Printable Form 8863: A Comprehensive Guide to Completion and Usage

Navigating the complexities of tax forms can be daunting, but understanding Printable Form 8863 is crucial for individuals seeking to claim the Earned Income Tax Credit (EITC) or Additional Child Tax Credit (ACTC). This guide provides a comprehensive overview of Form 8863, its significance, and effective strategies for completing it accurately.

Printable Form 8863 is a valuable tool that empowers taxpayers to conveniently access and complete the necessary documentation for claiming tax credits. Its user-friendly design and accessibility make it an ideal option for those who prefer a physical format.

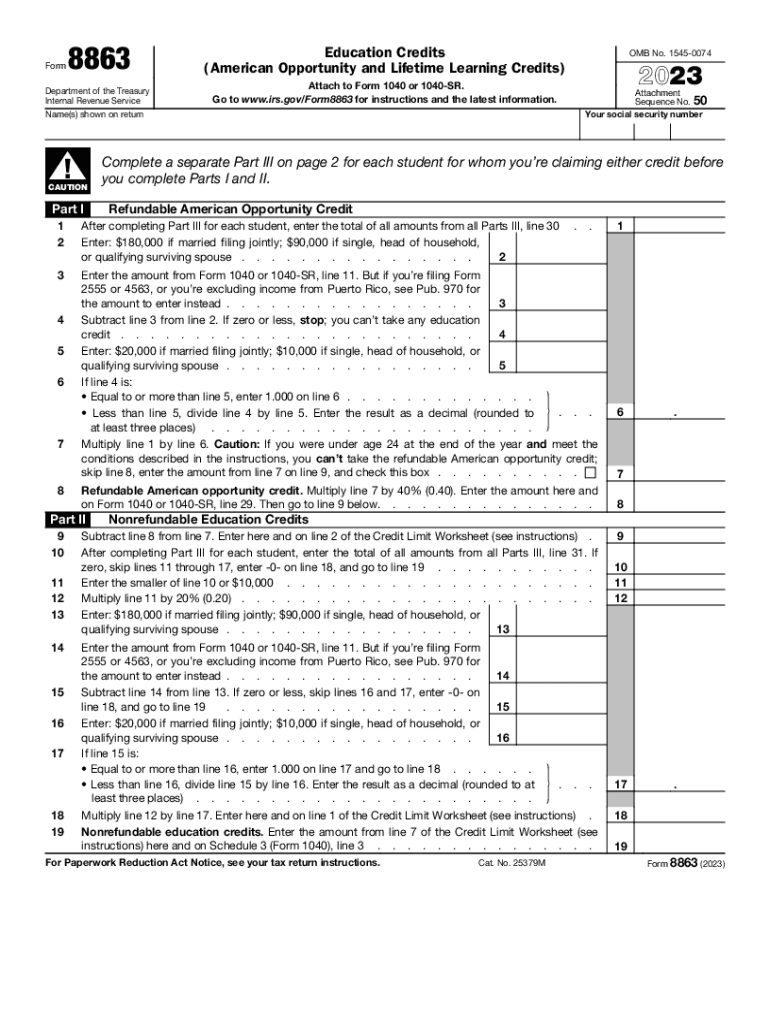

Printable Form 8863

Form 8863, also known as the “Education Credit”, is a tax form that allows you to claim certain education expenses as a tax credit. This credit can reduce the amount of taxes you owe or increase the amount of your refund. The information required on the form includes your personal information, education expenses, and other relevant details. Using a printable version of Form 8863 offers convenience and flexibility, allowing you to complete and file the form at your own pace without relying on online platforms or professional assistance.

s for Completing Form 8863

Filling out Form 8863 can be a bit of a hassle, but it doesn’t have to be. Here’s a step-by-step guide to help you get it done quickly and easily.

Before you start, gather all the necessary documents, such as your Social Security number, tax return, and bank account information. You’ll also need a pen and a calculator.

Personal Information

The first section of the form asks for your personal information, such as your name, address, and Social Security number. Make sure to fill out this section carefully and accurately.

Tax Information

The next section of the form asks for your tax information, such as your filing status, income, and deductions. If you’re not sure how to answer any of these questions, refer to your tax return.

Refund Information

The third section of the form asks for your refund information. This is where you’ll enter the amount of your refund and choose how you want to receive it.

Signature

The final section of the form requires your signature. Make sure to sign and date the form before you mail it in.

Additional Tips

- Use a black or blue pen to fill out the form.

- Write clearly and legibly.

- Make sure to answer all the questions completely.

- If you make a mistake, cross it out and write the correct information next to it.

- Mail the form to the address listed on the form.

Common Errors and Troubleshooting

Completing Form 8863 can be tricky, and even the most careful individuals can make mistakes. To help you avoid common pitfalls and ensure your form is accurate, here’s a rundown of the most frequent errors and some troubleshooting tips:

Incorrect Information

Providing inaccurate information is one of the most common mistakes. This can include errors in your personal details, such as your name, address, or Social Security number. It’s also important to double-check the information you provide about your spouse or dependents.

Missing Information

Leaving out required information is another common issue. Make sure you’ve filled out every field on the form, including those that may not seem relevant to you. If a field doesn’t apply to you, write “N/A” instead of leaving it blank.

Incorrect Calculations

Mistakes in calculations can also lead to errors on Form 8863. Be sure to double-check your math, especially when calculating your income or deductions. If you’re not sure about a particular calculation, refer to the IRS instructions or consult with a tax professional.

Incorrect Filing Status

Choosing the wrong filing status can have a big impact on your tax liability. Make sure you select the filing status that correctly reflects your marital status and dependency status as of December 31st of the tax year.

Late Filing

Filing Form 8863 late can result in penalties and interest charges. To avoid this, file your form by the April 15th deadline (or October 15th if you’re filing an extension). If you can’t meet the deadline, file for an extension as soon as possible.

Troubleshooting Tips

To troubleshoot errors on Form 8863, follow these tips:

- Carefully review the IRS instructions before filling out the form.

- Use a tax software program to help you complete the form and avoid errors.

- Consult with a tax professional if you have any questions or need assistance.

Using Printable Form 8863 in Different Situations

Printable Form 8863, also known as the “Application for Employer Identification Number (EIN)”, can be used in a variety of situations, including:

Starting a new business

- When starting a new business, you’ll need to obtain an EIN to identify your business with the IRS. Form 8863 is the primary method for applying for an EIN.

- Advantages: Easy to fill out and can be submitted online or by mail. Disadvantages: Can take several weeks to process.

Changing the structure of an existing business

- If you change the structure of your existing business (e.g., from a sole proprietorship to an LLC), you’ll need to obtain a new EIN.

- Advantages: Ensures your business is properly identified with the IRS. Disadvantages: Can be time-consuming to obtain a new EIN.

Acquiring a business

- If you acquire an existing business, you may need to obtain a new EIN, especially if you’re changing the name or structure of the business.

- Advantages: Ensures your business is properly identified with the IRS. Disadvantages: Can be time-consuming to obtain a new EIN.

Opening a bank account

- Many banks require businesses to have an EIN in order to open a bank account.

- Advantages: Essential for conducting business transactions. Disadvantages: May require additional documentation to open an account.

Design Considerations for Printable Form 8863

Designing a user-friendly and effective printable Form 8863 is crucial for ensuring its accessibility and ease of use. Several key design elements should be considered to optimize the form for readability and ease of completion.

One of the most important elements is the use of clear and legible fonts. Sans-serif fonts, such as Arial or Helvetica, are generally recommended for printable forms as they are easy to read, even in small sizes. The font size should also be large enough to be easily readable, typically around 12 points or larger.

Appropriate Spacing

Appropriate spacing is essential for creating a visually appealing and uncluttered form. Ample white space should be used around the form fields, instructions, and other elements to improve readability and prevent overcrowding. Adequate line spacing should also be used to separate lines of text and make it easier to read through the form.

Effective Layout

The layout of the form should be logical and intuitive, guiding the user through the completion process smoothly. Form fields should be grouped according to their relevance, and a clear flow should be established from one section to the next. The use of headings, subheadings, and bolding can help organize the form and make it easier to navigate.

Accessibility and Compliance

Accessibility and compliance are crucial when creating a printable Form 8863 to ensure it is accessible to individuals with disabilities and meets regulatory requirements.

The Web Content Accessibility Guidelines (WCAG) provide guidelines for making web content accessible to people with disabilities. These guidelines include requirements for providing alternative text for images, using headings and lists to structure content, and ensuring that form elements are accessible to screen readers.

WCAG Guidelines

– Use descriptive alternative text for images to provide context for users who cannot see the image.

– Structure content using headings and lists to make it easier to navigate and understand.

– Ensure form elements are accessible to screen readers by providing appropriate labels and instructions.

– Use color contrast to make text and form elements easy to read for users with low vision.

– Provide keyboard shortcuts to allow users to navigate the form without using a mouse.

Alternatives to Printable Form 8863

Submitting Form 8863 is a crucial step for claiming the Education Credits. Besides using the Printable Form 8863, you have other options to complete and submit it. Each alternative offers unique advantages and drawbacks. Understanding these alternatives will help you choose the method that best suits your situation.

Filing Online

Filing Form 8863 online through the IRS website or tax software is a convenient and efficient option. It allows you to complete the form electronically, ensuring accuracy and saving time. Moreover, you can e-file your return directly, eliminating the need for mailing or faxing.

Advantages:

- Convenience and ease of use

- Automatic calculations and error checks

- Direct e-filing capability

Disadvantages:

- Requires access to a computer and internet connection

- May not be suitable for complex tax situations

Using Tax Software

Tax software programs can guide you through completing Form 8863, offering step-by-step instructions and built-in calculations. They also allow you to import your tax information, saving time and reducing the risk of errors.

Advantages:

- Comprehensive guidance and support

- Automated calculations and error checks

- Ability to import tax information

Disadvantages:

- Can be more expensive than other options

- May not be as flexible as using the Printable Form 8863

Hiring a Tax Preparer

Hiring a tax preparer can ensure accuracy and professionalism in completing Form 8863. They can also provide advice on tax-related matters and help you navigate complex tax situations.

Advantages:

- Expertise and knowledge of tax laws

- Peace of mind knowing your return is prepared correctly

- Guidance on tax-related matters

Disadvantages:

- Can be more expensive than other options

- May not be necessary for simple tax situations

Choosing the Right Alternative

The best alternative for completing and submitting Form 8863 depends on your individual circumstances. Consider factors such as your comfort level with technology, the complexity of your tax situation, and your budget. If you are comfortable using computers and have a straightforward tax situation, filing online or using tax software may be suitable options. If you prefer professional assistance or have a complex tax situation, hiring a tax preparer may be a wise choice.

FAQs

What are the eligibility criteria for claiming the EITC or ACTC?

To qualify for the EITC or ACTC, individuals must meet specific income and filing status requirements. Refer to the IRS website or consult with a tax professional for detailed eligibility guidelines.

Can I use the printable Form 8863 to file my taxes electronically?

No, Printable Form 8863 is not designed for electronic filing. It is intended for manual completion and submission by mail.

Where can I find additional resources and support for completing Form 8863?

The IRS website provides comprehensive instructions, FAQs, and helpful resources to assist taxpayers in completing Form 8863 accurately. Additionally, tax professionals can offer personalized guidance and support.