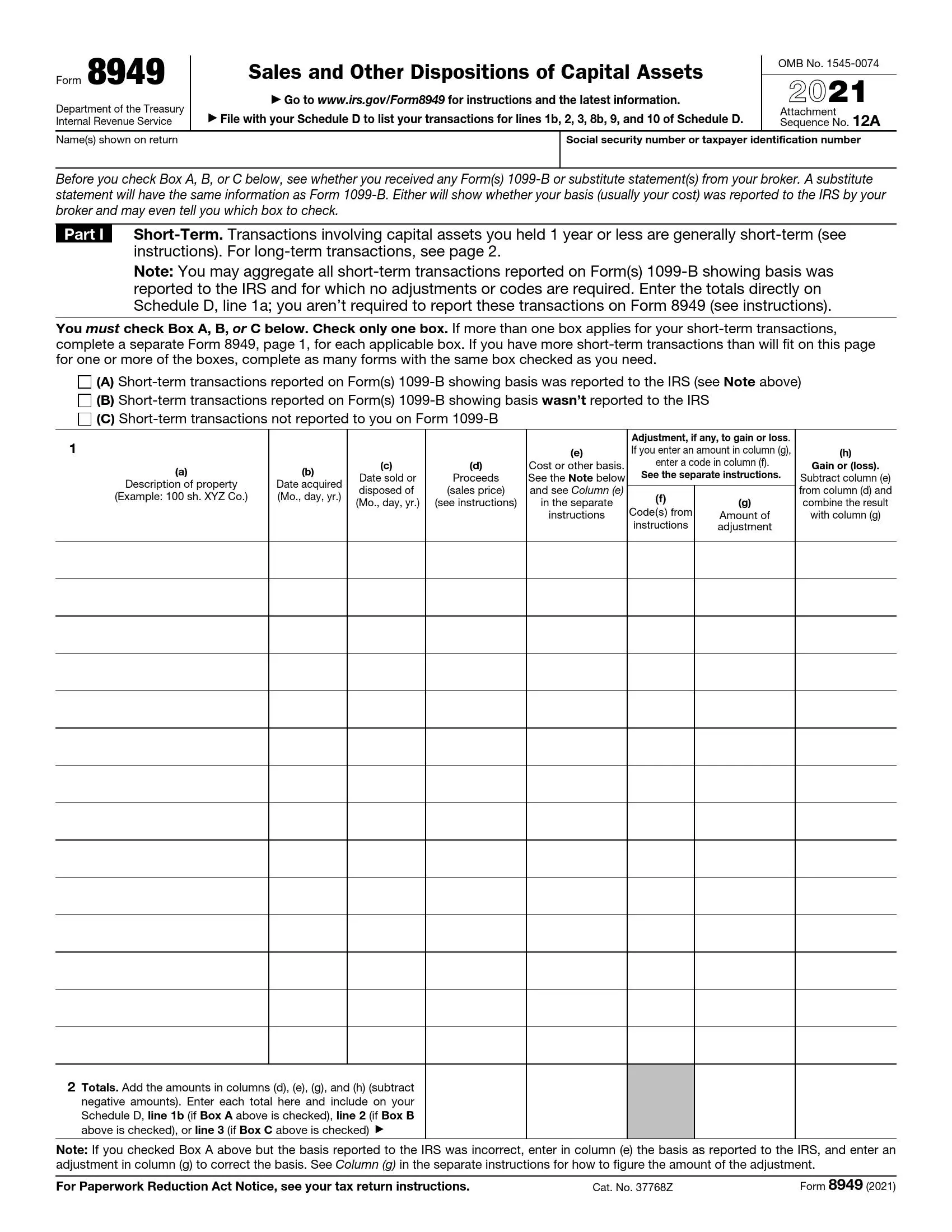

Mastering Printable Form 8949: A Comprehensive Guide for Filing Success

Navigating the complexities of tax filing can be daunting, but understanding Printable Form 8949 is a crucial step towards ensuring accuracy and efficiency. This form plays a vital role in reporting sales and other dispositions of capital assets, and its proper completion is essential for meeting tax obligations.

This comprehensive guide will provide a thorough overview of Printable Form 8949, empowering you with the knowledge and resources to navigate its intricacies with confidence. We will delve into the purpose, eligibility criteria, step-by-step instructions, and benefits of using this printable form, ensuring you have all the tools necessary for successful tax filing.

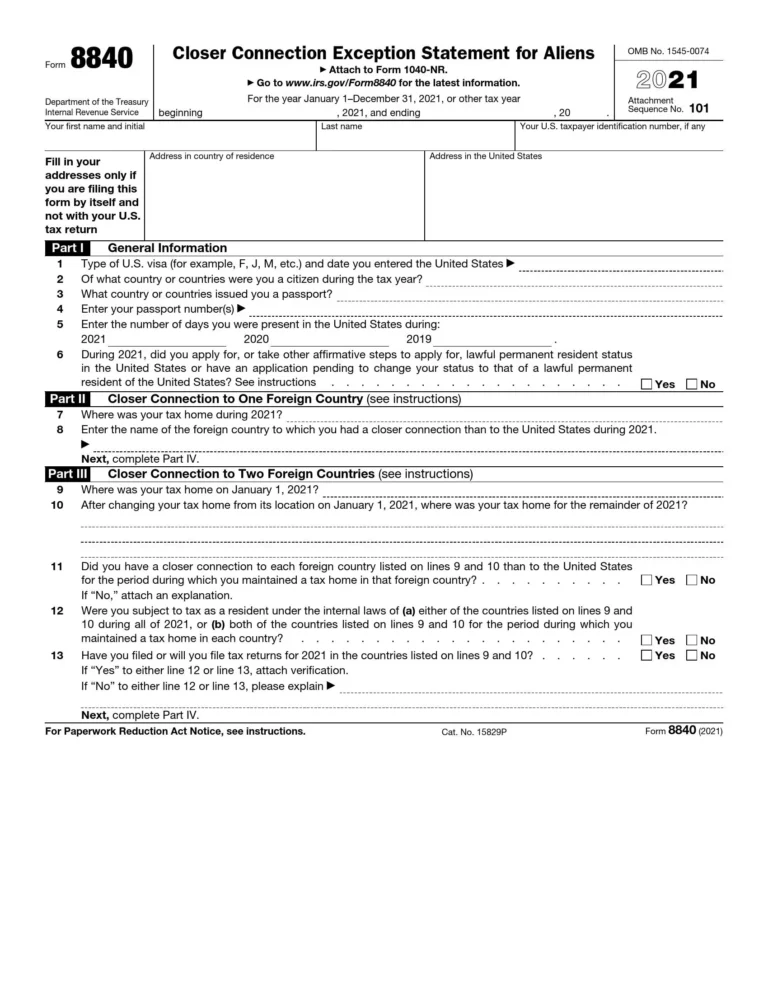

Definition of Form 8949

Form 8949 is a tax form used to report sales and other dispositions of capital assets, such as stocks, bonds, and real estate.

The information required on the form includes the date of the sale, the cost or other basis of the asset, the amount of the sale proceeds, and any gain or loss on the sale.

Purpose of Form 8949

The purpose of Form 8949 is to help you calculate your capital gains and losses for the year. Capital gains are profits from the sale of capital assets, and capital losses are losses from the sale of capital assets. You must report your capital gains and losses on your tax return, and Form 8949 helps you do this.

Filing Requirements for Form 8949

Listen up, peeps! Form 8949 is a must-file if you’ve got sales or exchanges of capital assets. But hold your horses, not everyone needs to jump through this hoop.

To be eligible for Form 8949, you need to have sold or traded stocks, bonds, or other investments that have appreciated in value since you bought them. Basically, if you’ve made a profit, you’ll need to report it.

Due Dates and Penalties

The deadline for filing Form 8949 is the same as your tax return, so make sure you get it in by April 15th. If you’re running late, you can file for an extension, but you’ll still need to pay any taxes you owe by the original due date.

Missing the deadline can lead to some hefty penalties, so don’t be a slacker. The IRS will charge you a late filing fee of 5% of the tax you owe for each month you’re late, up to a maximum of 25%. Plus, you’ll have to pay interest on the unpaid taxes.

s for Completing Form 8949

Form 8949 is a straightforward form, but there are a few tips that can help you avoid common errors.

Before you start filling out the form, gather all of the necessary information. This includes your Social Security number, the name and address of your broker, and the details of your sales and purchases of capital assets.

Section A – Sales and Exchanges of Capital Assets

In this section, you will report the details of your sales and exchanges of capital assets. For each transaction, you will need to provide the following information:

- The date of the sale or exchange

- A description of the asset

- The date you acquired the asset

- The cost or other basis of the asset

- The amount of the sales proceeds

If you are selling a security, you will also need to provide the CUSIP number. This is a unique identifier for each security.

Section B – Sales and Exchanges of Depreciable Property

In this section, you will report the details of your sales and exchanges of depreciable property. For each transaction, you will need to provide the following information:

- The date of the sale or exchange

- A description of the property

- The date you acquired the property

- The cost or other basis of the property

- The amount of the sales proceeds

- The depreciation allowed or allowable

Section C – Net Gain or Loss

In this section, you will calculate your net gain or loss from the sale or exchange of capital assets and depreciable property. To do this, you will add up your gains and losses from all of your transactions. Your net gain or loss will be reported on line 16 of Form 8949.

Section D – Capital Loss Carryover

If you have a net capital loss, you may be able to carry it over to future years. To do this, you will need to complete Section D of Form 8949. In this section, you will calculate the amount of your capital loss carryover. Your capital loss carryover will be reported on line 22 of Form 8949.

Examples of Printable Form 8949

Printable Form 8949 is accessible in diverse formats, including PDF and Excel. These formats offer flexibility and convenience for taxpayers who prefer digital record-keeping or manual completion.

Accessing and Downloading Form 8949

To access and download printable Form 8949, follow these steps:

– Visit the official Internal Revenue Service (IRS) website.

– Navigate to the “Forms & Publications” section.

– Search for “Form 8949” and select the desired format (PDF or Excel).

– Download and save the form to your computer or device.

By obtaining Form 8949 from reputable sources like the IRS, you can ensure the authenticity and accuracy of the document.

Benefits of Using Printable Form 8949

Printable forms, such as Form 8949, offer a range of advantages over other methods of filing.

Convenience

Printable forms are incredibly convenient. You can download and print them from anywhere with an internet connection, eliminating the need to visit a tax office or mail in your forms.

Cost-Effectiveness

Printable forms are free to download and print, saving you money on postage and other expenses associated with filing taxes.

Accessibility

Printable forms are accessible to everyone, regardless of their technical skills or access to technology. You can easily print them on any printer, making it a convenient option for those who may not have access to online filing services.

Considerations for Using Printable Form 8949

Printable Form 8949 offers several advantages, but there are also some potential drawbacks to consider before using it.

Drawbacks of Printable Form 8949

One potential drawback is that it can be more time-consuming to fill out a printable form compared to using electronic filing software. Additionally, there is a greater risk of errors when filling out a printable form by hand, as it is easy to make mistakes when transcribing information.

Importance of Accuracy

It is crucial to ensure accuracy when completing Form 8949, as any errors can lead to delays in processing or even penalties. It is advisable to carefully review the form before submitting it to ensure that all information is correct and complete.

Need for Careful Review

Before submitting Form 8949, it is essential to thoroughly review the form to identify any potential errors. This includes checking for any missing information, incorrect calculations, or inconsistencies. It is also a good idea to have someone else review the form to ensure its accuracy.

Resources for Printable Form 8949

This section provides a list of reputable websites and organizations that offer printable Form 8949, along with their contact information and links.

Websites

- Internal Revenue Service (IRS)

Website: https://www.irs.gov

Contact: 1-800-829-1040 - TaxAct

Website: https://www.taxact.com

Contact: 1-800-293-0123 - H&R Block

Website: https://www.hrblock.com

Contact: 1-800-HRBLOCK (1-800-472-5625)

Organizations

- National Association of Tax Professionals (NATP)

Website: https://www.natptax.com

Contact: 1-800-558-2848 - American Institute of Certified Public Accountants (AICPA)

Website: https://www.aicpa.org

Contact: 1-888-777-7077

These resources can provide you with the latest version of Form 8949 and assist you in completing and filing it correctly.

Questions and Answers

What is the purpose of Printable Form 8949?

Form 8949 is used to report the sale or disposition of capital assets, such as stocks, bonds, or real estate. It provides detailed information about the transaction, including the date of sale, purchase price, and proceeds.

Who is required to file Form 8949?

Individuals or entities that have sold or disposed of capital assets during the tax year are required to file Form 8949 if the total proceeds from these transactions exceed $400.

Where can I find a printable version of Form 8949?

Printable versions of Form 8949 can be found on the IRS website or through reputable tax software providers.

What are the benefits of using a printable Form 8949?

Using a printable form offers convenience, cost-effectiveness, and accessibility. It allows you to complete the form at your own pace and submit it electronically or by mail.

What are some common errors to avoid when completing Form 8949?

Common errors include incorrect calculation of gain or loss, missing or incomplete information, and using the wrong basis. Carefully review your entries and consult a tax professional if needed.