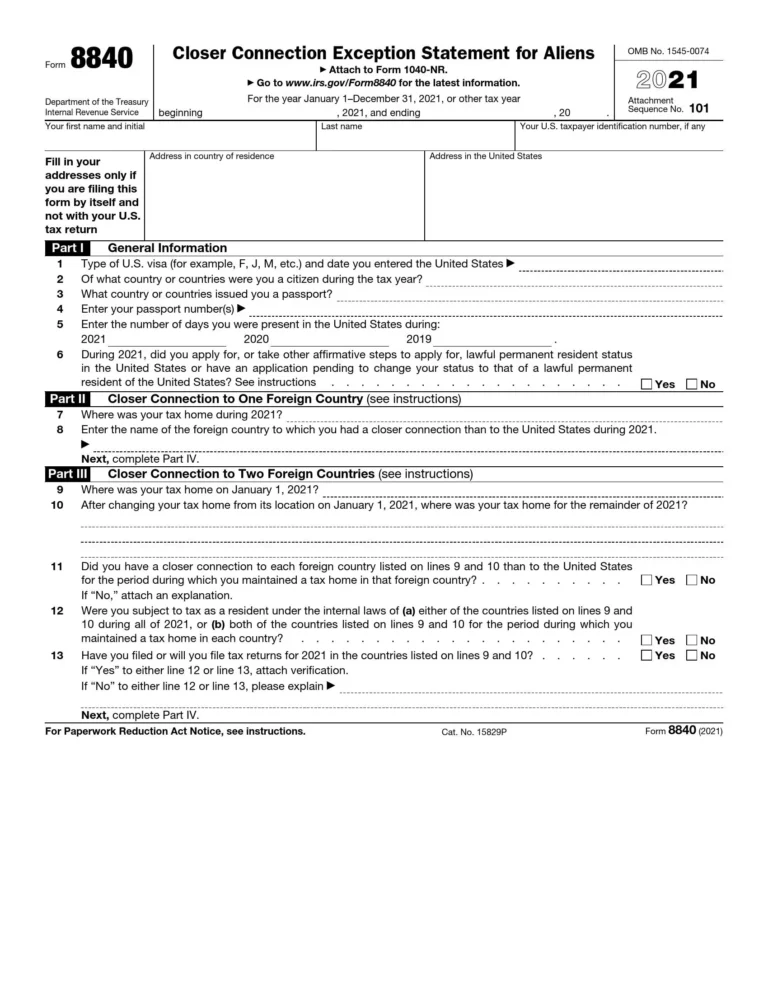

Printable Form 9465: A Comprehensive Guide to Streamline Your Filing Process

Navigating the complexities of tax filing can be a daunting task, but with the right tools and resources, it doesn’t have to be. Printable Form 9465 is an essential document that plays a crucial role in ensuring accuracy and efficiency in your tax filing process. In this comprehensive guide, we will delve into the purpose, benefits, and intricacies of Form 9465, providing you with the knowledge and insights to make your filing experience seamless.

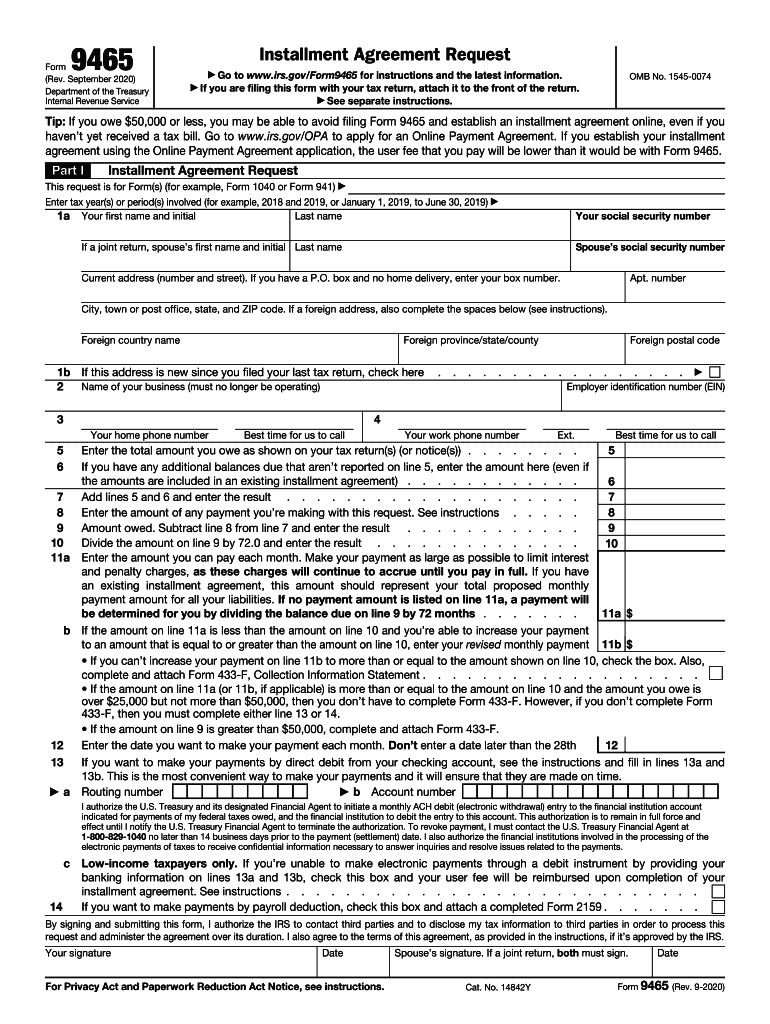

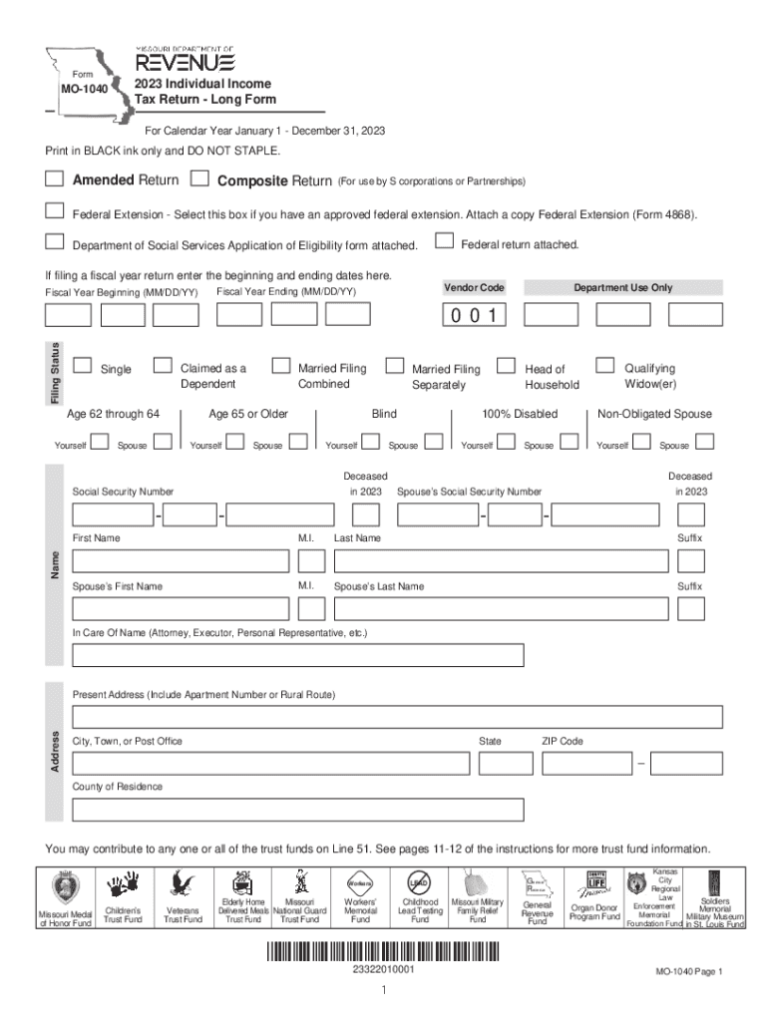

Form 9465, also known as the Installment Agreement Request, is a vital document that allows taxpayers to request an installment plan with the Internal Revenue Service (IRS). Whether you’re facing financial hardship or simply need more time to settle your tax obligations, this form empowers you to spread your payments over a manageable period, providing much-needed flexibility and peace of mind.

Printable Form 9465 Overview

Yo, listen up! Printable Form 9465 is a proper important document that you need to know about. It’s a tax form that lets you tell the taxman about any credits you’re due for. These credits can save you a pretty penny, so it’s worth taking the time to fill out this form if you think you might qualify.

Form 9465 has been around for a while, since 2018. It was created to make it easier for people to claim certain tax credits, like the Child Tax Credit and the Earned Income Tax Credit. These credits are designed to help low- and middle-income families, so if you’re in that boat, you’ll want to check out Form 9465.

Target Audience

Form 9465 is aimed at taxpayers who meet certain criteria, including:

- Taxpayers who have qualifying children

- Taxpayers who have earned income below a certain threshold

- Taxpayers who are not claimed as dependents on someone else’s tax return

s for Completing Form 9465

Filling out Form 9465 can seem like a daunting task, but by following these step-by-step s, you can ensure that your form is accurate and complete.

Before you begin, gather all the necessary documents, such as your tax return, W-2s, and 1099s. You’ll also need a copy of the Form 9465 instructions.

Section 1: Taxpayer Information

The first section of the form asks for your basic taxpayer information, such as your name, address, and Social Security number. Be sure to enter this information accurately, as it will be used to process your return.

Section 2: Income

In this section, you’ll report your total income from all sources. This includes wages, salaries, tips, and other taxable income. Be sure to include all of your income, even if it’s from multiple sources.

Section 3: Adjustments to Income

In this section, you’ll report any adjustments to your income. This includes things like IRA contributions, student loan interest, and alimony payments. These adjustments will reduce your taxable income.

Section 4: Taxable Income

Your taxable income is your total income minus any adjustments to income. This is the amount of income that will be taxed.

Section 5: Tax

In this section, you’ll calculate your tax liability. This is the amount of tax that you owe based on your taxable income. Be sure to use the correct tax rates for your filing status.

Section 6: Credits

In this section, you’ll claim any tax credits that you’re eligible for. This includes things like the child tax credit and the earned income credit. These credits will reduce your tax liability.

Section 7: Payments

In this section, you’ll report any payments that you’ve made towards your tax liability. This includes things like withholding taxes and estimated tax payments. These payments will reduce the amount of tax that you owe.

Section 8: Refund or Amount You Owe

This section will show you whether you’re due a refund or if you owe additional taxes. If you’re due a refund, it will be sent to you by direct deposit or check. If you owe additional taxes, you’ll need to pay them by the due date.

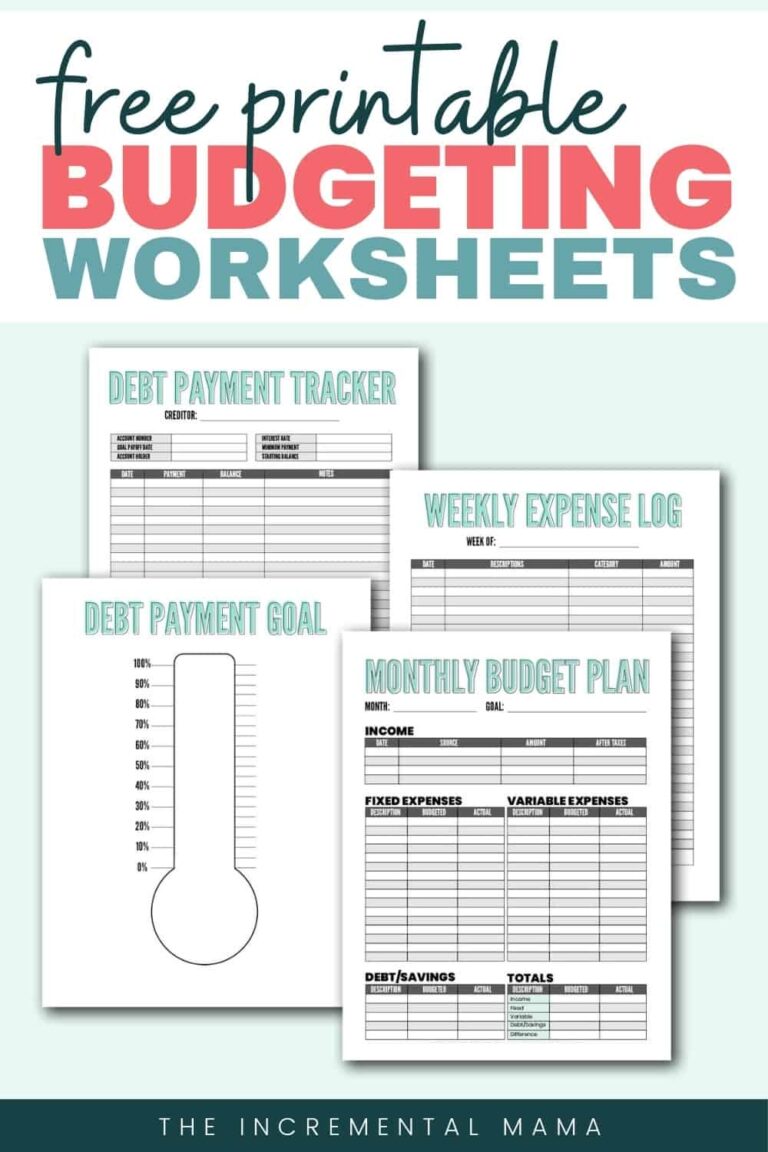

Benefits of Using Printable Form 9465

Fam, using a printable Form 9465 is a right result for saving time, dodging errors, and giving your tax life a major glow-up. It’s like having a cheat code for filing your taxes.

Say goodbye to scribbling on paper and squinting at tiny boxes. With a printable form, you can fill it out digitally, making it easy to make changes and avoid any blunders.

Saves Time

- No more waiting for the mail or filling out forms by hand.

- Complete the form at your own pace, without any rush or hassle.

Reduces Errors

- Digital forms have built-in error checks to catch any slip-ups.

- No more smudged handwriting or crossed-out numbers.

Streamlines the Process

- Fill out the form once and print it as many times as you need.

- Easily share the form with your accountant or tax preparer.

Testimonials

“Using the printable Form 9465 saved me hours of time and gave me peace of mind knowing my taxes were done right.” – Satisfied Taxpayer

“I’m not a tax expert, but the printable form made it so easy to understand and complete my taxes.” – Tax Newbie

Alternatives to Printable Form 9465

Filling out Form 9465 doesn’t have to be a chore. There are a bunch of alternatives to the printable form that can make the process easier and quicker.

These alternatives include:

Online Platforms

Several online platforms allow you to complete and submit Form 9465 electronically. These platforms are user-friendly and often provide guidance and support throughout the process. One major benefit of using an online platform is that it can save you time and effort, as you won’t have to print, fill out, and mail the form manually.

Some popular online platforms for completing Form 9465 include:

- IRS e-file

- TaxSlayer

- TurboTax

Software

You can also use tax preparation software to complete Form 9465. These software programs typically offer a range of features to help you with your taxes, including the ability to import your tax information from previous years, calculate your deductions and credits, and e-file your return. Some popular tax preparation software programs include:

- H&R Block

- Jackson Hewitt

- Intuit TurboTax

Suitability of Alternatives

The best alternative for you will depend on your individual needs and preferences. If you’re comfortable using online platforms, then an online platform may be a good option for you. However, if you prefer to have a physical copy of your tax return, then using software may be a better choice.

No matter which alternative you choose, be sure to do your research and choose a reputable provider. You should also make sure that the alternative you choose is compatible with your computer and operating system.

Resources for Printable Form 9465

There are a bunch of useful resources available to assist you with completing and using Form 9465. These resources include official websites, downloadable templates, and support forums.

- Official IRS website: The IRS website provides a wealth of information about Form 9465, including instructions, FAQs, and downloadable forms.

- Downloadable templates: There are a number of websites that offer free downloadable templates for Form 9465. These templates can make it easier to complete the form correctly.

- Support forums: There are a number of online support forums where you can ask questions about Form 9465 and get help from other users.

These resources can be a valuable help when completing and using Form 9465. Be sure to take advantage of them!

FAQs and Troubleshooting

This section aims to anticipate potential queries and offer solutions related to Printable Form 9465.

Common Questions

- Where can I find a copy of Printable Form 9465?

Printable Form 9465 can be accessed from the official website of the relevant authority or through authorized third-party providers. - What are the eligibility criteria for submitting Form 9465?

The eligibility criteria vary depending on the purpose of the form. It is recommended to refer to the official guidelines or consult with a relevant professional for specific details. - What is the deadline for submitting Form 9465?

The deadline for submitting Form 9465 can vary depending on the specific context. It is crucial to check the official guidelines or consult with the relevant authority for accurate information.

Troubleshooting Tips

- I’m having trouble downloading the form. What should I do?

Ensure you have a stable internet connection and sufficient storage space on your device. If the issue persists, try using a different browser or contact the relevant authority for assistance. - I made a mistake while filling out the form. How can I correct it?

If you notice an error, it is advisable to contact the relevant authority for guidance on how to rectify it. Depending on the situation, you may need to submit a corrected form or follow specific instructions provided by the authority. - My form was rejected. What could be the reason?

Reasons for form rejection can vary. It is recommended to review the form carefully for any errors or missing information. Additionally, ensure that you have met the eligibility criteria and followed the submission guidelines accurately.

Q&A

What is the purpose of Form 9465?

Form 9465 allows taxpayers to request an installment agreement with the IRS, enabling them to spread their tax payments over a manageable period.

Who should use Form 9465?

Individuals or businesses who are unable to pay their tax obligations in full by the due date can benefit from using Form 9465.

What are the benefits of using Form 9465?

Form 9465 offers several advantages, including flexibility in payment arrangements, reduced late payment penalties, and the ability to avoid enforced collection actions.

How do I complete Form 9465?

Follow the step-by-step instructions provided in the comprehensive guide to ensure accuracy and completeness when filling out Form 9465.

Where can I find additional resources for Form 9465?

The comprehensive guide includes a list of helpful resources, such as official IRS websites, downloadable templates, and support forums, to assist you further.