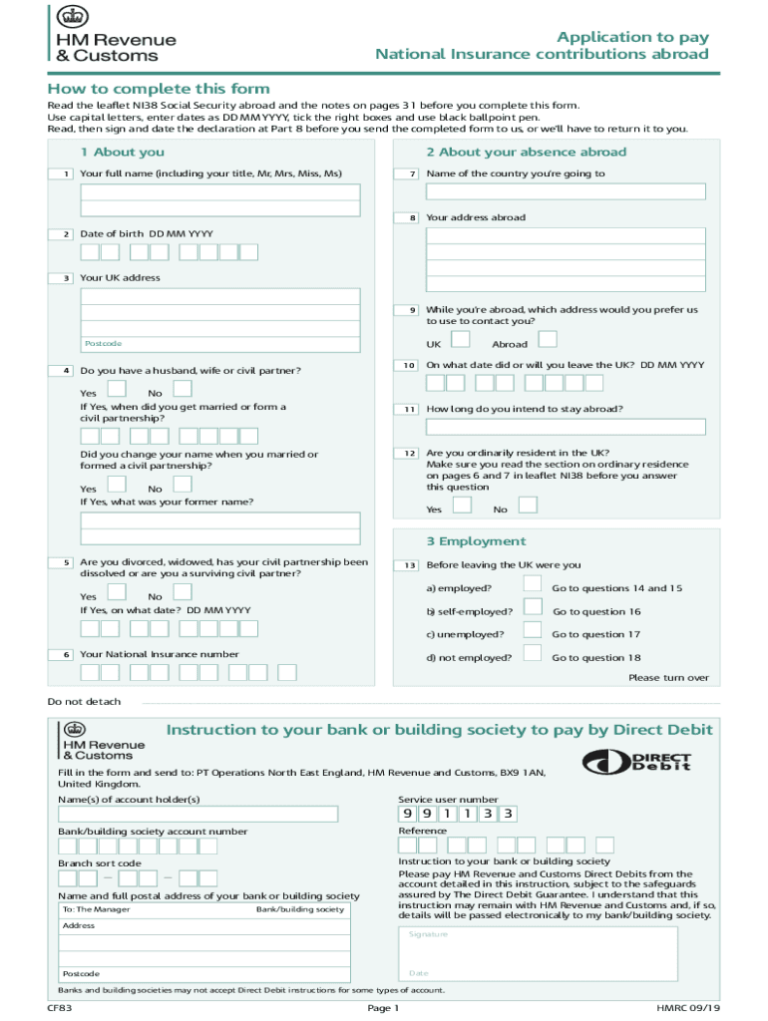

Introduction to W-4v Printable Form

The W-4v printable form is a vital document used by employees in the United Kingdom to inform their employers about their tax status and personal allowances.

It’s crucial to fill out the form accurately to ensure you pay the correct amount of tax and claim the allowances you’re entitled to. This can help you avoid underpaying or overpaying taxes, saving you potential penalties or refunds.

s for Completing the Form

Filling out the W-4v form is a straightforward process. Follow these simple s to ensure accuracy and completeness:

Gather necessary information: Before starting, make sure you have your personal information (name, address, SSN), as well as details about your income and deductions.

Step 1: Personal Information

- Enter your full name and current address in the designated fields.

- Provide your Social Security Number (SSN) in the space provided.

- Indicate your filing status: Single, Married Filing Jointly, Married Filing Separately, Head of Household, or Qualifying Widow(er) with Dependent Child.

Step 2: Income Information

- Estimate your total annual wages, tips, and other taxable income for the current year.

- Enter this amount in the “Wages, tips, other compensation” field.

Step 3: Deductions

- Review the list of deductions available on the form and select those that apply to you.

- For each deduction, enter the estimated amount you expect to claim for the year.

Step 4: Additional Information

- Indicate if you have any other jobs or sources of income.

- Provide information about any dependents you claim on your tax return.

- Sign and date the form in the designated area.

Step 5: Submit the Form

- Once you have completed the form, submit it to your employer as soon as possible.

- Your employer will use this information to calculate the amount of federal income tax withheld from your paychecks.

Common Mistakes to Avoid

Filling out the W-4v form might seem like a simple task, but it’s easy to make mistakes that could lead to over or underpaying taxes. To avoid these costly blunders, it’s important to be aware of the common pitfalls and take steps to prevent them.

Here are some of the most common mistakes to watch out for:

Not understanding your filing status

- Choosing the wrong filing status can result in incorrect withholding amounts. Make sure you understand the different filing statuses and select the one that applies to your situation.

- For example, if you’re married but filing separately, you’ll need to use the “married filing separately” status. If you’re not sure which filing status to choose, consult the IRS website or a tax professional.

Not claiming the correct number of allowances

- Allowances are used to reduce the amount of tax withheld from your paycheck. Claiming too few allowances can result in overpaying taxes, while claiming too many can lead to underpaying.

- To determine the correct number of allowances to claim, you’ll need to consider your income, deductions, and other factors. The IRS provides a worksheet that can help you calculate your allowances.

Not accounting for other income

- If you have other sources of income, such as self-employment or investments, you’ll need to account for them on the W-4v form. Not doing so can result in underpaying taxes.

- To avoid this, be sure to list all of your income sources on the form, even if they’re not subject to withholding.

Not updating your W-4v form

- Your W-4v form should be updated whenever your financial situation changes. This includes changes to your income, deductions, or filing status.

- Failing to update your W-4v form can result in over or underpaying taxes. To avoid this, make sure to review your form annually and update it as needed.

Using the Form to Calculate Withholdings

Blud, using this W-4v form, you can suss out how much bread the taxman’s gonna nick from your paycheck. It’s a bit of a blag, but we’ll break it down, innit?

The amount of dosh they take depends on a bunch of bits, like:

- Your marital status – are you a singleton, hitched, or somewhere in between?

- How many dependants you’ve got – little rugrats, elderly relatives, the whole shebang

- Your pay rate – how much cheddar you’re bringing in

Calculating Withholdings

To figure out your withholdings, you need to do a bit of maths, mate. Here’s the lowdown:

Step 1: Tot up your estimated annual income.

Step 2: Find the corresponding withholding amount in the tax tables provided by the taxman.

Step 3: Divide the withholding amount by the number of pay periods you’ll have in the year.

Step 4: Write this amount on line 5 of the W-4v form.

That’s it, guv. You’ve now sussed out how much the taxman’s gonna pinch from your hard-earned dough.

Special Considerations for Different Tax Situations

Understanding your tax situation is crucial, especially if you have multiple income sources or claim dependents and itemized deductions. Here’s a breakdown of special considerations to keep in mind:

Multiple Jobs or Income Sources

If you work multiple jobs or have income from different sources, you’ll need to consider how your earnings will impact your tax liability. You may end up paying more or less in taxes depending on your total income and the withholding allowances you claim on your W-4 form.

- Estimate Your Total Income: Calculate your estimated income from all sources to determine your tax bracket and withholding amount.

- Adjust Your Allowances: Use the IRS withholding calculator or consult with a tax professional to adjust your withholding allowances on your W-4 form based on your estimated income.

- Avoid Underpayment Penalties: Ensure you’re withholding enough taxes to avoid penalties for underpayment. You can make estimated tax payments if necessary.

Claiming Dependents and Itemized Deductions

If you have dependents or plan to itemize your deductions, you may be eligible for additional withholding allowances or deductions on your W-4 form. This can reduce the amount of taxes withheld from your paycheck.

- Dependents: Each dependent you claim entitles you to one additional withholding allowance.

- Itemized Deductions: If you expect your itemized deductions (e.g., mortgage interest, charitable contributions) to exceed the standard deduction, you can adjust your withholding allowances accordingly.

- Use the IRS Withholding Calculator: The IRS withholding calculator considers dependents and itemized deductions to help you determine the appropriate withholding allowances.

Filing and Submitting the Form

Submitting your W-4V form is crucial to ensure accurate tax withholding. Here’s a guide on where and when to file it, along with options for electronic or mail submission.

Filing Deadline

The W-4V form should be submitted to your employer as soon as possible after you start a new job or experience a change in your tax situation. There’s no specific filing deadline, but it’s best to submit it promptly to avoid any potential tax issues.

Filing Options

You can submit your W-4V form electronically or by mail:

Electronic Submission

– Use your employer’s online payroll system or a third-party tax software if available.

– This method is convenient and allows for instant submission.

Mail Submission

– Print and fill out a paper copy of the W-4V form.

– Mail it to your employer’s address as provided on the form.

– Ensure you use a trackable mailing method for proof of submission.

FAQ Corner

What is the purpose of the W-4v printable form?

The W-4v printable form is an essential document used to communicate your tax withholding preferences to your employer. It allows you to indicate your marital status, number of dependents, and other relevant information to determine the appropriate amount of federal income tax to be withheld from your paycheck.

How often should I review and update my W-4v form?

It is advisable to review and update your W-4v form annually or whenever there is a significant change in your financial situation, such as marriage, the birth of a child, or a change in income. This ensures that your tax withholding remains aligned with your current circumstances.

What are the consequences of completing the W-4v form inaccurately?

Inaccurate completion of the W-4v form can result in either underpayment or overpayment of taxes. Underpayment may lead to penalties and interest charges, while overpayment will result in a refund but represents an interest-free loan to the government.

Where can I find the W-4v printable form?

The W-4v printable form can be easily accessed on the official website of the Internal Revenue Service (IRS). Alternatively, you can request a physical copy from your employer or local IRS office.

Can I submit my W-4v form electronically?

Yes, many employers offer the option to submit your W-4v form electronically through their payroll systems. This method is convenient, secure, and ensures the timely processing of your withholding preferences.