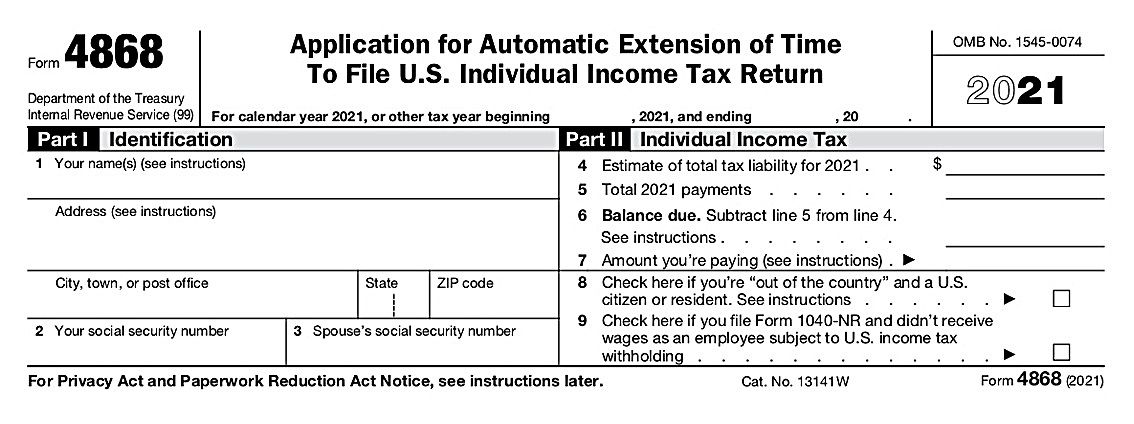

Printable IRS Form 4868: A Comprehensive Guide to Filing

Navigating the complexities of tax filing can be daunting, but understanding and completing IRS Form 4868 is crucial for individuals and businesses alike. This form plays a significant role in claiming the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return. In this comprehensive guide, we will delve into the purpose, completion process, common errors, filing methods, and provide a printable PDF version of Form 4868, empowering you with the knowledge and tools to fulfill your tax obligations efficiently.

Whether you’re an individual seeking an extension for your personal tax return or a business owner managing multiple filings, this guide will provide you with a clear understanding of IRS Form 4868, ensuring a seamless and accurate filing process.

Overview of IRS Form 4868

Yo, check it, IRS Form 4868 is a wicked important document that helps you get your hands on some serious dough. It’s like the golden ticket to claiming that Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.

Back in the day, you had to send in a letter or call the IRS to request an extension. But now, you can just fill out this form and chuck it in the mail. It’s a breeze, fam.

s for Completing Form 4868

Filling out Form 4868 is a breeze if you follow these simple steps. Let’s dive into each section and field, making sure you’ve got it sorted.

Part I: Applicant Information

Start by giving us the lowdown on who’s applying. Pop in your name, address, and all the nitty-gritty details like your Social Security number and contact info.

Part II: Application Details

Now, let’s get into the nitty-gritty of your application. Choose the type of application you’re after (extension, renewal, or whatever floats your boat) and give us the dates you need it for.

Part III: Basis for Application

Time to spill the beans on why you need this extension or renewal. Tick the boxes that apply, whether it’s compassionate grounds, humanitarian reasons, or anything else that’s got you in a pickle.

Part IV: Supporting Documents

Don’t forget to attach any documents that back up your application. Think birth certificates, medical records, or anything else that shows why you deserve a helping hand.

Part V: Signature

Last but not least, sign and date the form. Make sure it’s your John Hancock, or else it’s not official.

Example

Let’s say you’re applying for an extension because you’re stuck in a foreign country due to a family emergency. In Part III, you’d tick the box for “compassionate grounds” and attach a letter from your doctor explaining the situation.

Common Errors and Troubleshooting

:max_bytes(150000):strip_icc()/Screenshot2023-03-02at11.05.35AM-1f84898730d248759e61f6ad2e1cb4fe.png?w=700)

Innit, making blunders when filling out Form 4868 is a right pain in the neck. But fret not, mate! We’ve got the 411 on the most common cock-ups and how to dodge ’em like a pro.

If you’re having a mare with Form 4868, don’t be a tit. Reach out to the IRS for a helping hand. They’re a dab hand at sorting out tax-related kerfuffles.

Mismatched SSN

Listen up, mate! If the SSN on your Form 4868 doesn’t match the one on your tax return, the taxman will chuck it in the bin quicker than you can say “blimey!” Make sure they’re a perfect match, or you’ll be in a right pickle.

Missing or Incorrect Info

Don’t be a donut and leave any boxes empty. Fill in every single one, even if it’s just to write “N/A.” And double-check your info is bang on. Any mistakes could lead to delays or even a dreaded audit.

Incorrect Filing Status

Choosing the wrong filing status is a rookie error. Make sure you tick the right box based on your relationship status and any dependants you’re claiming. If you’re not sure, give the IRS a bell and they’ll set you straight.

Wrong Calculations

Don’t trust your dodgy maths skills. Use a calculator or the IRS website to make sure your calculations are spot on. Even a tiny mistake could mess up your refund or leave you owing the taxman a pretty penny.

Filing and Submission of Form 4868

Alright, mate, now that you’ve got your Form 4868 sorted, it’s time to get it in the hands of the taxman. There are a couple of ways you can do this:

- Online: File it electronically through the IRS website or an authorized e-filing provider. This is the quickest and easiest way to do it, and you’ll get a confirmation email right away.

- Mail: Print out the form and send it to the IRS address that’s printed on the instructions. Make sure you include all the necessary attachments and a copy of your return.

No matter which method you choose, make sure you submit your form on time. The deadline for filing Form 4868 is April 15th, but if you’re filing an extension, you’ll have until October 15th. Filing late or incorrectly can lead to penalties, so don’t mess about.

That’s all there is to it, mate. Just make sure you get your Form 4868 in on time, and you’ll be golden.

Sample Form 4868 with Annotations

This annotated sample of Form 4868 provides detailed explanations and highlights important fields to assist you in accurately completing the form.

The following annotations are organized into sections:

- Part I: Application Information

- Part II: Employer Information

- Part III: Employee Information

- Part IV: Certification

Part I: Application Information

- Name and Address: Enter your full name and current address.

- Social Security Number (SSN): Provide your Social Security Number.

- Date of Birth: Enter your date of birth in MM/DD/YYYY format.

- Employer Identification Number (EIN): Enter the EIN of the employer you are applying for the refund from.

Part II: Employer Information

- Name and Address: Enter the full name and address of the employer.

- Contact Person: Provide the name of the contact person at the employer.

- Phone Number: Enter the phone number of the employer.

- Fax Number: If applicable, provide the fax number of the employer.

- Email Address: If available, provide the email address of the employer.

Part III: Employee Information

- Name and Address: Enter your full name and address.

- Social Security Number (SSN): Provide your Social Security Number.

- Date of Birth: Enter your date of birth in MM/DD/YYYY format.

- Dates of Employment: Specify the start and end dates of your employment with the employer.

- Gross Wages: Enter the total amount of wages earned during the period of employment.

- Federal Income Tax Withheld: Enter the amount of federal income tax withheld from your wages.

- Social Security Tax Withheld: Enter the amount of Social Security tax withheld from your wages.

- Medicare Tax Withheld: Enter the amount of Medicare tax withheld from your wages.

- Reason for Refund: Briefly explain the reason why you are applying for a refund.

Part IV: Certification

- Signature: Sign and date the form to certify the accuracy of the information provided.

- Date: Enter the date on which you are signing the form.

- Contact Information: Provide your phone number and email address so the IRS can contact you if necessary.

Printable PDF Version of Form 4868

Fancy a printable version of Form 4868, bruv? We’ve got you covered. It’s a right handy way to fill out the form at your own pace, without any pesky internet gremlins interrupting you.

To grab the PDF, simply click the link below. It’ll whisk you away to a downloadable version of the form that you can print out and fill in whenever you’re ready.

Accessing and Printing the Form

- Click on the link provided to access the PDF version of Form 4868.

- Once the PDF has loaded, click on the “Print” option in your PDF viewer.

- Select your printer and any necessary printing options, then hit “Print” to get your hard copy of Form 4868.

FAQs

What is the purpose of IRS Form 4868?

IRS Form 4868 is used to request an automatic 6-month extension of time to file your U.S. individual income tax return.

When is Form 4868 due?

Form 4868 must be filed by the original tax filing deadline, typically April 15th.

Where can I find a printable PDF version of Form 4868?

A printable PDF version of Form 4868 can be found on the IRS website.

Can I file Form 4868 electronically?

No, Form 4868 cannot be filed electronically. It must be mailed to the IRS.