Printable Form 8812: A Comprehensive Guide for Understanding and Completing

Filing taxes can be a daunting task, especially when dealing with complex forms like Form 8812. This guide will provide you with a comprehensive understanding of Printable Form 8812, its purpose, who needs to file it, and the consequences of not filing on time. We will also delve into the intricacies of completing the form, common mistakes to avoid, and the significance of each section. By the end of this guide, you will be equipped with the knowledge and resources to navigate Form 8812 with confidence.

Form 8812 is a vital document for taxpayers who have sold or exchanged a principal residence. Understanding the ins and outs of this form will not only ensure compliance with tax regulations but also help you claim eligible deductions and avoid potential penalties. Let’s dive into the details of Printable Form 8812 and empower you with the knowledge to complete it accurately and efficiently.

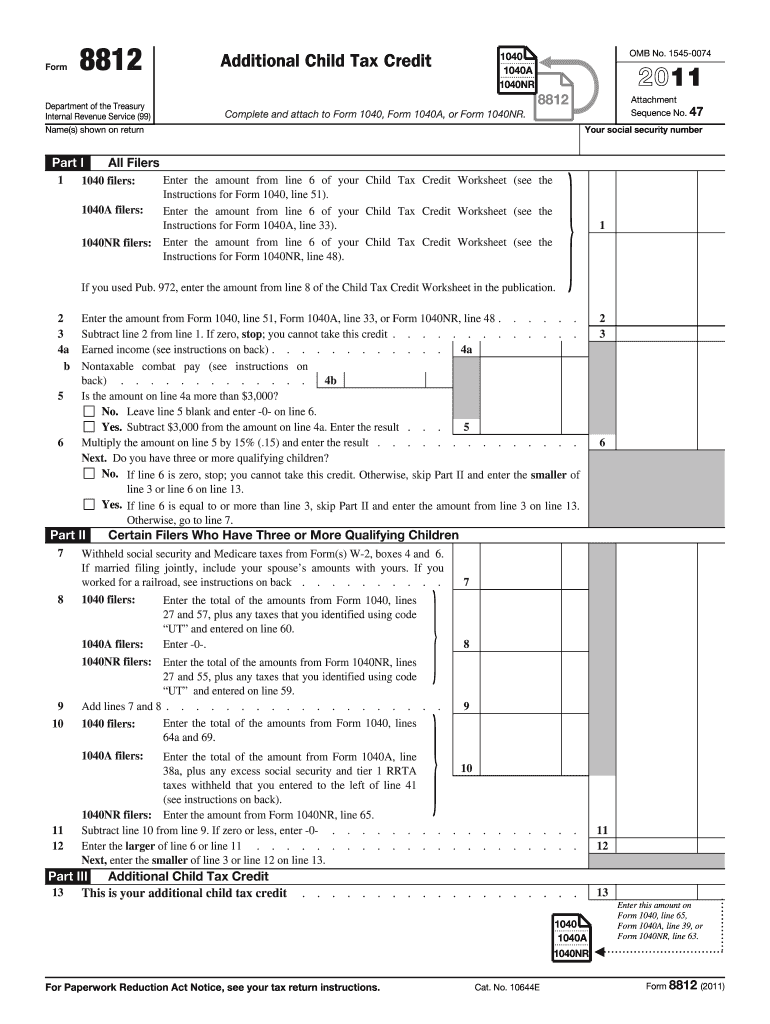

Form 8812 Overview

Form 8812, “Additional Child Tax Credit,” is used to claim the additional child tax credit for qualifying children. This credit is available to taxpayers who have earned income and meet certain other requirements. The credit is worth up to £2,000 per qualifying child.

You are required to file Form 8812 if you have a qualifying child and you meet the following requirements:

- You must have earned income.

- Your AGI must be less than £43,000.

- Your filing status must be married filing jointly, head of household, or qualifying widow(er).

If you do not file Form 8812 on time, you may lose out on the additional child tax credit. The IRS may also impose a penalty for late filing.

Form 8812 s

Filling out Form 8812 can be a bit of a hassle, but it’s important to do it right to avoid any delays or problems with your tax return. Here’s a step-by-step guide to help you fill out the form:

1. Gather your information. You’ll need your Social Security number, your spouse’s Social Security number (if filing jointly), your income, and any deductions or credits you’re claiming.

2. Complete the header. Enter your name, address, and Social Security number in the header section of the form.

3. Complete the income section. List all of your income sources on lines 1-7. Be sure to include your wages, salaries, tips, interest, dividends, and any other taxable income.

4. Complete the deduction section. List all of your itemized deductions on lines 8-16. Be sure to include your mortgage interest, property taxes, charitable contributions, and any other eligible deductions.

5. Complete the credit section. List all of the tax credits you’re claiming on lines 17-22. Be sure to include the child tax credit, the earned income tax credit, and any other eligible credits.

6. Calculate your tax. Use the tax tables or the tax software to calculate your tax liability.

7. Enter your payments. List all of your tax payments on lines 23-26. Be sure to include your withholding, estimated tax payments, and any other tax payments you’ve made.

8. Calculate your refund or balance due. Subtract your payments from your tax liability to calculate your refund or balance due.

Here are some common mistakes to avoid when completing Form 8812:

* Don’t forget to sign the form. Your signature is required for the form to be valid.

* Don’t make math errors. Double-check your math before you submit the form.

* Don’t forget to attach any necessary schedules. If you’re claiming certain deductions or credits, you may need to attach additional schedules to your tax return.

The different sections of Form 8812 are:

* Header: This section contains your personal information, such as your name, address, and Social Security number.

* Income: This section lists all of your income sources.

* Deductions: This section lists all of your itemized deductions.

* Credits: This section lists all of the tax credits you’re claiming.

* Tax: This section calculates your tax liability.

* Payments: This section lists all of your tax payments.

* Refund or balance due: This section calculates your refund or balance due.

Form 8812 Examples

Innit, let’s check out some bangin’ examples of how to smash Form 8812 like a pro.

Example 1: Calculating Credit for Foreign Taxes Paid

Suppose you’re a boss who paid some dough in foreign taxes. To get credit for those payments, you need to fill out Part I of Form 8812. Here’s how it goes:

- Line 1: Enter the country you paid the taxes in.

- Line 2: Write down the amount of taxes you paid in that country.

- Line 3: Check the box that matches your tax year.

- Line 4: Calculate your credit by multiplying Line 2 by the tax rate for your income bracket. This rate is found in the instructions for Form 8812.

Key Takeaways:

- Use the correct tax rate for your income bracket.

- Don’t forget to check the box for your tax year.

Example 2: Claiming Foreign Tax Credit for Dividends

If you’re a shareholder who received dividends from a foreign company, you can claim a credit for the taxes paid by that company. Here’s how to do it:

- Line 5: Enter the name of the foreign company.

- Line 6: Write down the amount of dividends you received.

- Line 7: Calculate your credit by multiplying Line 6 by the foreign tax rate on dividends. This rate is usually provided by the foreign company.

Key Takeaways:

- Get the foreign tax rate from the foreign company.

- Make sure you have the correct amount of dividends.

Example 3: Calculating Deduction for Foreign Losses

If you had any foreign losses, you can deduct them on your tax return. Here’s how to do it:

- Line 9: Enter the country where you had the losses.

- Line 10: Write down the amount of losses you had.

- Line 11: Calculate your deduction by multiplying Line 10 by the exchange rate for the year you had the losses.

Key Takeaways:

- Use the exchange rate for the year you had the losses.

- Make sure you have the correct amount of losses.

Form 8812 Resources

Getting your hands on Form 8812 is a doddle. You can either nick it online or grab it IRL. Both options have their own perks, so let’s suss them out.

Online Resources

If you’re a tech whizz, why not nab Form 8812 online? It’s a piece of cake. Just head to the IRS website or use tax preparation software like TurboTax or H&R Block. These online resources are bang up-to-date and easy peasy to use.

Offline Resources

If you’re more of a traditionalist, you can always order Form 8812 by post or phone. Just give the IRS a bell on 1-800-829-3676 or drop them a line at the address on the IRS website. You can also pop into your local IRS office and pick one up in person.

Questions and Answers

Is Form 8812 available online?

Yes, Form 8812 is available for download from the IRS website.

What is the deadline for filing Form 8812?

Form 8812 must be filed with your tax return by the tax filing deadline, typically April 15th.

What are the penalties for not filing Form 8812 on time?

Failure to file Form 8812 on time may result in penalties and interest charges.

Can I file Form 8812 electronically?

Yes, Form 8812 can be filed electronically using tax preparation software or through the IRS website.

Where can I get help completing Form 8812?

You can consult a tax professional, visit the IRS website, or refer to the instructions provided with Form 8812 for assistance.