Taxable Social Security Worksheet 2023 Printable: A Comprehensive Guide to Understanding and Using the Worksheet

Navigating the complexities of Social Security can be daunting, but understanding the Taxable Social Security Worksheet 2023 Printable can simplify the process. This worksheet is an essential tool for individuals seeking to accurately calculate their taxable Social Security income, ensuring proper tax payments and maximizing their benefits.

This guide will delve into the purpose, structure, and proper usage of the Taxable Social Security Worksheet 2023 Printable. By providing clear instructions, examples, and FAQs, we aim to empower you with the knowledge and confidence to utilize this worksheet effectively.

Taxable Social Security Worksheet Overview

The Taxable Social Security Worksheet is an essential tool for calculating the amount of your income that is subject to Social Security taxes. It is a multi-step worksheet that takes into account your total income, wages, and other factors to determine your taxable Social Security income.

The worksheet has been around for decades, and it has been updated several times over the years to reflect changes in the Social Security tax laws. The most recent update was in 2023, which increased the amount of income that is subject to Social Security taxes.

The Taxable Social Security Worksheet is used by millions of people every year. It is an important tool for ensuring that you are paying the correct amount of Social Security taxes.

Significance of the Worksheet

The Taxable Social Security Worksheet is important because it helps you determine how much of your income is subject to Social Security taxes. This is important because Social Security taxes are used to fund the Social Security program, which provides retirement, disability, and survivor benefits to millions of Americans.

If you do not pay the correct amount of Social Security taxes, you may end up owing money to the IRS when you file your tax return. You may also be subject to penalties.

The Taxable Social Security Worksheet can help you avoid these problems by ensuring that you are paying the correct amount of Social Security taxes.

Usage of the Worksheet

The Taxable Social Security Worksheet is available on the IRS website. You can also get a copy of the worksheet from your tax preparer.

To use the worksheet, you will need to gather information about your income, wages, and other factors. Once you have gathered this information, you can follow the instructions on the worksheet to calculate your taxable Social Security income.

If you are not comfortable using the worksheet on your own, you can ask your tax preparer to help you.

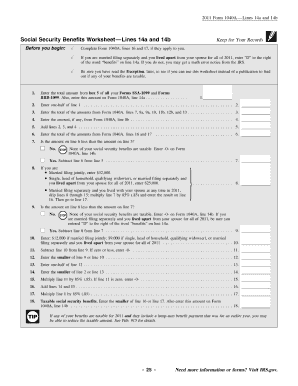

Worksheet Structure and Components

The Taxable Social Security Worksheet 2023 Printable is designed to help you determine your taxable Social Security income. It’s a straightforward worksheet with clear sections and fields to make it easy to fill out.

The worksheet is divided into three main sections:

- Section 1: Personal Information – This section collects basic information such as your name, Social Security number, and filing status.

- Section 2: Income – This section lists all types of income that are subject to Social Security tax, including wages, self-employment income, and certain types of benefits.

- Section 3: Taxable Social Security Income – This section calculates your taxable Social Security income based on the information you provided in Sections 1 and 2.

To complete the worksheet accurately, you’ll need to gather all of the necessary information and enter it into the appropriate fields. The worksheet will then automatically calculate your taxable Social Security income.

Key Fields and Data

Some of the key fields and data that you’ll need to provide on the worksheet include:

- Your name and Social Security number

- Your filing status

- Your total wages, self-employment income, and other types of income that are subject to Social Security tax

- Any adjustments to your income, such as deductions or exemptions

Calculating Taxable Social Security Income

The worksheet uses a series of formulas to calculate your taxable Social Security income. These formulas take into account your filing status, your total income, and any adjustments that you’ve made to your income.

Once you’ve entered all of the necessary information, the worksheet will automatically calculate your taxable Social Security income. This amount will be used to determine your Social Security tax liability.

s and Guidance for Completion

Completing the Taxable Social Security Worksheet 2023 Printable involves following a series of straightforward steps. Understanding the specific calculations and adjustments required is crucial to avoid errors and ensure accurate results.

Here’s a detailed breakdown of the steps:

Step 1: Gather Necessary Information

- Gather your Social Security statement, W-2 forms, and any other relevant tax documents.

- Determine your filing status (single, married filing jointly, etc.) and tax year.

Step 2: Calculate Adjusted Gross Income (AGI)

- Calculate your AGI by adding up all your income sources, such as wages, salaries, dividends, and interest.

- Subtract any eligible deductions and adjustments from your total income to arrive at your AGI.

Step 3: Determine Social Security Taxable Wage Base

- Refer to the provided Social Security Taxable Wage Base table to find the applicable limit for your tax year.

- This limit represents the maximum amount of wages or self-employment income subject to Social Security tax.

Step 4: Calculate Taxable Social Security Income

- Compare your AGI to the Social Security Taxable Wage Base.

- If your AGI is below the base, your taxable Social Security income is equal to your AGI.

- If your AGI exceeds the base, your taxable Social Security income is equal to the base amount.

Step 5: Apply Tax Rates and Calculate Tax

- Apply the Social Security tax rates (6.2% for employees, 12.4% for self-employed individuals) to your taxable Social Security income.

- Calculate the Social Security tax owed by multiplying the taxable income by the applicable tax rate.

Printable and Digital Formats

The Taxable Social Security Worksheet is available in both printable and digital formats. Printable worksheets can be downloaded from the official website of the Social Security Administration (SSA). The printable version is a PDF document that can be printed and filled out by hand. The digital version is an interactive PDF document that can be filled out on a computer or tablet. Both formats are free to download and use.

The printable format is convenient for those who prefer to fill out the worksheet by hand. The digital format is convenient for those who prefer to fill out the worksheet on a computer or tablet. The digital format also allows users to save their work and return to it later.

Where to Find and Download the Official Worksheet

The official Taxable Social Security Worksheet can be found on the website of the Social Security Administration (SSA). The link to the worksheet is: https://www.ssa.gov/forms/ssa-530.pdf.

Examples and Case Studies

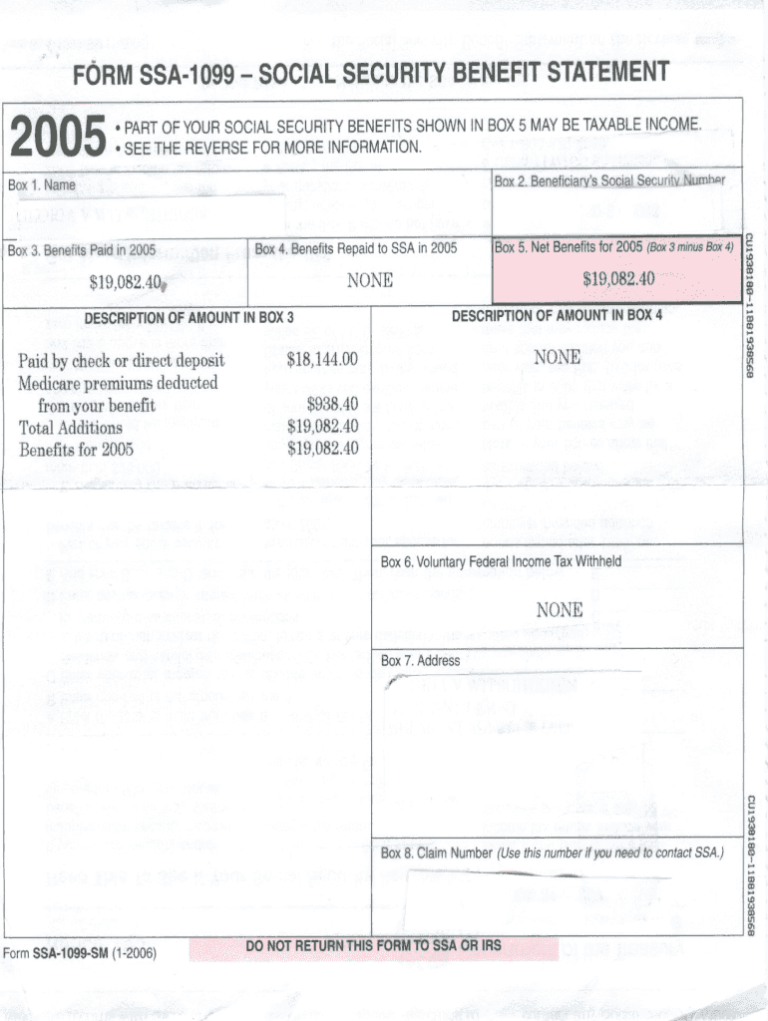

The Taxable Social Security Worksheet is a valuable tool that helps individuals accurately calculate their taxable Social Security income. Here are some real-world examples and case studies that demonstrate its application:

Example 1

Sarah, a 35-year-old employee, earns an annual salary of £55,000. Using the worksheet, she can determine that her taxable Social Security income is £38,500. This calculation is crucial because it affects the amount of Social Security taxes she will owe.

Example 2

John, a 60-year-old retiree, receives Social Security benefits and has additional income from a part-time job. The worksheet helps John calculate his taxable Social Security income, which is subject to taxation based on his combined income. By understanding his taxable income, John can plan his financial affairs effectively.

Potential Scenarios

The Taxable Social Security Worksheet is particularly useful in situations where individuals have multiple sources of income or complex financial circumstances. For instance, it can help:

– Individuals who are nearing retirement age and need to estimate their future taxable Social Security income.

– Self-employed individuals who must calculate their Social Security taxes accurately.

– Individuals who receive Social Security benefits and have other sources of income, such as wages or investment earnings.

Related Forms and Resources

The Taxable Social Security Worksheet is part of a comprehensive tax system that involves various forms and resources. Understanding these related elements can enhance your understanding and streamline your tax filing process.

Forms such as W-2, 1099, and Schedule SE provide crucial information that feeds into the Taxable Social Security Worksheet. These forms capture earnings, wages, and self-employment income, which are essential for determining your taxable Social Security benefits.

IRS Publication 915

IRS Publication 915 offers detailed guidance on Social Security and Medicare taxes. It provides comprehensive explanations, examples, and tables to assist taxpayers in understanding the complexities of these taxes. The publication complements the Taxable Social Security Worksheet by providing a broader context and clarifying specific rules and regulations.

IRS Website

The IRS website is a valuable resource for accessing a wide range of tax-related information, including the Taxable Social Security Worksheet. The website provides up-to-date forms, instructions, and frequently asked questions (FAQs) to support taxpayers throughout the tax filing process.

Tax Software and Professionals

Tax software and tax professionals can assist with the preparation of the Taxable Social Security Worksheet and other tax-related tasks. They can guide you through the complexities of the tax code, ensure accuracy, and maximize your tax savings.

Helpful Answers

What is the purpose of the Taxable Social Security Worksheet 2023 Printable?

The Taxable Social Security Worksheet 2023 Printable assists individuals in calculating their taxable Social Security income, which is subject to Social Security taxes.

Where can I find the official Taxable Social Security Worksheet 2023 Printable?

The official Taxable Social Security Worksheet 2023 Printable can be downloaded from the IRS website at https://www.irs.gov/forms-pubs/about-form-ssa-1040.

Is it mandatory to use the Taxable Social Security Worksheet 2023 Printable?

While using the Taxable Social Security Worksheet 2023 Printable is not mandatory, it is highly recommended to ensure accurate calculation of taxable Social Security income.