Simplify Tax Season with Printable Tax Forms

Navigating tax season can be a daunting task, but printable tax forms offer a convenient and accessible solution. Whether you’re a seasoned tax filer or tackling your taxes for the first time, these forms empower you to file your taxes accurately and efficiently.

Printable tax forms provide a comprehensive solution for individuals and small businesses alike. From understanding your tax obligations to completing your returns, these forms guide you through the process step by step.

Introduction

Printable tax forms are crucial documents that play a significant role in the tax filing process. They provide a structured and standardized way for individuals and businesses to declare their income, expenses, and other relevant financial information to tax authorities. By completing and submitting these forms, taxpayers can fulfill their legal obligations and ensure that they pay the correct amount of tax.

There are various types of printable tax forms available, each designed for a specific purpose. Some common examples include:

Types of Printable Tax Forms

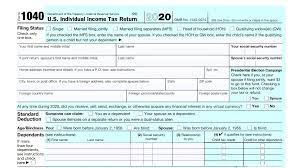

- Form 1040: Used by individuals to file their annual federal income tax return.

- Form 1040-EZ: A simplified version of Form 1040 for individuals with basic tax situations.

- Form 1040-SR: Designed for senior citizens to report their income and claim tax credits.

- Form 1040-NR: Used by non-resident aliens to file their U.S. income tax return.

- Form 1120: Filed by corporations to report their annual income and expenses.

- Form 1065: Used by partnerships to report their business income and expenses.

Benefits of Using Printable Tax Forms

Filling out your taxes can be a daunting task, but using printable tax forms can make the process easier and more convenient. Here are some of the benefits of using printable tax forms:

Cost-effectiveness

Printable tax forms are free to download and print, making them a cost-effective option for taxpayers. E-filing can incur fees, so if you’re on a budget, printable tax forms are a great way to save money.

Accessibility

Printable tax forms are accessible to everyone, regardless of their computer skills or internet access. You don’t need any special software or equipment to fill out printable tax forms, so they’re a great option for people who are not comfortable with technology.

Ease of Use

Printable tax forms are easy to use. The instructions are clear and concise, and the forms are well-organized. This makes it easy for taxpayers to fill out their taxes accurately and on time.

Considerations for Using Printable Tax Forms

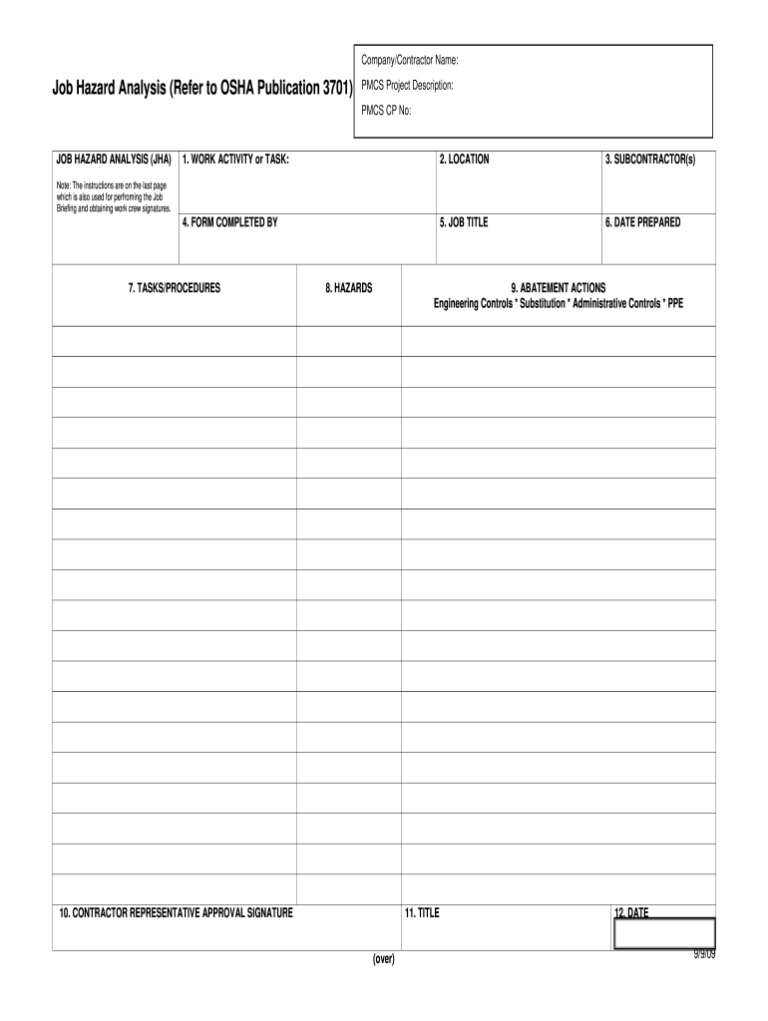

Choosing the right tax forms is crucial to ensure accurate tax filing. Different tax situations require specific forms, so it’s essential to select the appropriate ones for your circumstances. Gather all necessary documents and information before you start filling out the forms to avoid delays or errors.

Potential Errors and Avoidance

Using printable tax forms can lead to potential errors, such as incorrect calculations, missed deductions, or omissions. To avoid these mistakes, double-check your entries, use a tax software or seek professional assistance if needed. Additionally, keep a record of all your tax-related documents for future reference.

Step-by-Step Guide to Using Printable Tax Forms

:max_bytes(150000):strip_icc()/Form1041-36b8feef0014418ab6aa150c951c7609.png?w=700)

Navigating the world of taxes can be a bit of a headache, but using printable tax forms can make the process a lot smoother. Here’s a step-by-step guide to help you get started:

First, you’ll need to download the tax forms you need from the official websites of the relevant tax authorities. Make sure you’re downloading the most up-to-date versions to avoid any errors.

Filling Out Tax Forms

Once you’ve got your forms, it’s time to fill them out. Be sure to read the instructions carefully and answer all questions accurately and completely. If you’re not sure about something, don’t guess – reach out to a tax professional for help.

Submitting Tax Forms

Once you’ve filled out your tax forms, you’ll need to submit them to the relevant authorities. You can do this by mailing them in or submitting them electronically. If you’re mailing them in, make sure you use the correct postage and address. If you’re submitting them electronically, follow the instructions on the tax authority’s website.

Troubleshooting Common Issues

Getting your taxes done can be a breeze with printable tax forms, but sometimes you might run into a few snags. Let’s look at some common issues and how to sort them out.

If you’re having trouble, you can always reach out to the taxman for help. They have a crack team of advisors ready to guide you through the tax maze.

Wrong Form

Oops! You’ve picked the wrong tax form. It’s like trying to fit a square peg in a round hole. Make sure you’re using the right form for your situation. The taxman has a handy list of all the forms you might need on their website.

Missing Information

Hold up! You’ve left some blanks unfilled. The taxman needs all the info to calculate your tax bill. Double-check that you’ve filled in every box and section that applies to you.

Errors in Calculations

Oops! You’ve made a bit of a boo-boo in your calculations. It’s easy to get tripped up by all those numbers. Grab a calculator or use the taxman’s online tools to make sure your sums are spot on.

Filing Deadline

Don’t be a latecomer! Make sure you send in your tax forms by the deadline. The taxman is a stickler for punctuality, and you don’t want to end up paying any penalties.

Contacting the Taxman

If you’re still stuck, don’t hesitate to reach out to the taxman. They’ve got a friendly bunch of folks ready to lend a hand. You can give them a ring, drop them an email, or visit their website for more info.

Additional Resources

Check out these websites and platforms for more info on printable tax forms:

- HMRC (UK tax authority): https://www.gov.uk/government/organisations/hm-revenue-customs

- GOV.UK: https://www.gov.uk/browse/tax

- TaxCalc (tax software provider): https://www.taxcalc.com/

If you need help with your taxes, there are plenty of options:

- Tax preparation software: This can guide you through the process and make sure your forms are filled out correctly.

- Tax services: These companies can prepare your taxes for you, which can save you time and hassle.

- Professional tax assistance: If you have a complex tax situation, you may want to consider getting help from a tax accountant or other professional.

Q&A

What are the benefits of using printable tax forms?

Printable tax forms offer numerous benefits, including cost-effectiveness, accessibility, ease of use, and the ability to work offline.

How do I choose the correct tax forms for my situation?

Selecting the appropriate tax forms is crucial. Consult the IRS website or a tax professional to identify the forms that align with your specific tax circumstances.

What are some common errors to avoid when using printable tax forms?

Common errors include incorrect calculations, missing information, and using outdated forms. Carefully review your forms before submitting them to minimize errors.