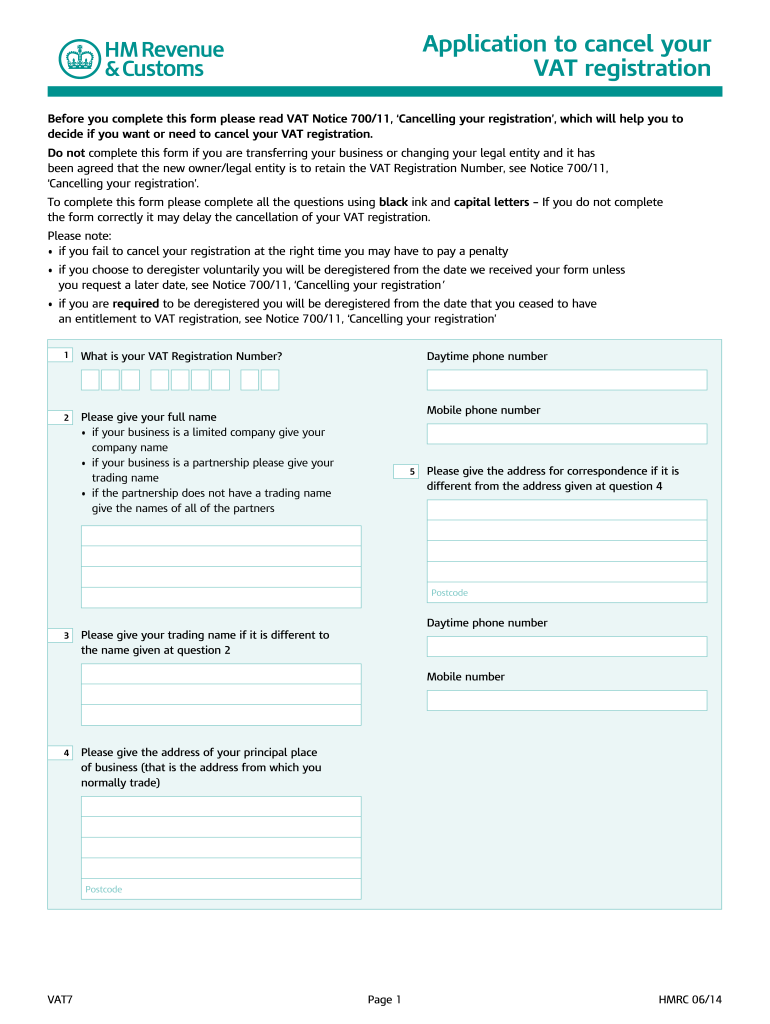

The Ultimate Guide to VAT 7 Printable Form: A Comprehensive Overview

Navigating the complexities of Value-Added Tax (VAT) can be a daunting task, but with the VAT 7 Printable Form, businesses have a valuable tool at their disposal. This form plays a crucial role in the VAT compliance process, enabling businesses to accurately report their VAT transactions and avoid costly penalties.

In this comprehensive guide, we will delve into the intricacies of the VAT 7 Printable Form, exploring its purpose, sections, completion process, and common pitfalls. We will also provide valuable resources and industry insights to ensure you have all the knowledge you need to master this essential document.

Definition and Purpose of VAT 7 Printable Form

Yo, check it! VAT 7 Printable Form is a banging form that helps you, the slick business owner, get your Value-Added Tax (VAT) sorted. VAT is like a special tax that’s added to the price of goods and services. It’s the government’s way of getting a cut of the dough.

The VAT 7 Printable Form is like your cheat sheet for figuring out how much VAT you owe. It’s got all the deets you need, like the tax rate and the amount of VAT you’ve charged. Fill it in, send it off, and you’re golden.

Purpose of VAT 7 Printable Form

The VAT 7 Printable Form is a lifesaver for businesses that are registered for VAT. It’s your way of telling HMRC, the taxman, how much VAT you’ve collected and how much you owe them. Without this form, you’re like a lost sheep in the tax jungle.

Sections and Content of VAT 7 Printable Form

The VAT 7 Printable Form is organized into several sections, each with its own specific purpose and information requirements.

The main sections of the VAT 7 Printable Form are as follows:

Section A: Business Details

- This section includes basic information about your business, such as your business name, address, and contact details.

- It also includes your VAT registration number and the period of time that the VAT return covers.

Section B: Sales and Purchases

- This section summarizes your sales and purchases for the period covered by the VAT return.

- You will need to provide details of your standard-rated sales, zero-rated sales, and exempt sales.

- You will also need to provide details of your purchases, including your input tax and output tax.

Section C: VAT Calculation

- This section calculates your VAT liability for the period covered by the VAT return.

- You will need to use the information from Section B to calculate your VAT liability.

- The result of this calculation will be the amount of VAT that you owe to HMRC.

Section D: Payment Details

- This section provides details of how you will pay your VAT liability.

- You can choose to pay by direct debit, BACS, or cheque.

- You will also need to provide your bank account details if you are paying by direct debit or BACS.

Section E: Declaration

- This section is a declaration that the information provided on the VAT return is true and correct.

- You will need to sign and date this section.

How to Complete and Submit VAT 7 Printable Form

Completing and submitting the VAT 7 Printable Form is straightforward and can be done in a few simple steps. This guide will walk you through the process, ensuring you provide the necessary information accurately and efficiently. Once completed, you have options for submitting the form, which we’ll also cover.

Step-by-Step Guide to Completing the Form

- Download and Print the Form: Obtain the VAT 7 Printable Form from the official tax authority website. Download and print the form to fill in manually.

- Fill in Your Details: Begin by providing your personal and business information in the designated sections. Ensure you enter your name, address, and tax identification number accurately.

- Provide Sales and Purchase Details: In the relevant sections, record your sales and purchase transactions for the specified period. Include details such as invoice numbers, dates, and amounts.

- Calculate and Fill in VAT Amount: Based on your sales and purchases, calculate the VAT amount using the appropriate formula. Enter the calculated VAT amount in the designated field.

- Sign and Date: Once all sections are complete, sign and date the form in the designated areas. This step confirms the accuracy of the information provided.

Methods for Submitting the Completed Form

- Online Submission: Some tax authorities allow online submission of VAT 7 Printable Forms. Visit the official website, locate the submission portal, and upload the completed form.

- Postal Mail: If online submission is unavailable, you can send the completed form via postal mail to the address provided by the tax authority.

- In-Person Submission: In certain cases, you may be able to submit the form in person at a designated tax office. Contact your local tax authority for more information.

Examples and Templates of VAT 7 Printable Form

VAT 7 Printable Forms come in various formats and designs to suit different needs and preferences. Below are some common examples and templates available online:

Table of VAT 7 Printable Form Examples

| Form Name | Description | Download Link |

|---|---|---|

| VAT 7 Printable Form (Standard) | A basic VAT 7 form that includes all necessary fields for completing a VAT return. | Download |

| VAT 7 Printable Form (Simplified) | A simplified version of the VAT 7 form with fewer fields for businesses with straightforward VAT calculations. | Download |

| VAT 7 Printable Form (Excel Template) | A VAT 7 form in Excel format that allows for automatic calculations and easier data manipulation. | Download |

| VAT 7 Printable Form (PDF Template) | A VAT 7 form in PDF format that can be filled out digitally or printed and completed manually. | Download |

These templates can be easily downloaded and customized to meet specific requirements. It is important to use the correct form and version for your particular situation and ensure accurate completion.

Common Mistakes and Troubleshooting

Completing the VAT 7 Printable Form is generally straightforward, but there are some common mistakes that can be easily avoided.

Let’s explore these mistakes and provide troubleshooting tips to ensure accuracy and a smooth submission process.

Errors in Entering Personal Information

Mistakes in entering personal information can delay the processing of your form. Ensure that the following details are accurate:

- Full name

- Address

- Contact information (email and phone number)

Incorrect Tax Calculations

Errors in tax calculations can lead to incorrect payments or penalties. Double-check your calculations using the following steps:

- Review the taxable amount

- Apply the correct tax rate

- Calculate the total tax due

Missing or Incomplete Information

Incomplete forms can cause delays or rejection. Make sure you provide all the necessary information, including:

- Tax period

- Taxable turnover

- VAT return

Late Submission

Submitting your VAT 7 Printable Form late can result in penalties or interest charges. File your return on time to avoid any additional costs.

Additional Resources and Information

There are many helpful resources available to assist you in understanding and completing the VAT 7 Printable Form. These resources include:

- The HMRC website provides a wealth of information on VAT, including guidance on completing the VAT 7 Printable Form.

- There are a number of commercial software packages available that can help you to complete the VAT 7 Printable Form.

- You can also seek advice from a qualified accountant or tax advisor.

Industry-Specific Insights and Updates

The VAT 7 Printable Form is a key document for businesses that are required to file VAT returns. HMRC regularly updates the form and its guidance notes, so it is important to stay up-to-date with the latest changes.

FAQ

What is the purpose of the VAT 7 Printable Form?

The VAT 7 Printable Form is used to declare VAT returns to the tax authorities. It provides a detailed record of all VAT-related transactions, including sales, purchases, and expenses.

What information is required on the VAT 7 Printable Form?

The VAT 7 Printable Form requires businesses to provide information such as their VAT registration number, taxable turnover, VAT due, and VAT reclaimed.

How do I complete the VAT 7 Printable Form?

To complete the VAT 7 Printable Form, businesses should follow the instructions provided by the tax authorities. This typically involves gathering the necessary financial records, calculating VAT due and reclaimed, and filling out the form accurately.

What are some common mistakes to avoid when completing the VAT 7 Printable Form?

Common mistakes to avoid include incorrect VAT calculations, missing information, and late submissions. Businesses should carefully review their form before submitting it to minimize errors.