Printable Form 5062: A Comprehensive Guide to Filing and Understanding

Navigating the complexities of tax filing can be daunting, but understanding and completing Form 5062 is essential for ensuring accurate reporting. This printable form serves as a crucial tool for reporting certain types of income, and its significance extends beyond simply meeting filing requirements. In this comprehensive guide, we will delve into the purpose, completion process, filing methods, and essential resources related to Printable Form 5062, empowering you to confidently navigate this aspect of tax filing.

Form 5062 plays a vital role in ensuring compliance with tax regulations. It is specifically designed for reporting distributions from certain types of trusts and estates, providing the Internal Revenue Service (IRS) with detailed information about the distribution’s source and recipient. Understanding the nuances of Form 5062 is paramount for both individuals and entities involved in trust or estate distributions, as it directly impacts tax liability and potential penalties for incorrect reporting.

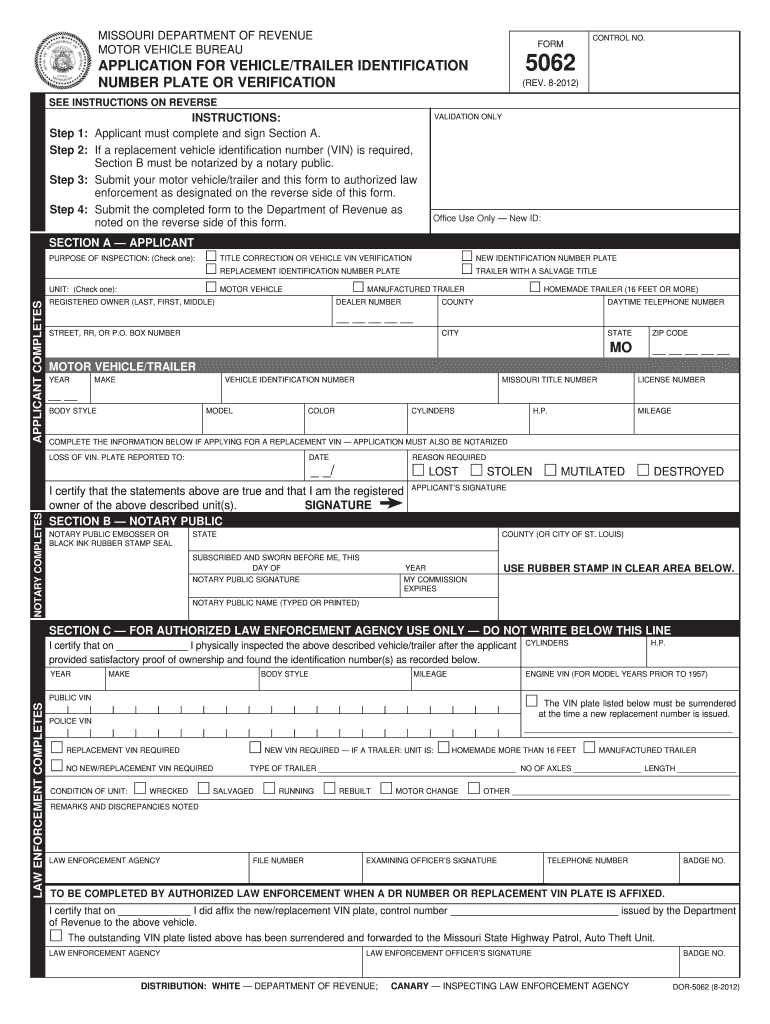

Printable Form 5062 Overview

Form 5062 is a printable tax form used to report certain types of income and expenses. It’s also known as the “Application for Extension of Time to File U.S. Individual Income Tax Return.”

Anyone who needs more time to file their tax return can use Form 5062 to request an extension. This includes individuals, trusts, and estates.

Form 5062 asks for basic information about the taxpayer, including their name, address, and Social Security number. It also asks for information about the tax year for which the extension is being requested, the reason for the extension, and the amount of additional time needed.

Who is Required to File Form 5062?

Anyone who needs more time to file their tax return can use Form 5062 to request an extension. This includes individuals, trusts, and estates.

Information Reported on Form 5062

Form 5062 asks for basic information about the taxpayer, including their name, address, and Social Security number. It also asks for information about the tax year for which the extension is being requested, the reason for the extension, and the amount of additional time needed.

Completing Form 5062

Filling out Form 5062 is a piece of cake, bruv. Just follow these easy steps and you’ll be sorted in no time.

First, you need to gather all the info you’ll need. This includes your personal details, like your name, address, and National Insurance number, as well as details about your income and expenses.

Filling Out the Form

Once you’ve got all your info together, you can start filling out the form. The form is divided into different sections, so just take it one step at a time.

- Section A: Personal Details – This section is where you fill in your basic info, like your name, address, and National Insurance number.

- Section B: Income – This section is where you list all your income from different sources, like wages, self-employment, and benefits.

- Section C: Expenses – This section is where you list all your allowable expenses, like travel costs, equipment, and uniforms.

- Section D: Tax Calculation – This section is where the taxman works his magic and calculates how much tax you owe.

If you’re not sure how to fill out a particular section, don’t fret. There’s plenty of help available online and from HMRC.

Filing Form 5062

Alright, listen up, it’s time to get down to the nitty-gritty of filing Form 5062.

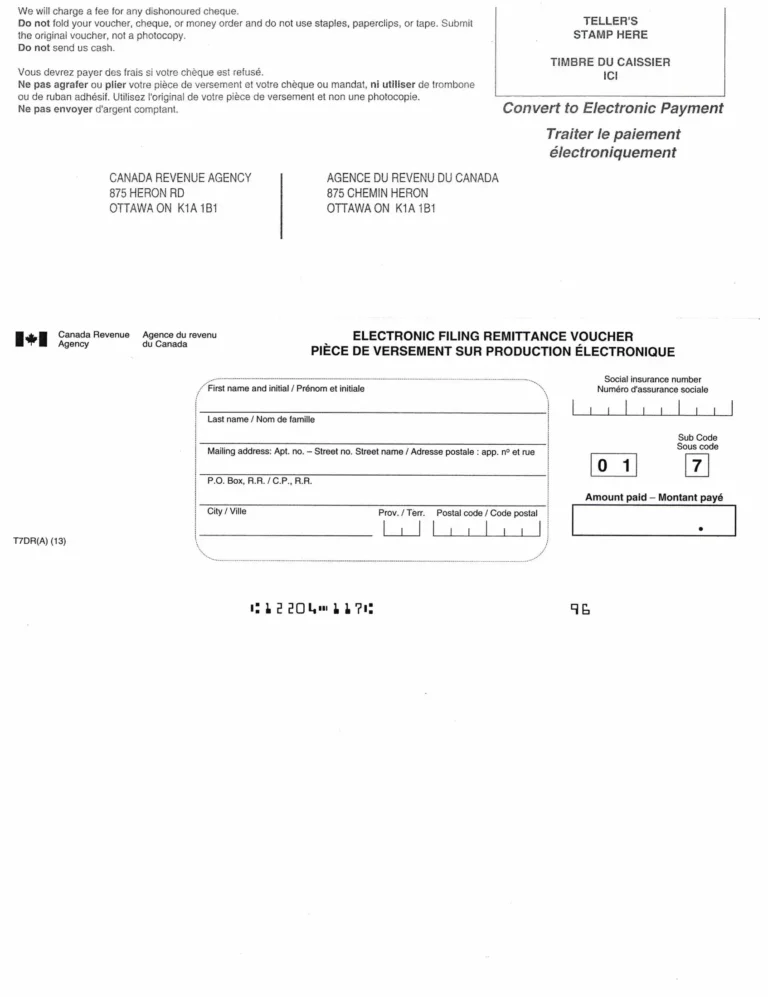

There are a few different ways you can file Form 5062:

- Electronically: You can file Form 5062 electronically through the IRS website or using tax software.

- By mail: You can mail Form 5062 to the IRS address listed on the form.

- In person: You can file Form 5062 in person at an IRS office.

The deadline for filing Form 5062 is April 15th. If you file your return after the deadline, you may have to pay penalties and interest.

| Filing Method | Requirements |

|---|---|

| Electronically | You must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN) and an email address. |

| By mail | You must have a valid Social Security number or ITIN. |

| In person | You must have a valid Social Security number or ITIN and a photo ID. |

Resources for Printable Form 5062

Check out these sick links for all the official tea on Printable Form 5062.

Official Websites and Resources

Contact Information for Assistance

Need a hand with Form 5062? Don’t be a mug, reach out to these peeps:

- IRS Customer Service: 1-800-829-1040

- IRS Tax Help Line: 1-800-829-4477

Downloadable PDF or Fillable Online Version

Get your mitts on a printable or fillable online version of Form 5062 right here, right now:

Frequently Asked Questions

What is the significance of Form 5062?

Form 5062 is crucial for reporting distributions from trusts and estates, providing the IRS with essential information for tax purposes.

Who is required to file Form 5062?

Individuals or entities receiving distributions from trusts or estates are responsible for filing Form 5062.

What information is reported on Form 5062?

Form 5062 captures details such as the trust or estate’s name, taxpayer identification number, and the amount and type of distribution received.

Where can I access the printable Form 5062?

The printable Form 5062 can be obtained from the IRS website or through the links provided in this guide.