Printable Form 8962: A Comprehensive Guide to Filing for Premium Tax Credit

Navigating the intricacies of tax filing can be daunting, but understanding and utilizing Form 8962 can significantly impact your tax situation. This form plays a crucial role in claiming the Premium Tax Credit, a valuable subsidy that helps reduce the cost of health insurance premiums for eligible individuals and families. In this comprehensive guide, we will delve into the purpose, completion, filing, and consequences of Form 8962, empowering you with the knowledge to maximize your tax benefits and avoid potential penalties.

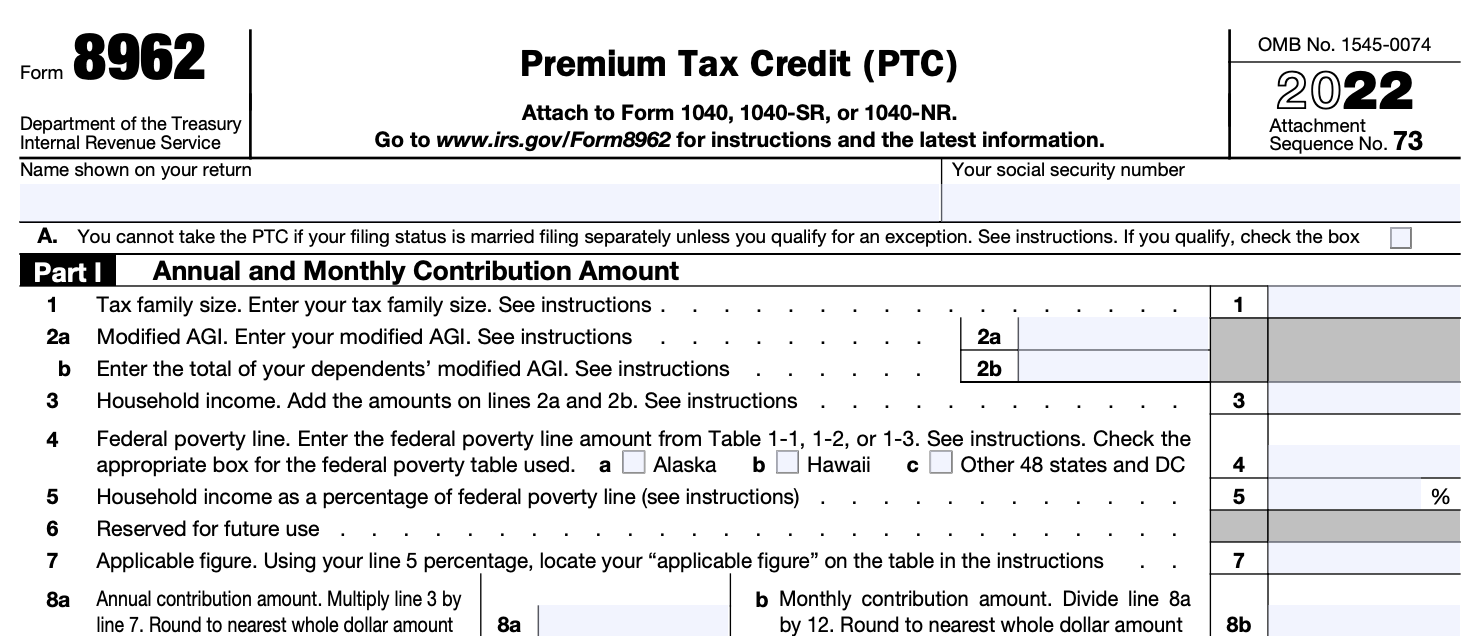

Form 8962 is an essential document for taxpayers who receive advance payments of the Premium Tax Credit through the Health Insurance Marketplace. It allows you to reconcile the estimated credit you received with the actual amount you are eligible for based on your income and family size. Filing Form 8962 accurately ensures that you receive the correct amount of credit and avoid any repayment obligations.

Form 8962 Overview

Form 8962 is a tax form used to report the passive income and losses generated from foreign sources. It’s primarily utilized by US citizens, resident aliens, and non-resident aliens who have an interest in foreign corporations or partnerships.

Filing Form 8962 becomes necessary when you have passive income from foreign sources that exceeds specific thresholds. These thresholds vary depending on your filing status and whether you’re claiming certain deductions or credits.

Information Reported on Form 8962

Form 8962 requires you to provide detailed information about your foreign income, including dividends, interest, rents, royalties, and capital gains. Additionally, you must report any foreign taxes paid and claim any applicable deductions or credits.

Completing Form 8962

Filling out Form 8962 can be a bit of a drag, but it’s not rocket science. Here’s a quick guide to help you get it done without any major meltdowns.

Gathering Your Info

Before you start filling out the form, you’ll need to gather some bits and bobs of information. This includes:

- Your Social Security number

- The name and address of the person or organisation you’re claiming the credit for

- The amount of the credit you’re claiming

- Any other information required by the form

Avoiding Common Pitfalls

Here are a few things to watch out for when you’re filling out Form 8962:

- Don’t make any mistakes. Any errors could delay your refund or even cause you to have to pay more tax.

- Don’t leave any questions blank. If you don’t know the answer to a question, write “N/A” or “Unknown”.

- Don’t forget to sign and date the form. This is a must-do or your form won’t be valid.

Filing Form 8962

Blud, listen up, filing Form 8962 ain’t rocket science. You got a few options, so let’s suss ’em out.

If you’re feeling old school, you can post your Form 8962 to the taxman. Make sure you check the address on the form, cuz it might change depending on where you live.

Electronic Filing

Wanna go digital? You can file Form 8962 electronically through tax software or an authorized e-file provider. It’s quick, easy, and you can even get a refund faster.

Deadlines

Don’t be a donut and miss the deadlines, fam. The due date for Form 8962 is usually the same as your tax return. So, mark your calendars and get it sorted before it’s too late.

Consequences of Not Filing Form 8962

Not filing Form 8962 can lead to penalties from HMRC. These penalties can be significant, so it’s important to file your form on time.

How to avoid the penalties

There are a few things you can do to avoid the penalties associated with not filing Form 8962:

- File your form on time.

- If you can’t file your form on time, you can request an extension.

- If you have not filed Form 8962, you should contact HMRC as soon as possible.

What to do if you have not filed Form 8962

If you have not filed Form 8962, you should contact HMRC as soon as possible. HMRC may be able to waive the penalties if you have a reasonable excuse for not filing your form.

Special Considerations for Form 8962

Filing Form 8962 can be a bit tricky, especially if you’re a bit clueless about tax laws. Here are some special considerations to keep in mind to avoid any dramas:

Different Types of Taxpayers

Depending on your tax status, there might be some extra hoops you need to jump through when filing Form 8962. For instance, if you’re a non-resident alien, you’ll need to provide additional documentation to prove your tax residency status.

Impact of State Tax Laws

The laws of the state you live in can also affect how you fill out Form 8962. Some states have their own rules for calculating income and deductions, which can impact the amount of tax you owe. Make sure to check with your state’s tax agency for any specific requirements.

Amended Returns

If you realize you’ve made a mistake on your Form 8962 after you’ve already filed it, don’t panic. You can file an amended return to correct the error. Just make sure to do it before the deadline for filing your original return.

Printable Form 8962

Blud, need to file Form 8962? You can print it off the IRS website, easy as pie.

Why bother printing it? Well, it’s a right faff to fill it in online, and it gives you a physical copy to keep for your records, which is always handy.

How to Print and Use Printable Form 8962

To print the form, just click on the link below and follow the instructions on the IRS website.

Once you’ve printed the form, you can fill it in by hand or using a computer. If you’re filling it in by hand, make sure you use black ink and write clearly.

Once you’ve filled in the form, you can mail it to the IRS or file it electronically. If you’re mailing it, make sure you use the correct address and postage.

Form 8962 Examples

Form 8962 provides a clear overview of the premium tax credit received and the advance payments of the premium tax credit made on your behalf during the tax year. This information is crucial for reconciling the premium tax credit you claimed on your tax return with the actual amount you received. To further illustrate the usage of Form 8962, let’s delve into a few examples.

Consider the scenario where you received advance payments of the premium tax credit throughout the year. These payments were based on the estimated amount of premium tax credit you were eligible to receive. However, when you file your tax return, you may find that the actual amount of premium tax credit you are entitled to is different from the advance payments you received. In such cases, Form 8962 helps you reconcile these differences and determine whether you owe additional tax or are eligible for a refund.

Illustrative Examples

To provide a more tangible understanding, let’s examine two illustrative examples:

- Example 1: In this instance, you received advance payments of the premium tax credit totaling $2,500 during the tax year. Upon filing your tax return, you discover that the actual amount of premium tax credit you are eligible for is $2,200. As a result, you will need to repay the excess advance payments of $300 to the IRS. Form 8962 will reflect this information, indicating the amount of advance payments received, the amount of premium tax credit you are eligible for, and the amount you owe to the IRS.

- Example 2: In this scenario, you received advance payments of the premium tax credit amounting to $1,800 during the tax year. After filing your tax return, you determine that you are entitled to a premium tax credit of $2,000. Consequently, you are eligible for a refund of $200. Form 8962 will reflect this information, showing the advance payments received, the amount of premium tax credit you are eligible for, and the amount of refund you are entitled to receive from the IRS.

Helpful Answers

What is the purpose of Form 8962?

Form 8962 is used to reconcile the advance payments of the Premium Tax Credit received through the Health Insurance Marketplace with the actual amount of credit you are eligible for based on your income and family size.

When is Form 8962 due?

Form 8962 is generally due on the same date as your federal income tax return, typically April 15th. However, if you file an extension for your tax return, you will also have an extension to file Form 8962.

What are the penalties for not filing Form 8962?

Failure to file Form 8962 may result in penalties and repayment of the Premium Tax Credit you received. The penalty for not filing Form 8962 is $260 or 1% of the total amount of the Premium Tax Credit you received, whichever is greater.

Where can I get a copy of Form 8962?

You can download a copy of Form 8962 from the IRS website or you can request a copy by calling the IRS at 1-800-829-3676.

Can I file Form 8962 electronically?

Yes, you can file Form 8962 electronically using tax preparation software or through the IRS website.