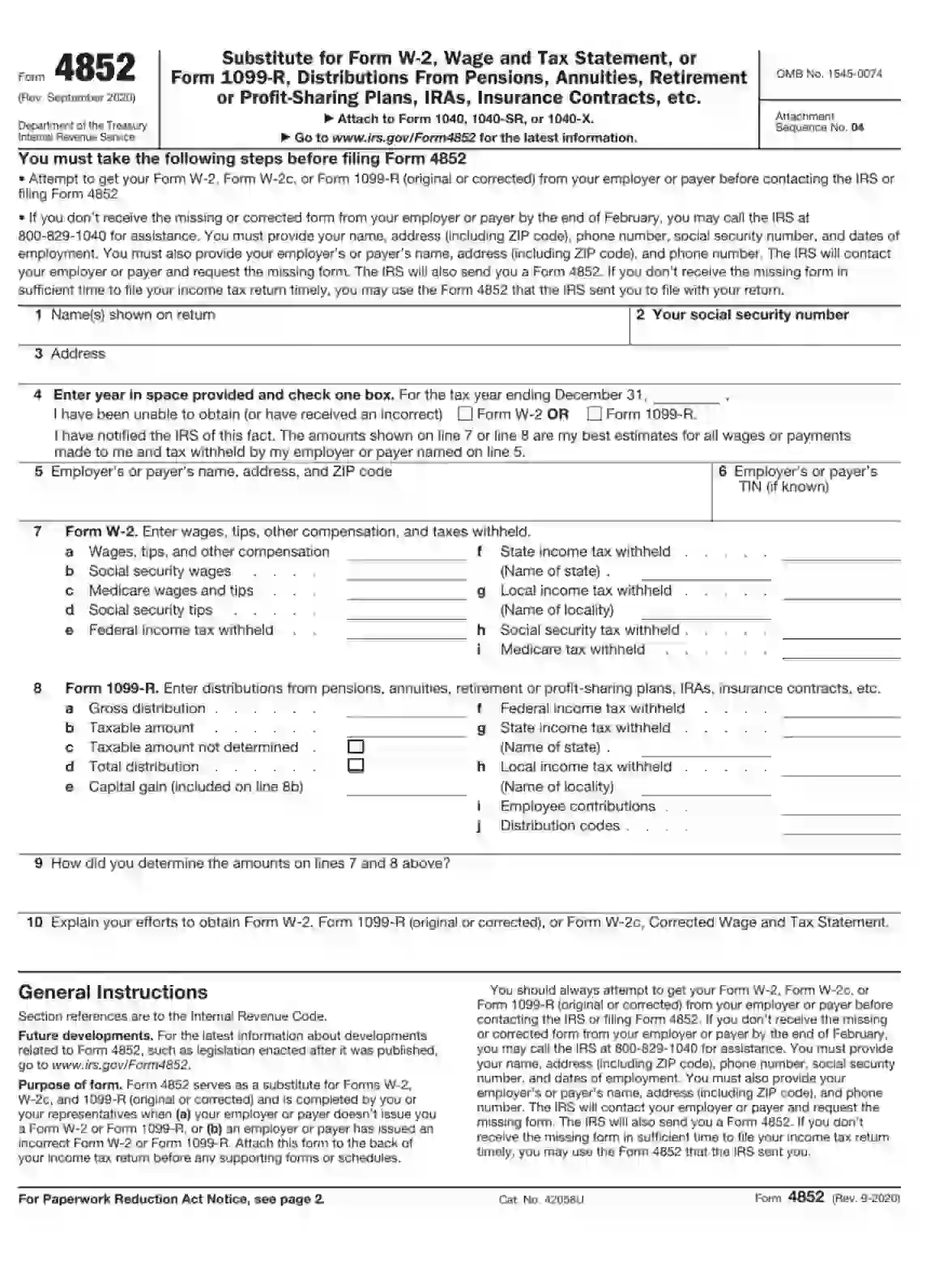

Printable Form 4852: A Comprehensive Guide for Filing and Avoiding Common Errors

Navigating the complexities of tax filing can be daunting, but understanding and utilizing Form 4852 can significantly simplify the process. This printable form offers a convenient and accessible way to report certain income and expenses, making it essential for individuals seeking to accurately fulfill their tax obligations.

In this comprehensive guide, we will delve into the purpose, benefits, and step-by-step instructions for completing Printable Form 4852. We will also highlight common errors to avoid, ensuring that you can confidently and accurately file your taxes using this form.

Definition of Printable Form 4852

Yo, listen up! Printable Form 4852 is a sick document that’s all about reporting casualty, disaster, or theft losses. It’s like a secret weapon for getting your insurance sorted when the worst happens.

This form is like a map that guides you through all the info you need to provide. It’s got sections for describing the loss, the property involved, and even the insurance policies that cover it. It’s like having a personal assistant who knows exactly what to ask to make sure your claim is sorted.

When to Use Form 4852

Form 4852 is your go-to form when you’ve suffered a major loss. Think car crashes, house fires, or robberies. It’s like a lifeline that helps you get your life back on track.

Benefits of Using Printable Form 4852

Printable Form 4852 offers a range of advantages that make it a preferred choice for many individuals and businesses. It enhances convenience and accessibility, enabling users to complete and submit the form at their own pace and from any location with an internet connection.

Enhanced Convenience

Printable Form 4852 eliminates the need for handwritten forms, which can be time-consuming and prone to errors. Users can simply download the printable version, fill in the required information on their computer, and print it out for submission. This streamlined process saves time and effort, allowing users to focus on other important tasks.

Improved Accessibility

The printable form is accessible to anyone with a computer and internet connection. It is not limited by geographical location or business hours, making it convenient for individuals and businesses to complete and submit the form at their convenience. This accessibility is particularly beneficial for those who live in remote areas or have limited access to physical submission points.

Ensuring Accuracy and Validity

To ensure the accuracy and validity of the printable form, users should follow these tips:

– Use a high-quality printer to produce clear and legible copies.

– Carefully proofread the form before printing to identify any errors or omissions.

– Make sure to use the most up-to-date version of the form, which can be downloaded from the official website.

– Submit the completed form to the correct address or email address as specified in the instructions.

s for Completing Printable Form 4852

Completing the Printable Form 4852 is a breeze if you follow these simple steps. We’ll break down each section of the form and guide you through filling it out accurately.

Part I: Personal Information

- Enter your name, address, and Social Security number as they appear on your tax return.

- If you’re married filing jointly, enter your spouse’s information as well.

Part II: Income and Adjustments

- Report your total income from all sources, including wages, salaries, and investments.

- Enter any adjustments to your income, such as deductions or contributions to retirement accounts.

Part III: Tax Calculation

- Calculate your taxable income by subtracting your adjustments from your total income.

- Determine your tax liability based on the applicable tax rates.

Part IV: Credits and Payments

- List any tax credits or payments you’re eligible for, such as the child tax credit or earned income credit.

- Subtract these credits and payments from your tax liability to arrive at your final tax due or refund.

Part V: Refund or Payment

- If you’re due a refund, enter the amount you want directly deposited into your bank account.

- If you owe taxes, enter the amount you’ll pay with your return.

Part VI: Signature and Verification

- Sign and date the form to certify the accuracy of the information you’ve provided.

- Enter the date you prepared the return and the name of the person who prepared it if it’s not you.

Common Errors to Avoid When Completing Form 4852

Filling out Form 4852 can be a bit of a chore, but it’s important to do it right to avoid any headaches down the road. Here are a few common errors to watch out for:

Incorrect Social Security Number

Your Social Security Number (SSN) is one of the most important pieces of information on Form 4852. Make sure you enter it correctly, including any hyphens. If you enter an incorrect SSN, the IRS may not be able to process your return, which could delay your refund.

Missing or Incorrect Address

Your address is also important information that the IRS needs to process your return. Make sure you enter your current address, including your street address, city, state, and ZIP code. If you have recently moved, be sure to update your address with the IRS before you file your return.

Incorrect Filing Status

Your filing status tells the IRS how you want to file your taxes. There are five different filing statuses: single, married filing jointly, married filing separately, head of household, and qualifying widow(er). Make sure you choose the correct filing status for your situation. If you choose the wrong filing status, it could affect your tax liability.

Incorrect Income Information

The IRS uses the income information you provide on Form 4852 to calculate your tax liability. Make sure you enter all of your income, including wages, salaries, tips, and investment income. If you miss any income, you could end up paying more taxes than you owe.

Incorrect Deductions and Credits

Deductions and credits can reduce your tax liability. However, you can only claim deductions and credits that you are eligible for. Make sure you carefully review the instructions for Form 4852 to determine which deductions and credits you can claim. If you claim deductions or credits that you are not eligible for, you could end up owing more taxes.

Incomplete or Missing Signature

Your signature is required on Form 4852. If you do not sign your return, the IRS may not be able to process it. Make sure you sign your return in the space provided.

Additional Resources for Printable Form 4852

Need a hand with Form 4852? Here’s where you can get your mitts on the printable form and some right nifty assistance.

For the official printable form, check out these links:

If you’re stumped while filling out the form, here’s where you can seek some guidance:

- IRS helpline: 1-800-829-1040

- Tax preparation software (e.g., TurboTax, H&R Block)

- Local tax professionals (e.g., accountants, tax preparers)

Regulations and Guidelines

When using Form 4852, keep these regulations in mind:

- The form must be completed accurately and submitted on time.

- Failure to comply with the instructions may result in penalties.

- Refer to the IRS website or consult with a tax professional for the most up-to-date information.

Answers to Common Questions

What is the purpose of Form 4852?

Form 4852 is used to report certain income and expenses related to qualified exchanges under Section 1031 of the Internal Revenue Code.

Who needs to use Form 4852?

Individuals who have engaged in a like-kind exchange of real property must file Form 4852 to report the transaction and calculate any potential tax liability.

Where can I find the printable version of Form 4852?

The printable version of Form 4852 can be downloaded from the official website of the Internal Revenue Service (IRS).

What are some common errors to avoid when completing Form 4852?

Common errors include incorrect property identification, inaccurate calculation of boot received, and failure to attach required documentation.