Printable Form 943: A Comprehensive Guide to Filing Taxes

Navigating the complexities of tax filing can be a daunting task, but with the right tools and guidance, it doesn’t have to be. Printable Form 943 offers a convenient and accessible solution for individuals and businesses looking to fulfill their tax obligations accurately and efficiently.

In this comprehensive guide, we’ll delve into the intricacies of Form 943, exploring its purpose, completion process, and benefits. We’ll provide practical tips, address common FAQs, and equip you with the knowledge to confidently use this form for your tax filing needs.

Printable Form 943 Overview

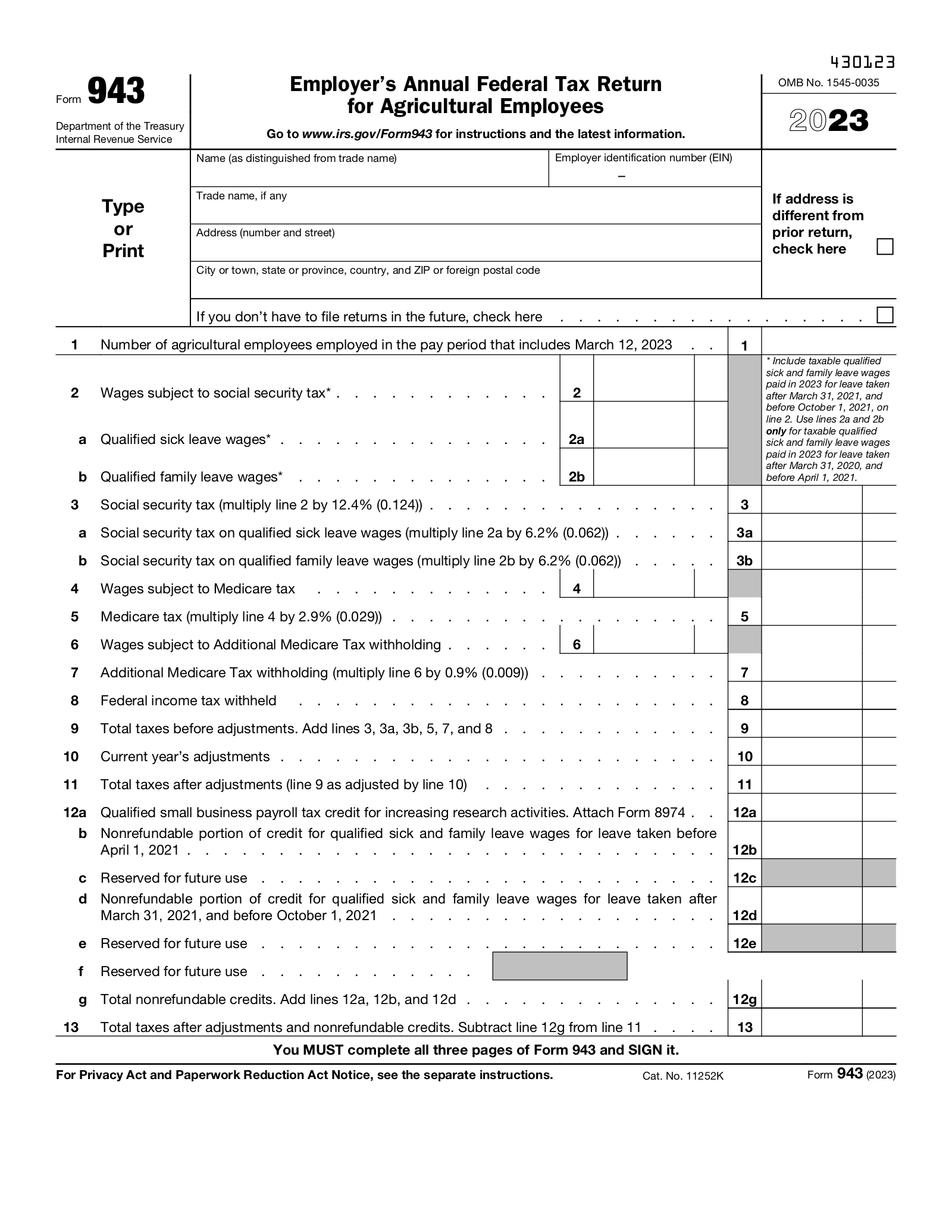

Form 943, Employer’s Annual Federal Tax Return for Agricultural Employees, is a tax form used by employers to report federal income tax withheld from agricultural employees.

It is a crucial document for both employers and employees, as it ensures accurate reporting of tax information and compliance with tax regulations.

History and Background

Form 943 was first introduced in 1939 and has undergone several revisions over the years to reflect changes in tax laws and regulations.

The current version of Form 943 is designed to streamline the reporting process and make it easier for employers to comply with their tax obligations.

Completing Printable Form 943

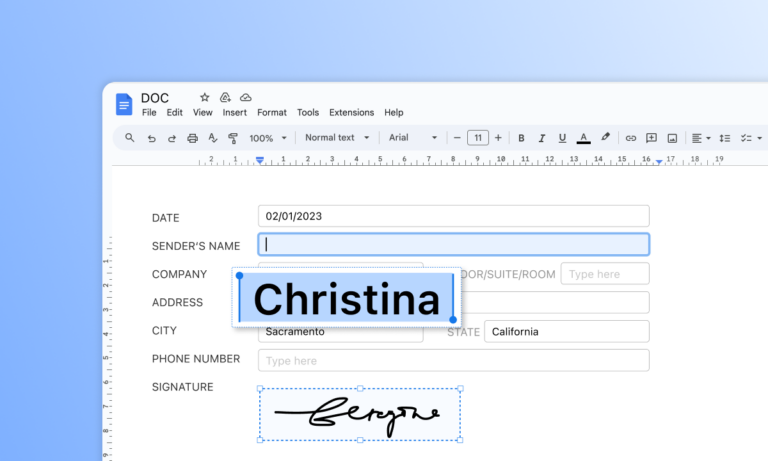

Filling out Form 943 is a breeze if you know what you’re doing. Let’s break down the sections and fields so you can nail it.

Sections of Form 943

- Employer Information: Your deets, like name, address, and EIN.

- Tax Period: When you were getting paid.

- Tax Liability: How much you owe the taxman.

- Payments and Credits: What you’ve already paid and any tax breaks you’re claiming.

- Signature and Verification: Your John Hancock and a witness to make it legit.

Filling Out Form 943 Accurately

Here’s the scoop on filling out each section:

- Employer Information: Double-check your details are spot on.

- Tax Period: Make sure the dates match your pay period.

- Tax Liability: Calculate your tax using the instructions on the form.

- Payments and Credits: Record all your payments and any tax credits you’re eligible for.

- Signature and Verification: Sign and date the form, and get a witness to sign too.

Avoiding Errors and Omissions

Don’t make these rookie mistakes:

- Missing or Incorrect Information: Fill in all the blanks and make sure your info is correct.

- Math Mishaps: Double-check your calculations to avoid any tax blunders.

- Forgetting Payments or Credits: Make sure you’ve included all your payments and tax breaks.

- Unsigned Form: Don’t forget to sign and date the form.

Using Printable Form 943

Form 943 is a versatile tool that can be used for a variety of purposes, including:

- Calculating and paying employment taxes, including federal income tax, Social Security tax, and Medicare tax.

- Filing quarterly returns with the IRS.

- Making estimated tax payments.

- Correcting errors on previous returns.

It is important to keep a copy of your completed Form 943 for your records. This copy can be used as proof of your tax payments and can help you to resolve any issues that may arise with the IRS.

Once you have completed Form 943, you can submit it to the IRS by mail or electronically. If you are filing by mail, you should send your return to the address listed on the form. If you are filing electronically, you can use the IRS’s e-file system.

You can track the status of your return by visiting the IRS’s website or by calling the IRS customer service line.

Benefits of Using Printable Form 943

Printable Form 943 offers a range of advantages, making it a preferred choice for many individuals and businesses. It’s a convenient and flexible option that streamlines the filing process, saving you time and reducing errors.

Time-Saving and Efficiency

Unlike electronic filing, which requires access to the internet and specific software, printable forms can be completed offline at your own pace. You can take your time to gather the necessary information, fill in the form, and mail it without any technical hassles. This eliminates the need for logging in, navigating through online platforms, and dealing with potential connectivity issues, saving you valuable time.

Error Reduction and Accuracy

Printable forms provide a physical copy of the document, allowing you to double-check your entries before submitting them. This reduces the chances of making mistakes, such as inputting incorrect data or overlooking certain sections. By having a tangible record, you can carefully review your work and make any necessary corrections before mailing the form.

Convenience and Flexibility

Printable Form 943 offers unparalleled convenience. You can print the form anytime, anywhere, and fill it out at your leisure. Whether you’re at home, in the office, or on the go, you have the flexibility to complete the form whenever it’s most convenient for you. This eliminates the need to schedule specific times for electronic filing or rely on internet availability.

Record-Keeping and Accessibility

Once completed, printable forms serve as physical records that you can easily store and access. You can keep a copy for your own reference or file it away for future use. This eliminates the need to rely on digital storage or cloud-based platforms, which may be subject to technical glitches or security concerns. Having a physical copy of your tax information provides peace of mind and ensures that your records are readily available whenever you need them.

Printable Form 943 Examples and Templates

Yo, check it, we’ve got the lowdown on printable Form 943 examples and templates. These bad boys are gonna help you sort out your tax situation like a boss.

We’ve got a table below with a list of printable Form 943s for different tax years, so you can grab the one that’s right for you. Plus, we’ll hook you up with links to official IRS templates and other reliable sources where you can download the form.

Different Versions

Heads up, there are different versions of Form 943 out there. The one you need depends on the tax year you’re filing for. Make sure you choose the correct version to avoid any aggro with the taxman.

Q&A

Can I use Printable Form 943 for both personal and business taxes?

No, Printable Form 943 is specifically designed for employers to report federal income tax withheld from employees’ wages and other compensation.

Where can I find official IRS templates or reputable sources for downloading Printable Form 943?

You can download the official IRS Form 943 template from the IRS website or access it through reputable tax preparation software.

What are the key differences between various versions of Printable Form 943?

Different versions of Form 943 are released each year to reflect changes in tax laws and regulations. It’s important to use the correct version for the tax year you are filing for.