Printable Form 8840: A Comprehensive Guide to Navigating the Credit for Empowerment Zones

Navigating the complexities of tax codes can be daunting, but understanding Form 8840 is crucial for businesses operating in designated Empowerment Zones. This form unlocks substantial tax benefits, empowering businesses to thrive in these economically challenged areas. Join us as we delve into the nuances of Form 8840, guiding you through its sections, eligibility criteria, and filing requirements. Let’s empower your business with the knowledge to maximize this valuable tax credit.

In this comprehensive guide, we’ll provide step-by-step instructions, tips for accurate completion, and address common errors to ensure your Form 8840 submission is seamless. Whether you’re new to this form or seeking a refresher, this guide will equip you with the confidence to harness the benefits of Empowerment Zones.

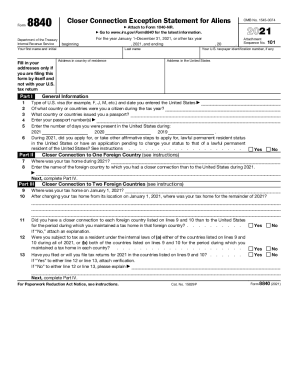

Form 8840 Overview

Form 8840, Credit for Qualified Research Expenses, is a tax form used to claim the research credit. The research credit is a tax credit that allows businesses to deduct a certain amount of their qualified research expenses from their taxable income. The research credit was created to encourage businesses to invest in research and development.

Form 8840 was first introduced in 1981. The form has been updated several times since then, most recently in 2015. The 2015 updates included changes to the eligibility criteria for the research credit and the amount of the credit that businesses can claim.

Eligibility Criteria

To be eligible to claim the research credit, a business must meet the following criteria:

- The business must be engaged in qualified research.

- The research must be conducted in the United States.

- The research must be undertaken for the purpose of discovering information that is technological in nature.

- The research must be intended to be used in the development of a new or improved product, process, or software.

Completing Form 8840

Filling out Form 8840 is a crucial step in claiming your credit for research and experimentation activities. Here’s a quick guide to help you complete the form accurately and efficiently.

Start by gathering all necessary documents and information, including your tax records, research expenses, and any supporting documentation. This will make the process smoother and prevent delays.

Part I: Identification Information

- Provide your personal information, including your name, address, and Social Security number.

- Enter the tax year for which you’re claiming the credit.

Part II: Research or Experimental Expenditures

- In this section, you’ll list your qualified research and experimentation expenses. These may include wages, supplies, and equipment used in your research activities.

- Make sure to provide detailed information for each expense, including the amount, purpose, and date incurred.

Part III: Credit Computation

- Calculate the amount of credit you’re claiming based on your eligible expenses.

- Follow the instructions on the form to determine the percentage of credit you’re entitled to.

Part IV: Elections and Other Information

- Indicate whether you’re electing to claim the credit for the current year or carry it forward to future years.

- Provide any additional information or explanations that may support your claim.

Tips for Completing the Form

- Use clear and concise language.

- Be as specific as possible when describing your expenses.

- Keep a copy of your completed form for your records.

Common Errors to Avoid

- Don’t include expenses that aren’t eligible for the credit.

- Don’t overstate the amount of your expenses.

- Don’t forget to sign and date the form.

Filing Form 8840

Filing Form 8840 is crucial for individuals who have made certain credits or payments. Let’s explore the different filing methods and deadlines.

You can file Form 8840 in the following ways:

- Obtain a physical copy of Form 8840 from the IRS website or a tax professional.

- Fill out the form accurately and completely.

- Mail the form to the designated IRS address for your location.

Electronic Filing

- Use tax preparation software or an e-filing service that supports Form 8840.

- Enter the required information into the software or service.

- Transmit the electronic file securely to the IRS.

Deadlines and Penalties

The deadline for filing Form 8840 is April 15th of the year following the tax year for which you are claiming the credit or payment. Late filing may result in penalties and interest charges.

Resources for Form 8840

Need a helping hand with Form 8840? Check out these official resources:

IRS Website

- Official IRS Form 8840: https://www.irs.gov/forms-pubs/about-form-8840

- Instructions for Form 8840: https://www.irs.gov/pub/irs-pdf/i8840.pdf

- IRS Help Line: 1-800-829-1040

Reputable Websites

- TurboTax: https://turbotax.intuit.com/tax-tools/tax-forms/irs-form-8840/

- H&R Block: https://www.hrblock.com/tax-center/filing/irs-forms/form-8840/

- TaxAct: https://www.taxact.com/support/101/8840-credit-for-prior-year-minimum-tax

Remember, these resources are here to make your tax-filing journey a breeze!

Frequently Asked Questions

What is the purpose of Form 8840?

Form 8840 allows eligible businesses operating in designated Empowerment Zones to claim a tax credit against their federal income tax liability.

Who is eligible to file Form 8840?

Businesses must meet specific criteria, including being located in a designated Empowerment Zone and meeting certain gross income and employment requirements.

How do I complete Form 8840?

This guide provides detailed instructions on completing each section of Form 8840, ensuring accuracy and efficiency.

What are common errors to avoid when filling out Form 8840?

We highlight common pitfalls to help you avoid mistakes that could delay your refund or lead to penalties.

Where can I find additional resources for Form 8840?

We provide links to official IRS resources, reputable websites, and contact information for IRS support to ensure you have all the necessary assistance.