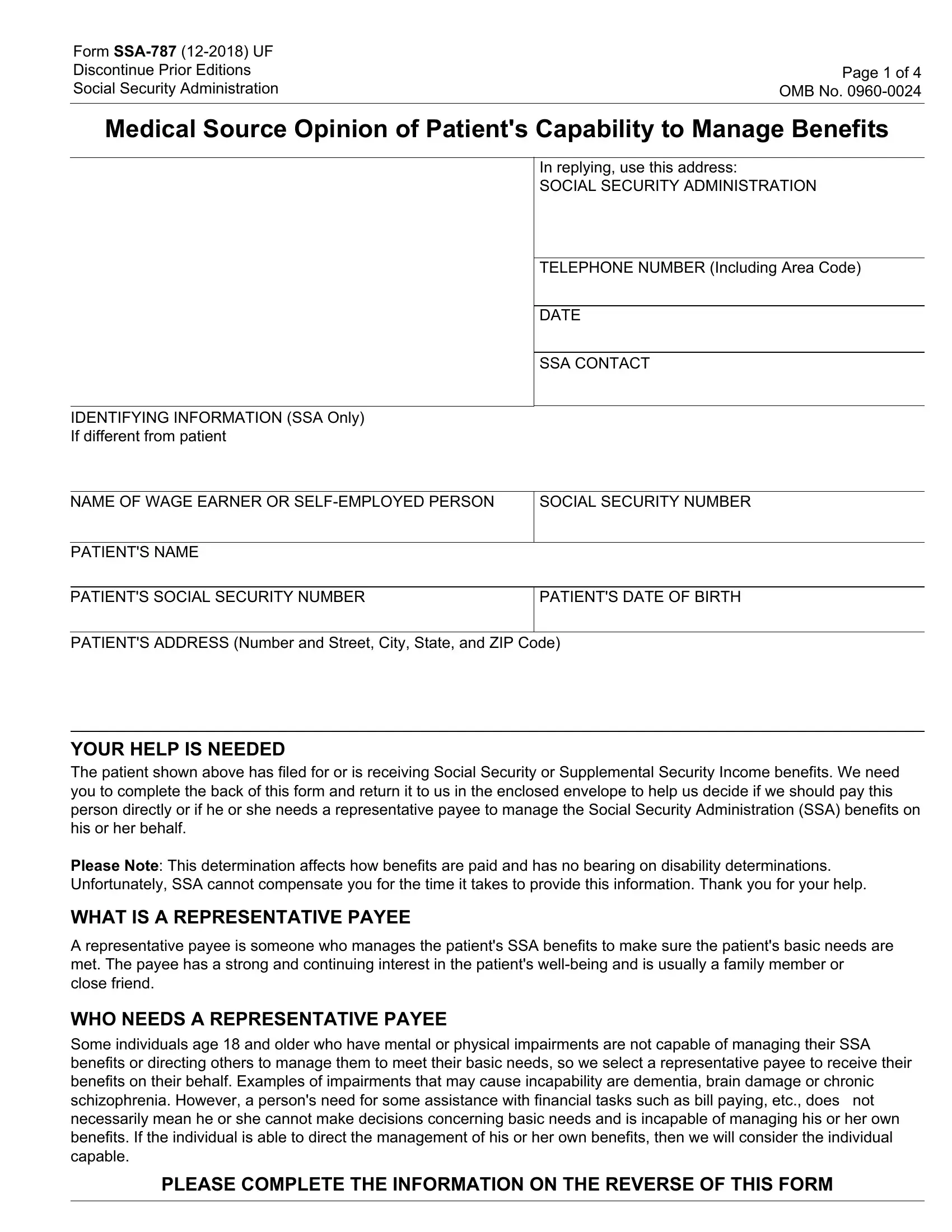

SSA 787 Printable Form 2023: A Comprehensive Guide

Navigating the complexities of government forms can be daunting, but understanding SSA Form 787 is crucial for individuals seeking Social Security benefits. This comprehensive guide will delve into the purpose, eligibility, and key sections of this essential document, empowering you to complete it accurately and efficiently.

As we explore the intricacies of Form 787, you will gain insights into the filing process, common errors to avoid, and valuable resources available for assistance. Whether you are applying for retirement, disability, or survivors’ benefits, this guide will provide you with the knowledge and confidence to navigate the Social Security system.

Overview of SSA Form 787

SSA Form 787, also known as the Application for Benefits Under the Social Security Disability Insurance Program, is a crucial document for individuals seeking Social Security Disability Insurance (SSDI) benefits. It’s a formal request to the Social Security Administration (SSA) for financial assistance due to a disabling condition.

To be eligible for SSDI, you must meet specific criteria. Firstly, you must have worked long enough and paid Social Security taxes. Secondly, you must have a medical condition that prevents you from engaging in substantial gainful activity (SGA), which is defined as work that generates income above a certain threshold.

Filing Form 787 involves gathering medical records, obtaining work history information, and providing personal details. The application can be submitted online, by mail, or in person at a local SSA office. It’s essential to file within 12 months of becoming disabled to avoid any delays in receiving benefits.

Key Sections of SSA Form 787

Yo, the SSA Form 787 is like a sick document that’s gonna help you get that bread from the government, blud. It’s got a bunch of different sections, and each one’s got its own thing to do. So, let’s break it down, fam.

Personal Information

This is where you spill the beans about yourself, bruv. It’s got your name, address, date of birth, and all that jazz. Make sure you fill this out properly, otherwise the government might think you’re trying to pull a fast one.

Work History

Time to flex your work game, my G. This section wants to know all about the jobs you’ve had in the past. Include the dates you worked, the names of the companies, and what you did. The more detailed you are, the better.

Income

Now, it’s time to talk about the cheddar you’ve been raking in. List all your income sources, like wages, self-employment, and investments. Be honest, or the taxman will come knocking.

Assets

What’s your net worth, bruv? This section is where you list all your assets, like cash, property, and vehicles. It helps the government figure out how much you’re worth.

Expenses

Don’t forget about the dough you’re spending, blud. This section is for all your expenses, like rent, food, and transportation. It helps the government determine how much money you need to live on.

Additional Information

Any extra bits you need to tell the government go here. Maybe you’ve got a disability or you’re taking care of a sick relative. Whatever it is, spill it in this section.

Common Errors to Avoid

Filling out SSA Form 787 correctly is essential to ensure your application is processed smoothly and without delays. Here are some common mistakes to avoid:

Missing Information

Leaving out required information can delay the processing of your application. Make sure you fill out all the fields on the form, including your personal information, contact details, and financial data.

Inaccurate Information

Providing incorrect information on your application can lead to errors in your benefit calculations or even denial of your claim. Double-check all the information you enter on the form to ensure its accuracy.

Unsigned Form

Your application will not be processed unless it is signed. Make sure you sign and date the form in the designated section before submitting it.

Missing Documentation

Supporting documentation, such as proof of income or medical records, is often required to support your application. Failure to provide the necessary documentation can delay the processing of your claim or even result in its denial.

Filing Too Late

There are deadlines for submitting SSA Form 787. If you file your application after the deadline, it may not be processed or you may be penalized. Check the deadlines carefully and submit your application on time.

Additional Resources for Assistance

Need help understanding or completing Form 787? Here are some useful resources:

Social Security Administration Contact Information

– Phone: 1-800-772-1213

– Website: https://www.ssa.gov/

– Local office locator: https://secure.ssa.gov/ICON/main.jsp

Support Groups and Online Forums

– National Organization of Social Security Claimants’ Representatives (NOSSCR): https://www.nosscr.org/

– Social Security Disability Advocates Association (SSDAA): https://www.ssdaa.org/

– Online forum for Social Security disability benefits: https://www.ssa.gov/benefits/disability/forum/

FAQ

What is the purpose of SSA Form 787?

SSA Form 787 is used to apply for retirement, disability, or survivors’ benefits from the Social Security Administration.

Who is eligible to file Form 787?

Individuals who have worked and paid into the Social Security system may be eligible to file Form 787, depending on their age, work history, and other factors.

What are the deadlines for filing Form 787?

The filing deadlines for Form 787 vary depending on the type of benefits being applied for. It is recommended to file as early as possible to avoid any potential delays.

Where can I get help completing Form 787?

You can get help completing Form 787 from the Social Security Administration’s website, by calling their toll-free number, or by visiting a local Social Security office.