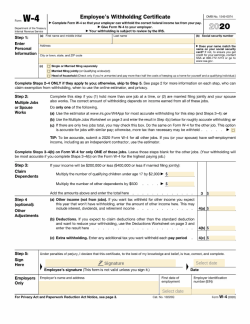

W-4 Printable Form: A Comprehensive Guide to Understanding and Completing

Navigating the world of taxes can be a daunting task, especially when it comes to understanding and completing the W-4 form. This essential document plays a crucial role in determining your tax withholding, ensuring that the right amount of income tax is deducted from your paycheck. In this comprehensive guide, we will delve into the intricacies of the W-4 printable form, providing a step-by-step walkthrough and addressing common questions to help you confidently complete and utilize this form.

Whether you’re a seasoned taxpayer or new to the workforce, this guide will empower you with the knowledge and understanding you need to accurately fill out your W-4 form, avoid costly penalties, and optimize your tax planning strategy. So, let’s embark on this journey together and simplify the complexities of tax withholding.

W-4 Form Basics

Yo, the W-4 form is like a heads-up for the taxman about how much cheddar to hold back from your pay packet each month. It’s all about making sure you don’t end up owing a ton of dough come tax time or getting a massive refund that could’ve been chilling in your pocket all along.

The form’s got a few different bits:

- Your personal deets (name, addy, and so on)

- Your filing status (single, married, got kids, etc.)

- How many allowances you’re claiming (this is the biggie)

- Extra bits and bobs (like if you want more or less tax taken out)

Filling out the W-4 right is key, bruv. It means you won’t get stung with a hefty tax bill later on or have to wait ages for a refund.

Filling Out the W-4 Form

Alright, time to get your W-4 form sorted, innit? It’s a bit of a faff, but trust me, it’s worth it. This form tells the taxman how much of your hard-earned dough they can nick before it even hits your bank account. So, let’s dive in and make sure you’re not overpaying or underpaying, yeah?

The W-4 form is split into a few sections, each asking for specific info. Let’s break it down, shall we?

Personal Information

This bit’s easy. Just fill in your name, address, and Social Security number. Make sure it’s all correct, or else the taxman will be like, “Who’s this bloke?” and you’ll have a right mess on your hands.

Filing Status

Here’s where you tell the taxman your relationship status. Are you single, married, or something else? This helps them figure out how much tax to take out of your pay. If you’re not sure, check out the IRS website for more info.

Dependents

Got any little ones running around? Each dependent you have means you can claim an allowance, which reduces the amount of tax withheld from your pay. So, if you’ve got a bunch of kids, you’ll pay less tax. Sorted.

Other Income

If you’ve got other income besides your job, like investments or side hustles, you can enter it here. This helps the taxman make sure you’re paying the right amount of tax overall.

Adjustments

This is where you can make any other adjustments to your withholding, like if you’ve got a lot of deductions or credits. If you’re not sure what to put here, check with your accountant or the IRS website.

Sign and Date

Once you’ve filled everything out, don’t forget to sign and date the form. This makes it official and tells the taxman you’re good to go.

Tips for Determining Allowances

Not sure how many allowances to claim? Here’s a quick guide:

- If you’re single with no dependents, claim 1 allowance.

- If you’re married with no dependents, claim 2 allowances.

- For each dependent, add 1 allowance.

- If you have other income or deductions, you may need to adjust your allowances.

Remember, these are just guidelines. The best way to figure out your allowances is to use the IRS Withholding Calculator on their website. It’s quick, easy, and will help you get it right.

Consequences of Inaccurate W-4 Information

Innit, getting your W-4 form wrong can be a right pain. Not only could you end up paying more tax than you should, but you might also face penalties for underpaying.

If you realize you’ve made a mistake on your W-4 form, don’t panic. You can correct it by filling out a new form and giving it to your employer.

It’s also important to update your W-4 form if your life situation changes, like if you get married, have a baby, or start a new job.

Penalties for Incorrect Withholding

If you underpay your taxes by more than £500 in a tax year, you could be hit with a penalty of up to £1,000.

Correcting Errors on the Form

To correct an error on your W-4 form, simply fill out a new form and give it to your employer. You can get a new form from your employer or from the HMRC website.

Updating the W-4 Form When Life Events Occur

If your life situation changes, it’s important to update your W-4 form so that your withholding is accurate. Here are some examples of life events that may require you to update your W-4 form:

- Getting married

- Having a baby

- Starting a new job

- Retiring

Using the W-4 Form for Tax Planning

The W-4 form can be used to adjust tax withholding, which can impact your tax refund or balance due. Adjusting withholding can be beneficial in certain situations.

Adjusting Withholding to Avoid Refunds or Balances Due

If you consistently receive large refunds or owe a significant amount of taxes, adjusting your withholding can help you avoid these situations. By increasing your withholding, you can reduce the amount of taxes you owe and avoid penalties. Conversely, decreasing your withholding can increase your refund or reduce your balance due.

Adjusting Withholding for Life Events

Life events can affect your tax situation, making it necessary to adjust your withholding. For example, if you get married, have a child, or change your income, you may need to update your W-4 to ensure you are withholding the correct amount of taxes.

Impact of Withholding Adjustments on Refunds and Balances Due

Adjusting your withholding can impact the amount of your tax refund or balance due. If you increase your withholding, your refund will be smaller or you may even owe taxes. Conversely, if you decrease your withholding, your refund will be larger or you may have a smaller balance due.

Additional Resources

Fam, need some extra help with your W-4 Form? Check out these sick resources:

Official IRS Resources

- IRS Website: https://www.irs.gov/forms-pubs/about-form-w-4

- IRS Publication 15-T: https://www.irs.gov/pub/irs-pdf/p15t.pdf

Online Withholding Allowance Calculators

Don’t wanna do the math? No stress. These tools got you covered:

- IRS Withholding Calculator: https://www.irs.gov/newsroom/irs-withholding-calculator-available-to-help-taxpayers-avoid-surprises-at-tax-time

- ADP Withholding Calculator: https://www.adp.com/tools-and-resources/calculators-and-tools/w4-withholding-calculator.aspx

Common Questions and Concerns

- What if I make a mistake? No worries, mate. Just fill out a new W-4 Form and give it to your employer.

- What if my situation changes? Life’s unpredictable, right? Update your W-4 Form whenever you get married, have kids, or make a major change in your income.

- How can I avoid getting a refund or owing taxes? Use the online calculators to get it spot on. It’s like having a cheat sheet for your taxes.

Frequently Asked Questions

What is the purpose of the W-4 form?

The W-4 form is used by employees to indicate their withholding allowances to their employers. This information helps employers calculate the correct amount of federal income tax to withhold from your paycheck.

How many sections are included in the W-4 form?

There are five sections in the W-4 form: Personal Information, Allowances, Deductions and Adjustments, Additional Income and Adjustments, and Signature.

What are the consequences of inaccurate W-4 information?

Inaccurate W-4 information can result in underpayment or overpayment of taxes. If you underpay, you may face penalties and interest charges. If you overpay, you will receive a refund when you file your tax return.

How can I correct errors on my W-4 form?

You can correct errors on your W-4 form by submitting a new form to your employer. The new form will supersede the previous one.

How often should I update my W-4 form?

You should update your W-4 form whenever your personal or financial situation changes, such as getting married, having a child, or changing jobs.