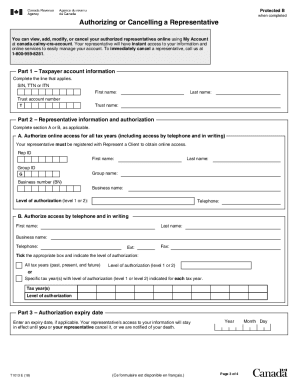

The Ultimate Guide to the T1013 Printable Form: Unlock Simplicity and Efficiency

Navigating the complexities of tax forms can be daunting, but the T1013 Printable Form is here to simplify the process. This versatile document is designed to assist individuals in reporting certain types of income, making it an essential tool for taxpayers seeking accuracy and ease of use.

Whether you’re a seasoned tax professional or an individual seeking to understand your tax obligations, this comprehensive guide will empower you with the knowledge and confidence to complete the T1013 Printable Form effortlessly.

T1013 Printable Form Overview

The T1013 Printable Form is an official document used to apply for a provisional driving licence in the United Kingdom. It is a straightforward form that can be filled out online or downloaded and printed to be completed by hand.

The T1013 form is designed for individuals who are at least 15 years and 9 months old and have never held a driving licence before. It is a crucial step in the process of obtaining a provisional driving licence, which allows learners to practise driving on public roads under the supervision of a qualified driver.

Target Audience

The T1013 Printable Form is primarily aimed at young people who are eager to start their driving journey. It is particularly relevant for those who are approaching the legal driving age and are keen to gain the necessary skills and experience to operate a vehicle safely and responsibly.

Key Features and Benefits

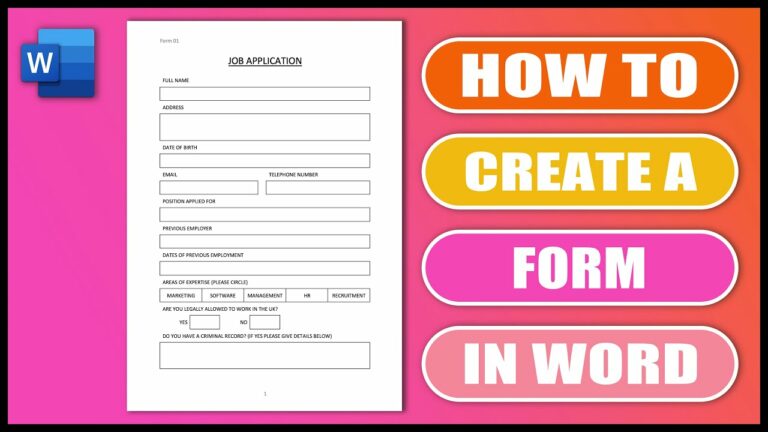

The T1013 Printable Form is a highly useful and advantageous document that offers a range of key features and benefits. It’s designed to streamline processes, enhance efficiency, and provide a convenient solution for various needs.

Let’s dive into the key features and explore the advantages of using this form:

Customizable Template

- Easily adapt the form to specific requirements by customizing fields, sections, and overall layout.

- Tailor the form to match your brand identity, ensuring a consistent and professional presentation.

Digital Accessibility

- Access the form anytime, anywhere, on multiple devices with an internet connection.

- Share the form electronically, making it convenient for collaborators and recipients.

Time-Saving

- Automate repetitive tasks and streamline processes by using the digital form.

- Eliminate manual data entry, reducing the risk of errors and saving valuable time.

Enhanced Data Management

- Organize and store data securely in a digital format, making it easy to retrieve and manage.

- Access data from anywhere, ensuring real-time collaboration and decision-making.

Improved Collaboration

- Share the form with multiple users, allowing for simultaneous collaboration and input.

- Track changes and comments, facilitating effective communication and feedback.

Step-by-Step Guide to Completing the Form

Filling out the T1013 Printable Form is a breeze, fam. Just follow these sick steps, and you’ll be sorted in no time.

Before you dive in, make sure you’ve got all the deets you need, like your National Insurance number and your employer’s info. Now, let’s get cracking!

Personal Details

First up, let’s get your personal info sorted. Fill in your full name, address, and contact details. Make sure it’s all correct, or HMRC might get confused.

Employment Details

Next, it’s time to dish the dirt on your job. Enter your employer’s name and address, and don’t forget to include your job title and start date.

Income and Deductions

Now, let’s talk money. Fill in your gross pay, deductions, and any other income you might have. This is where you show HMRC what you’re earning and what’s being taken out.

Tax Calculations

This is where the magic happens. HMRC will work their wizardry and calculate your tax based on the info you’ve provided. Just sit back and let them do their thing.

Declaration

Finally, it’s time to sign on the dotted line. Read the declaration carefully, then sign and date it. This is where you’re saying everything you’ve filled in is legit.

Common Mistakes and Pitfalls

Filling out the T1013 Printable Form can be a breeze, but watch out for these common traps to avoid any headaches.

Double-check every detail, like your personal info and income, to make sure it’s spot on. Remember, accuracy is key.

Leaving Fields Blank

- Don’t leave any blanks. If a section doesn’t apply to you, write “N/A” or “Not Applicable” instead of leaving it empty.

Misinterpreting Instructions

- Read the instructions carefully. If something’s unclear, don’t guess – reach out to the relevant authority for clarification.

Using the Wrong Form

- Make sure you’re using the correct T1013 Printable Form for your specific situation. There are different versions for different purposes, so choose wisely.

Alternative Options and Resources

While the T1013 Printable Form is a valuable tool for managing specific tasks, there are alternative options and resources that can provide additional support or cater to different needs.

One alternative is using digital task management apps or software. These tools offer a range of features, including task organization, reminders, collaboration, and project tracking. They can be particularly useful for managing complex projects or tasks that involve multiple team members.

Additional Resources

- Task Management Apps: Trello, Asana, Todoist

- Time Management Tools: Google Calendar, RescueTime, Toggl

- Productivity Techniques: Pomodoro Technique, Kanban

Questions and Answers

Who can benefit from using the T1013 Printable Form?

Individuals who need to report income from sources such as self-employment, rental properties, or investments can utilize the T1013 Printable Form.

What are the key features of the T1013 Printable Form?

The T1013 Printable Form provides a structured layout for reporting income, expenses, and deductions, ensuring accuracy and completeness.

How can I avoid common mistakes when completing the T1013 Printable Form?

Pay close attention to instructions, double-check calculations, and seek professional assistance if needed to minimize errors.

Are there any alternative options to the T1013 Printable Form?

In some cases, individuals may consider using tax software or online platforms as alternatives to the printable form.