Uitr 1 Printable Form: A Comprehensive Guide

Navigating the complexities of tax filing can be a daunting task, especially when it comes to understanding and completing the Uitr 1 Printable Form. This comprehensive guide will delve into the intricacies of this essential document, providing you with a clear understanding of its purpose, structure, and the step-by-step process involved in filing it.

The Uitr 1 Printable Form plays a crucial role in ensuring accurate and timely tax reporting. It empowers individuals to take control of their tax obligations and maximize their potential deductions and credits. By equipping yourself with the knowledge Artikeld in this guide, you can confidently navigate the Uitr 1 Printable Form and fulfill your tax responsibilities with ease.

Uitr 1 Printable Form

The Uitr 1 Printable Form, or the Income Tax Return Form 1, is an official document issued by the Inland Revenue Board of Malaysia (IRB) for individuals to declare their income and calculate their income tax liability for a specific year of assessment.

It is a simplified version of the income tax return form designed for individuals with straightforward income sources, such as employment income, business income, or rental income. Using this form, individuals can easily calculate their taxable income, deductions, and tax payable.

Eligibility Criteria

To be eligible to use the Uitr 1 Printable Form, individuals must meet the following criteria:

- Resident individual in Malaysia for the relevant year of assessment.

- Total income for the year does not exceed RM100,000.

- Income sources are solely from employment, business, or rental.

- No complex income sources, such as overseas income, capital gains, or dividends.

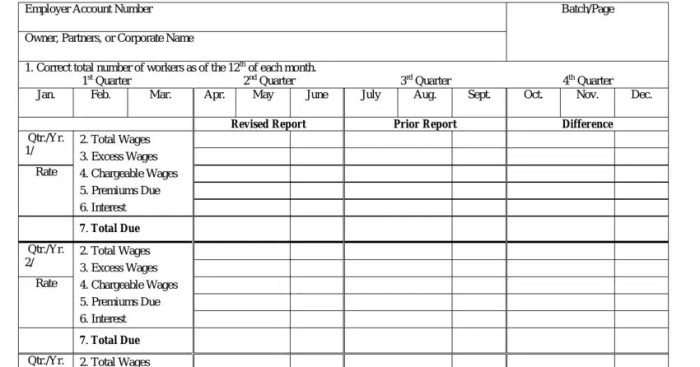

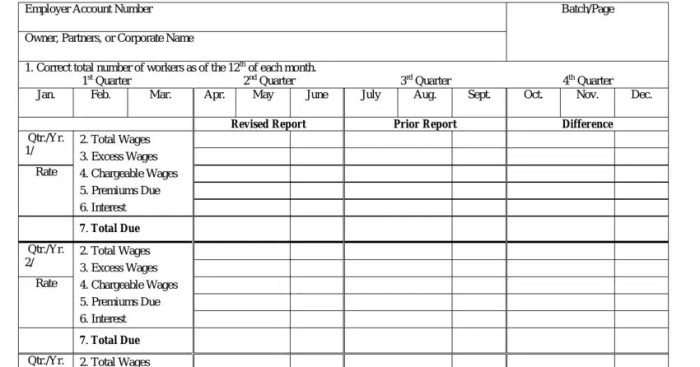

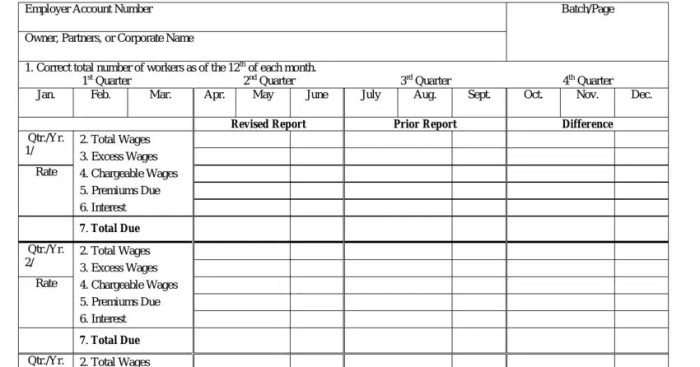

Uitr 1 Printable Form: Structure and Sections

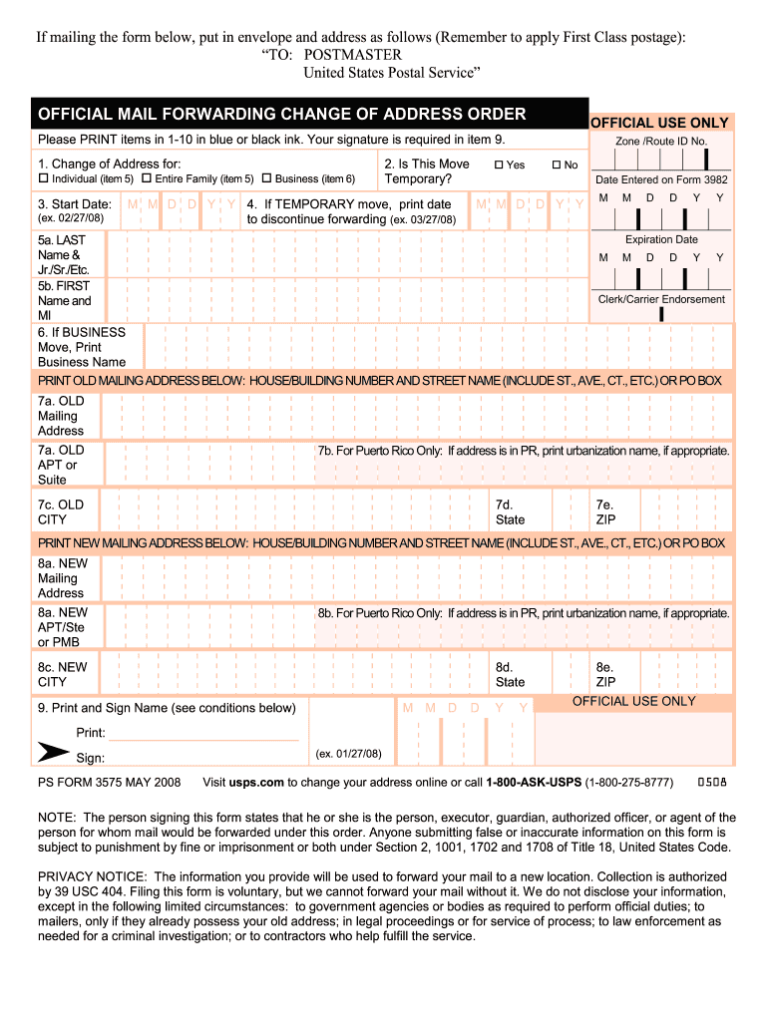

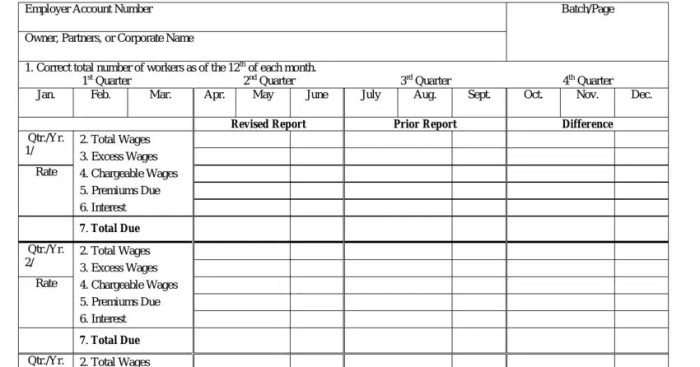

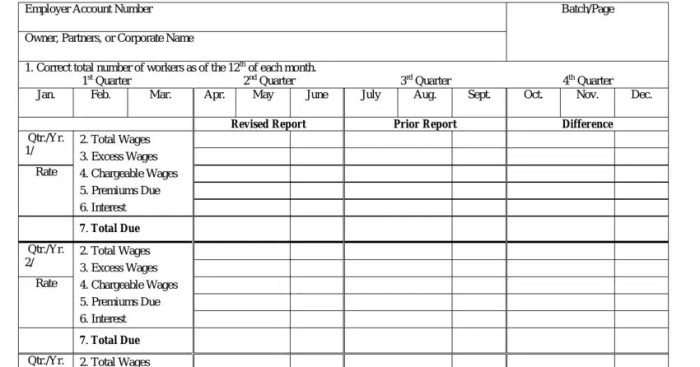

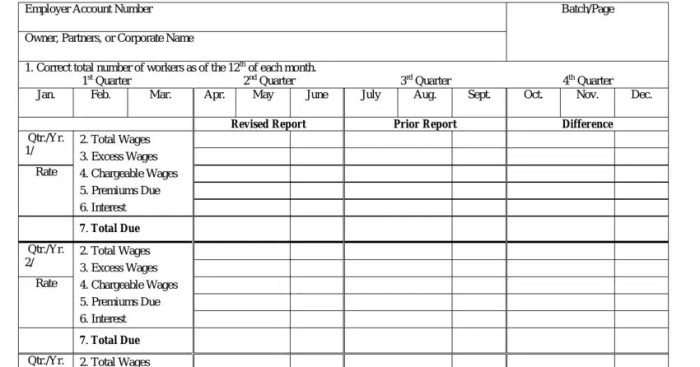

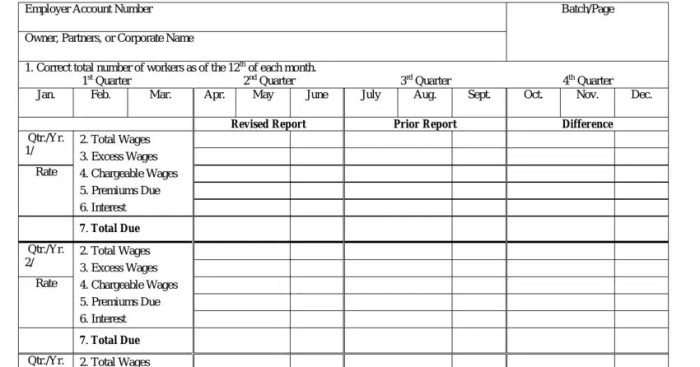

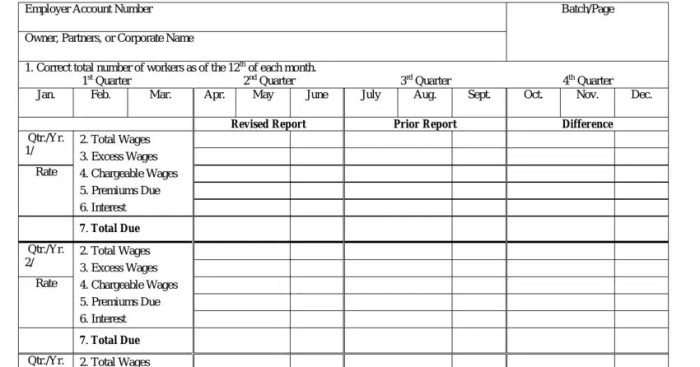

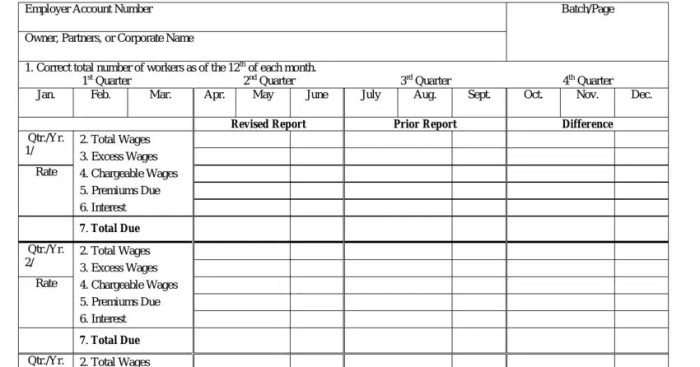

The Uitr 1 Printable Form is a comprehensive document designed to gather detailed information from taxpayers for income tax purposes. It is structured into various sections, each dedicated to collecting specific types of data. The form follows a logical flow, ensuring that taxpayers can provide the necessary information in an organized manner.

Personal Information Section

This section captures basic personal details of the taxpayer, such as name, address, contact information, and taxpayer identification number. It also includes fields for declaring the taxpayer’s marital status and residency status.

Income Section

The income section is divided into several subsections, each dedicated to a specific income source. These subsections include:

- Employment Income: Captures details of income earned from employment, including salaries, wages, bonuses, and allowances.

- Business Income: Collects information on income generated from business activities, such as profits, losses, and expenses.

- Investment Income: Records income derived from investments, such as dividends, interest, and capital gains.

li>Other Income: Includes any other income sources not covered in the previous subsections, such as rental income or lottery winnings.

Deductions and Allowances Section

This section allows taxpayers to claim deductions and allowances that reduce their taxable income. Deductions are expenses that can be subtracted from income before calculating taxes, while allowances are specific amounts that can be deducted from taxes owed.

Tax Calculation Section

Based on the information provided in the previous sections, this section calculates the taxpayer’s tax liability. It includes fields for computing taxable income, applying tax rates, and determining the amount of tax payable.

Payment Section

The payment section provides options for taxpayers to indicate how they will settle their tax liability. It includes fields for specifying the method of payment, such as cash, cheque, or online transfer, and the date of payment.

Uitr 1 Printable Form: s and Guidance

Filling out the Uitr 1 Printable Form can be a breeze, mate. Here’s the lowdown on how to get it done right:

Completing the Form

- Use black or blue ink, ‘cos pencils ain’t gonna cut it.

- Write clearly and legibly, like you’re sending a love letter to your crush.

- If you make a boo-boo, don’t panic. Just cross it out and write the correct info next to it.

- Sign and date the form in the designated spot, like a boss.

Specific Requirements

Heads up! There are some bits you need to pay extra attention to:

- Personal details: Make sure your name, address, and contact info are spot on.

- Income: List all your earnings from the tax year, including wages, dividends, and investments.

- Deductions: Claim any expenses you’re entitled to, like travel costs or work-related expenses.

Getting Support

If you’re feeling a bit lost, don’t fret. There are plenty of resources to help you out:

- HMRC website: They’ve got a treasure trove of info on the Uitr 1 Printable Form.

- Tax helpline: Give ’em a ring if you’ve got any burning questions.

- Tax advisor: If you’re feeling overwhelmed, a tax advisor can give you a hand.

Uitr 1 Printable Form

Filing Process

Filing the Uitr 1 Printable Form is a crucial step in ensuring you meet your tax obligations. The process involves several steps, including gathering necessary documents, completing the form, and submitting it to the relevant tax authorities. Here’s a breakdown of the filing process:

Gathering Documents: Before you start filling out the Uitr 1 Printable Form, it’s important to gather all the necessary documents. These may include your income slips, bank statements, and any other relevant financial documents.

Completing the Form: Once you have all the necessary documents, you can start filling out the Uitr 1 Printable Form. The form is divided into several sections, each covering a specific aspect of your income and expenses. It’s important to complete each section carefully and accurately.

Submission Options: Once you have completed the Uitr 1 Printable Form, you have two options for submitting it: online or mail. Filing online is the preferred method as it’s faster and more convenient. However, if you’re unable to file online, you can mail the completed form to the address provided by the tax authorities.

Timelines and Deadlines: It’s important to be aware of the timelines and deadlines for filing the Uitr 1 Printable Form. The deadline for filing varies depending on your circumstances, so it’s best to check with the tax authorities for specific dates.

Uitr 1 Printable Form

Uitr 1 Printable Form: Examples and Case Studies

To illustrate the practical application of the Uitr 1 Printable Form, we’ll delve into some real-world examples and case studies:

Example 1: Completing the Form for a Basic Tax Return

In this example, we’ll focus on a simple tax return scenario. Our taxpayer, a 25-year-old single individual with a modest income, uses the Uitr 1 Printable Form to declare their earnings and deductions. The form helps them accurately calculate their tax liability and ensure a timely submission to the tax authorities.

Example 2: Navigating Complex Tax Situations

For a more intricate case study, let’s consider a self-employed individual who runs a small business. They use the Uitr 1 Printable Form to report their business income, expenses, and other relevant financial details. The form’s flexibility allows them to capture all necessary information and accurately determine their tax obligations.

Common Mistakes and Challenges

While the Uitr 1 Printable Form is generally straightforward to use, there are a few common mistakes to watch out for:

- Incorrectly entering personal or financial data, which can lead to errors in tax calculations.

- Missing or incomplete sections, which may result in delays in processing the tax return.

- Not attaching supporting documentation, such as receipts or bank statements, which can hinder the verification process.

Q&A

What is the purpose of the Uitr 1 Printable Form?

The Uitr 1 Printable Form is a document used by individuals to file their annual income tax returns with the relevant tax authorities.

Who is eligible to use the Uitr 1 Printable Form?

Individuals who meet specific criteria, such as income level and residency status, are eligible to use the Uitr 1 Printable Form.

Where can I find additional support or resources if needed?

Tax authorities often provide online resources, helplines, and support centers to assist individuals with completing the Uitr 1 Printable Form.