Printable Form SSA-1099: A Comprehensive Guide to Filing

Navigating the complexities of tax filing can be a daunting task, especially when it comes to understanding and completing specific forms. Among the various tax documents, Form SSA-1099 plays a crucial role in reporting Social Security benefits received during the tax year. This comprehensive guide will delve into the purpose, significance, and step-by-step instructions for completing Printable Form SSA-1099, ensuring accuracy and completeness.

Understanding the nuances of Form SSA-1099 is essential for taxpayers who receive Social Security benefits. This form serves as an official record of the benefits received, and its timely and accurate completion is crucial for both the taxpayer and the Social Security Administration (SSA). By providing a clear overview of the form’s purpose, structure, and submission process, this guide aims to empower taxpayers with the knowledge and confidence to navigate the complexities of Form SSA-1099.

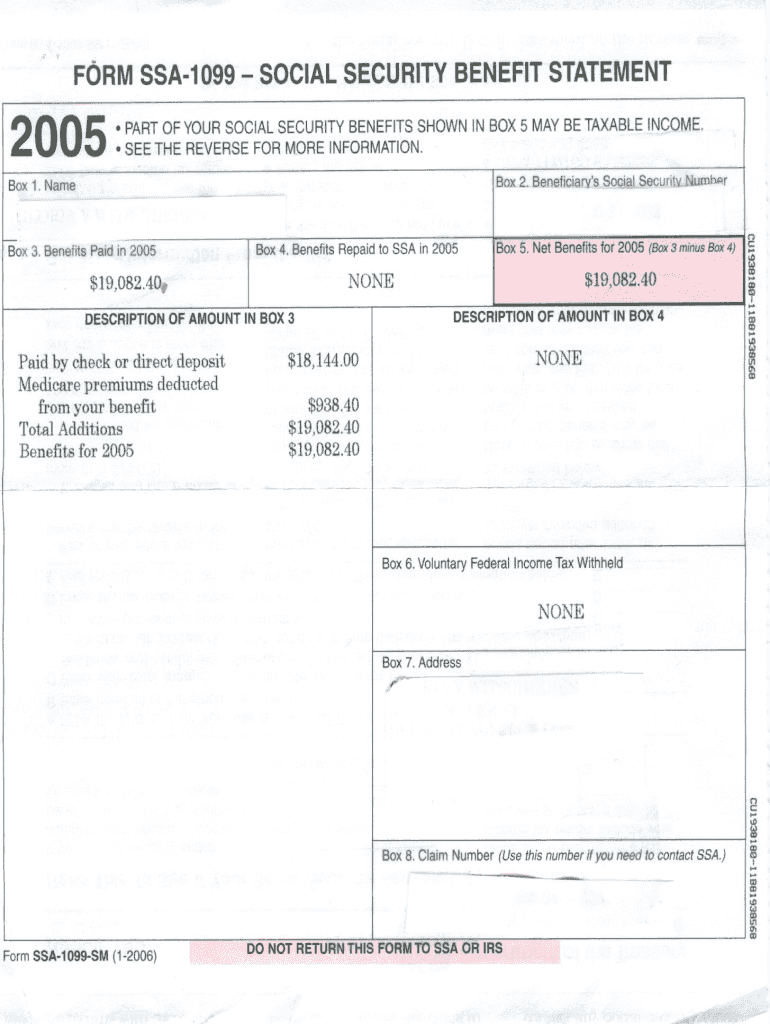

Printable Form SSA-1099 Overview

The Printable Form SSA-1099, also known as the Social Security Administration Form 1099, is a crucial document that reports income earned from self-employment, dividends, or other sources that are not subject to regular withholding taxes. It plays a significant role in the accurate reporting of income for tax purposes and ensures that individuals fulfill their tax obligations.

The form typically includes the following information: the payer’s name and address, the recipient’s name and address, the amount of income earned, and any applicable tax withholding. Accuracy and completeness are of utmost importance when filling out Form SSA-1099, as it forms the basis for tax calculations and determines the amount of taxes owed.

Purpose and Significance

The primary purpose of Form SSA-1099 is to report income that is not subject to regular withholding taxes. This includes income from self-employment, such as freelance work or running a small business, as well as dividends, prizes, and other miscellaneous income. By providing this information to the Social Security Administration (SSA) and the Internal Revenue Service (IRS), individuals can ensure that their income is accurately reported and that they are paying the correct amount of taxes.

Importance of Accuracy and Completeness

Accuracy and completeness are crucial when filling out Form SSA-1099. Incorrect or incomplete information can lead to errors in tax calculations, resulting in underpayment or overpayment of taxes. It is essential to carefully review the form and ensure that all the required information is provided accurately. This includes verifying the payer’s and recipient’s information, the amount of income earned, and any applicable tax withholding. By ensuring accuracy and completeness, individuals can avoid potential penalties and ensure that they fulfill their tax obligations.

Step-by-Step Guide to Completing Form SSA-1099

Filing Form SSA-1099 accurately is crucial to ensure timely and correct Social Security benefits for recipients. Here’s a detailed guide to help you navigate each section and complete the form efficiently:

Payer Information

Begin by providing your business or organization’s legal name, address, and Employer Identification Number (EIN). If you don’t have an EIN, apply for one through the IRS website.

Recipient Information

Next, enter the recipient’s full name, address, and Social Security number (SSN). If you don’t have their SSN, request it from them. It’s essential for processing benefits.

Benefits Paid

In this section, specify the total amount of benefits paid to the recipient during the tax year. This includes:

- Social Security benefits (Boxes 3 and 5)

- Medicare benefits (Box 6)

- Railroad Retirement benefits (Box 7)

Refer to your accounting records or the recipient’s benefit statement for accurate figures.

Tax Withheld

Indicate any taxes withheld from the recipient’s benefits, such as Medicare tax or income tax. Check your records or consult with a tax professional for guidance.

Additional Information

Use this section to provide any additional details or explanations that may be relevant to the recipient’s benefits, such as:

- Reason for withholding taxes

- Changes in the recipient’s address or SSN

- Corrections to previously filed forms

Signature and Date

Finally, sign and date the form as the authorized representative of your business or organization. Keep a copy for your records.

Common Errors and Troubleshooting

/ScreenShot2020-02-03at1.34.19PM-439f6abd8f244fcaa75c85491542ca95.png?w=700)

Completing Form SSA-1099 accurately is crucial to avoid delays in processing and potential penalties. However, common errors can occur during the completion process. Understanding these errors and implementing solutions can ensure accuracy and hassle-free filing.

Common errors and their troubleshooting tips include:

Incorrect Recipient Information

- Mistakes in the recipient’s name, address, or Taxpayer Identification Number (TIN) can cause delays or rejection of the form.

- Ensure the information matches the recipient’s Social Security card or official records.

Incorrect Amounts Reported

- Inaccurate reporting of taxable benefits or other amounts can lead to discrepancies and potential audits.

- Reconcile the amounts reported with the recipient’s records and supporting documentation.

Missing or Incomplete Information

- Incomplete forms or missing information can cause delays or rejection.

- Carefully review the form before submitting it to ensure all required fields are filled out.

Filing Deadlines Not Met

- Missing filing deadlines can result in penalties and interest charges.

- Mark the filing deadlines on your calendar and allow ample time for preparation and mailing.

Incorrect Filing Method

- Using an incorrect filing method, such as mailing instead of electronic filing, can cause delays or rejection.

- Choose the appropriate filing method based on the number of forms and your available resources.

Submission and Processing of Form SSA-1099

The completed Form SSA-1099 can be submitted in various ways, including:

- Electronically: Using the Social Security Administration’s (SSA) online portal or through a tax software provider.

- By mail: Sending the form to the SSA’s designated address.

The processing timeline for Form SSA-1099 varies depending on the submission method. Electronic submissions are typically processed faster than mailed submissions. After submission, you can expect the SSA to:

- Review the form for completeness and accuracy.

- Process the information and update the recipient’s Social Security record.

- Issue a notice if any corrections or adjustments are necessary.

Late or incorrect submissions can result in delays in processing or penalties. It’s crucial to submit the form accurately and on time to avoid any potential issues.

Electronic Submission

Electronic submission is the preferred method as it’s secure, convenient, and faster than mailing. To submit electronically, you can use the SSA’s online portal or a tax software provider. The SSA’s portal allows you to create an account and submit the form directly. Tax software providers offer integrated solutions that streamline the filing process.

Mail Submission

If you prefer to submit the form by mail, you must send it to the SSA’s designated address. Ensure you include all necessary documentation and follow the instructions provided on the form.

Processing Timeline

The processing timeline for electronic submissions is typically within a few days, while mailed submissions may take several weeks. You can check the status of your submission through the SSA’s online portal or by contacting the SSA directly.

Consequences of Late or Incorrect Submissions

Late or incorrect submissions can lead to delays in processing, penalties, or adjustments to the recipient’s Social Security record. It’s important to file the form accurately and on time to avoid any potential issues.

Alternative Options for Filing

Innit, bruv? There are bare other ways to file Form SSA-1099, like online platforms or software. Let’s check ’em out and see what’s the crack.

Online Platforms

Filing online is dead easy, innit? You just need to find a legit platform, create an account, and upload your info. Sorted! Here’s the lowdown on the pros and cons:

Advantages

- Convenient: Can be done anytime, anywhere with an internet connection.

- Secure: Most platforms use encryption to protect your data.

- Time-saving: Automates calculations and reduces the risk of errors.

Disadvantages

- Cost: Some platforms may charge a fee for their services.

- Technical issues: Can be frustrating if you encounter any glitches.

- Limited support: May not have access to direct support if needed.

Software

If you’re more of a software type, there are options for that too. You can download software onto your computer and use it to file your Form SSA-1099. Here’s the scoop:

Advantages

- Control: Gives you more control over the filing process.

- Customization: Can be customized to meet specific needs.

- Offline access: Can be used without an internet connection.

Disadvantages

- Cost: Software can be expensive to purchase.

- Updates: May require regular updates, which can be time-consuming.

- Compatibility: May not be compatible with all operating systems or devices.

Recommendation

The best option for you depends on your specific circumstances and preferences. If you’re looking for convenience and security, online platforms are a solid choice. If you prefer more control and customization, software might be a better fit. Just weigh up the pros and cons and make the decision that works for you.

Resources and Support

Individuals seeking assistance with Form SSA-1099 can access various resources and support channels.

The following resources provide guidance and assistance:

Government Agencies

- Social Security Administration (SSA): The SSA website (www.ssa.gov) offers a wealth of information and resources related to Form SSA-1099. Individuals can access the website to download the form, obtain instructions, and contact the SSA for further assistance.

- Internal Revenue Service (IRS): The IRS website (www.irs.gov) provides information on tax-related matters, including Form SSA-1099. Individuals can access the website to obtain guidance on completing the form and meeting their tax obligations.

Websites

- Nolo: Nolo (www.nolo.com) is a website that provides legal information and resources to individuals. It offers a comprehensive guide to Form SSA-1099, covering topics such as who needs to file, how to complete the form, and common mistakes to avoid.

- LegalZoom: LegalZoom (www.legalzoom.com) is a website that provides legal services and resources to individuals. It offers a service to assist individuals with completing Form SSA-1099, ensuring accuracy and compliance with tax regulations.

Professionals

- Tax Preparers: Tax preparers are professionals who specialize in preparing tax returns. They can assist individuals with completing Form SSA-1099 and ensuring that it is filed correctly.

- Accountants: Accountants are professionals who provide accounting and tax services. They can assist individuals with understanding the tax implications of Form SSA-1099 and ensuring that it is completed accurately.

Common Queries

What is the purpose of Form SSA-1099?

Form SSA-1099 is used to report Social Security benefits received during the tax year. It serves as an official record for both the taxpayer and the Social Security Administration (SSA).

What information is typically included on Form SSA-1099?

Form SSA-1099 includes the taxpayer’s name, Social Security number, the total amount of Social Security benefits received, and any taxes withheld.

What are the consequences of late or incorrect submissions of Form SSA-1099?

Late or incorrect submissions of Form SSA-1099 may result in penalties and interest charges. It can also delay the processing of your tax return and the issuance of your refund.

Are there any alternative options for filing Form SSA-1099?

Yes, taxpayers can file Form SSA-1099 online through the SSA’s website or by using tax preparation software.

Where can I find resources and support for completing Form SSA-1099?

The SSA’s website provides comprehensive information and resources for completing Form SSA-1099. You can also contact the SSA directly for assistance.