The Ultimate Guide to Printable Form W2: Your Comprehensive Resource

Navigating the complexities of tax filing can be a daunting task, but understanding and utilizing Printable Form W2 can simplify the process significantly. This comprehensive guide will provide you with an in-depth overview of Form W2, its types, completion instructions, legal considerations, and best practices. Whether you’re an individual taxpayer or a business owner, this guide will empower you with the knowledge and tools necessary to effectively manage your Form W2 requirements.

Printable Form W2 offers numerous advantages, including convenience, flexibility, and cost-effectiveness. By understanding the different types of Form W2 available, you can select the one that best suits your specific needs. Our step-by-step instructions will guide you through the completion process, ensuring accuracy and compliance with tax regulations.

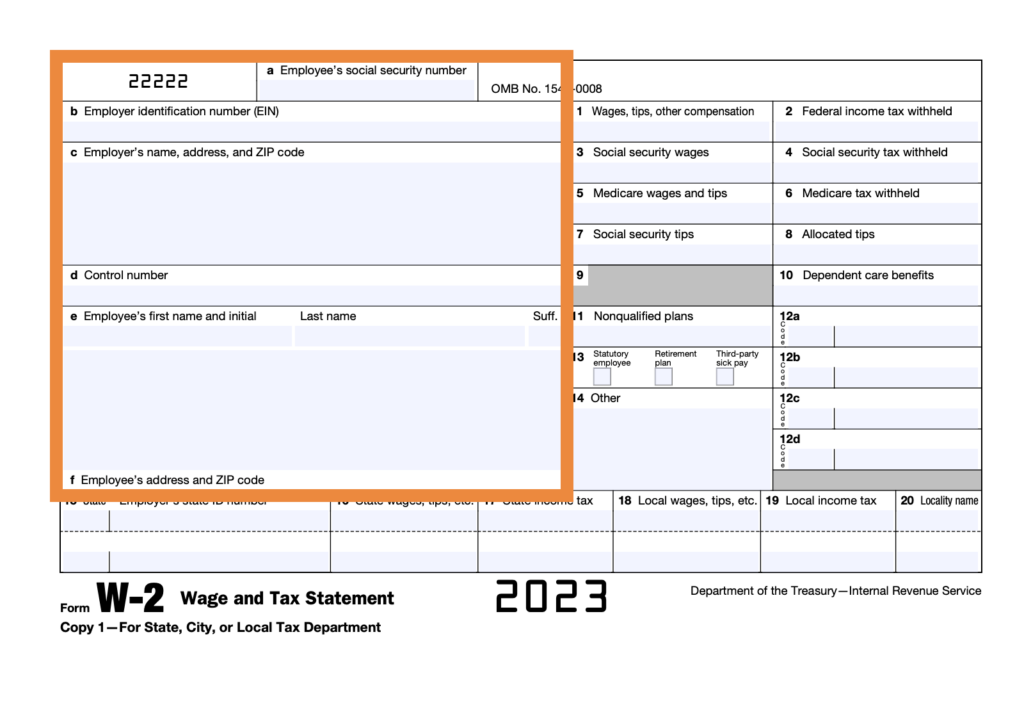

Introduction to Printable Form W2

Form W2, also known as the Wage and Tax Statement, is an essential document issued by employers to employees in the United Kingdom. It serves as an official record of an employee’s earnings and tax deductions for a specific tax year.

Printable Form W2 is a convenient option for individuals who need a physical copy of their W2 for tax filing, record-keeping, or other purposes. It allows them to print the form directly from a computer or mobile device, ensuring accuracy and accessibility.

Target Audience

The target audience for printable Form W2 includes:

- Employees who need a physical copy of their W2 for tax filing.

- Individuals who have lost or misplaced their original W2.

- Tax professionals who assist clients with tax preparation.

- Financial institutions that require W2 information for loan applications or other financial transactions.

Benefits of Using Printable Form W2

There are several benefits to using printable Form W2:

- Convenience: Printable Form W2 provides employees with a convenient way to obtain a physical copy of their W2 without having to wait for it to be mailed.

- Accuracy: Printable Form W2 is generated electronically, ensuring accuracy and reducing the risk of errors.

- Accessibility: Printable Form W2 can be accessed and printed from any computer or mobile device with an internet connection.

- Cost-effective: Printable Form W2 eliminates the need for employers to purchase and mail paper copies of W2s, saving on postage and printing costs.

Types of Printable Form W2

There are a few different types of printable Form W2 available, each with its own specific uses and applications.

The most common type of Form W2 is the “Copy A” form, which is the official copy that is filed with the IRS. Copy A must be filed with the IRS by January 31st of the year following the tax year for which the form is being filed. Copy B is for the employee’s records, and Copy C is for the employer’s records.

Types of Printable Form W2

- Copy A: The official copy that is filed with the IRS.

- Copy B: For the employee’s records.

- Copy C: For the employer’s records.

s for Completing Printable Form W2

Buckle up, bruv, it’s time to tackle that Printable Form W2 like a pro. Don’t worry, we’ll break it down into bite-sized chunks so you can nail it.

Before we dive in, make sure you have the following bits:

- Your payslips or any other records of your earnings.

- Your National Insurance number.

- Your employer’s details, including their address and contact info.

Right, let’s get cracking:

Personal Details

Fill in your personal info, like your name, address, and National Insurance number. Make sure it’s all correct and up to date, or HMRC might get confused.

Employer Details

Next up, it’s your employer’s turn. Enter their name, address, and contact details. If they have a PAYE reference number, pop that in too.

Earnings and Deductions

Now for the nitty-gritty: your earnings and deductions. This is where you list all the cash you’ve earned, as well as any deductions like tax, National Insurance, and pension contributions.

For each type of income, you’ll need to enter the amount and the code that corresponds to it. The codes are usually printed on your payslips, but if you’re not sure, check with your employer or HMRC.

Benefits and Expenses

If you’ve received any benefits or expenses from your employer, you’ll need to declare them here. This could include things like company cars, medical insurance, or travel expenses.

Tax Credits

If you’re entitled to any tax credits, make sure you claim them here. This could reduce the amount of tax you owe.

Declarations

Finally, you need to sign and date the form, and then send it off to HMRC. Make sure you keep a copy for your records.

Common Errors and Pitfalls to Avoid

Watch out for these common mistakes:

- Entering incorrect or incomplete personal details.

- Mixing up the earnings and deductions codes.

- Forgetting to claim tax credits.

- Submitting the form late.

Legal Considerations for Printable Form W2

Filling and submitting Form W2 is a legal obligation for employers. There are specific requirements and penalties associated with completing and filing this form. Understanding these legal considerations helps ensure compliance with tax laws.

Legal Requirements for Completing Form W2

Employers must complete Form W2 for each employee who earns wages or other compensation during the tax year. The form must include accurate information, including the employee’s name, address, Social Security number, wages, and taxes withheld. Failure to provide accurate information can result in penalties.

Penalties for Incorrect or Incomplete Form W2

Incorrect or incomplete Form W2 can lead to penalties for both the employer and the employee. Penalties may include fines, interest charges, and even criminal charges in severe cases. Employers should ensure the form is completed accurately and filed on time to avoid these penalties.

Compliance with Tax Laws

To ensure compliance with tax laws, employers should follow these guidelines:

– Complete Form W2 accurately and completely.

– File Form W2 with the IRS by the required deadline.

– Keep copies of all Form W2s for at least four years.

– Be prepared to provide Form W2s to employees upon request.

Best Practices for Using Printable Form W2

To maximize the effectiveness of printable Form W2, follow these best practices:

Maintain an organized filing system for all Form W2 records, both physical and digital copies. This ensures easy retrieval and accessibility when needed.

Avoiding Common Mistakes

- Carefully review the instructions provided with the form to avoid errors.

- Use clear and legible handwriting or type the information to ensure accuracy.

- Double-check all calculations and ensure the information aligns with other tax-related documents.

- Keep a copy of the completed Form W2 for your records.

Troubleshooting Printable Form W2

:max_bytes(150000):strip_icc()/w2-9ca13523f4d74e958b821aab63af2e60.png?w=700)

Printable Form W2 can sometimes pose challenges. This section identifies common issues and provides troubleshooting steps to resolve them effectively.

Incorrect Information

If you encounter incorrect information on your Printable Form W2, it’s crucial to address it promptly.

- Contact your employer: Reach out to your employer immediately to report the error. They can provide the correct information and issue an amended Form W2.

- File an amended return: If the error is discovered after filing your tax return, you’ll need to file an amended return (Form 1040-X) with the corrected information.

Technical Difficulties

Technical issues can arise when working with Printable Form W2. Here are some common problems and solutions:

- Printer issues: Ensure your printer is properly connected and has sufficient ink or toner. Check the printer settings to ensure they align with the Form W2 requirements.

- Software compatibility: Verify that the software you’re using to access and print the Form W2 is compatible with your operating system and printer.

- Form alignment: If the printed Form W2 is misaligned, adjust the printer settings or try printing on a different paper size.

Filing Issues

Issues related to filing Printable Form W2 can also occur. Here’s how to address them:

- Missing or incomplete information: Ensure that all required fields on the Form W2 are filled out accurately and completely before submitting it.

- Late filing: Avoid filing your Form W2 late, as it can result in penalties and interest charges. File it by the deadline to avoid any complications.

- Incorrect filing method: Make sure you’re using the correct method to file your Form W2, whether it’s by mail, electronically, or through a tax professional.

Alternatives to Printable Form W2

Yo, bruv, there’s more ways than one to get your mitts on Form W2. Check out these other options, each with its own perks and pitfalls:

Online Services

- Convenience: No need to print, fill, or mail. Just hop online and get it sorted.

- Security: Secure portals protect your info from prying eyes.

- Fees: Some services charge a small fee for their assistance.

Electronic Signature

- Ease of Use: Sign your Form W2 digitally with a few clicks.

- Time-Saving: No need to wait for snail mail or meet up for physical signatures.

- Legal Validity: E-signatures are legally binding in most cases.

Employer-Provided Options

- Convenience: Your employer can provide you with pre-filled forms or online access.

- Accuracy: Employers have access to your payroll info, ensuring accuracy.

- Limited Options: May not offer all the customization or flexibility of other methods.

Choosing the Best Option

The best choice for you depends on your needs. Consider these factors:

- Tech Savviness: Online services and electronic signatures require some tech know-how.

- Time Constraints: If you’re in a hurry, online options or e-signatures can save time.

- Security Concerns: If you’re worried about privacy, consider using a secure online service.

Q&A

Q: What is the purpose of Form W2?

A: Form W2 is an official document issued by employers to employees that reports wages, salaries, tips, and other compensation paid during the tax year. It is used by individuals to file their annual tax returns and by businesses to report employee income to the government.

Q: Who can use Printable Form W2?

A: Printable Form W2 is available for use by both individuals and businesses. Individuals can use it to prepare their own tax returns, while businesses can use it to generate W2 forms for their employees.

Q: What are the benefits of using Printable Form W2?

A: Printable Form W2 offers several benefits, including convenience, flexibility, and cost-effectiveness. It allows individuals to prepare their tax returns without the need for professional assistance and provides businesses with a cost-effective way to generate W2 forms for their employees.

Q: How do I complete Printable Form W2?

A: Completing Printable Form W2 involves filling out various fields with information such as employee personal information, income details, and tax withholdings. Our guide provides step-by-step instructions to ensure accurate completion.

Q: What are the legal considerations for Printable Form W2?

A: Employers are legally required to provide accurate and timely Form W2 to their employees. Failure to do so can result in penalties and fines. Our guide discusses the legal requirements and provides guidance on how to ensure compliance.