Printable Quit Claim Deed: A Comprehensive Guide to Transferring Property Ownership

When it comes to transferring property ownership, understanding the legal implications and drafting a valid document is crucial. A Printable Quit Claim Deed serves as a simple yet effective tool for transferring property rights. This guide will delve into the purpose, content, legal considerations, and drafting process of a Printable Quit Claim Deed, providing you with the knowledge to navigate this essential legal document.

A Printable Quit Claim Deed is a legal document that allows an individual or entity to transfer their interest in a property to another party. Unlike a warranty deed, a quit claim deed does not provide any guarantees or warranties regarding the property’s title or condition. It simply conveys whatever interest the grantor has in the property, making it a suitable option for transferring property between family members or in situations where the title is uncertain.

Printable Quit Claim Deed Overview

A Printable Quit Claim Deed is a legal document that transfers ownership of real estate from one party to another. It is commonly used when the property is being transferred between family members or friends, or when there is no mortgage or other liens on the property.

Using a Quit Claim Deed has several legal implications. First, it does not guarantee that the grantor (the person transferring the property) has clear title to the property. This means that the grantee (the person receiving the property) could be at risk of losing the property if there are any outstanding claims or liens against it. Second, a Quit Claim Deed does not convey any warranties or guarantees about the condition of the property. This means that the grantee is responsible for any repairs or maintenance that may be needed.

Significance of Using a Quit Claim Deed

Despite the potential risks, there are several reasons why people choose to use a Quit Claim Deed. First, it is a relatively simple and inexpensive way to transfer property. Second, it can be used to transfer property between family members or friends without having to pay gift tax. Third, it can be used to clear up title defects or to correct errors in a previous deed.

Content and Structure

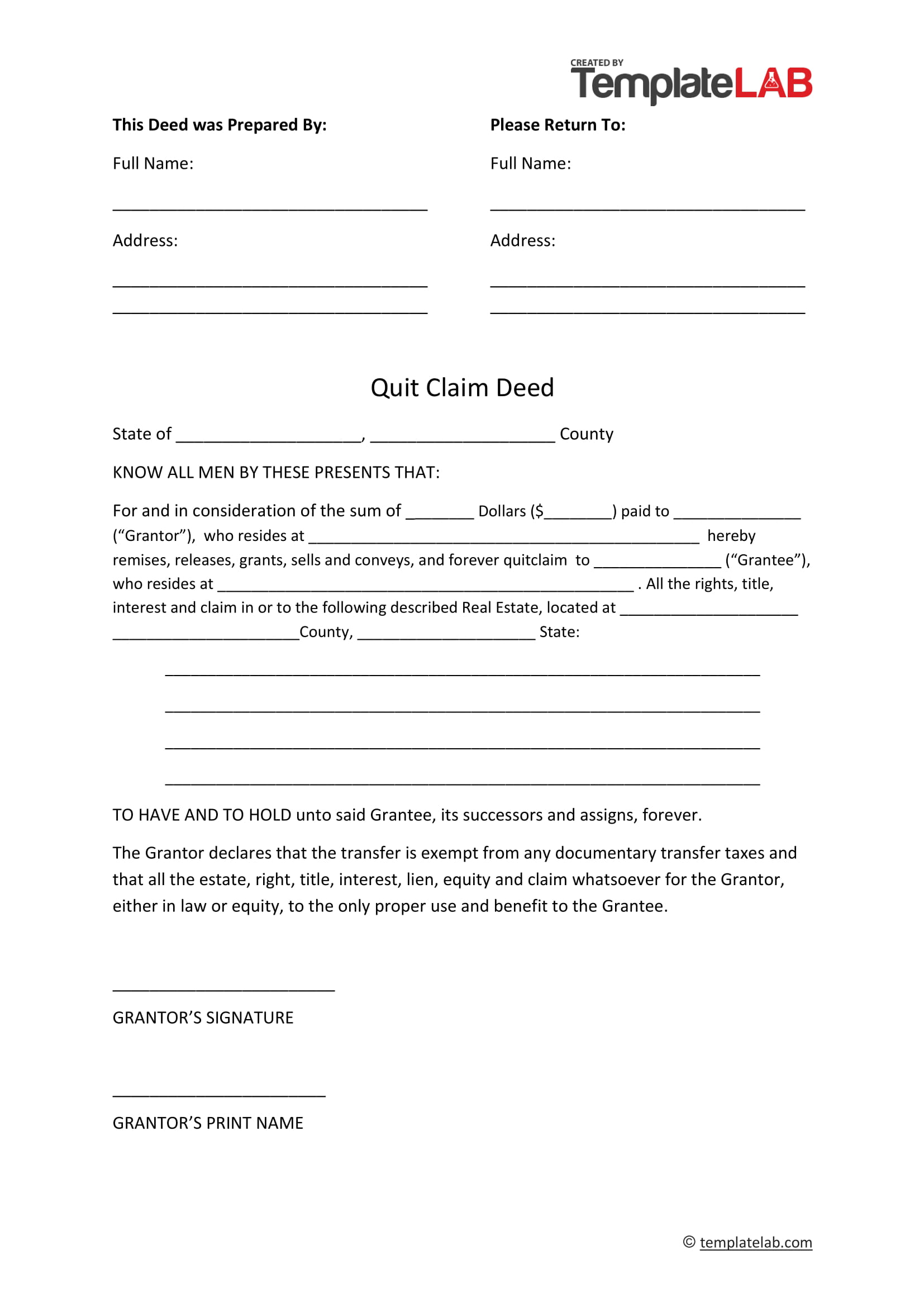

A Printable Quit Claim Deed is a legal document used to transfer ownership of real estate. It contains several essential elements that are organized into logical sections to ensure clarity and validity.

Essential Elements

- Grantor and Grantee: The individuals or entities transferring and receiving ownership of the property.

- Property Description: A detailed description of the real estate, including its location, size, and any improvements.

- Consideration: The value or payment exchanged for the transfer of ownership.

- Quitclaim Clause: A statement that the grantor is transferring only the rights and interests they have in the property, without any warranties or guarantees.

- Signatures and Notarization: The signatures of the grantor and grantee, along with the notarization of a public official, are required for the deed to be valid.

Logical Sections

The Quit Claim Deed is typically divided into the following sections:

- Introduction: Identifies the parties involved and the purpose of the deed.

- Granting Clause: Transfers ownership of the property from the grantor to the grantee.

- Quitclaim Clause: States that the grantor is not providing any warranties or guarantees regarding the property.

- Covenants: May include additional agreements or restrictions related to the property.

- Execution: Includes the signatures of the grantor and grantee, as well as the notarization.

By organizing the content into these logical sections, the Quit Claim Deed ensures that all necessary information is included and that the transfer of ownership is clear and legally binding.

Drafting and Execution

When drafting a Printable Quit Claim Deed, follow these steps:

- Gather necessary information: names and addresses of grantor and grantee, property description, and consideration (if any).

- Download a Quit Claim Deed template and fill in the information.

- Review the deed carefully to ensure all information is accurate and complete.

Signing and Witnessing

Once the deed is drafted, it must be signed by the grantor in the presence of two witnesses. The witnesses must also sign the deed.

Notarization

In most cases, a Quit Claim Deed must be notarized. A notary public will verify the identity of the grantor and witnesses and will witness the signing of the deed.

5. Sample and Templates

If you’re not comfortable drafting a Quit Claim Deed from scratch, you can use a pre-drafted template. These templates are widely available online and can be easily customized to fit your specific needs.

Benefits of Using Pre-Drafted Templates

- Saves time and effort

- Ensures that the deed is legally valid

- Provides peace of mind

Drawbacks of Using Pre-Drafted Templates

- May not be tailored to your specific needs

- Could contain errors or omissions

- May not be suitable for complex transactions

If you’re considering using a pre-drafted template, it’s important to carefully review it before signing it. You should also make sure that you understand the terms of the deed and that it meets your needs.

Sample Printable Quit Claim Deed Template

[Insert sample template here]

Online Resources

Accessing Printable Quit Claim Deeds online provides numerous benefits, including convenience, efficiency, and accessibility. However, it’s crucial to consider the advantages and disadvantages before relying on online resources.

Advantages of Using Online Resources

- Convenience: Online resources allow individuals to access Printable Quit Claim Deeds from anywhere with an internet connection, eliminating the need for physical visits to government offices or legal professionals.

- Efficiency: Websites and platforms often provide user-friendly interfaces and automated processes, making it easy to find and download the necessary documents quickly and efficiently.

- Accessibility: Online resources are available 24/7, allowing individuals to access Printable Quit Claim Deeds at any time, regardless of location or business hours.

- Cost-effective: Many online resources offer Printable Quit Claim Deeds for free or at a minimal cost, eliminating the need for expensive legal fees.

Disadvantages of Using Online Resources

- Accuracy and Legality: It’s essential to ensure that the online resources are reputable and provide accurate and legally compliant Printable Quit Claim Deeds.

- Technical Issues: Individuals may encounter technical difficulties such as slow loading times, website crashes, or compatibility issues, which can delay or hinder the process of accessing Printable Quit Claim Deeds.

- Security Concerns: Providing personal information online carries inherent security risks. Individuals should ensure that the online resources they use employ robust security measures to protect sensitive data.

FAQ

What are the essential elements of a Printable Quit Claim Deed?

A Printable Quit Claim Deed typically includes the names and addresses of the grantor and grantee, a legal description of the property, the consideration (purchase price or other value exchanged), and the signatures of the grantor and witnesses.

Is a Printable Quit Claim Deed legally binding?

Yes, a Printable Quit Claim Deed is a legally binding document once it has been properly executed and recorded with the appropriate government agency.

Can I use a Printable Quit Claim Deed to transfer property to myself?

Yes, you can use a Quit Claim Deed to transfer property to yourself, but it is important to note that this will not create a new title. It will simply merge your existing interest in the property with the interest you are acquiring.

What are the benefits of using a Printable Quit Claim Deed?

Printable Quit Claim Deeds are relatively simple to draft and can be used to transfer property quickly and easily. They are also cost-effective, as they do not require the involvement of an attorney.

What are the drawbacks of using a Printable Quit Claim Deed?

Printable Quit Claim Deeds do not provide any warranties or guarantees regarding the property’s title or condition. They also may not be suitable for complex real estate transactions or situations where the title is uncertain.