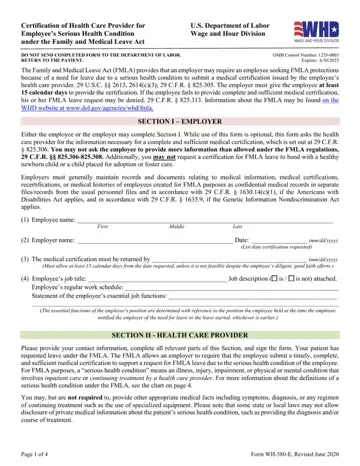

Navigating Form Wh 380 E PDF: A Comprehensive Guide

Navigating the intricacies of tax forms can be a daunting task, but understanding Form Wh 380 E PDF is crucial for accurate tax reporting. This form serves as a vital document in various tax-related processes, and its proper completion ensures compliance and avoids potential complications.

In this comprehensive guide, we will delve into the purpose, structure, completion process, submission methods, and accessibility of Form Wh 380 E PDF. By providing clear and concise information, we aim to empower individuals and businesses with the knowledge necessary to navigate this essential tax document effectively.

Printable Form Wh 380 E PDF Overview

Form Wh 380 E PDF is a document that employers use to report employee wages and withholdings to the Inland Revenue (IR). It is also known as the “Employer’s Monthly Return of Wages and Withholdings”.

The form is used to calculate and pay the following taxes and contributions:

- Income tax

- National Insurance contributions

- Student loan repayments

- Pension contributions

Form Wh 380 E PDF must be submitted to the IR by the 19th of each month following the month in which the wages were paid.

Purpose and Significance

The main purpose of Form Wh 380 E PDF is to ensure that employers are meeting their legal obligations to report and pay employee taxes and contributions. The form also helps the IR to track employee earnings and ensure that the correct amount of tax is being paid.

Target Audience and Intended Use

Form Wh 380 E PDF is intended for use by employers who are required to deduct and pay taxes and contributions from their employees’ wages. This includes employers of all sizes, from small businesses to large corporations.

History and Background

Form Wh 380 E PDF was first introduced in 2003. It replaced the previous form, Wh 380, which was used to report employee wages and withholdings to the IR.

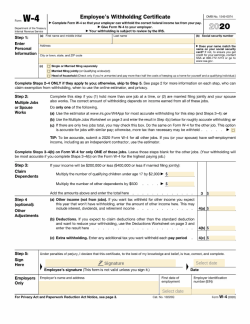

Form Structure and Content

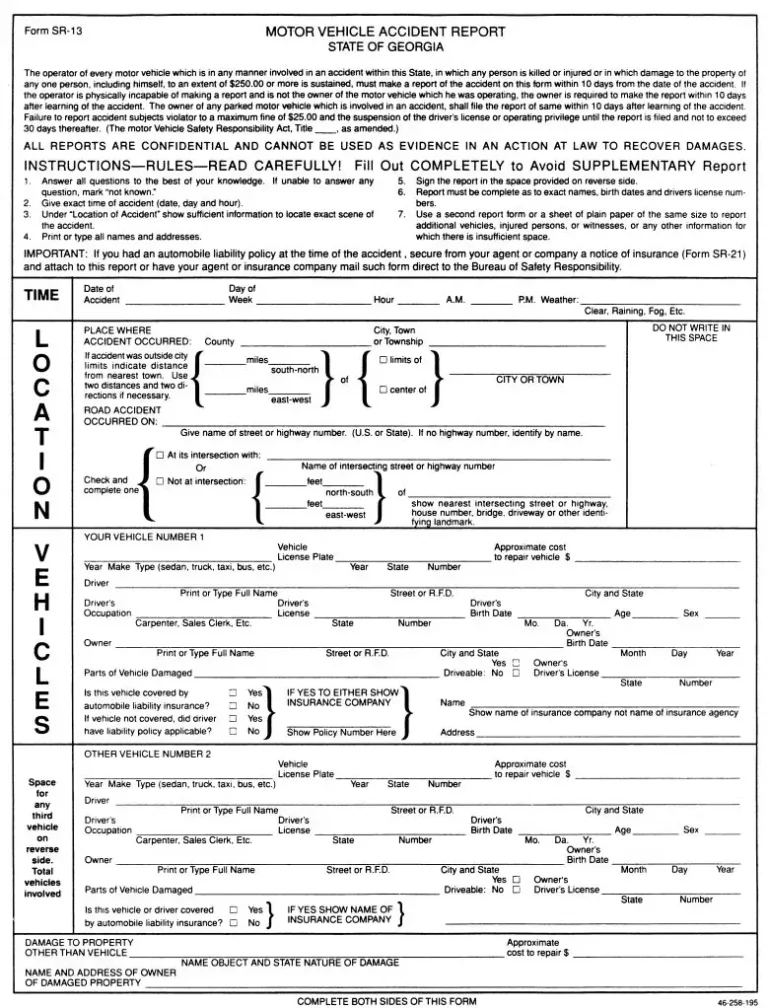

Form Wh 380 E PDF is a structured document designed for individuals to provide information regarding their employment and income. The form is organized into distinct sections, each serving a specific purpose. Understanding the layout and content of the form is crucial for accurate completion.

Layout and Organization

The form comprises several sections, including personal information, employment details, income information, and deductions. Each section is clearly labeled and organized in a logical manner, making it easy to navigate and locate the required information.

Key Sections and Fields

Personal Information

– Captures basic details such as name, address, and contact information.

Employment Details

– Provides information about the employer, including name, address, and contact details.

– Includes details of the employee’s position, start date, and termination date (if applicable).

Income Information

– Contains fields for reporting various types of income, including wages, salaries, bonuses, and commissions.

– Additional sections capture information on benefits received, such as health insurance premiums and employer contributions to retirement plans.

Deductions

– Lists allowable deductions, including contributions to retirement plans, health insurance premiums, and charitable donations.

– Provides fields for entering the amounts deducted.

Significance of Each Section

Each section plays a vital role in providing a comprehensive overview of the employee’s employment and income. The personal information section establishes the identity of the individual, while the employment details provide context for the income earned. Income information captures the employee’s earnings and benefits, and deductions detail the expenses that reduce taxable income.

Form Completion s

Filling out the Printable Form WH 380 E PDF requires attention to detail and accuracy. Here are some crucial tips to ensure your submission is complete and correct:

- Read the form thoroughly before you start filling it out.

- Use black or blue ink and write clearly in block letters.

- Fill in all required fields. Leaving any fields blank may delay the processing of your form.

- Be accurate and provide complete information. Double-check your entries before submitting the form.

- If you make a mistake, cross out the incorrect information and write the correct information next to it.

- Sign and date the form in the designated areas.

Importance of Accuracy and Completeness

Submitting an accurate and complete Printable Form WH 380 E PDF is essential for several reasons:

- Prevents delays: Incomplete or inaccurate forms may be returned to you for correction, leading to delays in processing.

- Ensures correct assessment: Accurate information allows for proper assessment of your application or request.

- Facilitates smooth communication: Complete contact details enable clear and efficient communication throughout the process.

- Maintains credibility: Submitting a well-filled form demonstrates your attention to detail and professionalism.

Form Submission Process

Submittin’ Form WH 380 E PDF is a doddle, bruv. You can either do it online or send it in the post. If you’re a tech whizz, you can upload it to the HMRC website. Or, if you’re more old-school, you can print it out and send it to the address on the form.

Online Submission

To submit your form online, head over to the HMRC website and find the “Submit a Return” section. You’ll need to have a Government Gateway account to do this, so make sure you’ve got one set up. Once you’re logged in, follow the instructions on the screen to upload your form.

Physical Submission

If you’re not keen on doin’ it online, you can always post your form to HMRC. Just make sure you use the correct address, which is:

HM Revenue and Customs

BX9 1AS

United Kingdom

Timelines and Deadlines

There’s no rush to submit your Form WH 380 E PDF, but it’s best to get it done within the tax year. That way, you won’t have to worry about any late fees or penalties.

Form Accessibility and Availability

Form Wh 380 E PDF is readily available for download from the official website of the relevant government agency. Accessing and obtaining the form is generally unrestricted, and no specific requirements or permissions are necessary.

The form is available solely in PDF format, catering to its widespread accessibility and compatibility with various devices and software. However, alternative formats or translations into other languages may not be provided.

FAQ

What is the purpose of Form Wh 380 E PDF?

Form Wh 380 E PDF is used to report income tax withheld from wages, salaries, and other compensation paid to non-resident aliens.

Who is required to file Form Wh 380 E PDF?

Individuals and businesses that make payments to non-resident aliens are required to file Form Wh 380 E PDF.

When is Form Wh 380 E PDF due?

Form Wh 380 E PDF is generally due on or before March 15th of the year following the tax year.

Where can I find Form Wh 380 E PDF?

Form Wh 380 E PDF can be downloaded from the IRS website or obtained from a tax professional.