Mastering Form 8889: A Comprehensive Guide to Printable Forms

Navigating the complexities of tax forms can be daunting, but Form 8889 stands out as a crucial document for reporting Health Savings Account (HSA) contributions. This guide delves into the intricacies of Printable Form 8889, providing a comprehensive overview, step-by-step instructions, and troubleshooting tips to ensure accurate and efficient completion.

Whether you’re an individual managing your HSA or an employer administering HSA plans, understanding Form 8889 is essential. This guide empowers you with the knowledge and resources to confidently tackle this form, ensuring compliance and maximizing the benefits of your HSA.

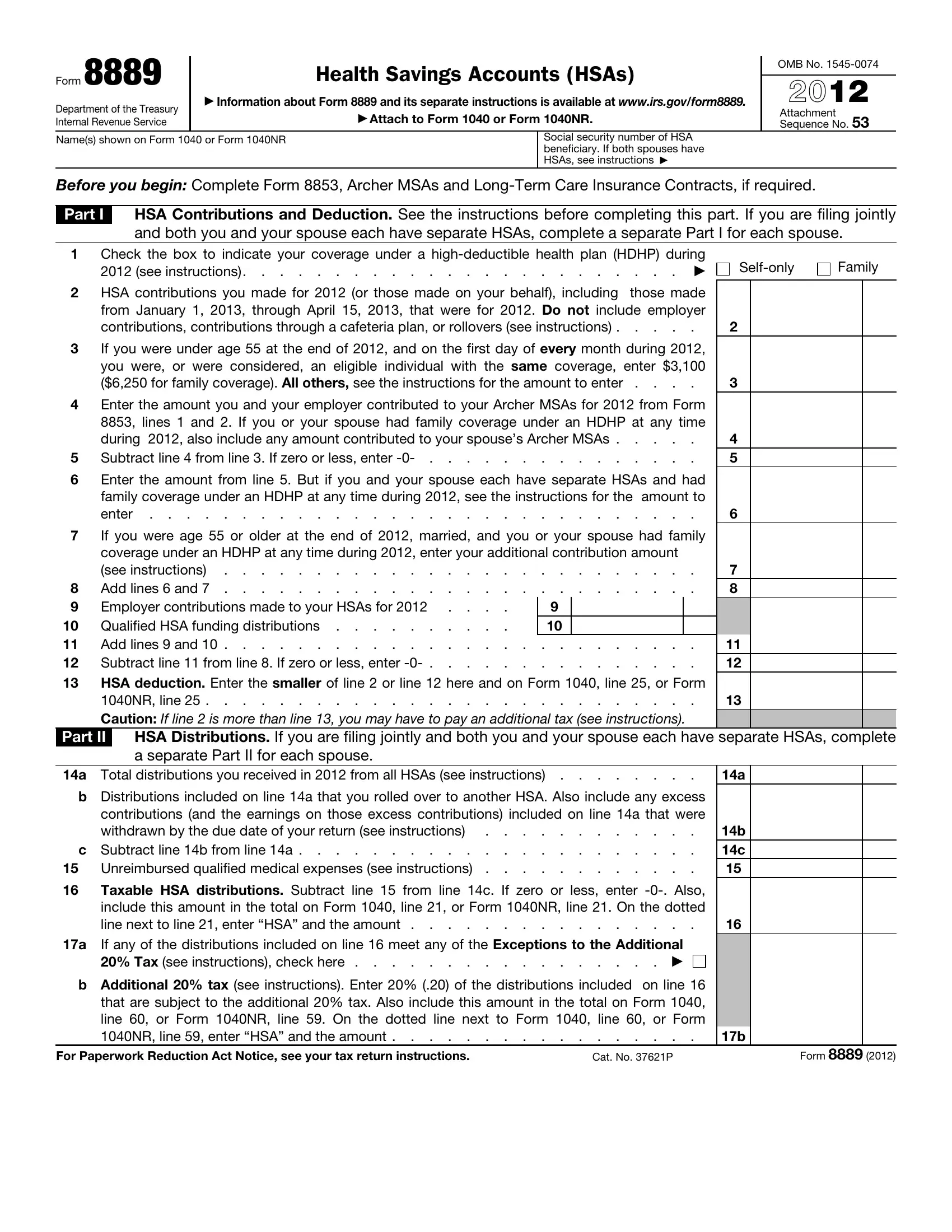

Printable Form 8889 Overview

Form 8889, Health Savings Accounts (HSAs), is an official tax form used to report contributions, distributions, and other transactions related to Health Savings Accounts (HSAs).

This form is intended for individuals who have established HSAs and are required to report HSA-related transactions for tax purposes.

Filing Requirements

Form 8889 must be filed with the Internal Revenue Service (IRS) by the April 15th tax deadline (or the extended due date if applicable) for the tax year in which the HSA transactions occurred.

Understanding Form 8889 Sections

Yo, getting to grips with Form 8889 can be a right pain, but it’s a doddle once you know the drill. It’s split into a bunch of sections, so let’s break ’em down and make sure you’re filling it in like a pro.

Part I: Personal Information

This is where you dish out the basics: your name, address, and Social Security number. Make sure it’s all accurate, as this info will be used to track your claim.

Part II: Health Coverage

Here’s where you show ’em what health coverage you’ve got. If you’ve had any health insurance or other assistance, like Medicaid or Medicare, list it here. This will help them figure out how much you need to pay.

Part III: Household Income and Size

Time to get into the nitty-gritty. This section is all about your income and how many people are in your household. You’ll need to provide info on your wages, self-employment income, and any other sources of cash. Don’t forget to include everyone who lives with you, even if they’re not related.

Part IV: Filing Status

This bit’s easy. Just tick the box that matches your filing status, like single, married filing jointly, or whatever applies to you.

Part V: Tax Credit Calculation

Here’s where the magic happens. This section is where you figure out how much tax credit you’re eligible for. You’ll need to do some calculations based on your income and household size. Don’t worry, there’s a worksheet to help you out.

Part VI: Payment or Refund

Last but not least, this section is where you find out if you’re getting a refund or need to pay up. If you’re owed money, you can choose to have it deposited directly into your bank account or mailed to you as a check. If you need to pay, there are instructions on how to do that too.

Common Errors and Troubleshooting

Filling out Form 8889 can be tricky, and it’s easy to make mistakes. Here are some common errors to watch out for, along with tips on how to avoid them.

Incorrectly Calculating Basis

One of the most common errors is incorrectly calculating the basis of your property. This can lead to you paying too much or too little tax. To avoid this error, be sure to use the correct formula to calculate your basis. You can find the formula in the Form 8889 instructions.

Entering Incorrect Information

Another common error is entering incorrect information on Form 8889. This can include entering the wrong property address, the wrong purchase price, or the wrong date of sale. To avoid this error, be sure to carefully review your information before submitting Form 8889.

Missing Required Information

It’s also important to make sure that you complete all of the required information on Form 8889. If you leave any information blank, the IRS may reject your return. To avoid this error, be sure to carefully review the Form 8889 instructions and make sure that you have completed all of the required information.

Filing Late

Finally, it’s important to file Form 8889 on time. If you file late, you may have to pay penalties and interest. To avoid this error, be sure to file Form 8889 by the deadline.

Electronic Filing Options

Filing Form 8889 electronically offers numerous benefits over traditional paper filing. It’s a secure, convenient, and efficient way to submit your return. You can file electronically through the IRS website or use tax software that supports electronic filing.

Benefits of Electronic Filing

* Faster processing: E-filed returns are processed more quickly than paper returns, so you’ll receive your refund or have your tax liability determined sooner.

* Increased accuracy: Electronic filing software performs automatic calculations and checks for errors, reducing the chances of mistakes.

* Convenience: You can file electronically from anywhere with an internet connection, 24/7.

Drawbacks of Electronic Filing

* Software costs: Some tax software programs may charge a fee for electronic filing.

* Technical issues: While rare, technical issues can sometimes delay the filing process.

How to File Form 8889 Electronically

To file Form 8889 electronically, you’ll need to:

* Gather your necessary documents and information.

* Choose an IRS-approved electronic filing provider or use the IRS website.

* Create an account and enter your personal and tax information.

* Import or manually enter your Form 8889 data.

* Review and submit your return.

* Pay any taxes due or request a refund.

Special Considerations

If you encounter complex scenarios or specific situations while completing Form 8889, it’s crucial to consider the following special considerations.

Understanding these considerations will help you navigate challenging situations and ensure accurate reporting.

Seeking Professional Assistance

In some cases, seeking professional assistance from a tax advisor or accountant may be necessary. These experts can provide personalized guidance and help you resolve complex tax issues related to Form 8889.

Consider seeking professional assistance if you:

- Have a complex tax situation involving multiple income sources or deductions.

- Are unsure about how to handle specific scenarios or calculate your HSA contributions.

- Need help understanding the tax implications of your HSA contributions and distributions.

Related Forms and Resources

Filing Form 8889 may involve using other forms and resources for a comprehensive tax reporting experience. Here are some essential forms and resources that complement Form 8889:

These resources provide additional guidance and support, ensuring accurate and timely tax filings.

Forms

- Form 1040: The main income tax return form for individuals, which Form 8889 is attached to.

- Form 8890: A continuation sheet for Form 8889, used when there are too many transactions to fit on the original form.

- Form 8891: A summary sheet for Form 8889, used to combine multiple Form 8889s into a single submission.

Resources

- IRS Publication 551: A comprehensive guide to the Earned Income Tax Credit (EITC), which Form 8889 is used to claim.

- IRS Website: Provides up-to-date information and resources related to the EITC and Form 8889.

- Tax Software: Many tax software programs include built-in features to assist with Form 8889 preparation and filing.

Printable Form 8889 Template

Need a hard copy of Form 8889? We’ve got you covered, mate.

We’ve cooked up a downloadable template that’ll have you sorted in no time. It’s like having a cheat sheet for your tax info.

How to Use the Template

Using our template is a doddle. Just follow these easy steps, bruv:

- Click the download button below to get your hands on the template.

- Open the template in your favourite PDF reader.

- Fill in the blanks with your tax info. It’s like playing a game of Mad Libs, but with numbers.

- Once you’re done, print out the completed form and send it to the taxman.

Field Name Table

Here’s a handy table to help you understand what each field on the template means:

| Field Name | Description | Data Type | Example |

|---|---|---|---|

| Part I – Taxpayer Information | Your personal details, like name, address, and Social Security number. | Text | John Smith, 123 Main Street, Anytown, CA 12345 |

| Part II – Health Coverage | Info about your health insurance, like the name of your provider and the dates of coverage. | Text and dates | Blue Cross Blue Shield, January 1, 2023 – December 31, 2023 |

| Part III – Shared Responsibility Payment | Calculations related to the shared responsibility payment, which is a fee you may have to pay if you don’t have health insurance. | Numbers and dates | $2,000, January 1, 2023 – December 31, 2023 |

| Part IV – Exemption from the Shared Responsibility Payment | Reasons why you might be exempt from paying the shared responsibility payment, like having low income or being a member of a religious sect. | Text | Low income |

| Part V – Advance Premium Tax Credit | Info about the advance premium tax credit, which is a tax credit that helps you pay for health insurance. | Numbers and dates | $1,000, January 1, 2023 – December 31, 2023 |

Printable Form 8889 Fillable PDF

Innit, this fillable PDF version of Form 8889 is right cheeky. It’s the perfect way to fill out and save the form without any hassle.

To get started, just click on the link below to download the PDF. Once you’ve got it, you can fill it out using any PDF editor, like Adobe Acrobat Reader. Just type in your info in the fields provided, and then save the PDF when you’re done.

How to Fill Out and Save the PDF

- Download the fillable PDF from the link below.

- Open the PDF in a PDF editor, like Adobe Acrobat Reader.

- Fill out the form by typing in your info in the fields provided.

- Save the PDF when you’re done.

Field Name, Description, Data Type, Example

| Field Name | Description | Data Type | Example |

|---|---|---|---|

| Name | Your name | Text | John Smith |

| Address | Your address | Text | 123 Main Street |

| City | Your city | Text | Anytown |

| State | Your state | Text | CA |

| Zip Code | Your zip code | Text | 12345 |

Printable Form 8889 Excel Spreadsheet

The Form 8889 Excel spreadsheet template provides a convenient and structured way to complete and calculate your Health Savings Account (HSA) or Archer Medical Savings Account (MSA) information. It automates calculations, reduces errors, and allows you to easily save and print your completed form.

Instructions

To use the spreadsheet:

– Download the template from the link provided below.

– Enter your information in the designated fields.

– The spreadsheet will automatically calculate your HSA or MSA information.

– Review the results and make any necessary adjustments.

– Save and print the completed form.

Field Details

The following table provides a summary of the fields included in the spreadsheet:

| Field Name | Description | Data Type | Example |

|---|---|---|---|

| HSA Owner Name | Name of the HSA owner | Text | John Smith |

| HSA Trustee Name | Name of the HSA trustee | Text | Bank of America |

| HSA Account Number | Account number of the HSA | Text | 123456789 |

| Covered Individuals | Names of individuals covered by the HSA | Text | John Smith, Jane Smith |

| Qualifying High-Deductible Health Plan (HDHP) Coverage | Dates of coverage under a qualifying HDHP | Dates | 01/01/2023 – 12/31/2023 |

| Contributions | Total contributions made to the HSA | Currency | $1,000 |

| Distributions | Total distributions made from the HSA | Currency | $500 |

| Excess Contributions | Any excess contributions made to the HSA | Currency | $0 |

| Penalty | Any penalty calculated for excess contributions | Currency | $0 |

FAQ Corner

Can I file Form 8889 electronically?

Yes, you can file Form 8889 electronically through the IRS website or authorized e-file providers. Electronic filing offers convenience, accuracy, and faster processing times.

What are common errors to avoid when filling out Form 8889?

Common errors include incorrect HSA account numbers, missing or incomplete information, and mathematical errors. Carefully review your information before submitting the form to avoid delays or penalties.

What if I need assistance completing Form 8889?

If you encounter difficulties or have complex scenarios, consider seeking professional assistance from a tax preparer or financial advisor. They can guide you through the process and ensure accurate reporting.