Printable Form 8879: A Comprehensive Guide to Filing and Understanding

Form 8879, also known as the Health Savings Account (HSA), is a crucial document for individuals seeking tax benefits on their medical expenses. Understanding its purpose, accessibility, and proper completion is essential for maximizing these benefits. This guide will delve into the intricacies of Printable Form 8879, providing a comprehensive overview and addressing common queries to ensure a seamless filing experience.

Form 8879 plays a vital role in claiming deductions for contributions made to an HSA, a tax-advantaged account used to cover qualified medical expenses. It allows individuals to reduce their taxable income, potentially saving a significant amount in taxes. By understanding the requirements and following the guidelines Artikeld in this guide, you can effectively utilize Form 8879 to optimize your tax savings.

Definition and Purpose of Form 8879

Form 8879, also known as the “Injured Spouse Allocation,” is a crucial tax form designed to assist married couples filing joint tax returns. It allows an eligible spouse to allocate a portion of the overpayment from their joint return to themselves instead of applying it to their spouse’s debts.

Form 8879 is primarily used in situations where one spouse owes a debt to a government agency, such as the IRS, and the other spouse does not. By completing Form 8879, the eligible spouse can prevent the government from seizing the overpayment from their joint return to satisfy their spouse’s debt.

Purpose

The purpose of Form 8879 is to provide a mechanism for equitable distribution of tax refunds and overpayments in cases where one spouse is not responsible for the other spouse’s debts. By allocating a portion of the overpayment to the eligible spouse, it ensures that both spouses receive their fair share of the refund and protects the eligible spouse from being held liable for their spouse’s debts.

Accessibility and Distribution of Printable Form 8879

Getting your hands on a printable Form 8879 is a breeze. You can snag it from the official IRS website or visit any of their local offices to grab a hard copy. The form is also available through tax software providers and other online resources.

Once you’re on the IRS website, simply search for “Form 8879” in the search bar. The website will direct you to a page where you can download the form in PDF format. You can then print it out on your own or take it to a local print shop.

If you prefer to get a physical copy, you can visit any IRS office and ask for Form 8879. They’ll be happy to provide you with one.

Distribution Limitations

There are no restrictions on who can access or download Form 8879. However, the IRS does not provide pre-printed copies of the form to tax professionals or other third parties.

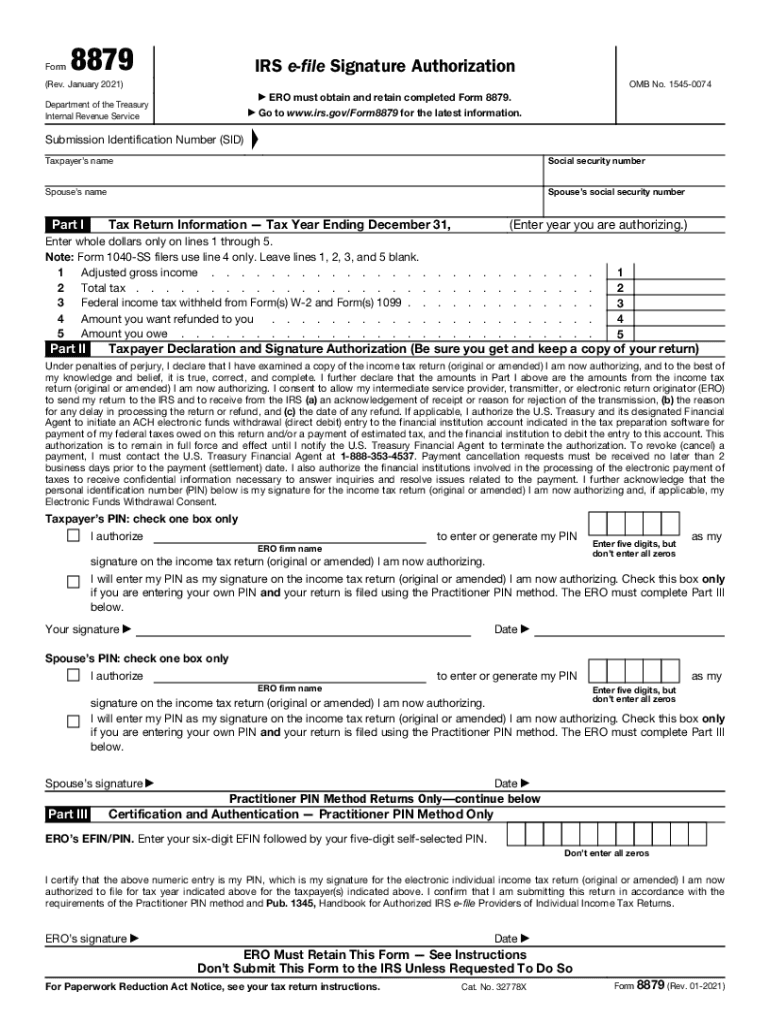

Structure and Content of Form 8879

Form 8879 is structured into three main sections: the header, the body, and the signature section. The header includes the form’s title, the IRS address, and the taxpayer’s information. The body of the form contains the questions and instructions for completing the form. The signature section includes the taxpayer’s signature, date, and preparer’s information, if applicable.

The purpose of each section or field within the form is to collect specific information from the taxpayer. The header information is used to identify the taxpayer and the form. The body of the form contains the questions and instructions for completing the form. The signature section includes the taxpayer’s signature, date, and preparer’s information, if applicable.

Types of Information Required to be Filled Out

The types of information required to be filled out on Form 8879 vary depending on the specific purpose of the form. However, some common types of information that may be required include:

- Taxpayer’s name, address, and Social Security number

- Spouse’s name and Social Security number, if applicable

- Dependent’s name and Social Security number, if applicable

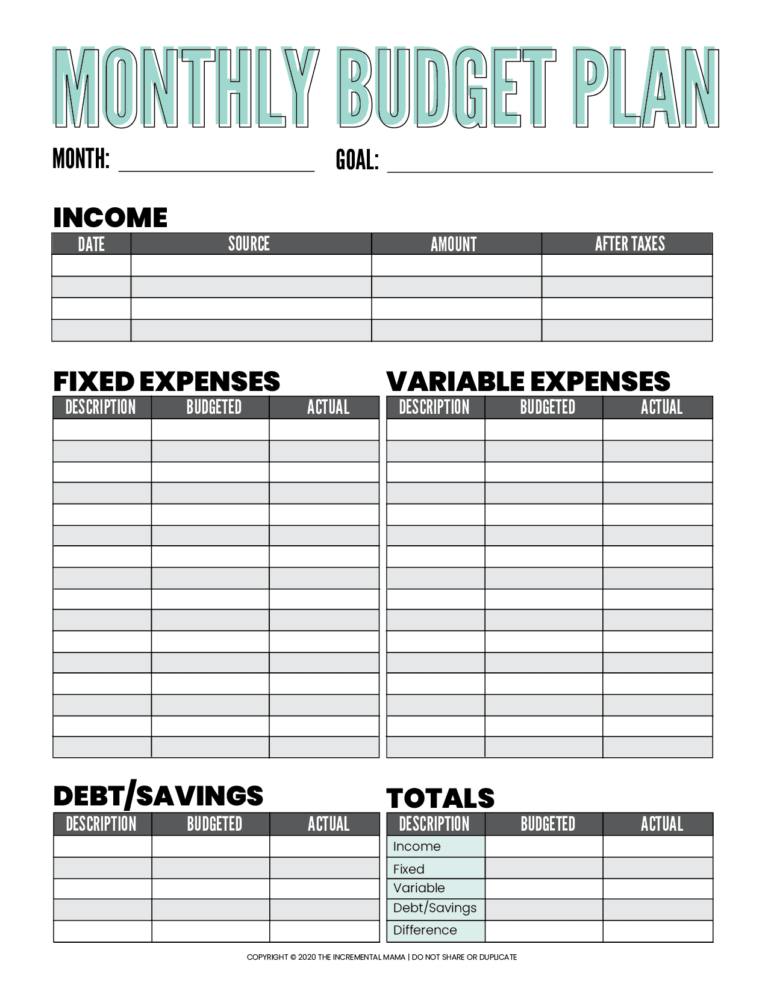

- Income information

- Deduction and credit information

- Tax liability information

- Refund or payment information

s and Guidance for Completing Form 8879

Bruv, need a helping hand with filling out Form 8879? Don’t stress, fam. We got you covered. Check out the official s or guidance to make sure you’re doing it right.

Why’s it important to follow the s, you ask? It’s like driving on the wrong side of the road, mate. You’re bound to mess up. So, read those s carefully, and you’ll be golden.

Tips for Completing the Form

- Chill out and take your time. Don’t rush it, or you’ll make mistakes.

- Read the s thoroughly before you start filling out the form. It’s like studying for a test—you need to know the rules before you play the game.

- Use a pen or type clearly. Don’t scribble like a madman, or the taxman won’t be able to read your masterpiece.

- If you get stuck, don’t be afraid to ask for help. Call the IRS or find a tax professional who can help you out.

Common Errors and Pitfalls in Completing Form 8879

It’s a bludger to make mistakes on your tax forms, so it’s best to avoid them like the plague. Here’s the 411 on the most common pitfalls and how to steer clear of them:

- Forgetting to sign and date the form: This is a rookie error that can delay the processing of your claim. Make sure you sign and date the form in the designated areas before sending it in.

- Entering incorrect information: Double-check all the info you enter on the form, especially your personal details and financial data. Even a small mistake can mess up your claim.

- Not attaching all required documentation: If you need to provide supporting documents, make sure you attach them to the form. Missing documents can cause delays or even lead to your claim being rejected.

- Filing late: The deadline for filing Form 8879 is usually April 15th. If you miss the deadline, you may have to pay penalties and interest on any taxes you owe.

Electronic Filing Options for Form 8879

Bruv, Form 8879 is not yet available for electronic filing. The IRS is still working on making it possible, so for now, you’ll have to print it out and mail it in the old-fashioned way.

Related Forms and Documents

There are several other forms and documents that are related to or complement Form 8879. These include:

- Form 8868, Application for Automatic Extension of Time to File an Exempt Organization Return

- Form 990, Return of Organization Exempt From Income Tax

- Form 990-EZ, Short Form Return of Organization Exempt From Income Tax

- Form 990-PF, Return of Private Foundation or Section 4947(a)(1) Nonexempt Charitable Trust Treated as a Private Foundation

- Form 990-N, Electronic Notice (e-Postcard) for Tax-Exempt Organizations Not Required to File a Return

- Publication 557, Tax-Exempt Status for Your Organization

- Publication 1223, International Tax Information for Business

These forms and documents provide additional information and guidance on the tax reporting requirements for exempt organizations.

Form 8868

Form 8868 is used by exempt organizations to request an automatic extension of time to file their annual return. The extension is for six months, and it can be granted for reasonable cause.

Forms 990, 990-EZ, 990-PF, and 990-N

These forms are used by exempt organizations to file their annual returns. Form 990 is the most comprehensive return, and it is used by most exempt organizations. Form 990-EZ is a simplified return that can be used by smaller exempt organizations. Form 990-PF is used by private foundations. Form 990-N is an electronic notice that is used by exempt organizations that are not required to file a return.

Publication 557

Publication 557 provides guidance on the tax-exempt status of organizations. It includes information on the requirements for obtaining and maintaining tax-exempt status, as well as the tax reporting requirements for exempt organizations.

Publication 1223

Publication 1223 provides information on the international tax rules that apply to businesses. It includes information on the foreign tax credit, the foreign income exclusion, and the foreign sales corporation (FSC).

FAQ

What is the purpose of Form 8879?

Form 8879 is used to report contributions made to a Health Savings Account (HSA) and claim deductions for qualified medical expenses.

Where can I obtain Printable Form 8879?

You can download Printable Form 8879 from the IRS website or obtain it from a tax professional.

What information is required on Form 8879?

Form 8879 requires information such as your personal details, HSA account information, and details of contributions made and medical expenses incurred.

Can I file Form 8879 electronically?

Currently, Form 8879 cannot be filed electronically. It must be mailed to the IRS.

What are some common errors to avoid when completing Form 8879?

Common errors include incorrect calculations, missing or incomplete information, and failing to attach supporting documentation.