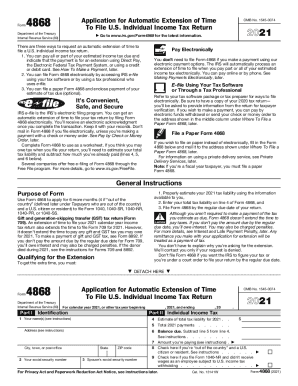

A Comprehensive Guide to Printable Form 4868: Understanding Its Significance and Completing It with Ease

Form 4868, a crucial document in various financial transactions, holds significant importance for individuals and businesses alike. Whether you’re navigating the complexities of tax reporting or managing retirement funds, understanding and completing Form 4868 accurately is essential. This comprehensive guide will delve into the purpose, eligibility, and step-by-step instructions for completing Form 4868, ensuring you navigate this process with confidence and ease.

In this guide, we’ll explore the key sections of Form 4868, providing clear explanations and examples to illustrate their relevance. We’ll also share helpful resources and support channels to assist you throughout the process. By the end of this guide, you’ll have a thorough understanding of Form 4868 and the ability to complete it accurately, empowering you to manage your financial matters effectively.

Printable Form 4868: An Overview

Form 4868 is a crucial document used for applying for an extension of time to file a tax return. It’s a way to request additional time beyond the usual April 15th deadline. This form is designed for individuals who need more time to gather their tax information or complete their return due to special circumstances.

Target Audience and Eligibility Criteria

Form 4868 is primarily intended for taxpayers who anticipate facing challenges in meeting the regular tax filing deadline. This includes situations like:

– Gathering complex financial data

– Dealing with personal or family emergencies

– Experiencing natural disasters or other unforeseen events

To be eligible, taxpayers must have a valid reason for needing the extension and must file Form 4868 before the original tax filing deadline.

Step-by-Step Guide to Completing Form 4868

Filling out Form 4868 is a breeze, bruv. Just follow these sick steps and you’ll be sorted in no time.

Part I: Applicant Information

Spill the beans about yourself, innit. This section’s all about your personal deets like name, address, and taxpayer ID.

- Line 1: Name. Put your full monty here, mate.

- Line 2: Address. Where you hang your hat, blud.

- Line 3: City, State, and ZIP. Your postcode and gaff’s location.

- Line 4: Phone Number. Your digits so they can give you a bell.

- Line 5: Email Address. Your online crib for comms.

- Line 6: Taxpayer ID. Your National Insurance number or Unique Taxpayer Reference.

Part II: Application Details

Now, let’s get down to the nitty-gritty. This bit’s about why you’re filling out this form.

- Line 7: Application Type. Tick the box that fits your sitch.

- Line 8: Tax Period. The dates you’re claiming for.

- Line 9: Amount Claimed. How much you’re asking for, quid for quid.

- Line 10: Explanation of Application. Spill the tea on why you’re making this claim.

Part III: Supporting Documentation

Time to back up your claim, G. Attach any proof you’ve got, like receipts or invoices.

- Line 11: Supporting Documentation. List what you’re sending in.

Common Pitfalls to Dodge

Watch out for these traps, or you might end up in a right pickle:

- Incomplete info. Make sure you fill in every box, or they’ll send it back faster than a yo-yo.

- Wrong taxpayer ID. Check your number twice, or you might end up with someone else’s dough.

- Missing docs. If you don’t send in your proof, they won’t believe you.

- Late submission. Get it in before the deadline, or you’ll be out of luck.

Understanding the Form’s Key Sections

Form 4868 comprises various sections, each with its own purpose and significance. Understanding these sections is crucial for accurate completion.

Applicant Information Section

This section captures the applicant’s personal details, including name, address, contact information, and taxpayer identification number. It’s vital to provide accurate information here, as it’s used to identify the applicant and process their application.

Application Details Section

This section specifies the type of application being submitted, whether it’s for an extension of time to file, an extension of time to pay, or both. It also includes the requested extension period and the reason for the request. Clearly stating the need for an extension enhances the chances of approval.

Supporting Documentation Section

This section allows the applicant to attach supporting documents that justify their request for an extension. It could include financial statements, medical records, or other evidence that demonstrates the applicant’s inability to meet the original filing or payment deadline. Providing robust documentation strengthens the application’s credibility.

Signature and Date Section

The applicant must sign and date the form, indicating their agreement to the information provided and their commitment to fulfill any obligations arising from the extension granted. A valid signature is essential for the application to be processed.

Preparer Information Section (Optional)

If an authorized representative or preparer assists the applicant, their details should be provided in this section. This includes the preparer’s name, address, and contact information. The preparer’s signature and date are also required.

Privacy Act Notice

This section informs the applicant about the privacy and confidentiality of the information they provide on the form. It explains how the data will be used and protected. Reading and understanding this notice is important for the applicant’s peace of mind.

Additional Resources and Support

In addition to the information provided here, there are several resources available to help you complete and understand Form 4868. These include:

- The IRS website has a dedicated page for Form 4868, which includes instructions, FAQs, and other helpful information.

- There are a number of online tax software programs that can help you complete Form 4868 electronically.

- You can also seek assistance from a tax professional, such as an accountant or tax attorney.

Online Support

In addition to the resources listed above, there are also a number of online support channels available to help you with Form 4868. These include:

- The IRS has a dedicated online forum where you can ask questions and get answers from other taxpayers and IRS representatives.

- There are a number of tax-related websites and blogs that provide information and support on Form 4868.

- You can also find support on social media platforms such as Twitter and Facebook.

Offline Support

If you need offline support, you can contact the IRS by phone or mail. The IRS has a toll-free number that you can call to speak to a customer service representative. You can also write to the IRS at the following address:

Internal Revenue Service

Attn: Form 4868

Ogden, UT 84201

Form 4868 in HTML Table Format

Yo, let’s get digital with Form 4868! We’ve cooked up a responsive HTML table that’s the spitting image of the original form, innit?

It’s got all the bells and whistles, with table headings and column labels sorted. Plus, it’s like a chameleon, resizing itself to fit any screen, bruv.

HTML Table Layout

Picture this, fam. Our HTML table is gonna mimic the layout of Form 4868 to a T. It’s like a digital twin, with all the sections and fields in the exact same place.

We’ve got table headings at the top, like “Part I: Taxpayer Information” and “Part II: Application for Automatic Extension of Time to File U.S. Individual Income Tax Return.” Each row is like a different section, and the columns are the individual fields you need to fill in.

And get this, it’s optimized for different screen sizes, so it’ll look sharp on your laptop, tablet, or even your nan’s flip phone. No more squinting or scrolling like a madman, blud.

Printable Form 4868 with Bullet Points

Creating a printable version of Form 4868 using bullet points offers a concise and easy-to-navigate format for users. The following sections provide a step-by-step guide to organizing the form’s sections and fields into clear and concise bullet points.

This printable version ensures readability and ease of use, making it an ideal resource for individuals seeking to complete Form 4868 efficiently.

Sections and Fields

- Applicant Information:

- Name

- Address

- Contact information

- Business Information:

- Business name

- Address

- Industry

- Application Details:

- Type of application

- Reason for application

- Supporting documents

- Declaration and Signature:

- Applicant’s declaration

- Signature

- Date

Q&A

What is the purpose of Form 4868?

Form 4868 is used to report certain transactions related to retirement plans, such as rollovers, distributions, and plan-to-plan transfers.

Who is eligible to use Form 4868?

Individuals and businesses involved in transactions related to retirement plans may need to use Form 4868.

Where can I find additional resources and support for completing Form 4868?

The IRS website provides detailed instructions and resources for completing Form 4868. You can also consult with a tax professional for guidance.