Virginia Form 21-526ez Printable: A Comprehensive Guide to Filing

Navigating the complexities of tax filing can be daunting, but understanding the significance of specific forms like Virginia Form 21-526ez can make the process smoother. This printable form plays a crucial role in ensuring accurate and timely tax reporting for Virginia residents. In this comprehensive guide, we’ll delve into the purpose, accessibility, completion, filing, and related resources of Virginia Form 21-526ez.

Whether you’re a seasoned taxpayer or filing for the first time, this guide will provide you with a clear understanding of the form’s requirements and guide you through the filing process effortlessly.

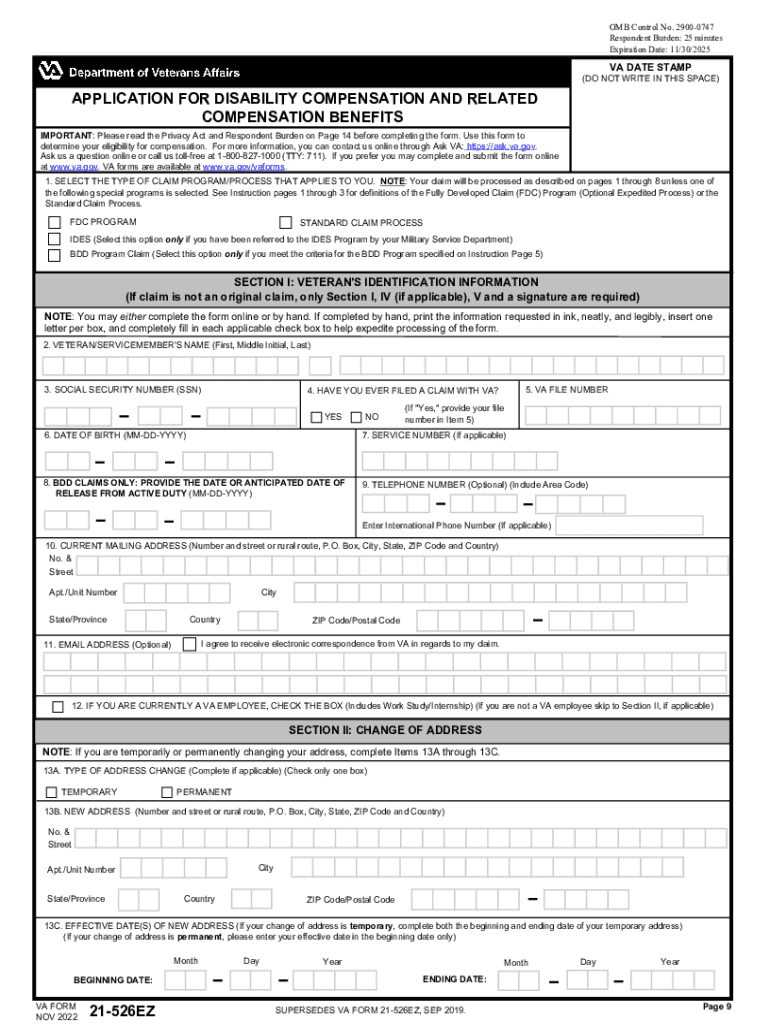

Virginia Form 21-526ez Overview

Virginia Form 21-526ez, titled “Virginia Individual Income Tax Return – EZ,” is a simplified tax return form designed for individuals with straightforward tax situations. It is intended to make tax filing easier for those who do not itemize deductions, have no dependents, and meet certain income and filing status criteria.

The form requires basic personal information, such as name, address, and Social Security number, as well as income and withholding information from W-2s or other sources. Filers must also indicate their filing status (single, married filing jointly, etc.) and calculate their Virginia taxable income and tax liability.

Filing Requirements and Deadlines

Virginia Form 21-526ez must be filed by individuals who meet the following criteria:

- Have a Virginia taxable income of $50,000 or less

- Do not itemize deductions

- Do not have any dependents

- Are not filing a Virginia return jointly with a spouse

The deadline for filing Virginia Form 21-526ez is April 15th of the year following the tax year. However, if you file for an extension, you have until October 15th to file.

Printable Form Accessibility

Accessing the printable version of Virginia Form 21-526ez is straightforward. The official website provides a direct link for download.

To download and print the form, follow these steps:

Steps to Download and Print

- Visit the Virginia Tax website at https://tax.virginia.gov/forms.

- Scroll down to the “Individual Income Tax Forms” section and click on “Form 21-526ez.”

- On the Form 21-526ez page, click on the “Printable Form” link.

- The PDF file will open in a new tab. Click on the “Print” icon to print the form.

Potential issues or challenges during the download or printing process may include:

- Slow internet connection

- Outdated browser or printer drivers

- Printer malfunctions

If you encounter any issues, try refreshing the page, updating your browser or printer drivers, or contacting the Virginia Tax Department for assistance.

Form Completion Guidance

Filling out Virginia Form 21-526ez can be a doddle if you follow these steps. Remember to keep your details blud and don’t mess it up, or you’ll end up in a right pickle.

Part 1: Personal Information

Start off by giving us your personal deets, like your monicker, crib address, and how to reach you. Make sure you write your John Hancock (signature) on the line provided. Sorted!

Part 2: Income Information

Next, spill the beans on your bread and butter. This includes your wages, dividends, and any other moolah you’ve raked in. Just remember to tot it all up and pop it in the right boxes.

Part 3: Deductions and Credits

Now, let’s chat about what you can knock off your tax bill. List down any deductions or credits you’re eligible for, like mortgage interest or charitable donations. These will help you save some dosh!

Part 4: Calculations

Time for some number-crunching. Follow the instructions on the form to calculate your taxable income, tax liability, and refund (if any). Don’t worry, it’s not rocket science, but if you’re feeling lost, you can always seek help from a pro.

Part 5: Payment or Refund

Finally, if you owe the taxman some lolly, indicate how you’ll be paying up. You can stump up the cash, set up a payment plan, or get a refund if you’ve overpaid. Easy peasy, lemon squeezy!

Common Errors to Avoid

To avoid any hiccups, watch out for these common pitfalls:

- Filling out the form in pencil or using Tipp-Ex. Use black or blue ink only, mate.

- Leaving any sections blank. If a section doesn’t apply to you, write “N/A” instead.

- Making mistakes in your calculations. Double-check your sums to make sure they’re spot on.

- Missing the filing deadline. Get your form in on time, or you could face penalties.

Filing and Submission Process

There are two ways to file Virginia Form 21-526ez: electronically or by mail.

Filing Electronically

- Go to the Virginia Tax website and select the “File Individual Income Taxes” option.

- Create an account or log in to your existing account.

- Follow the instructions to complete and submit the form.

Filing by Mail

- Print out the Virginia Form 21-526ez.

- Complete the form and mail it to the Virginia Department of Taxation.

The processing time for electronically filed returns is typically 1-2 weeks. The processing time for mailed returns is typically 6-8 weeks.

Related Forms and Resources

This section covers essential documents and support systems that complement Virginia Form 21-526ez.

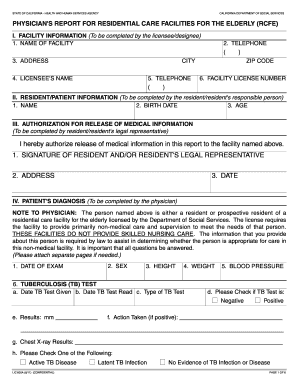

Related Forms

- Virginia Form 21-526: Used for filing a return with complete details and schedules. Consider using this form if you have complex tax situations or need to file additional schedules.

- Virginia Form 21-527: Used for making estimated tax payments. This form is relevant if you anticipate owing taxes of $500 or more when filing your return.

Additional Assistance

- Virginia Department of Taxation website: Provides comprehensive information on tax forms, instructions, and other resources.

- Virginia Tax Helpline: Offers telephone assistance at (804) 367-8031, Monday through Friday, 8:00 AM to 4:30 PM.

FAQ Summary

Where can I access the printable version of Virginia Form 21-526ez?

You can download the printable version of Virginia Form 21-526ez directly from the Virginia Tax website: https://tax.virginia.gov/.

What are the common errors to avoid when completing Virginia Form 21-526ez?

Some common errors to avoid include: entering incorrect Social Security numbers, making mathematical errors, and failing to sign and date the form.

Can I file Virginia Form 21-526ez electronically?

Yes, you can file Virginia Form 21-526ez electronically through the Virginia Tax website: https://tax.virginia.gov/.