Printable Quit Claim Deed Form: A Comprehensive Guide to Transferring Property Ownership

Navigating the complexities of real estate transactions can be daunting, especially when it comes to transferring property ownership. Quit claim deeds play a crucial role in this process, offering a simple and cost-effective way to transfer property rights. In this guide, we will delve into the intricacies of printable quit claim deed forms, exploring their benefits, legal implications, and step-by-step instructions to help you complete them accurately and efficiently.

Quit claim deeds are legal documents that convey an individual’s interest in a property to another party. They are commonly used in situations where the grantor does not warrant or guarantee the title to the property but simply relinquishes any claims they may have. Understanding the purpose, key elements, and legal significance of quit claim deeds is essential for ensuring a smooth and secure property transfer.

Define and Explain Quit Claim Deeds

Innit, a quit claim deed is a legal doc that basically says, “I’m giving up any claim I got to this property.” It’s like waving the white flag, mate. It doesn’t guarantee that the property is all good, like other types of deeds, but it does mean the person giving it up won’t come knocking later on, trying to claim it back.

Difference between Quit Claim Deeds and Other Types of Deeds

Unlike warranty deeds and grant deeds, quit claim deeds don’t come with any promises or guarantees. It’s a bit like buying a car from a mate. They might say it’s in tip-top nick, but you’re taking their word for it. With a quit claim deed, you’re taking the property as is, with all its quirks and potential problems.

Common Uses of Quit Claim Deeds

Quit claim deeds are often used when family members or close mates are transferring property between themselves. It’s a quick and easy way to get the job done without any fuss or legal jargon. They can also be used to clear up ownership issues, like when someone’s been squatting on a property for a while.

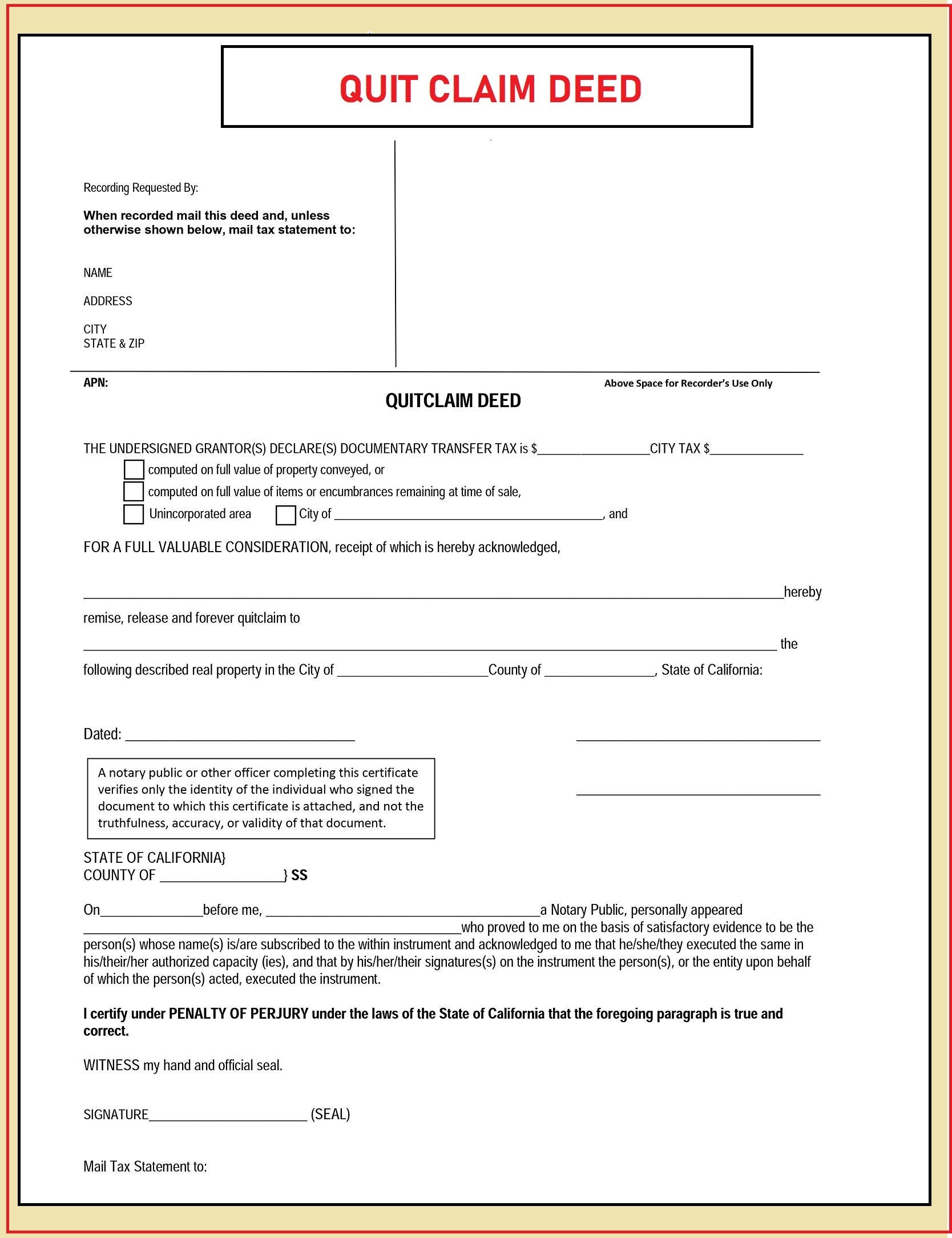

Identify the Key Elements of a Quit Claim Deed

Quit claim deeds are legal documents that transfer ownership of real estate from one party to another. They are typically used when the seller does not have a clear title to the property or when the buyer is willing to take on the risk of any title defects.

To ensure the validity of a quit claim deed, it must contain several essential elements, including:

Parties to the Deed

The deed must identify the grantor (seller) and the grantee (buyer) of the property. It should also include their full names, addresses, and marital statuses.

Description of the Property

The deed must provide a detailed description of the property being transferred. This includes the street address, legal description, and any other identifying information.

Consideration

The deed must state the consideration for the transfer of the property. This is the amount of money or other valuable thing that the buyer is paying for the property.

Granting Clause

The granting clause is the heart of the deed. It is the words that actually transfer ownership of the property from the grantor to the grantee.

Habendum Clause

The habendum clause states the type of ownership that the grantee will have in the property. This can be a fee simple, a life estate, or another type of ownership interest.

Covenants

Covenants are promises or warranties that the grantor makes to the grantee. These can include covenants of title, which guarantee that the grantor has good title to the property, and covenants of quiet enjoyment, which promise that the grantee will be able to possess and use the property without interference from the grantor.

Execution

The deed must be signed and notarized by the grantor. This is the final step in the execution of the deed and makes it a legally binding document.

Benefits and Considerations of Using a Printable Quit Claim Deed Form

Using a printable quit claim deed form offers several advantages:

– Convenience: These forms are readily available online and can be printed out, making them easily accessible.

– Cost-effective: Using a form can save money compared to hiring an attorney to draft a deed.

– Simplicity: Quit claim deed forms are designed to be straightforward and easy to understand, simplifying the transfer process.

However, there are potential drawbacks to consider:

– Limited legal protection: Quit claim deeds offer less legal protection than other types of deeds, as they do not warrant the title to the property being transferred.

– Errors: Using a form without proper guidance may lead to errors or omissions that could invalidate the deed.

To select a reliable and comprehensive quit claim deed form, consider the following tips:

– Seek professional advice: Consult an attorney or legal professional to ensure the form meets your specific requirements.

– Review the form carefully: Before signing, thoroughly review the form to ensure it contains all the necessary information and is free of errors.

– Use reputable sources: Obtain the form from a trusted source, such as a legal website or a government agency.

Step-by-Step Guide to Completing a Printable Quit Claim Deed Form

Innit, completing a printable quit claim deed form can be a right faff, but don’t fret, fam. We’ve got you covered with this sick step-by-step guide. Let’s smash it!

Before you start, make sure you’ve got all the necessary bits and bobs, like your ID, the property details, and any other paperwork you need. Now, let’s dive in!

Grantor and Grantee Info

- Chuck the grantor’s name (the person giving up the property) in the first box.

- Next up, drop the grantee’s name (the lucky sod getting the property) in the second box.

Property Description

- Get specific about the property you’re flogging off. Include the address, size, and any other details that make it unique.

Consideration (aka Payment)

- If there’s any dough changing hands, write down the amount in this section.

- If it’s a gift, just write “love and affection” or something else that shows it’s a freebie.

Signatures and Notary

- Both the grantor and grantee need to sign on the dotted line.

- To make it official, get a notary public to witness the signatures and stamp the deed.

Delivery

- Once it’s all signed and sealed, hand over the deed to the grantee.

- Congratulations! You’ve just transferred ownership like a pro.

Legal Implications and Precautions

Quit claim deeds have significant legal implications, so it’s crucial to understand them before using one. One key issue is that quit claim deeds do not provide any warranties or guarantees about the title to the property. This means that if there are any liens, encumbrances, or other claims against the property, the grantee (the person receiving the property) will be responsible for them, even if they were not aware of them at the time of the transfer.

It’s also important to have the deed reviewed by an attorney before signing it. An attorney can help you understand the legal implications of the deed and ensure that it is properly executed. This can help you avoid common pitfalls and protect your legal rights.

Common Pitfalls to Avoid

- Not understanding the implications of a quit claim deed: Quit claim deeds do not provide any warranties or guarantees about the title to the property. This means that if there are any liens, encumbrances, or other claims against the property, the grantee will be responsible for them, even if they were not aware of them at the time of the transfer.

- Signing a quit claim deed without having it reviewed by an attorney: An attorney can help you understand the legal implications of the deed and ensure that it is properly executed. This can help you avoid common pitfalls and protect your legal rights.

- Not recording the quit claim deed with the county recorder: Recording the deed with the county recorder is essential to give notice to the world that you are the owner of the property. If you do not record the deed, you may not be able to protect your rights to the property.

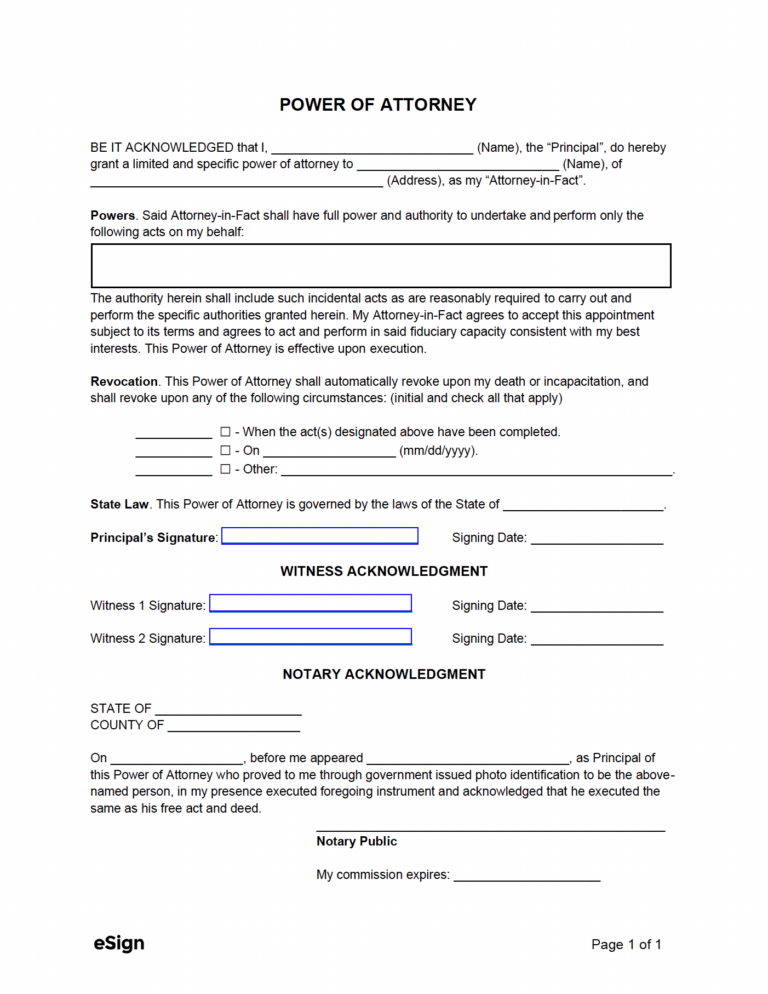

Alternatives to Using a Printable Quit Claim Deed Form

While printable quit claim deed forms offer a convenient and cost-effective way to transfer property ownership, they may not be suitable in all situations. Here are some alternative methods for transferring property ownership along with their pros and cons:

Warranty Deeds

Warranty deeds provide the highest level of protection to the buyer as they guarantee that the seller has clear title to the property and that there are no liens or encumbrances on the property. Pros of using warranty deeds include:

- Strongest form of deed, providing maximum protection to the buyer.

- Guarantees that the seller has clear title to the property.

- Protects the buyer against any liens or encumbrances on the property.

Cons of using warranty deeds include:

- More expensive than quit claim deeds.

- Can be more complex and time-consuming to prepare.

- May not be suitable for situations where the seller does not have clear title to the property.

Grant Deeds

Grant deeds offer a less comprehensive level of protection to the buyer than warranty deeds, but they are still a common and widely accepted form of deed. Pros of using grant deeds include:

- Less expensive than warranty deeds.

- Easier and faster to prepare than warranty deeds.

- Provide a reasonable level of protection to the buyer.

Cons of using grant deeds include:

- Do not guarantee that the seller has clear title to the property.

- Do not protect the buyer against any liens or encumbrances on the property that were created before the deed was granted.

Bargain and Sale Deeds

Bargain and sale deeds are the simplest and least protective type of deed. They simply transfer the property from the seller to the buyer without any warranties or guarantees. Pros of using bargain and sale deeds include:

- Least expensive and easiest to prepare.

- Can be used in situations where the seller does not have clear title to the property.

Cons of using bargain and sale deeds include:

- Provide no protection to the buyer.

- Buyer assumes all risk of liens or encumbrances on the property.

FAQ Corner

What is the difference between a quit claim deed and a warranty deed?

A quit claim deed simply transfers the grantor’s interest in the property without any warranties or guarantees regarding the title. A warranty deed, on the other hand, provides assurances that the grantor has a clear and marketable title to the property and is responsible for any defects or encumbrances that may arise.

When is it appropriate to use a quit claim deed?

Quit claim deeds are commonly used in situations where the grantor does not have a clear or marketable title to the property, such as when inheriting property or transferring property between family members.

What are the benefits of using a printable quit claim deed form?

Printable quit claim deed forms offer convenience, cost-effectiveness, and ease of use. They provide a standardized template that ensures all necessary information is included and can be easily customized to suit specific needs.

What are some potential drawbacks of using a printable quit claim deed form?

Printable quit claim deed forms may not be suitable for complex property transfers or situations where legal advice is required. It is important to carefully review the form and consider seeking legal counsel to ensure it meets your specific needs.

What are some alternatives to using a printable quit claim deed form?

Alternatives to using a printable quit claim deed form include hiring an attorney to draft a custom deed, using an online deed preparation service, or exploring other methods of transferring property ownership, such as a gift deed or a trust.