Quit Claim Deed Printable Form: A Comprehensive Guide

Navigating the world of real estate can be daunting, especially when it comes to transferring property ownership. One commonly used document in this process is the Quit Claim Deed. Understanding its purpose, implications, and how to obtain and fill out a Quit Claim Deed Printable Form is crucial for a smooth and secure property transfer.

This guide will delve into the intricacies of Quit Claim Deeds, providing you with a comprehensive understanding of their advantages, disadvantages, legal considerations, and alternative methods. Whether you’re a seasoned real estate professional or a first-time homebuyer, this guide will equip you with the knowledge and resources you need to navigate the Quit Claim Deed process with confidence.

Definition of Quit Claim Deed

A Quit Claim Deed is a legal document that transfers ownership of real estate from one party to another. It’s often used when the seller doesn’t have a clear title to the property or when they want to get rid of any potential claims against the property in the future.

Unlike a Warranty Deed, a Quit Claim Deed doesn’t guarantee that the seller has a clear title to the property. Instead, it simply transfers whatever interest the seller has in the property to the buyer. This means that the buyer could end up with a title that’s not as clear as they thought.

Parties Involved in a Quit Claim Deed

There are two main parties involved in a Quit Claim Deed: the grantor and the grantee. The grantor is the person who is transferring ownership of the property, and the grantee is the person who is receiving ownership of the property.

In addition to the grantor and grantee, there may also be other parties involved in a Quit Claim Deed, such as a notary public or a title company. A notary public is a person who is authorized to witness the signing of a document and verify the identities of the parties involved. A title company is a company that searches for liens and other encumbrances on a property and issues title insurance to protect the buyer from any claims against the property.

Advantages and Disadvantages of Using a Quit Claim Deed

Quit Claim Deeds are commonly used in property transactions for their simplicity and cost-effectiveness. However, it’s crucial to understand both the advantages and disadvantages of using this type of deed before making a decision.

Advantages of Using a Quit Claim Deed

- Ease of transfer: Quit Claim Deeds are relatively simple to draft and execute, making the property transfer process quick and straightforward.

- Low cost: Quit Claim Deeds typically incur lower fees compared to other types of deeds, such as Warranty Deeds.

- Suitable for specific situations: Quit Claim Deeds are particularly useful in situations where the grantor (person transferring the property) does not have a clear title or does not want to make any warranties about the property’s condition.

Disadvantages of Using a Quit Claim Deed

- Limited warranties: Unlike Warranty Deeds, Quit Claim Deeds do not provide any warranties regarding the title or condition of the property. This means that the grantee (person receiving the property) assumes all risks associated with the property’s ownership.

- Potential for hidden liens or encumbrances: Quit Claim Deeds do not guarantee that the property is free from any liens or encumbrances. As a result, the grantee may face unexpected financial obligations or legal challenges related to the property.

- May not be accepted by lenders: Some lenders may be hesitant to accept Quit Claim Deeds as collateral for loans due to the lack of warranties and potential risks associated with the property’s title.

Benefits of Using a Quit Claim Deed for Specific Situations

Quit Claim Deeds can be particularly beneficial in the following situations:

- Transferring property within a family: When transferring property between family members, a Quit Claim Deed can be a cost-effective and convenient option, as it does not require extensive title searches or warranties.

- Correcting errors in property records: Quit Claim Deeds can be used to correct errors or omissions in property records, such as incorrect ownership information or boundary disputes.

- Transferring property to a trust: Quit Claim Deeds are commonly used to transfer property into a trust, as they allow for a simple and efficient transfer of ownership without the need for title insurance.

Risks Associated with Using a Quit Claim Deed

Using a Quit Claim Deed also comes with certain risks that should be considered:

- No protection against hidden defects: Quit Claim Deeds do not provide any warranties against hidden defects or undisclosed issues with the property, which could lead to costly repairs or legal disputes.

- Potential for title disputes: Quit Claim Deeds do not guarantee a clear title, which could lead to title disputes or claims from third parties.

- Difficulty in obtaining title insurance: Due to the lack of warranties, it can be more difficult to obtain title insurance for properties transferred using Quit Claim Deeds.

It’s important to carefully consider the advantages and disadvantages of using a Quit Claim Deed before making a decision. Consulting with an attorney or real estate professional can provide valuable guidance and ensure that the deed used meets your specific needs and circumstances.

How to Obtain a Quit Claim Deed Printable Form

To obtain a Quit Claim Deed Printable Form, you can either download it from the internet or obtain it from your local courthouse or land registry office. Here are some steps involved in obtaining a Quit Claim Deed Printable Form:

Online Resources

There are numerous websites that provide free Quit Claim Deed Printable Forms. You can search for “Quit Claim Deed Printable Form” on the internet and select a reputable website. Make sure to review the terms and conditions of the website before downloading the form.

Local Courthouse or Land Registry Office

You can also obtain a Quit Claim Deed Printable Form from your local courthouse or land registry office. The staff at these offices can provide you with the necessary form and assist you with any questions you may have.

Importance of Reviewing the Form

Before signing the Quit Claim Deed, it is crucial to carefully review the form. Ensure that all the information is correct, including the names of the grantor and grantee, the legal description of the property, and the date of the transfer. If you have any questions or concerns, it is advisable to consult with an attorney.

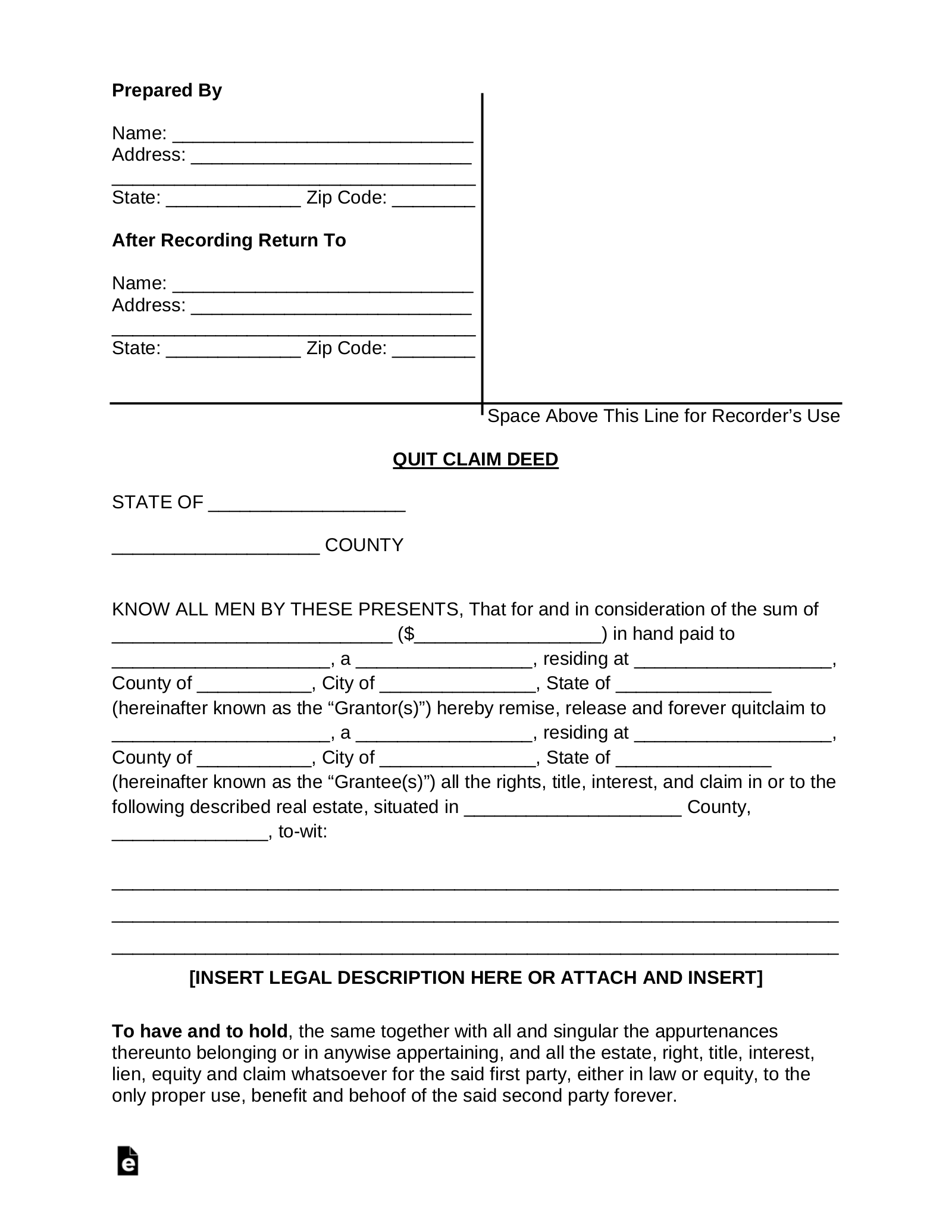

Filling Out a Quit Claim Deed Printable Form

Filling out a Quit Claim Deed Printable Form is a simple process, but it’s important to do it correctly to ensure that the transfer of property is valid. Here’s a step-by-step guide to help you fill out the form:

Step 1: Gather Necessary Information

Before you begin filling out the form, you’ll need to gather some essential information, including:

- The names and addresses of the grantor (the person transferring the property) and the grantee (the person receiving the property)

- A legal description of the property

- The date of the transfer

- The amount of consideration (if any) being paid for the property

Step 2: Complete the Grantor and Grantee Information

In the first section of the form, you’ll need to provide the names and addresses of the grantor and the grantee. Make sure to use the legal names of both parties.

Step 3: Describe the Property

In the next section of the form, you’ll need to provide a legal description of the property. This description should include the street address, the city, the county, and the state. You can find the legal description of the property on your property deed or tax bill.

Step 4: Enter the Date of Transfer

In the next section of the form, you’ll need to enter the date of the transfer. This is the date that the property is being transferred from the grantor to the grantee.

Step 5: State the Consideration

In the next section of the form, you’ll need to state the amount of consideration (if any) being paid for the property. Consideration can be anything of value, such as money, goods, or services.

Step 6: Sign and Notarize the Form

Once you’ve completed all of the information on the form, you’ll need to sign and notarize it. The grantor must sign the form in front of a notary public. The notary public will then verify the grantor’s identity and sign the form.

Common Mistakes to Avoid

Here are some common mistakes to avoid when filling out a Quit Claim Deed Printable Form:

- Using the wrong legal names of the grantor and the grantee

- Providing an incorrect legal description of the property

- Entering the wrong date of transfer

- Failing to state the consideration being paid for the property

- Signing the form before a notary public

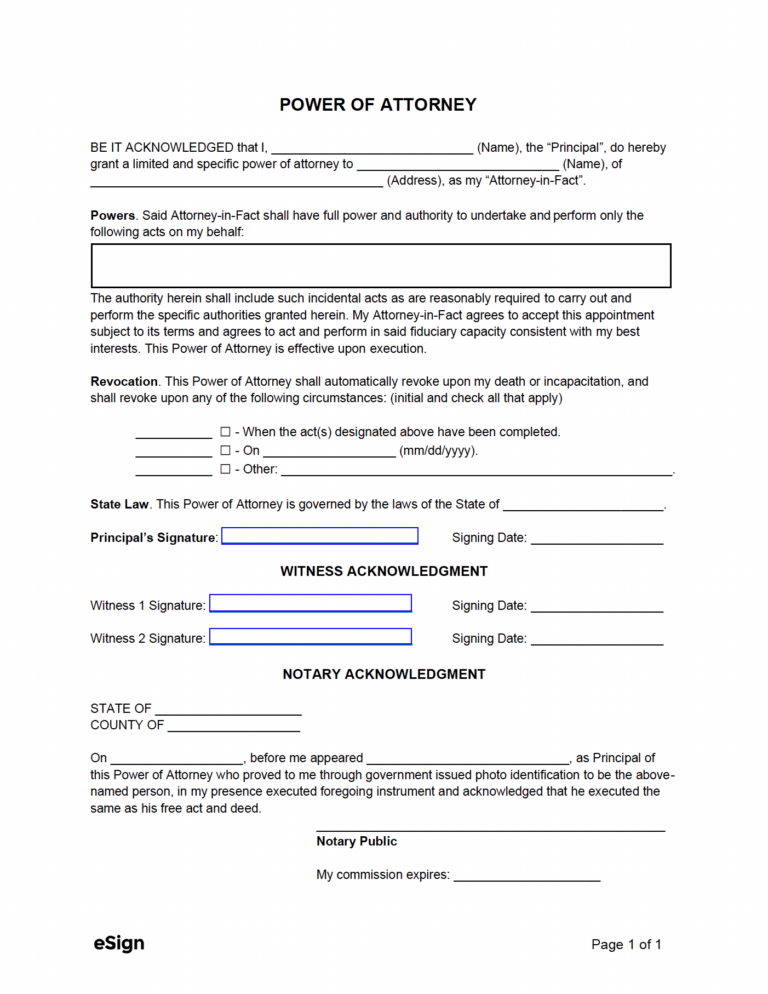

Legal Considerations for Quit Claim Deeds

Executing a Quit Claim Deed involves adhering to specific legal requirements. Understanding these requirements ensures the validity and enforceability of the deed.

Notarization plays a crucial role in Quit Claim Deeds. A notary public, a state-appointed official, verifies the identities of the grantor and grantee and witnesses their signatures. This process adds an extra layer of authenticity and prevents fraud.

Recording the Quit Claim Deed

Once executed, a Quit Claim Deed must be recorded in the county where the property is located. Recording serves several purposes. It provides public notice of the transfer of ownership, protects the grantee’s interest against subsequent claims, and allows the deed to be used as evidence in legal proceedings.

Consequences of Failing to Follow Legal Procedures

Failure to follow the proper legal procedures when executing a Quit Claim Deed can have serious consequences. An improperly executed deed may be deemed invalid, leaving the transfer of ownership incomplete. This can lead to legal disputes, financial losses, and potential claims against the parties involved.

Alternative Methods to Quit Claim Deeds

There are alternative methods to transfer property ownership apart from using a Quit Claim Deed. These include Warranty Deeds and Gift Deeds. Let’s compare these methods:

Warranty Deed

A Warranty Deed is a legal document that guarantees that the seller has the legal right to sell the property and that there are no outstanding claims or liens on the property. This type of deed offers the most protection to the buyer as it provides a guarantee of ownership.

Gift Deed

A Gift Deed is a legal document that transfers property ownership from one person to another without any payment or consideration. This type of deed is often used when transferring property between family members or close friends.

Choosing the Right Method

The best method for transferring property ownership will depend on the specific circumstances of the transaction. A Quit Claim Deed is a good option when the seller does not want to make any warranties about the property or when the buyer is aware of any potential issues with the property. A Warranty Deed is a better option when the buyer wants to be sure that the seller has the legal right to sell the property and that there are no outstanding claims or liens on the property. A Gift Deed is a good option when transferring property between family members or close friends without any payment or consideration.

FAQs

What is the difference between a Quit Claim Deed and a Warranty Deed?

A Quit Claim Deed transfers ownership without any warranties or guarantees, while a Warranty Deed provides assurances that the grantor has clear title to the property and is authorized to transfer it.

Can I use a Quit Claim Deed to transfer property to myself?

Yes, you can use a Quit Claim Deed to transfer property from one of your entities to another, such as from your personal name to your LLC.

Is it safe to use a Quit Claim Deed Printable Form?

Yes, Quit Claim Deed Printable Forms are generally safe to use as long as they are obtained from reputable sources and reviewed by a legal professional before signing.