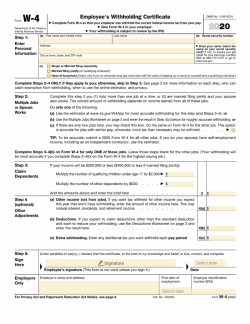

Printable Form W-4: A Guide to Completing and Understanding Your Tax Withholding

Navigating the complexities of tax withholding can be a daunting task, but understanding and completing Form W-4 is crucial for ensuring accurate tax deductions from your paycheck. This printable form plays a pivotal role in determining the amount of federal income tax withheld by your employer, ultimately impacting your tax refund or balance due at the end of the year.

In this comprehensive guide, we will delve into the significance of Form W-4, its various sections, and provide step-by-step instructions for completing it accurately. We will also explore the benefits of using a printable Form W-4 and address frequently asked questions to empower you with the knowledge to confidently manage your tax withholding.

Printable Form W-4

Form W-4, also known as the Employee’s Withholding Certificate, is a crucial document that determines the amount of federal income tax withheld from your paycheck. It’s your responsibility as an employee to complete this form accurately to ensure the correct amount of taxes is being deducted.

-

Purpose of Form W-4

Form W-4 helps the employer calculate the correct amount of federal income tax to withhold from your paycheck based on your personal circumstances, such as your filing status, number of dependents, and any additional income or deductions you may have.

-

Sections of Form W-4

Form W-4 consists of several sections, each designed to gather specific information about your tax situation:

- Personal Information: Includes your name, address, and Social Security number.

- Filing Status: Indicates your marital status and filing status for tax purposes.

- Dependents: Lists the number of dependents you claim for tax purposes.

- Additional Income: Allows you to report any additional income you expect to receive during the year.

- Deductions: Provides space for you to indicate any itemized deductions or tax credits you expect to claim.

-

Importance of Completing Form W-4 Accurately

Completing Form W-4 accurately is essential to ensure that the correct amount of federal income tax is withheld from your paycheck. If you don’t complete the form or provide inaccurate information, you may end up paying too much or too little in taxes. This could result in a tax refund or a tax bill when you file your tax return.

Benefits of Using a Printable Form W-4

Innit, fam! Get ready to sort out your tax business like a pro with a printable Form W-4. It’s the ultimate lifesaver for anyone who wants to make filing their taxes as easy as pie. Let’s break it down, shall we?

Convenience

With a printable Form W-4, you’re the boss of your own tax destiny. You can fill it out whenever, wherever, without having to wait for snail mail or fiddle with online forms. It’s like having a personal tax assistant at your fingertips, ready to help you get the job done.

Accessibility

Printable Form W-4 is open to all, no matter what your situation is. It’s free, accessible, and you don’t need any fancy software or special skills to use it. Just print it out and get cracking. It’s like having a tax superpower!

Cost-Effectiveness

Let’s talk money, shall we? Printable Form W-4 is totally free. No hidden fees, no subscription charges. It’s like finding a gold mine in your tax filing journey. Plus, it can help you avoid costly mistakes that could lead to overpaying taxes.

Streamlining Tax Filing

Picture this: you’ve got your printable Form W-4 filled out, and it’s looking sharp. Now, when it’s time to file your taxes, you’re already ahead of the game. Simply enter the info from your form into your tax software or send it to your accountant. It’s like having a cheat code for a faster and smoother tax filing experience.

s for Completing Form W-4

Filling out Form W-4 accurately is crucial to ensure you pay the correct amount of income tax throughout the year. Follow these detailed s to complete your W-4 form precisely, avoiding common pitfalls and ensuring its accuracy.

Remember, the accuracy of your Form W-4 directly impacts your tax liability and potential refund or amount owed. Take your time and refer to these s for guidance.

Personal Information

Start by filling in your personal information, including your legal name, address, and Social Security number. Ensure all information matches your official records and is entered accurately.

Filing Status

Indicate your filing status for the tax year. Choose the option that best describes your marital status and tax filing situation. The most common filing statuses are single, married filing jointly, and married filing separately.

Allowances

Enter the number of allowances you claim on your W-4. Allowances reduce the amount of income tax withheld from your paycheck. The more allowances you claim, the less tax will be withheld. Use the Personal Allowances Worksheet in the Form W-4 instructions to determine the number of allowances you are eligible to claim.

Additional Amount

If you want an additional amount of tax withheld from your paycheck each pay period, enter the dollar amount in the “Additional Amount” field. This is useful if you anticipate owing taxes at the end of the year due to additional income sources or deductions.

Common Errors to Avoid

- Claiming too many allowances: Overclaiming allowances can lead to underpayment of taxes and potential penalties.

- Not claiming enough allowances: Underclaiming allowances can result in overpayment of taxes and a larger refund at tax time.

- Entering incorrect personal information: Inaccurate personal information can delay the processing of your W-4 and potentially lead to errors in your tax calculations.

- Leaving sections blank: Incomplete W-4 forms may cause delays in processing and potential errors.

Tips for Ensuring Accuracy

- Use the Personal Allowances Worksheet to determine your eligible allowances.

- Consider your other income sources and deductions when claiming allowances.

- Review your W-4 annually or whenever your financial situation changes.

- Keep a copy of your completed W-4 for your records.

Examples and Templates

Dive into the nitty-gritty of Form W-4 with our examples and templates. These will help you ace your tax withholding like a pro.

Scenario Comparison Table

Visualize the impact of different scenarios on your Form W-4 entries. Check out our comparison table:

| Scenario | Form W-4 Entries |

|---|---|

| Single, no dependents, standard deduction | 1 allowance |

| Married, filing jointly, 2 children, itemized deductions | 4 allowances |

| Head of household, 1 dependent, child tax credit | 3 allowances |

Fillable Templates

Get your hands on our fillable PDF or online templates of Form W-4. It’s like having a cheat sheet at your fingertips:

- Fillable PDF Template: Download here

- Online Template: Fill out online

Completed Form W-4 Examples

Witness the power of a completed Form W-4. These examples will inspire you:

- Single filer with no dependents: Example 1

- Married couple with 2 children: Example 2

- Head of household with 1 dependent: Example 3

Additional Resources

Seeking further guidance on Form W-4? Here are some reputable resources to assist you.

Explore these helpful websites and platforms for printable Form W-4s and insightful articles:

Websites and Platforms

- Internal Revenue Service (IRS): https://www.irs.gov/forms-pubs/about-form-w-4

- ADP: https://www.adp.com/resources/topics/payroll/form-w4.aspx

- Paychex: https://www.paychex.com/glossary/w-4-form

Helpful Articles and Guides

- IRS: https://www.irs.gov/newsroom/heres-how-to-fill-out-the-new-w-4-form

- Forbes: https://www.forbes.com/sites/forbesbusinesscouncil/2022/01/24/everything-you-need-to-know-about-the-new-form-w-4/?sh=27d99d145364

- The Balance: https://www.thebalancemoney.com/new-form-w-4-2020-4842829

FAQs

What is the purpose of Form W-4?

Form W-4, also known as the Employee’s Withholding Certificate, is used to inform your employer of your withholding allowances and any additional withholding you want to have deducted from your paycheck for federal income tax purposes.

What are withholding allowances?

Withholding allowances represent the number of dependents you can claim on your tax return. Each allowance reduces the amount of tax withheld from your paycheck.

What are the consequences of inaccurate Form W-4 information?

Inaccurate Form W-4 information can lead to underpayment or overpayment of taxes. Underpayment may result in penalties and interest charges, while overpayment will result in a refund when you file your tax return.

Where can I find a printable Form W-4?

You can download a printable Form W-4 from the Internal Revenue Service (IRS) website or obtain one from your employer.