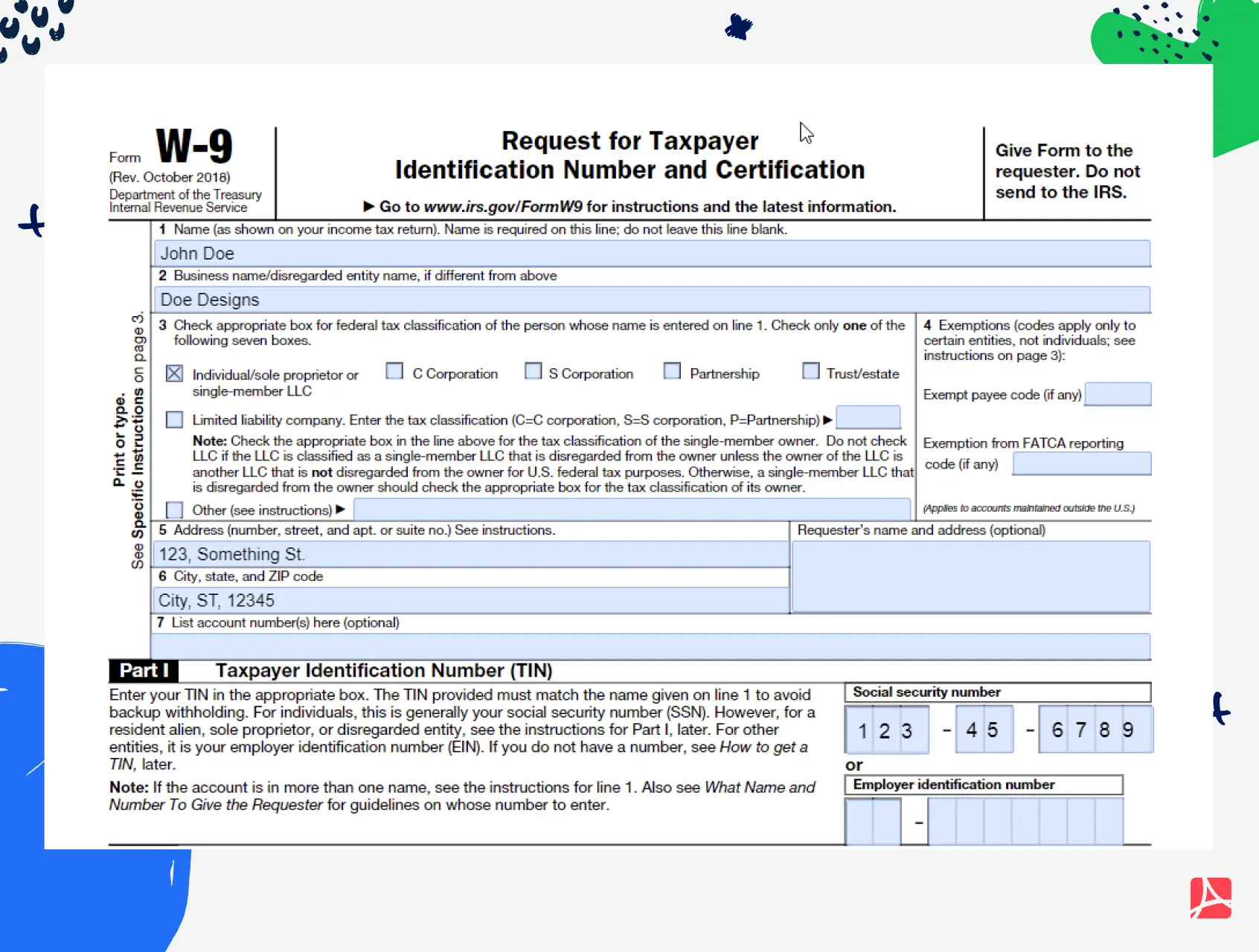

Printable W-9 Form: A Comprehensive Guide to Simplify Tax Preparation

Navigating the complexities of tax preparation can be daunting, but understanding and utilizing printable W-9 forms can significantly streamline the process. These forms are crucial for accurate tax filing, and their accessibility makes it easier than ever to gather the necessary information from individuals or businesses.

This comprehensive guide will delve into the purpose, structure, and benefits of printable W-9 forms. We will provide step-by-step instructions for completing them accurately, highlight common errors to avoid, and explore their role in tax preparation. Additionally, we will provide links to official resources and support materials to ensure a smooth and error-free experience.

Understanding Printable W-9 Forms

A W-9 form is a crucial document used by businesses to collect tax information from individuals or entities they hire as independent contractors. It helps ensure accurate tax reporting and compliance with regulations.

Sections and Fields Included in a W-9 Form

A W-9 form typically includes the following sections and fields:

– Requester Information: This section includes the name, address, and taxpayer identification number (TIN) of the business requesting the W-9.

– Taxpayer Information: This section includes the name, address, TIN, and signature of the individual or entity providing services.

– Certification: This section includes a statement that the taxpayer is not subject to backup withholding and certifies that the information provided is correct.

– Signature and Date: The taxpayer must sign and date the W-9 form to validate the information provided.

Benefits of Using Printable W-9 Forms

Intro paragraph

Printable W-9 forms offer a range of advantages that make them a valuable resource for both individuals and businesses. Their convenience, accessibility, and time-saving capabilities are just a few of the reasons why printable W-9 forms are so widely used.

Convenience

- Printable W-9 forms are readily available online, making them easy to access and download whenever needed.

- They can be printed and filled out at any time, eliminating the need to wait for forms to be mailed or delivered.

- Printable W-9 forms can be easily customized to meet specific requirements, such as adding a company logo or including additional fields.

Accessibility

- Printable W-9 forms are available to anyone with an internet connection, regardless of their location or financial situation.

- They can be downloaded and printed for free, making them an affordable option for individuals and businesses alike.

- Printable W-9 forms are available in multiple languages, ensuring that non-native English speakers can easily access and complete them.

Time-saving

- Printable W-9 forms eliminate the need for manual data entry, saving time and reducing the risk of errors.

- They can be filled out and submitted electronically, further streamlining the process and speeding up the turnaround time.

- Printable W-9 forms allow for easy tracking and management of multiple forms, ensuring that all necessary information is collected and stored securely.

s for Completing Printable W-9 Forms

Filling out a printable W-9 form is a simple process that can be completed in a few minutes. By following these s, you can ensure that your form is accurate and complete.

Here are the s for completing a printable W-9 form:

Step 1: Gather your information

Before you begin filling out the form, gather the following information:

- Your name (or the name of your business)

- Your address

- Your taxpayer identification number (TIN)

- Your certification (if applicable)

Step 2: Complete the form

Once you have gathered your information, you can begin filling out the form. The form is divided into several sections. Each section contains specific instructions on how to complete it.

The following are some tips for completing each section of the form:

- Part I: Taxpayer Information – This section includes your name, address, and TIN. If you are a business, you will also need to provide your business name and address.

- Part II: Certification – This section contains the certification that you are required to sign. The certification states that you are a U.S. citizen or resident, or that you are a foreign person who is not subject to backup withholding.

- Part III: Backup Withholding – This section is only required if you are subject to backup withholding. Backup withholding is a tax that is withheld from certain payments, such as interest and dividends.

Step 3: Sign and date the form

Once you have completed the form, you must sign and date it. The form must be signed by the taxpayer or by an authorized representative of the taxpayer.

Common Errors to Avoid When Completing Printable W-9 Forms

When completing printable W-9 forms, it’s crucial to avoid common mistakes that can lead to delays in processing or even rejection of your forms. These errors can range from simple oversights to more complex misunderstandings. Let’s explore some of the most frequent errors to steer clear of:

Incorrect Name and Address

- Mistakes in your legal name or business name can cause confusion and delays in processing.

- Ensure the address you provide is complete and accurate, including the street number, street name, city, state, and ZIP code.

Missing or Incomplete Taxpayer Identification Number (TIN)

- The TIN is a crucial piece of information that identifies you to the IRS.

- If you’re an individual, provide your Social Security Number (SSN). If you’re a business, provide your Employer Identification Number (EIN).

Incorrect Certification

- The certification section at the bottom of the form requires you to attest to the accuracy of the information provided.

- Make sure you read and understand the certification before signing and dating the form.

Leaving Fields Blank

- Leaving any fields blank can result in your form being rejected.

- Complete all applicable fields, even if you don’t have information for certain sections.

Submitting an Outdated Form

- The W-9 form is revised periodically, so it’s essential to use the most recent version.

- Download the latest form from the IRS website to ensure you’re using the correct version.

Using Printable W-9 Forms in Tax Preparation

Printable W-9 forms are crucial for tax preparation as they provide essential information required by the Internal Revenue Service (IRS) for accurate tax filing. These forms capture vital details about the taxpayer, including their name, address, taxpayer identification number (TIN), and certification.

Accurate and complete W-9 forms are vital to ensure smooth and error-free tax processing. Incomplete or inaccurate forms can lead to delays in tax refunds, additional scrutiny by the IRS, or even penalties. Hence, it’s imperative to pay meticulous attention to the information provided on W-9 forms to avoid potential issues.

Additional Resources for Printable W-9 Forms

Seeking further assistance with Printable W-9 Forms? Explore these valuable resources:

IRS Resources

- IRS Website: https://www.irs.gov/forms-pubs/about-form-w-9

- Form W-9 Instructions: https://www.irs.gov/pub/irs-pdf/iw9.pdf

Additional Support

If you encounter difficulties completing or using Printable W-9 Forms, consider these support options:

- Tax Preparation Software: Many software programs offer guidance and support for completing W-9 forms.

- Tax Professionals: Certified Public Accountants (CPAs) or Enrolled Agents (EAs) can provide expert assistance with W-9 forms.

- Online Forums and Discussion Groups: Engage with tax professionals and other users in online forums dedicated to W-9 forms.

FAQ Corner

What is the purpose of a W-9 form?

A W-9 form is used to collect essential information from individuals or businesses who are receiving payments for services rendered. It provides the taxpayer identification number (TIN) and other relevant details, ensuring accurate reporting of income and withholding.

Where can I find a printable W-9 form?

Printable W-9 forms are readily available on the official IRS website (https://www.irs.gov/forms-pubs/about-form-w-9) and various other reputable sources.

How do I fill out a W-9 form correctly?

Follow the step-by-step instructions provided in this guide, carefully entering the required information in each field. Pay close attention to details and ensure that all sections are completed accurately.

What are some common errors to avoid when completing a W-9 form?

Common errors include incorrect TINs, missing or incomplete information, and failing to sign and date the form. These errors can lead to delays in processing and potential tax penalties.

How are printable W-9 forms used in tax preparation?

Completed W-9 forms are submitted to the payer, who uses the information to report payments made to the recipient. This ensures accurate income reporting and appropriate withholding of taxes.