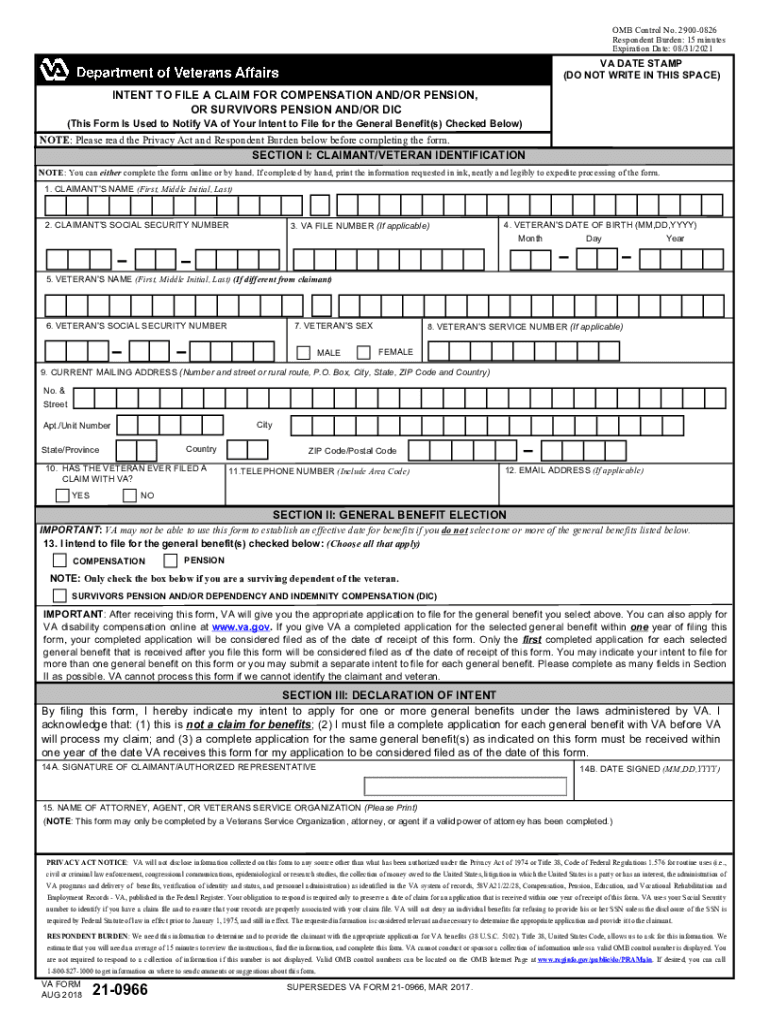

Virginia Form 21-0966 Printable: A Comprehensive Guide

Navigating the complexities of Virginia’s tax laws can be daunting, but understanding Form 21-0966 is crucial for ensuring compliance. This form serves as a vital tool for reporting various types of income, deductions, and credits. In this comprehensive guide, we will delve into the intricacies of Form 21-0966, providing a step-by-step breakdown, highlighting key sections, and addressing frequently asked questions. Whether you’re a seasoned filer or a first-timer, this guide will empower you to complete Form 21-0966 accurately and efficiently.

As we embark on this journey, we will explore the purpose and significance of Form 21-0966, identify who is required to file it, and discuss the filing deadlines and potential penalties for late submissions. We will then dissect the form’s structure, examining each section and providing examples to ensure accurate completion. Additionally, we will provide practical guidance, troubleshooting tips, and resources to assist you throughout the filing process.

Virginia Form 21-0966 Overview

Yo, listen up! Form 21-0966 is a bit of a biggie in Virginia, fam. It’s like a form that snitches on you to the taxman about how much dough you made last year. If you’re a resident of the Commonwealth, you better get ready to fill it out and hand it in by the deadline, otherwise, you’re gonna get slapped with some hefty fines.

Now, who’s got to do this form, you ask? Well, if you’re a Virginia resident who raked in more than $5,000 last year, you’re in the hot seat. Even if you don’t owe any taxes, you still gotta file. It’s like a rule, man.

Filing Deadlines

The deadline for filing your Virginia Form 21-0966 is April 15th. But hold up, if that day falls on a weekend or holiday, you get a little extra time to get your act together. So, if April 15th is a Saturday or Sunday, you can file on the following Monday. And if it’s a state holiday, you’ve got until the next business day to get it done.

Penalties for Late Filing

Now, don’t be a slacker and miss that deadline. If you file your Virginia Form 21-0966 late, you’re gonna have to pay a penalty. The penalty is 10% of the tax you owe, plus 1% for each month that you’re late, up to a maximum of 25%. So, don’t sleep on it, fam.

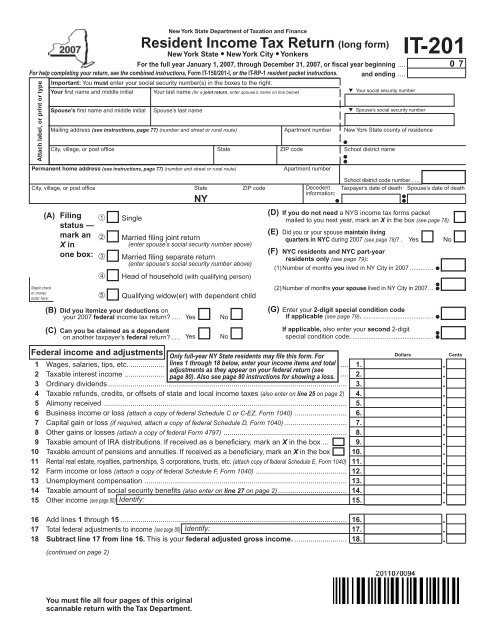

Form Structure and Content

Form 21-0966 is designed with a clear and organized structure to facilitate efficient completion. It comprises four distinct sections, each catering to specific information requirements. Understanding the layout and key fields of each section is crucial for accurate and comprehensive form completion.

The table below provides a detailed overview of the form’s structure and content:

| Section | Key Fields | Description |

|---|---|---|

| Section 1: Taxpayer Information | – Name – Address – Social Security Number – Filing Status |

This section collects basic taxpayer information, including their legal name, residential address, Social Security Number, and filing status for the tax year. |

| Section 2: Income | – Wages, salaries, tips – Interest – Dividends – Other income |

Section 2 focuses on capturing the taxpayer’s total income from various sources, such as employment, investments, and any additional income streams. |

| Section 3: Deductions and Credits | – Standard deduction – Itemized deductions – Tax credits |

This section allows taxpayers to claim deductions and credits that reduce their taxable income. Common deductions include the standard deduction, mortgage interest, and charitable contributions. |

| Section 4: Tax Calculation and Payment | – Taxable income – Tax amount – Refund or amount due |

The final section calculates the taxpayer’s taxable income, determines the tax liability, and indicates whether a refund is due or if additional payment is required. |

When completing Form 21-0966, it is important to pay close attention to the specific fields within each section and provide accurate information. For example, in Section 1, taxpayers should ensure their name and address are correctly entered, as any errors may delay the processing of their return.

s and Guidance

Completing Form 21-0966 can be a straightforward process with the right guidance. Here’s a step-by-step breakdown to ensure a smooth experience:

It’s crucial to avoid common pitfalls and follow best practices to enhance the accuracy and efficiency of your filing. Let’s explore some tips to help you steer clear of any potential roadblocks:

Step-by-Step s

- Gather your ducks in a row: Collect all the necessary documents and information, such as your social security number, income details, and any relevant tax forms.

- Read the instructions carefully, bruv: Take the time to thoroughly go through the form’s instructions. This will give you a clear understanding of what’s required and help you avoid any blunders.

- Fill out the form accurately and completely: Make sure you provide all the required information clearly and correctly. Double-check your entries to minimize any errors.

- Don’t forget to sign and date: Your signature and the date are essential for validating the form. Make sure you include them in the designated sections.

- Send it in on time, mate: Submit your completed form before the deadline to avoid any late penalties or complications.

Additional Guidance

- Seek professional help if needed: If you encounter any difficulties or have complex tax matters, don’t hesitate to seek assistance from a tax professional or the IRS.

- Keep a copy for your records: Make a copy of your completed form for your own reference and safekeeping.

Printable and Electronic Filing Options

The Virginia Form 21-0966 can be accessed in both printable and electronic formats.

Printable Version

To obtain the printable version, visit the Virginia Department of Motor Vehicles (DMV) website at www.dmv.virginia.gov. Navigate to the “Forms” section and search for Form 21-0966. Once located, download and print the form.

Electronic Filing

Currently, there is no option for electronic filing of Form 21-0966. It must be printed, completed, and submitted by mail or in person.

Common Questions and Troubleshooting

Innit, here are some bangers you might be curious about when it comes to Form 21-0966. We’ve got the answers and tips to sort you out.

Where can I find the form?

- You can nick it from the Virginia Tax website, mate. Just search for ‘Form 21-0966’.

Do I need to file this form?

- If you’re a Virginia resident and you’re claiming the Virginia Earned Income Tax Credit (EITC), then yeah, you need to fill in this form, bruv.

What if I make a mistake on the form?

- No stress, fam. Just cross out the wrong bit and write the correct info next to it. Make sure you sign and date the correction, too.

How do I file the form?

- You can either print it out and mail it to the Virginia Department of Taxation or file it electronically using the Virginia Tax website.

When is the deadline to file?

- The deadline to file Form 21-0966 is May 1, 2023. Don’t be a plonker and miss it, yeah?

FAQ Summary

What is the purpose of Form 21-0966?

Form 21-0966 is used to report Virginia taxable income, deductions, and credits for individuals, estates, and trusts.

Who is required to file Form 21-0966?

Generally, Virginia residents with a Virginia taxable income greater than $0 are required to file Form 21-0966.

What are the filing deadlines for Form 21-0966?

The filing deadline for Form 21-0966 is typically April 15th. However, if you file an extension, you have until October 15th to file.

What are the penalties for late filing Form 21-0966?

Late filing of Form 21-0966 may result in penalties and interest charges.

Where can I find the printable version of Form 21-0966?

You can download the printable version of Form 21-0966 from the Virginia Department of Taxation website.