Printable Form 990: A Comprehensive Guide to Filing and Accessibility

Navigating the complexities of tax reporting can be daunting, but understanding and utilizing Printable Form 990 can significantly simplify the process. This comprehensive guide delves into the significance, benefits, and considerations of using Printable Form 990, providing you with the knowledge and tools to effectively fulfill your tax obligations.

Printable Form 990 offers a convenient and cost-effective solution for non-profit organizations and tax-exempt entities to meet their annual reporting requirements. Its accessibility and flexibility empower organizations to complete the form at their own pace and within their budgetary constraints.

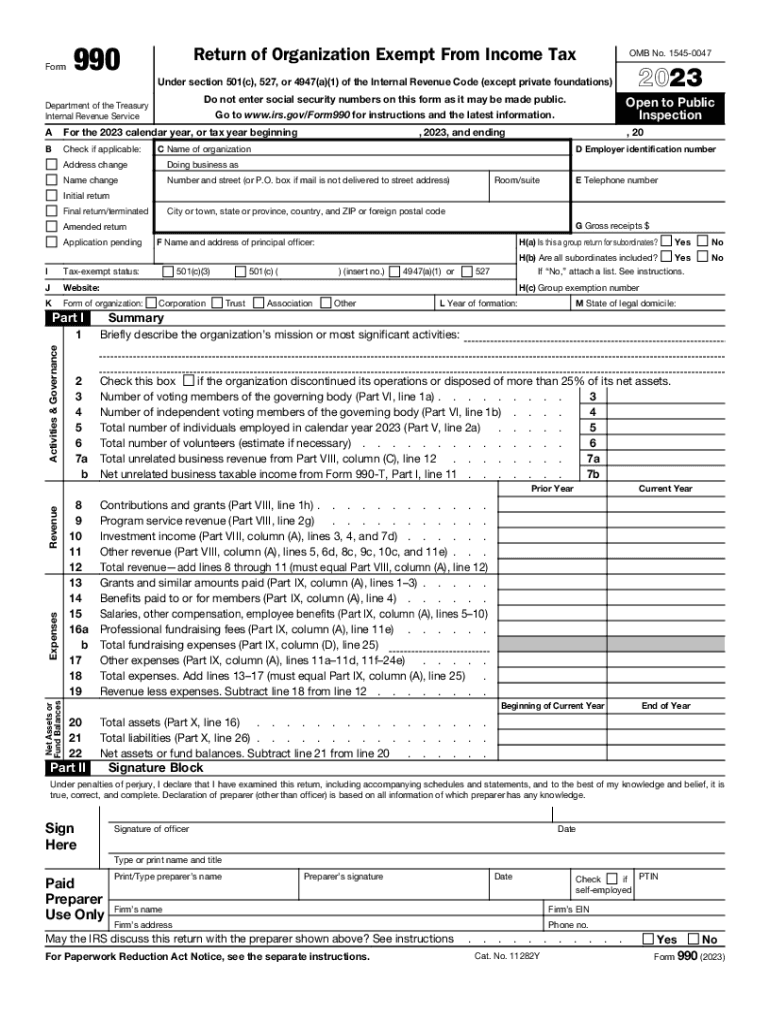

Understanding Form 990

Form 990 is a vital tax document that nonprofit organizations in the US must file annually with the Internal Revenue Service (IRS). It provides crucial information about an organization’s financial status, operations, and activities.

There are three main types of Form 990:

Form 990-EZ

- For smaller organizations with gross receipts of less than $200,000 in the previous year.

Form 990-N

- For organizations with gross receipts of less than $50,000 in the previous year.

Form 990

- For organizations with gross receipts of $200,000 or more in the previous year.

Benefits of Printable Form 990

Printable Form 990 offers a convenient and cost-effective solution for filing your nonprofit organization’s tax return. It provides numerous advantages, including:

Accessibility and Flexibility

- Printable Form 990 is available 24/7, allowing you to access and complete it at your own pace and convenience.

- You can print as many copies as needed, enabling you to make revisions or share the form with others involved in the filing process.

Cost-Saving Benefits

- Unlike online or professional preparation services, printable Form 990 is free to download and use.

- This can significantly reduce the cost of filing your tax return, especially for small nonprofits with limited resources.

Considerations for Using Printable Form 990

Innit, bruv? When you’re rocking the printable Form 990, there’s a few bits you need to keep in mind to avoid any blaggin’.

First up, make sure you’re graspin’ the right form. There’s different types for different orgs, so don’t go filling out the wrong one. It’s like trying to fit a square peg in a round hole, blud.

Potential Challenges and Limitations

Now, using a printable form can be a bit of a faff. Here’s the lowdown:

- Needs to be printed and mailed: No digital filing here, mate. You’ve got to print it out, stick it in an envelope, and send it off like it’s 1999.

- Prone to errors: Filling out a form by hand can be a bit of a nightmare. It’s easy to make mistakes, especially if you’re not paying attention.

- Not as flexible: Unlike digital forms, you can’t just add extra pages or sections if you need them. You’re stuck with what you’ve got.

Tips for Accuracy and Completeness

Alright, so you’ve got the form. Now let’s make sure you fill it out like a pro:

- Read the instructions carefully: Don’t just dive in headfirst. Take some time to read through the instructions and make sure you understand what’s being asked.

- Use a pen or typewriter: Don’t scribble it out with a pencil or anything. It needs to be legible, so use a pen or typewriter.

- Double-check your work: Once you’re done, take a step back and give it a good once-over. Make sure you haven’t missed anything or made any mistakes.

Where to Find Printable Form 990

Finding the printable Form 990 is a breeze, mate! Just head on over to the official website of the Internal Revenue Service (IRS) at www.irs.gov.

Once you’re on the IRS website, it’s like a treasure hunt. Type “Form 990” into the search bar, and it’ll lead you to the right spot. From there, you can select the specific form you need, depending on your charity’s size and activities.

Printable Form 990 Resources

- The IRS website provides detailed instructions and guidance on how to complete Form 990.

- If you’re feeling a bit lost, don’t fret! The IRS has got your back with their toll-free helpline at 1-800-829-1040. They’re like the superheroes of tax info, ready to answer all your burning questions.

Using Printable Form 990 Effectively

Filling out the Printable Form 990 can seem daunting, but with the right approach, you can complete it effectively and accurately.

Here’s a step-by-step guide to help you get started:

Step 1: Gather Necessary Information

Before you begin, make sure you have all the necessary information on hand, such as:

- Organization’s legal name and address

- EIN (Employer Identification Number)

- Financial statements (income, expenses, assets, liabilities)

- List of officers, directors, and key employees

- Description of your organization’s activities

Step 2: Download and Print the Form

Go to the IRS website and download the latest version of Form 990. You can also print the form from there.

Step 3: Complete the Form

Start by filling out the basic information on the first page. Then, work your way through the sections, providing the required information for each.

Step 4: Review and Check Your Work

Once you have completed the form, take some time to review your work carefully. Make sure all the information is accurate and complete.

Step 5: Sign and File

The form must be signed by an authorized officer of your organization. You can then file the form electronically or by mail.

Submitting Printable Form 990

Submitting your completed Form 990 is an important step in fulfilling your organization’s reporting obligations. There are two main ways to submit your form: by mail or electronically.

If you choose to mail your form, it must be postmarked by the due date. The due date for Form 990 is typically May 15th, but it can vary depending on your organization’s fiscal year-end. You can find the due date for your organization on the IRS website.

If you choose to file electronically, you can do so through the IRS’s e-File system. E-filing is available for all organizations that have a valid Employer Identification Number (EIN). You can find more information about e-filing on the IRS website.

Deadlines and Timelines

The deadline for submitting Form 990 is typically May 15th. However, if your organization’s fiscal year-end is not December 31st, you may have an extended deadline. You can find the due date for your organization on the IRS website.

If you file your Form 990 late, you may be subject to penalties. The penalty for late filing is $50 per day, up to a maximum of $5,000.

Additional Resources

Innit, fam? Here’s a cheeky list of resources to get you clued up on Form 990, blud.

These are like the golden tickets to understanding this bad boy.

IRS Websites

FAQs and Support

- Form 990 FAQs

- Call the IRS helpline at 1-800-829-4933

Webinars and Workshops

- Check the IRS website for upcoming webinars on Form 990.

- Attend workshops offered by local nonprofit organizations or tax professionals.

FAQ

What are the different types of Form 990?

There are three main types of Form 990: Form 990-EZ, Form 990, and Form 990-PF. Each type is designed for organizations with varying levels of revenue and complexity.

Where can I find Printable Form 990?

Printable Form 990 can be obtained from the official IRS website. The website provides clear instructions on how to navigate and locate the specific form you need.

Is there a deadline for submitting Form 990?

Yes, the deadline for submitting Form 990 is typically May 15th for calendar-year filers. However, organizations may be eligible for an extension by filing Form 8868.