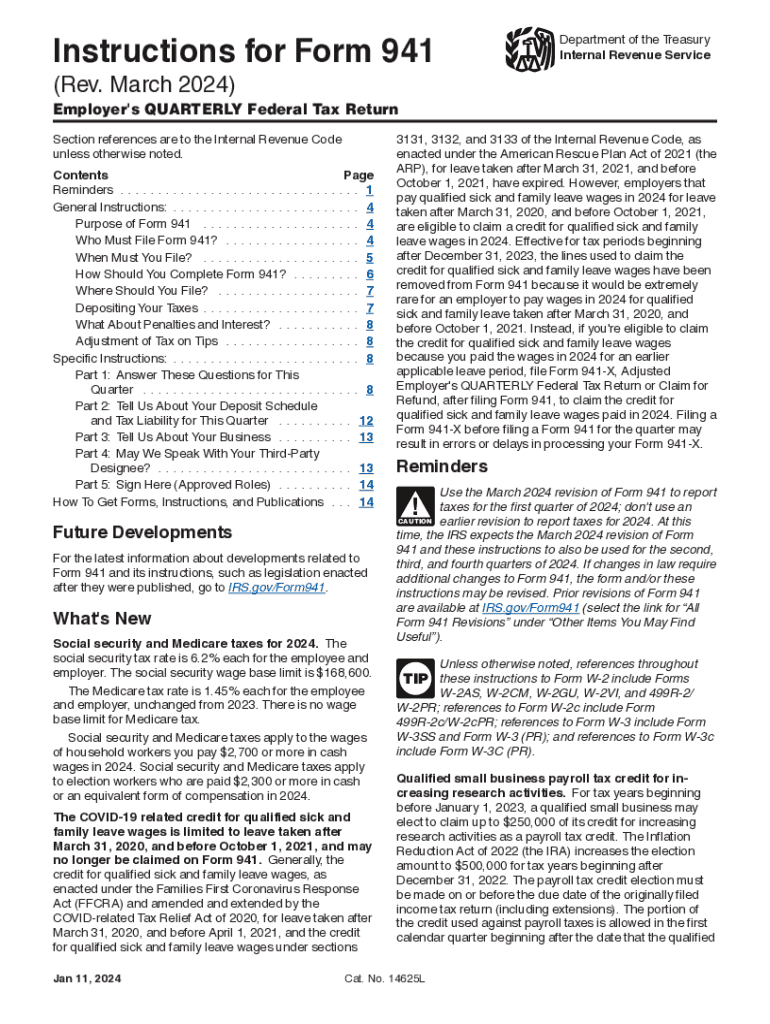

Printable Form 941 for 2024: A Comprehensive Guide

Form 941, the Employer’s Quarterly Federal Tax Return, is a crucial document for businesses in the United States. It serves as the primary means of reporting payroll taxes, including income tax, Social Security tax, and Medicare tax, to the Internal Revenue Service (IRS). Understanding and accurately completing Form 941 is essential for businesses to fulfill their tax obligations and avoid penalties.

This comprehensive guide will provide a detailed overview of Printable Form 941 for 2024. We will explore its purpose, different versions, sections, and the benefits of using a printable form. Additionally, we will provide step-by-step instructions on how to complete each section, identify common errors to avoid, and share additional resources for support.

Overview of Printable Form 941

Form 941, also known as the Employer’s Quarterly Federal Tax Return, is a crucial document for businesses in the UK that employ staff. It’s used to report and pay various taxes, including income tax, National Insurance contributions (NICs), and Construction Industry Scheme (CIS) deductions, to HM Revenue and Customs (HMRC).

Different Versions of Form 941 for 2024

There are two versions of Form 941 available for 2024:

- Form 941-EZ: This simplified version is suitable for businesses with a low number of employees and straightforward payroll.

- Form 941: This more comprehensive version is designed for businesses with a larger number of employees or complex payroll arrangements.

Sections Included in Form 941

Form 941 consists of several sections that capture essential information, including:

- Employer identification details

- Tax period covered

- Employee details (wages, taxes withheld, etc.)

- Tax calculations and payments

- Certification and signature

Benefits of Using a Printable Form 941

Printable Form 941 offers several advantages over electronic filing. Firstly, it provides convenience and flexibility. Businesses can fill out the form at their own pace, without being restricted by internet connectivity or software requirements. This flexibility allows businesses to work on the form when it’s most convenient for them.

Moreover, printable forms enable businesses to maintain physical records of their tax filings. This can be beneficial for businesses that prefer to have a tangible record of their tax submissions or for those that require physical copies for audits or other purposes.

s for Completing Form 941

Completing Form 941 accurately is crucial for businesses to fulfil their tax obligations. Here’s a comprehensive guide to help you navigate each section effectively.

Remember, precision and thoroughness are paramount. Incomplete or incorrect information can lead to penalties and delays in processing.

Part 1: Employer Identification

Begin by entering your Employer Identification Number (EIN), legal business name, and address. Ensure the information matches your records with the IRS.

Part 2: Tax Period Covered

Indicate the specific dates of the quarter for which you’re reporting.

Part 3: Wages, Tips, Other Compensation

Report the total wages, tips, and other compensation paid to employees during the quarter. Include taxable fringe benefits and any reimbursements subject to FICA taxes.

Part 4: Taxable Social Security Wages

Enter the amount of wages subject to Social Security tax, which may differ from the total wages reported in Part 3 due to wage limits.

Part 5: Taxable Medicare Wages and Tips

Report the amount of wages and tips subject to Medicare tax, which is generally the same as the amount reported in Part 4.

Part 6: Social Security Taxes

Calculate and enter the Social Security taxes owed based on the wages reported in Part 4.

Part 7: Medicare Taxes

Calculate and enter the Medicare taxes owed based on the wages reported in Part 5.

Part 8: Additional Taxes

Report any additional taxes, such as the Additional Medicare Tax or the Railroad Retirement Tax.

Part 9: Deposits and Payments

Indicate the dates and amounts of any deposits made towards your tax liability. The total deposits should equal the total taxes reported in Parts 6, 7, and 8.

Part 10: Signature and Verification

An authorized representative of your business must sign and date the form. The signature certifies the accuracy and completeness of the information provided.

Where to Obtain a Printable Form 941

Businesses can obtain a printable Form 941 for 2024 from various official sources. These sources include:

Internal Revenue Service (IRS) website

- Visit the IRS website at https://www.irs.gov/.

- Navigate to the “Forms & Publications” section.

- Search for “Form 941” or use the form number to find the printable version.

State tax agencies

Some state tax agencies may also provide printable Form 941s. Contact your state tax agency for more information.

Tax software providers

Many tax software providers offer printable Form 941s as part of their software packages. Check with your tax software provider to see if they offer this service.

There are no fees associated with obtaining a printable Form 941 from the IRS website or state tax agencies. However, some tax software providers may charge a fee for their services.

Common Errors to Avoid

When completing Form 941, it’s important to avoid common errors that can lead to delays, penalties, or even legal issues. Here are some common pitfalls to watch out for:

1. Incorrectly calculating taxes. This is one of the most common errors businesses make, and it can result in significant penalties. Make sure you understand the tax rates and calculation methods before completing the form.

2. Filing late. The due date for Form 941 is the last day of the month following the quarter end. If you file late, you may be subject to penalties and interest charges.

3. Missing or incorrect information. Make sure you complete all the required fields on the form and that the information you provide is accurate. Incomplete or incorrect information can delay the processing of your return and may result in penalties.

4. Not signing the form. The signature of an authorized representative is required on Form 941. If the form is not signed, it may be considered invalid and may not be processed.

5. Making changes to the form after it has been filed. If you need to make changes to your Form 941 after it has been filed, you must file an amended return. Do not make changes to the original form.

Additional Resources for Form 941

There are various helpful resources available online to assist you in understanding and completing Form 941 accurately. These resources provide comprehensive guidance and support, making the process easier for businesses.

Helpful Websites

– IRS Website: The official IRS website offers a dedicated section for Form 941, including instructions, forms, and frequently asked questions (FAQs).

– TaxSlayer: TaxSlayer provides a user-friendly online platform that allows you to prepare and file Form 941 effortlessly.

– Thomson Reuters: Thomson Reuters offers a comprehensive guide to Form 941, covering topics such as due dates, penalties, and common errors.

Informative Articles

– Forbes: Forbes publishes insightful articles that provide valuable tips and advice on completing Form 941.

– Small Business Trends: Small Business Trends offers practical guidance and case studies to help businesses navigate the complexities of Form 941.

– Entrepreneur: Entrepreneur magazine features articles that cover the latest changes and updates to Form 941, ensuring you stay informed.

Educational Webinars

– IRS Webinars: The IRS conducts free webinars throughout the year, providing expert insights and answering questions related to Form 941.

– National Taxpayer Advocate: The National Taxpayer Advocate offers webinars that focus on specific aspects of Form 941, such as common errors and audit procedures.

– AICPA: The American Institute of Certified Public Accountants (AICPA) hosts webinars that provide in-depth training on Form 941 for accounting professionals.

Common Queries

What is the purpose of Form 941?

Form 941 is used to report quarterly payroll taxes, including income tax withheld from employees’ wages, Social Security tax, and Medicare tax, to the IRS.

When is Form 941 due?

Form 941 is due on the last day of the month following the end of each calendar quarter (April 30, July 31, October 31, and January 31 of the following year).

Where can I obtain a printable Form 941?

Printable Form 941 can be obtained from the IRS website or by contacting the IRS directly.

What are the common errors to avoid when completing Form 941?

Common errors include miscalculating payroll taxes, entering incorrect employee information, and failing to sign and date the form.