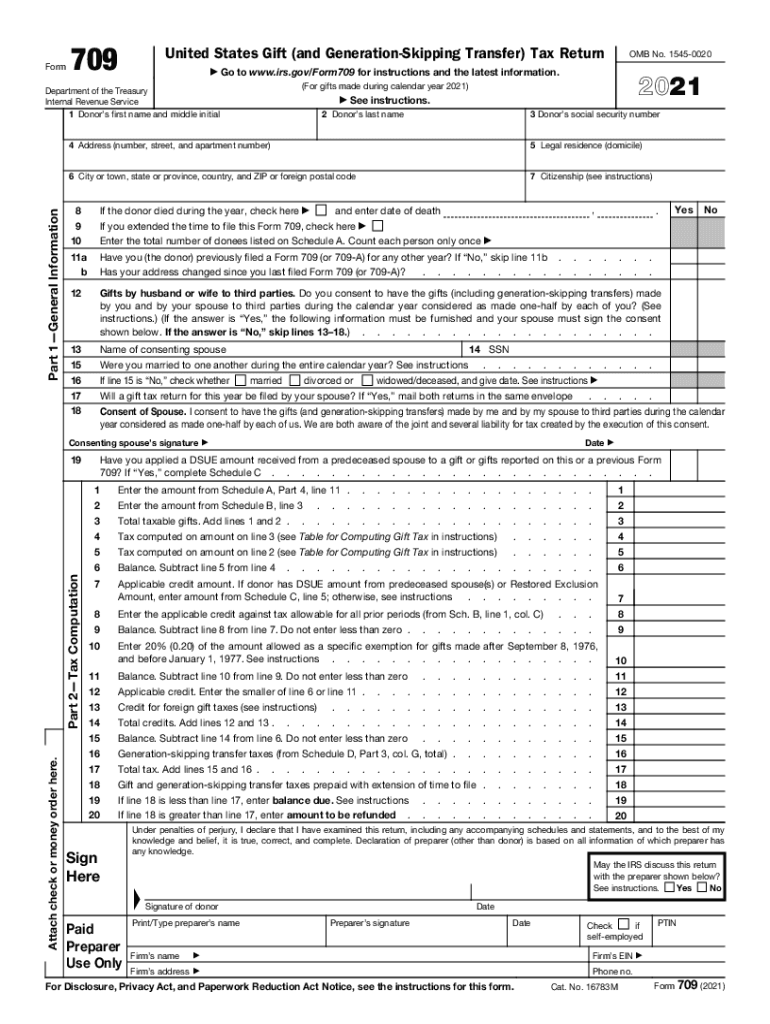

Printable Form 709: A Comprehensive Guide to Filing with Ease

Navigating the complexities of tax filing can be daunting, but with the advent of printable forms, the process has become more accessible than ever. Among these forms, Form 709 stands out as a crucial document for individuals seeking to report certain types of income and deductions. This guide delves into the intricacies of Printable Form 709, providing a comprehensive overview of its purpose, benefits, and step-by-step instructions for completion.

Whether you’re a seasoned taxpayer or filing for the first time, understanding the nuances of Form 709 is essential. This guide empowers you with the knowledge and resources to complete the form accurately and efficiently, ensuring a seamless tax filing experience.

Overview of Form 709

Form 709, also known as the Gift Tax Return, is a tax form filed with the Internal Revenue Service (IRS) to report gifts made during the tax year. It’s used to calculate and pay any gift tax owed on those gifts.

Individuals are required to file Form 709 if they make gifts that exceed the annual gift tax exclusion amount, which is currently $16,000 per recipient for 2023. The filing deadline for Form 709 is April 15th of the year following the year in which the gifts were made.

Who Must File Form 709?

Individuals are required to file Form 709 if they meet either of the following criteria:

- They made gifts that exceed the annual gift tax exclusion amount ($16,000 per recipient for 2023).

- They made gifts to a non-US citizen or resident.

Filing Deadline for Form 709

The filing deadline for Form 709 is April 15th of the year following the year in which the gifts were made. If April 15th falls on a weekend or holiday, the filing deadline is the next business day.

Benefits of Using a Printable Form 709

Blud, using a printable Form 709 is like a cheat code for saving time and effort. It’s like having a VIP pass to the tax filing game.

When you’re working with a digital form, you’re stuck staring at a screen, typing away. But with a printable form, you can just print it out and fill it in by hand. No need to worry about crashing or losing your progress. It’s like having a physical backup of your tax info, innit?

Accuracy and Reliability

Printable forms are like a trusty sidekick, they got your back when it comes to accuracy. Filling out a form by hand forces you to take your time and check your work. No more rushing through and making silly mistakes. Plus, you can easily refer back to your filled-out form later on if you need to make any changes or double-check something.

Steps for Completing a Printable Form 709

:max_bytes(150000):strip_icc()/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg?w=700)

Filling out a printable Form 709 can seem like a daunting task, but it’s actually quite straightforward. Here’s a step-by-step guide to help you complete the form accurately and efficiently.

Before you start, gather all the necessary documents, such as your tax return, W-2 forms, and any other relevant financial information. Having everything organized will make the process much smoother.

Personal Information

Start by filling in your personal information, including your name, address, and Social Security number. Be sure to write clearly and legibly, and double-check your information for accuracy.

Income Information

Next, enter your income information from your tax return. This includes your wages, salaries, tips, and any other taxable income. Use the amounts from your W-2 forms or other income statements.

Deductions and Credits

If you have any deductions or credits to claim, enter them in the appropriate sections of the form. Common deductions include mortgage interest, charitable contributions, and student loan interest. Credits can reduce your tax liability, so be sure to claim any that you’re eligible for.

Payments and Refunds

Indicate any estimated tax payments you’ve made during the year, as well as any refunds you’ve received. This information will help the IRS determine your final tax liability.

Signature and Date

Finally, sign and date the form in the designated areas. This step is essential for the form to be valid.

Resources for Obtaining a Printable Form 709

Blag this, where can you cop a printable Form 709, innit?

Don’t sweat it, mate. We got you covered. Here’s the lowdown on how to get your mitts on this essential doc:

Official Websites

Alternative Options

- Local Tax Office: Swing by your local tax office and ask for a hard copy.

- Accountant or Tax Advisor: If you’re working with an accountant or tax advisor, they can usually provide you with a Form 709.

Additional Considerations for Filing Form 709

Filing Form 709 requires attention to detail and accuracy. Failing to provide the necessary information or submitting an incorrect form can result in delays, penalties, or even legal issues. Therefore, it’s crucial to understand the additional considerations and requirements for completing this form.

- Accuracy and Completeness: Ensure all information provided on the form is accurate and complete. Missing or incorrect information can lead to delays or rejection of your application. Double-check all entries before submitting the form.

- Consequences of Incorrect or Incomplete Filing: Filing an incorrect or incomplete Form 709 can have serious consequences. You may face delays in processing, penalties, or even legal action. It’s advisable to seek professional assistance if you’re unsure about any aspect of the form.

- Avoiding Common Errors: Common errors when filling out Form 709 include missing signatures, incorrect calculations, and incomplete sections. Carefully review the form and ensure all required fields are filled in and calculations are accurate. Pay special attention to sections related to income, deductions, and tax credits.

HTML Table Example

An HTML table can be a useful way to present the key information from Form 709. This can make it easier to read and understand the data, and can also be helpful for comparing different years or periods.

To create an HTML table, you will need to use the following tags:

-

: This tag creates the table itself.

: This tag creates a row in the table. : This tag creates a header cell in the table. : This tag creates a data cell in the table. The following example shows how to create an HTML table to present the key information from Form 709:

“`html

Year Gross income Taxable income Total tax 2020 £100,000 £80,000 £20,000 2021 £110,000 £90,000 £22,000 “`

This table shows the gross income, taxable income, and total tax for the years 2020 and 2021. The table is easy to read and understand, and can be helpful for comparing the two years.

Additional Tips

Here are some additional tips for creating HTML tables:

- Use clear and concise headings for each column.

- Make sure the data in each cell is aligned correctly.

- Use CSS to style the table and make it more visually appealing.

Additional Resources

Seeking further information on Form 709? Check out these helpful resources:

These credible sources offer comprehensive materials to supplement your understanding of Form 709.

Official Resources

Guides and Articles

FAQ Summary

What is the purpose of Form 709?

Form 709 is used to report certain types of income and deductions, including income from trusts and estates, distributions from IRAs and pensions, and deductions for estate taxes paid.

Who is required to file Form 709?

Individuals who receive income from trusts or estates, or who have certain types of deductions related to trusts or estates, may be required to file Form 709.

What is the filing deadline for Form 709?

The filing deadline for Form 709 is April 15th for most taxpayers. However, extensions may be available in certain circumstances.