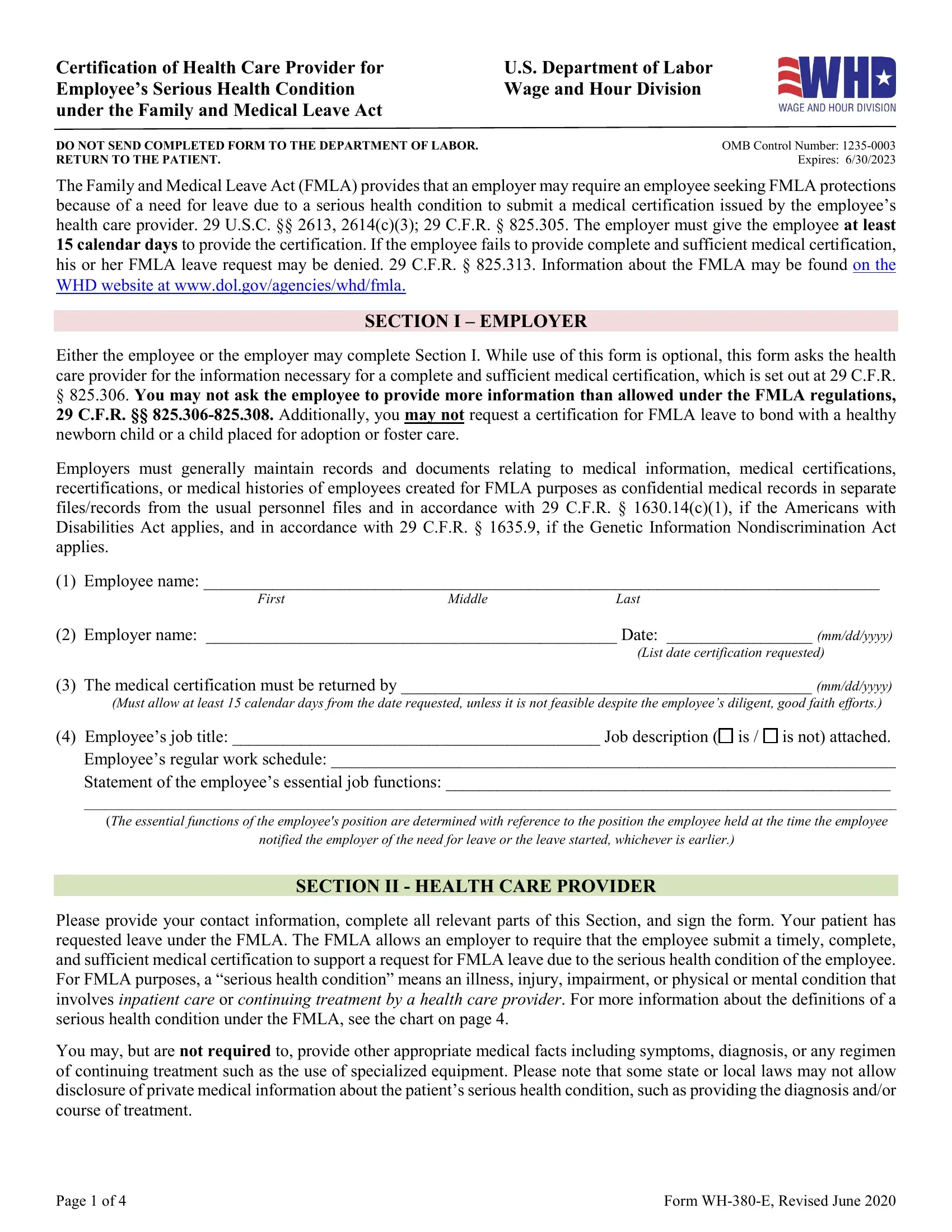

Understanding and Utilizing the Printable Form Wh 380 E

In the realm of financial management and taxation, understanding the intricacies of Form WH 380 E is essential. This document plays a pivotal role in the accurate reporting of income and withholding taxes, ensuring compliance with legal regulations and facilitating smooth financial transactions.

Through this comprehensive guide, we will delve into the purpose, significance, and intricacies of Form WH 380 E. We will provide step-by-step instructions for completing the form accurately, explore variations and alternative forms, and offer a valuable list of resources for further exploration.

Form WH 380 E Overview

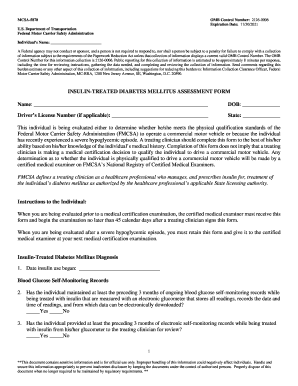

Form WH 380 E, also known as the Certificate of Residency, is an official document issued by the German tax authorities to certify an individual’s residency status in Germany. It’s primarily used for tax purposes, specifically to determine an individual’s tax liability and entitlement to tax benefits.

The form serves as proof of residency and is essential for individuals who are not domiciled in Germany but have established a residence there. It’s also required when claiming tax exemptions or reductions based on residency status, such as the reduced withholding tax rate on employment income.

Form WH 380 E s

If you’re self-employed and need to pay your tax and National Insurance contributions, you’ll need to fill in a Form WH 380 E. This guide will show you how to fill it in step-by-step.

Before you start, you’ll need to gather some information, including your National Insurance number, your Unique Taxpayer Reference (UTR), and your income and expenses for the tax year.

Personal Details

The first section of the form asks for your personal details, including your name, address, and contact information. Make sure you fill in all of the boxes clearly and accurately.

Income

The next section asks for details of your income. This includes all of the money you’ve earned from self-employment, as well as any other income you’ve received, such as benefits or interest.

- For each source of income, you’ll need to provide the following information:

- The name of the payer

- The amount of income you’ve received

- The tax year that the income relates to

Expenses

The next section asks for details of your expenses. This includes all of the costs you’ve incurred in running your business, such as travel expenses, equipment costs, and rent.

- For each expense, you’ll need to provide the following information:

- The type of expense

- The amount of the expense

- The date that the expense was incurred

Calculating Your Tax and National Insurance

Once you’ve filled in all of the sections, you’ll need to calculate your tax and National Insurance. The form includes a calculator that will help you do this.

Once you’ve calculated your tax and National Insurance, you’ll need to pay it to HMRC. You can do this online, by phone, or by post.

注意事项

- The deadline for filing your Form WH 380 E is 31st January following the end of the tax year.

- If you’re late filing your return, you may have to pay a penalty.

- If you’re not sure how to fill in your Form WH 380 E, you can get help from HMRC or from a tax adviser.

Form WH 380 E Examples

Below are some common scenarios where Form WH 380 E is used:

Employee Income Sources

| Scenario | Income Sources | Tax Withholdings | Other Relevant Data |

|---|---|---|---|

| Employee working in the UK | Salary, bonuses, commissions | PAYE (Pay As You Earn) | National Insurance contributions |

| Employee working overseas | Foreign income, UK income | PAYE, Foreign Tax Credit | Proof of overseas residence |

| Employee with multiple jobs | Income from different employers | PAYE from each employer | Total income and tax withheld |

| Employee receiving benefits | Salary, benefits (e.g., car allowance) | PAYE, Benefit-in-Kind tax | Value of benefits received |

Form WH 380 E Variations

There are no known variations or alternative forms of the WH 380 E form.

Form WH 380 E Resources

Innit, if you’re on the hunt for top-notch resources on Form WH 380 E, you’ve come to the right crib. This banger of a list will hook you up with official government websites, publications, and other bits that’ll help you smash your WH 380 E game plan.

Government Websites

– HMRC website: The official website of Her Majesty’s Revenue and Customs (HMRC) is your go-to for all things tax-related. They’ve got a dedicated page for Form WH 380 E with downloadable forms, guidance, and more.

– GOV.UK website: This government website is another ace source for info on Form WH 380 E. You’ll find a step-by-step guide to filling out the form, plus answers to frequently asked questions.

Publications

– Employer’s Guide to PAYE and NICs (P45): This HMRC publication is a must-read for employers who need to understand PAYE (Pay As You Earn) and National Insurance contributions (NICs). It covers Form WH 380 E and other essential forms.

– Form WH 380 E Guide: This handy guide from HMRC provides a clear and concise overview of Form WH 380 E, including who needs to fill it out and how to do it.

Other Resources

– TaxCalc website: This website offers a range of tax-related software and resources, including a free guide to Form WH 380 E.

– Croner-i website: Croner-i is a leading provider of tax and employment law information. Their website has a wealth of resources on Form WH 380 E, including articles, webinars, and training courses.

Common Queries

What is the primary purpose of Form WH 380 E?

Form WH 380 E serves as a withholding tax certificate for non-resident individuals receiving income from sources within the United States.

Are there any specific requirements or注意事项 that I should be aware of when completing Form WH 380 E?

Yes, it is crucial to provide accurate and complete information, including your name, address, tax identification number, and income details. Additionally, you may need to attach supporting documentation, such as a copy of your passport or visa.

Where can I find additional resources and support related to Form WH 380 E?

The Internal Revenue Service (IRS) website offers a wealth of information, including official forms, publications, and guidance. You can also seek assistance from a tax professional or consult reputable online resources.