The Ultimate Guide to Printable Form 8332

Navigating the world of tax forms can be a daunting task, but with the right tools and guidance, it doesn’t have to be. One essential form in the tax landscape is Form 8332, and in this comprehensive guide, we’ll delve into its purpose, how to access it, fill it out, and more.

Form 8332 plays a crucial role in reporting certain financial transactions, and understanding its intricacies is key to ensuring accuracy and compliance. Whether you’re a seasoned tax professional or an individual navigating the tax process, this guide will provide you with the knowledge and insights you need to master Printable Form 8332.

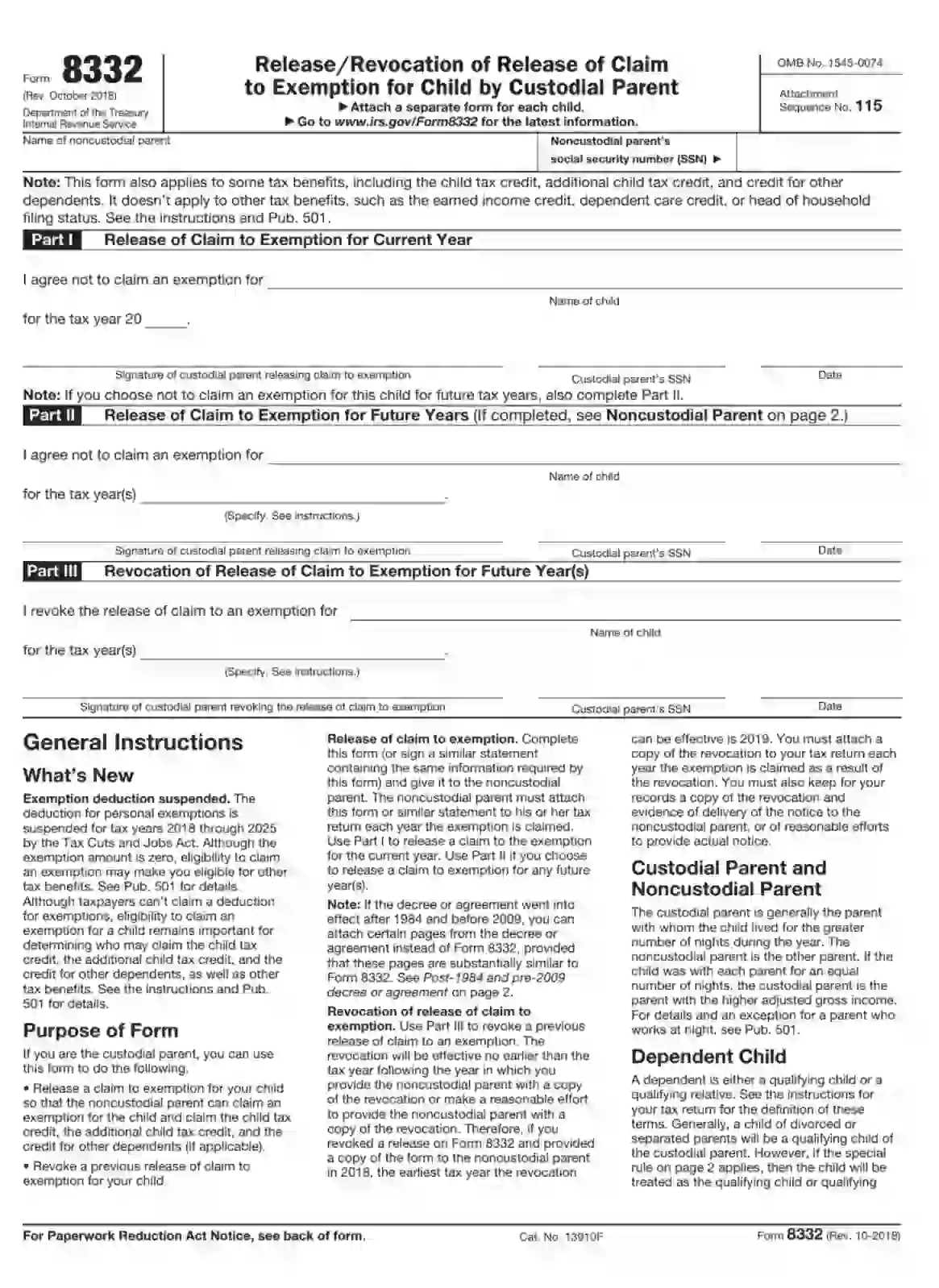

Printable Form 8332

Yo, listen up! Form 8332 is like the VIP pass to the world of taxes. It’s a form that you use to claim credits and deductions that can save you some serious dough on your tax bill.

This form is like a Swiss army knife for tax breaks. You can use it to claim credits for things like:

- Childcare expenses

- Education expenses

- Energy-efficient home improvements

It’s not just for credits, though. You can also use Form 8332 to deduct certain expenses from your taxable income, like:

- Alimony payments

- Gambling losses

- Moving expenses

So, if you’re looking to save some cash on your taxes, Form 8332 is your go-to form. It’s like the cheat code for getting the most out of your tax refund.

Downloading and Accessing Printable Form 8332

The printable version of Form 8332 is readily available for download from various reputable sources. These platforms offer convenient access to the form, ensuring you can obtain it effortlessly.

To obtain the printable Form 8332, you can visit the official website of the Internal Revenue Service (IRS) or reputable tax preparation software providers. These platforms host the latest version of the form, ensuring you have the most up-to-date information at your fingertips.

IRS Website

The IRS website is the primary source for obtaining official tax forms. You can navigate to the IRS website and search for Form 8332. The website will provide you with a downloadable PDF version of the form that you can print and complete at your convenience.

Tax Preparation Software

If you prefer using tax preparation software, you can utilize the software’s built-in feature to download Form 8332. Most tax preparation software programs offer a library of tax forms, including Form 8332. You can select the form within the software and download it as a printable PDF.

Form 8332

Form 8332: Step-by-Step Filling s

Filling out Form 8332 is simple and straightforward. Follow these step-by-step s to complete the form accurately.

Step 1: Gather Necessary Information

Before you begin filling out the form, ensure you have all the necessary information, including your personal details, tax information, and any supporting documents.

Step 2: Complete Section I – Taxpayer Information

In this section, provide your personal information, including your name, address, and Social Security number. If you are filing jointly, include the information for both spouses.

Step 3: Complete Section II – Income Information

List all your sources of income for the tax year, including wages, salaries, dividends, and interest. Refer to your tax return for the amounts.

Step 4: Complete Section III – Deductions and Credits

In this section, itemize any deductions or credits you are claiming. Refer to your tax return for the amounts and eligibility requirements.

Step 5: Complete Section IV – Tax Computation

Use the information from Sections II and III to calculate your tax liability. Refer to the tax tables or use tax software to determine the amount of tax you owe.

Step 6: Complete Section V – Payments and Refunds

In this section, indicate any tax payments you have made during the year, including estimated tax payments and withholding. Also, indicate if you are expecting a refund.

Step 7: Sign and Date the Form

Once you have completed all the sections, sign and date the form. Keep a copy of the completed form for your records.

Submitting and Processing Printable Form 8332

Submitting the completed Printable Form 8332 can be done in various ways, including through mail, fax, or an online portal. The processing time and follow-up procedures may vary depending on the submission method chosen.

Submission Methods

There are multiple options available for submitting your completed Printable Form 8332:

- Mail: Send the completed form by mail to the designated address provided in the instructions.

- Fax: Fax the completed form to the specified fax number.

- Online Portal: Some organizations may offer an online portal for submitting the form electronically. Check the instructions or contact the relevant authority for details.

Processing Time

The processing time for Printable Form 8332 may vary depending on the submission method and the volume of submissions being processed. It’s generally advisable to allow ample time for processing, especially if you need the results by a specific date.

Follow-Up Procedures

After submitting your Printable Form 8332, it’s essential to follow up to ensure it has been received and processed successfully. This can be done by:

- Checking the online portal: If you submitted the form through an online portal, you may be able to track its status or receive notifications.

- Calling the relevant authority: Contact the organization or agency responsible for processing the form to inquire about its status.

Troubleshooting Common Issues with Form 8332

Filling out Form 8332 can be a bit of a faff, especially if you’re not used to dealing with tax forms. But don’t worry, mate! We’ve got your back. Here are some of the most common issues people run into when filling out Form 8332, along with some tips on how to fix them:

Incorrect or Missing Information

One of the most common mistakes people make is entering incorrect or missing information on Form 8332. This can lead to delays in processing your form or even rejection. To avoid this, make sure you double-check all the information you enter on the form, including your personal information, income, and deductions.

Misunderstanding the Instructions

Another common issue is misunderstanding the instructions on Form 8332. This can lead to errors in filling out the form or even missing out on important deductions or credits. To avoid this, make sure you read the instructions carefully before you start filling out the form. If you’re still not sure about something, you can always contact the HMRC for help.

Forgetting to Sign and Date the Form

It’s easy to forget to sign and date Form 8332, but it’s an important step that you shouldn’t skip. Without your signature and date, the form is not valid and will not be processed. So, make sure you sign and date the form before you send it in.

Not Attaching Required Documents

In some cases, you may need to attach supporting documents to Form 8332. These documents can include things like proof of income, deductions, or credits. If you don’t attach the required documents, your form may be delayed or even rejected. So, make sure you check the instructions carefully to see if you need to attach any documents.

Submitting the Form Late

The deadline for filing Form 8332 is January 31st. If you file your form late, you may have to pay penalties and interest. So, make sure you file your form on time to avoid any unnecessary fees.

Advanced Tips for Using Printable Form 8332

With the basics of Printable Form 8332 under your belt, it’s time to take your game to the next level. These advanced tips will help you maximize accuracy, efficiency, and compliance when completing the form.

By following these tips, you’ll be able to ensure that your Form 8332 is error-free, complete, and submitted on time. So, let’s dive right in!

Master the Art of Proofreading

Proofreading your Form 8332 before submitting it is absolutely crucial. This involves carefully checking for any errors in spelling, grammar, and punctuation. Even the smallest mistake can delay the processing of your form or lead to rejection.

To proofread effectively, take your time and read through the form multiple times. Check each field for accuracy, completeness, and consistency. It’s also a good idea to have someone else review your form before you submit it.

Use Digital Tools to Your Advantage

There are several digital tools available that can help you complete Form 8332 more efficiently and accurately. For example, you can use a PDF editor to fill out the form electronically, which can save you time and reduce the risk of errors.

Additionally, there are online resources that provide step-by-step guidance on completing Form 8332. These resources can be especially helpful if you’re unfamiliar with the form or have any specific questions.

Stay Up-to-Date on Regulations

The regulations surrounding Form 8332 are subject to change. It’s important to stay up-to-date on the latest requirements to ensure that your form is compliant.

You can find the most current regulations on the official government website. By staying informed, you can avoid any potential delays or penalties associated with submitting an outdated or incorrect form.

Seek Professional Assistance if Needed

If you’re having difficulty completing Form 8332 or have any complex questions, don’t hesitate to seek professional assistance. A tax advisor or accountant can help you ensure that your form is accurate and compliant.

Professional assistance can be especially valuable if you’re dealing with a particularly complex tax situation or have any specific concerns.

Related Forms and Resources

Form 8332 is closely connected to several other forms and resources that can provide additional support and information. These resources complement Form 8332 by offering further guidance, clarifications, and related services.

Understanding the purpose and relevance of these related forms and resources can help you optimize your use of Form 8332 and ensure a smooth and efficient process.

Forms

- Form 8333: This form is used to report foreign currency transactions over a certain threshold. It complements Form 8332 by providing detailed information about the foreign currency transactions that may be subject to reporting.

- Form 8334: This form is used to file a late return or amendment for Form 8332. It allows you to correct any errors or omissions on your original Form 8332 filing.

Resources

- IRS Publication 5406: This publication provides detailed guidance on the reporting requirements for foreign currency transactions. It offers clear explanations and examples to help you understand the rules and regulations.

- IRS Website: The IRS website contains a wealth of information on Form 8332 and related topics. You can find frequently asked questions, instructions, and other helpful resources to assist you with your reporting.

Questions and Answers

Where can I find Printable Form 8332?

You can download Printable Form 8332 directly from the IRS website or access it through various tax software programs.

Can I submit Printable Form 8332 electronically?

No, Printable Form 8332 must be submitted by mail or fax. However, you can use tax software to complete the form electronically and then print it for submission.

What is the deadline for submitting Printable Form 8332?

The deadline for submitting Printable Form 8332 varies depending on the specific transaction being reported. Refer to the IRS website or consult with a tax professional for specific deadlines.

What are some common errors to avoid when filling out Printable Form 8332?

Common errors include incorrect calculations, missing information, and using the wrong version of the form. Carefully review the instructions and ensure all fields are filled out accurately.