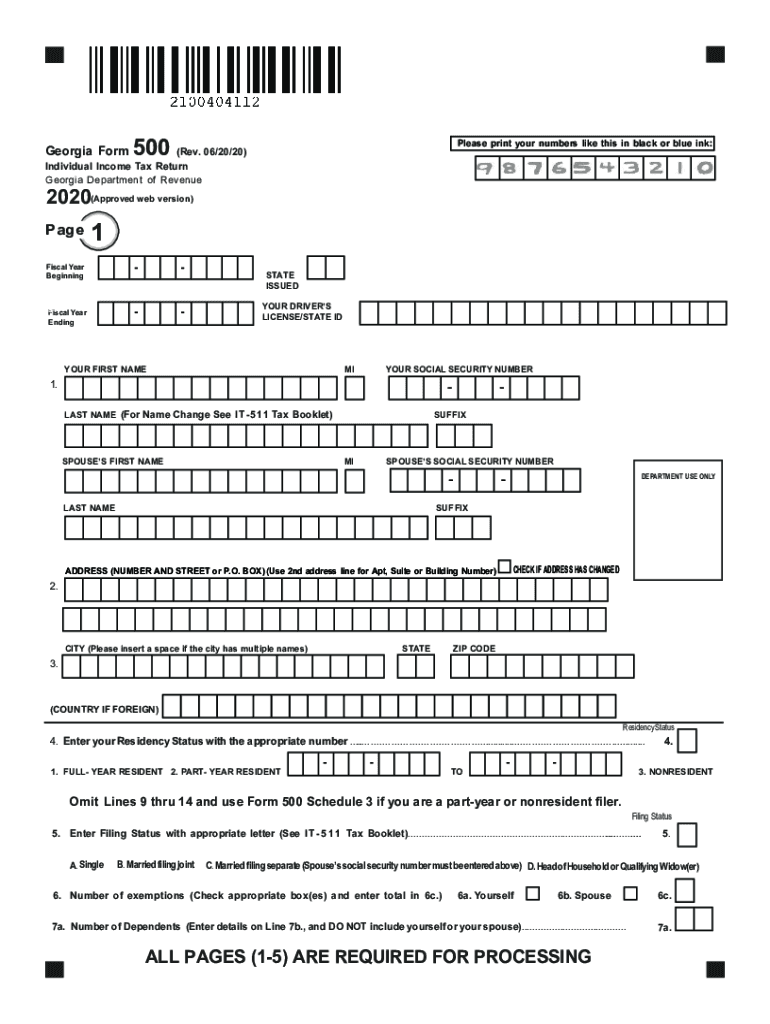

Printable Georgia Form 500: A Comprehensive Guide

Navigating the complexities of legal documents can be daunting, but understanding and utilizing the Printable Georgia Form 500 is essential for various legal and administrative processes. This comprehensive guide delves into the purpose, structure, and intricacies of this crucial form, empowering you to confidently complete and submit it with accuracy and ease.

Georgia Form 500 plays a significant role in legal proceedings, and its significance cannot be overstated. It serves as a foundation for legal actions, providing a standardized framework for presenting information and ensuring the validity of legal processes. Understanding the form’s history, legal implications, and requirements is paramount to utilizing it effectively.

Printable Georgia Form 500 Overview

Blud, if you’re thinkin’ about settlin’ down in the Peach State, you’re gonna need to get your hands on a Printable Georgia Form 500. It’s like the cheat code for livin’ large in Georgia, innit?

This form is your golden ticket to claimin’ your slice of the American dream. It’s the official document that lets you prove you’re a legit resident of Georgia, so you can do all the grown-up stuff like votin’, gettin’ a drivin’ license, and baggin’ those sweet government benefits.

History and Background

The Georgia Form 500 has been around for time, bruv. It was first cooked up in the 1970s when the state realized they needed a way to keep track of who was who and where they were at. Over the years, it’s been tweaked and updated, but it’s still the go-to form for provin’ your Georgia cred.

Legal Implications

Listen up, mate. Fillin’ out a Georgia Form 500 is not a joke. It’s a legal document, and you need to be on the level when you’re fillin’ it in. If you’re caught fibbin’ or usin’ fake info, you could be lookin’ at some serious trouble.

So, keep it real, tell the truth, and don’t be a bellend. Your Georgia Form 500 is like your digital footprint, so make sure it’s squeaky clean.

Filing and Submission Process

Filing Georgia Form 500 is a straightforward process. Follow these steps to ensure accurate and timely submission.

The Georgia Form 500 filing deadline is 15th April following the tax year. Late submissions may incur penalties and interest charges.

Submission Methods

There are multiple ways to submit Georgia Form 500:

- Online: File electronically through the Georgia Department of Revenue’s website.

- Mail: Send the completed form to the Georgia Department of Revenue, PO Box 740385, Atlanta, GA 30374-0385.

- In-person: Submit the form at any Georgia Department of Revenue office.

Common Errors and Pitfalls

Filling out Georgia Form 500 might seem straightforward, but there are some common errors and pitfalls that you should watch out for to avoid any delays or rejections.

Here are some of the most common mistakes to be aware of and tips on how to avoid them:

Mistakes and Solutions

- Incorrect or incomplete personal information: Make sure to provide your full name, address, and contact information accurately. Any errors or omissions could result in delays or rejections.

- Missing or incorrect tax identification number: Your Social Security number or Employer Identification Number is required on the form. Ensure it’s entered correctly to avoid processing issues.

- Mismatched income and deductions: The total income you report should match the sum of your wages, salaries, and other income sources. Similarly, the total deductions you claim should match the sum of your itemized deductions or standard deduction.

- Incorrect filing status: Choose the correct filing status based on your marital status and dependents. Filing with an incorrect status could lead to incorrect tax calculations.

- Missing or incorrect signatures: Both you and your spouse (if filing jointly) must sign and date the form. Failure to do so will result in the form being rejected.

Tips for Accuracy and Completeness

- Gather all necessary documents and information before starting the form.

- Read the instructions carefully and refer to them throughout the process.

- Use a tax software or consult with a tax professional if you have any doubts or complexities.

- Double-check your entries before submitting the form.

- Keep a copy of your completed form for your records.

Related Forms and Resources

Georgia Form 500 is connected to various other forms and resources that can be useful during the filing process. These include:

Georgia Department of Revenue (DOR)

The DOR website provides access to various forms and publications related to Georgia taxes, including Form 500. Taxpayers can download the form, instructions, and other relevant documents from the website.

Georgia Tax Center

The Georgia Tax Center offers free tax assistance to taxpayers. Taxpayers can call the Tax Center at (800) 241-4114 or visit their website for more information.

Certified Public Accountants (CPAs)

CPAs are licensed professionals who can provide tax advice and assistance. Taxpayers can find a CPA in their area by visiting the website of the Georgia Society of CPAs.

Tax Attorneys

Tax attorneys can provide legal advice and representation to taxpayers. Taxpayers can find a tax attorney in their area by visiting the website of the Georgia Bar Association.

Q&A

What is the purpose of Georgia Form 500?

Georgia Form 500 is a standardized legal document used for various legal proceedings, including initiating lawsuits, responding to legal actions, and filing motions.

Where can I obtain a copy of Georgia Form 500?

Printable copies of Georgia Form 500 can be obtained from the Georgia Courts website or from the clerk’s office of the relevant court.

Is it mandatory to use Georgia Form 500?

While not always mandatory, using Georgia Form 500 is highly recommended as it ensures compliance with legal requirements and streamlines the legal process.

What are the common errors to avoid when completing Georgia Form 500?

Common errors include incomplete or inaccurate information, incorrect formatting, and missing signatures. Carefully reviewing the form and seeking legal advice if necessary can help prevent these errors.