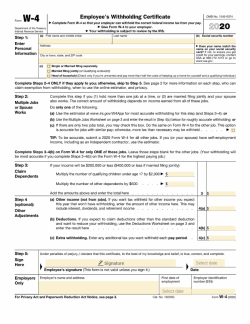

Printable W-4: A Guide to Understanding and Completing the Form

The Printable W-4 form is an essential document for employees in the United States. It allows individuals to provide their employers with information about their tax withholding allowances, which determines the amount of federal income tax withheld from their paychecks. Understanding and completing the Printable W-4 form correctly can help ensure that employees receive the correct amount of tax withholding and avoid unexpected tax bills or refunds.

This comprehensive guide will provide a detailed overview of the Printable W-4 form, including its purpose, who should use it, and the benefits of using it. We will also cover how to complete the form accurately, how to use it to calculate withholding allowances, and what the consequences are for not using the form correctly. Additionally, we will discuss alternative methods for calculating withholding allowances and provide resources for obtaining the Printable W-4 form and finding additional information.

Understanding the Printable W-4

The Printable W-4 is a tax form used to tell your employer how much federal income tax to withhold from your paychecks. It’s important to fill out the W-4 accurately so that you don’t have too much or too little tax withheld.

Everyone who earns income from a job is required to fill out a W-4. You should also fill out a new W-4 if you have a change in your tax situation, such as getting married, having a child, or changing jobs.

Benefits of Using the Printable W-4

- It’s easy to use and understand.

- It’s free to download and print.

- It can help you avoid having too much or too little tax withheld from your paychecks.

Completing the Printable W-4

To complete the Printable W-4 form, follow these steps:

Step 1: Personal Information

- Enter your name, address, and Social Security number.

- Check the box that indicates your filing status (single, married, etc.).

- If you have dependents, enter their names and ages.

Step 2: Allowances

Allowances are deductions from your paycheck that reduce the amount of taxes withheld. The more allowances you claim, the less taxes will be withheld.

- Enter the number of allowances you are claiming.

- Use the worksheet on the back of the W-4 to help you determine the number of allowances you should claim.

Step 3: Additional Income

If you have other sources of income, such as self-employment or investments, enter that information here.

Step 4: Adjustments

If you need to make any adjustments to your withholding, such as increasing or decreasing the amount of taxes withheld, enter that information here.

Step 5: Sign and Date

Once you have completed the form, sign and date it.

Tips for Completing the Printable W-4 Form Accurately

- Use the worksheet on the back of the W-4 to help you determine the number of allowances you should claim.

- If you are not sure how many allowances to claim, you can use the IRS Withholding Calculator.

- Make sure to enter your information accurately, as errors can lead to incorrect withholding.

- Keep a copy of your W-4 for your records.

Using the Printable W-4

The Printable W-4 form is a vital tool for employees to calculate their withholding allowances. It determines the amount of federal income tax withheld from their paychecks. Using the form correctly is crucial to ensure that the right amount of tax is withheld, avoiding potential penalties or refunds.

Calculating Withholding Allowances

To calculate withholding allowances, follow these steps:

– Determine your filing status (single, married, etc.).

– Enter the number of allowances claimed on line 5.

– If you have additional income, enter it on line 6.

– Use the withholding allowance worksheet on the form to calculate your total allowances.

Adjusting Withholding Allowances

If your circumstances change, you may need to adjust your withholding allowances. For example, if you get married, have a child, or experience a significant change in income, you should update your W-4. To do this, simply fill out a new W-4 and submit it to your employer.

Consequences of Incorrect W-4

Not using the Printable W-4 form correctly can have serious consequences. If too much tax is withheld, you may end up with a large refund at tax time. However, if too little tax is withheld, you may owe money to the IRS when you file your taxes, resulting in penalties and interest charges.

Printable W-4 Alternatives

Besides the Printable W-4 form, there are alternative methods to determine your withholding allowances. These include using the IRS withholding calculator, consulting a tax professional, or relying on software programs that can assist with tax calculations.

Each method has its advantages and disadvantages. The Printable W-4 form is straightforward and easy to use, but it may not be the most accurate method for everyone. The IRS withholding calculator is more accurate, but it can be more time-consuming to use. Consulting a tax professional is the most accurate method, but it can also be the most expensive.

IRS Withholding Calculator

The IRS withholding calculator is an online tool that can help you determine your withholding allowances. The calculator asks you a series of questions about your income, deductions, and credits. Based on your answers, the calculator will recommend the number of withholding allowances you should claim on your W-4 form.

The IRS withholding calculator is a good option for people who want a more accurate estimate of their withholding allowances. However, the calculator can be more time-consuming to use than the Printable W-4 form.

Tax Professionals

Tax professionals can help you determine your withholding allowances and complete your W-4 form. Tax professionals are familiar with the tax code and can help you make sure that you are claiming the correct number of allowances.

Consulting a tax professional is the most accurate method for determining your withholding allowances. However, it can also be the most expensive method.

Software Programs

There are a number of software programs that can help you calculate your withholding allowances. These programs typically ask you a series of questions about your income, deductions, and credits. Based on your answers, the software will recommend the number of withholding allowances you should claim on your W-4 form.

Software programs can be a good option for people who want a more accurate estimate of their withholding allowances. However, software programs can also be expensive.

Printable W-4 Resources

Getting your hands on the Printable W-4 form is a doddle. You can download it from the Internal Revenue Service (IRS) website, or you can order it by post. There are also a number of online tools and calculators that can help you complete the form.

Online Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-w-4

- W-4 Calculator: https://www.irs.gov/w4app

Additional Information

If you need more information about the Printable W-4 form, you can visit the IRS website or speak to a tax professional.

Q&A

Who should use the Printable W-4 form?

The Printable W-4 form should be used by all employees in the United States who are required to pay federal income tax. This includes both full-time and part-time employees, as well as self-employed individuals.

What are the benefits of using the Printable W-4 form?

Using the Printable W-4 form provides several benefits, including ensuring accurate tax withholding, avoiding unexpected tax bills or refunds, and reducing the need for tax adjustments at the end of the year.

How often should I complete the Printable W-4 form?

The Printable W-4 form should be completed whenever there is a change in your tax situation, such as getting married, having a child, or changing jobs. It is also a good idea to review and update your W-4 form annually to ensure that your withholding allowances are still accurate.