VA Form 10-3542 Printable: A Comprehensive Guide

Navigating the complexities of tax filing can be daunting, but understanding the significance of Virginia Form 10-3542 is crucial for ensuring compliance and maximizing potential benefits. This printable form plays a vital role in the taxation process, and we’re here to guide you through its purpose, completion, and advantages.

Whether you’re a seasoned taxpayer or filing for the first time, this comprehensive guide will provide you with a clear understanding of Form 10-3542, empowering you to complete it accurately and efficiently.

Virginia Form 10-3542 Printable Overview

Yo, check it, Virginia Form 10-3542 Printable is a gas form that you gotta fill in if you’re a business owner in the Commonwealth of Virginia. It’s like a tax return, but for your business.

This form is all about reporting your business income and expenses. It’s due on the 15th day of the fourth month after the end of your fiscal year. So, if your fiscal year ends on December 31st, your Form 10-3542 is due on April 15th.

Who Needs to File Form 10-3542?

Not everyone has to file Form 10-3542. Only businesses that are subject to Virginia’s corporate income tax need to file. This includes corporations, partnerships, and limited liability companies (LLCs).

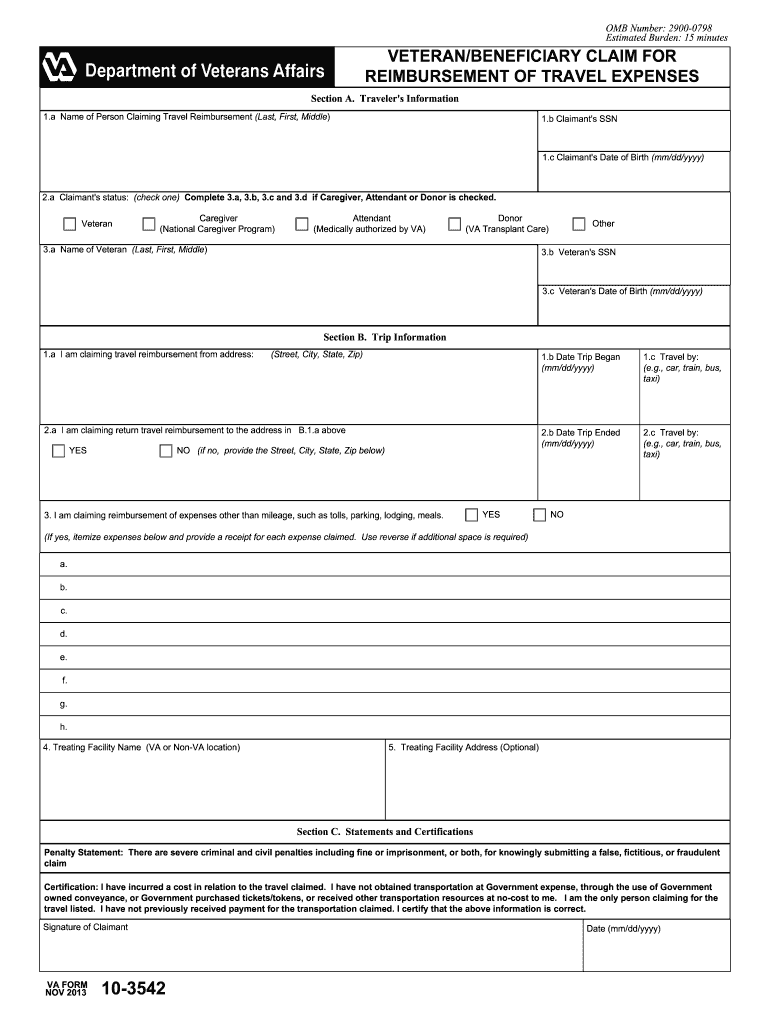

What Information Do I Need to Include on Form 10-3542?

Form 10-3542 asks for a bunch of info about your business, including:

- Your business name and address

- Your federal employer identification number (EIN)

- Your Virginia tax ID number

- Your fiscal year end date

- Your gross income

- Your deductions

- Your taxable income

- Your tax liability

How to Obtain and Complete Virginia Form 10-3542

Obtaining and completing Virginia Form 10-3542 is a straightforward process. Individuals can easily access the printable version of the form through the Virginia Department of Taxation website. Once downloaded, follow these steps to ensure accurate completion:

Section 1: Taxpayer Information

- Provide your full name, address, and contact details.

- Indicate your filing status (single, married filing jointly, etc.).

- Enter your Social Security number or Individual Taxpayer Identification Number.

Section 2: Income

- Report your gross income from all sources, including wages, salaries, and self-employment income.

- Deduct any applicable adjustments to income, such as contributions to retirement accounts.

- Calculate your adjusted gross income (AGI).

Section 3: Deductions and Credits

- Itemize your deductions or claim the standard deduction.

- List any applicable tax credits, such as the earned income tax credit or child tax credit.

Section 4: Tax Calculation

- Calculate your taxable income by subtracting deductions and credits from your AGI.

- Determine your Virginia income tax liability based on the tax brackets provided.

- Subtract any tax payments made during the year to calculate your tax due or refund.

Tips for Avoiding Errors

- Use clear and legible handwriting or type the form.

- Double-check all calculations and ensure accuracy.

- Attach all necessary supporting documentation, such as W-2s and 1099s.

Benefits of Using Virginia Form 10-3542 Printable

Innit, using the printable version of Form 10-3542 is a right laugh. It’s like, the best way to file your taxes without getting your knickers in a twist.

First off, it’s a doddle to fill in. You can do it in your own time, at your own pace, and without having to worry about queuing up at the post office or anything.

Time-Saving

Plus, it saves you a bundle of time. You don’t have to wait for the form to arrive in the post, and you don’t have to faff about with envelopes and stamps. Just download the form, print it off, and you’re good to go.

Cost-Effective

And let’s not forget the dosh. Using the printable form is way cheaper than using a tax agent. You don’t have to pay any fees, so you can keep your hard-earned cash in your back pocket.

Real-Life Example

Listen up, I know a mate who used the printable form last year. He was well chuffed with it. He said it was easy to use, saved him a ton of time, and he didn’t have to spend a penny on postage.

Common Questions and Troubleshooting

Navigating the Virginia Form 10-3542 filing process can raise questions. Here’s a compilation of commonly encountered queries and their clear-cut answers, along with troubleshooting tips to resolve any hiccups you may face.

Frequently Asked Questions

- What’s the deadline for submitting Form 10-3542?

The deadline for filing Virginia Form 10-3542 is April 15th of the year following the tax year being reported. - Where can I get assistance with completing the form?

The Virginia Department of Taxation offers various resources for assistance, including online instructions, a helpline, and local tax offices. - What happens if I make a mistake on the form?

If you discover an error after submitting the form, you can file an amended return using Form 10-3542A.

Troubleshooting

- My online filing isn’t working. What should I do?

Check if the online filing system is experiencing any technical difficulties. If not, try clearing your browser’s cache and cookies, or using a different browser. - I’m having trouble calculating my tax liability. Where can I find help?

The Virginia Department of Taxation provides online calculators and tax tables to assist with calculating your tax liability. - I’m missing some of the required documents. Can I still file?

If you’re missing required documents, you can file an extension using Form 10-3542E. However, you’ll need to provide the missing documents as soon as possible.

Helpful Answers

Where can I obtain the printable version of Virginia Form 10-3542?

The printable version of Form 10-3542 can be easily accessed on the official website of the Virginia Tax website.

What are the common errors to avoid when completing Form 10-3542?

Common errors include incorrect calculations, missing information, and using the wrong tax tables. Ensure you double-check your entries and refer to the provided instructions for guidance.

What is the deadline for filing Form 10-3542?

The filing deadline for Form 10-3542 typically aligns with the federal tax filing deadline, which falls on April 15th. However, it’s advisable to check with the Virginia Tax website for any updates or extensions.