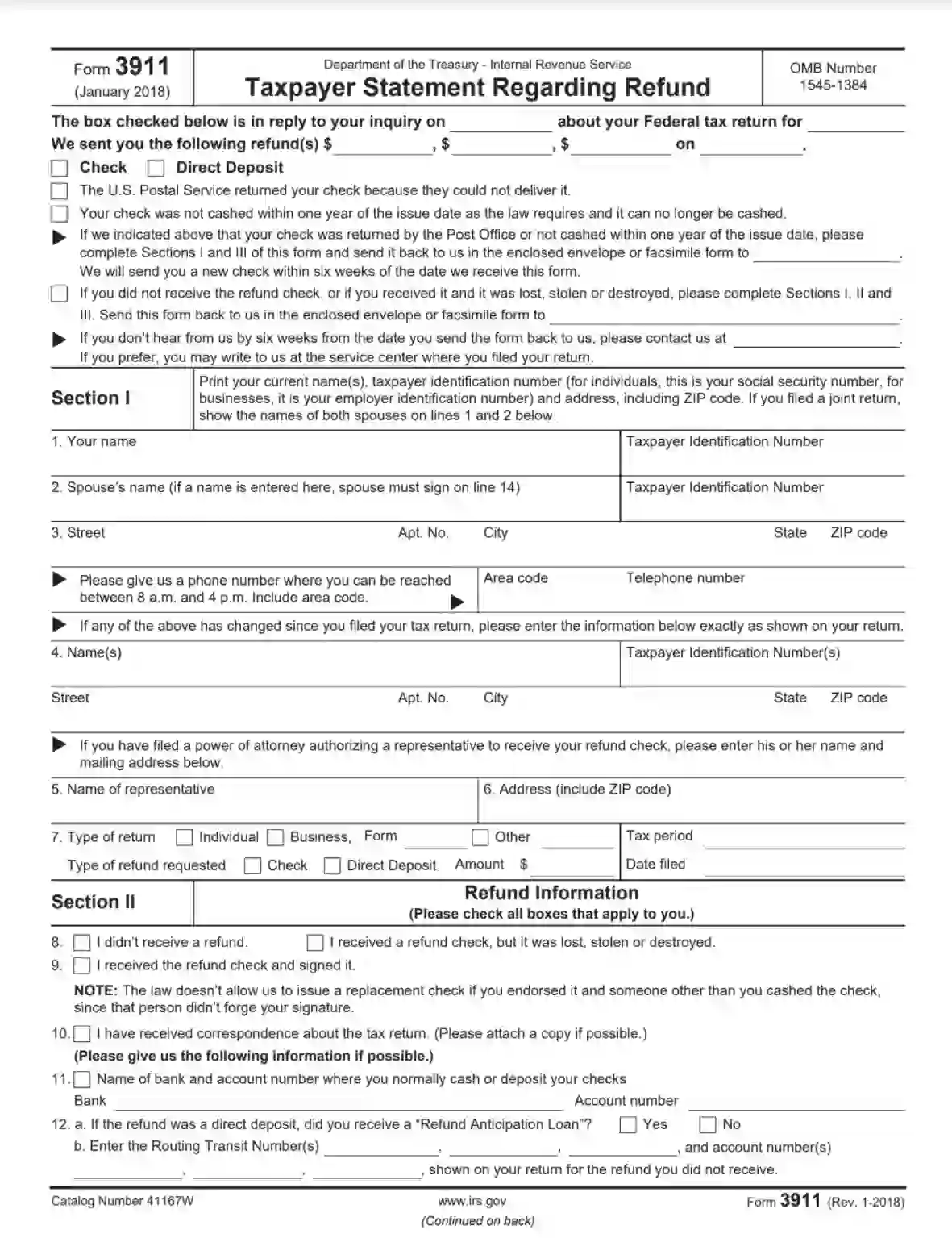

Printable Form 3911: A Comprehensive Guide

Navigating the complexities of tax forms can be daunting, but understanding Form 3911 is crucial for individuals and businesses alike. This printable form plays a significant role in streamlining tax-related processes and ensuring compliance. In this comprehensive guide, we will delve into the purpose, completion, filing, and impact of Form 3911, empowering you with the knowledge to navigate this essential document.

Form 3911, also known as the Tax Information Statement for U.S. Persons with Foreign Trusts and Foreign Estates, is a vital tool for reporting foreign trusts and estates to the Internal Revenue Service (IRS). It provides a detailed account of the taxpayer’s financial transactions and ownership interests in foreign entities, ensuring transparency and accountability in international tax matters.

Overview of Form 3911

Yo, Form 3911 is like a VIP pass to the world of taxes. It’s a tax return form that you need to file if you’re a student who’s earning some bread on the side.

This form has been around for time, helping students navigate the tax maze since the dawn of time. It’s designed for students who are working part-time, have scholarships, or are getting any other kind of dough that the taxman wants a piece of.

Who’s it for?

If you’re a student who’s earning some cash, then Form 3911 is your go-to. It’s the form you need to file to make sure you’re paying the right amount of tax and not getting into any trouble with the taxman.

Completing Form 3911

Yo, completing Form 3911 ain’t rocket science, but it’s important to do it right, innit? Here’s a guide to help you fill out this form like a pro.

Let’s break it down section by section:

Section 1: Personal Information

Start by filling in your personal details like name, address, and contact info. This is where you let the taxman know who you are.

Section 2: Income

Next up, tell the taxman about all the dosh you earned. List your wages, salaries, and any other income you got your hands on. Don’t forget to include your benefits and expenses.

Section 3: Deductions

Now it’s time to knock off some of that income. List all the deductions you’re entitled to, like pension contributions, charity donations, and work expenses.

Section 4: Tax Credits

Here’s where you can claim back some of the tax you’ve already paid. List any tax credits you’re eligible for, like the personal allowance or working tax credit.

Section 5: Calculations

This is where the taxman does the maths. They’ll work out how much tax you owe based on your income, deductions, and tax credits.

Section 6: Payment

Finally, if you owe any tax, this is where you pay up. You can do it online, by phone, or by post.

Remember, filling out Form 3911 accurately is crucial. If you’re not sure about anything, don’t be afraid to ask for help. You can get advice from a tax advisor or check out the HMRC website.

Filing and Submitting Form 3911

Yo, once you’ve got your Form 3911 ready, it’s time to send it in. There’s a few ways to do this, so check it:

The most common way is to mail it in. Just pop it in an envelope and send it to the address on the form. Make sure you get it in before the deadline, which is usually April 15th.

If you’re in a rush, you can also fax it in. The fax number is on the form. Just make sure you send it in on time, as the deadline is still April 15th.

And finally, if you’re feeling tech-savvy, you can also file it electronically. There’s a link on the IRS website where you can do this. Just make sure you have all your documents ready, as you’ll need to upload them as part of the process.

Common Errors and Troubleshooting

Completing Form 3911 accurately is crucial, but it’s not without its pitfalls. Let’s look at some common errors and how to avoid or fix them.

To ensure a smooth process, it’s essential to read the instructions thoroughly and double-check your entries before submitting the form. If you encounter any issues, don’t hesitate to seek assistance from the relevant authorities.

Incorrect or Incomplete Information

One of the most common errors is providing incorrect or incomplete information. Make sure you fill out all the required fields accurately and provide any supporting documents as necessary.

Calculation Errors

Another potential pitfall is making calculation errors. Double-check your math, especially when it comes to deductions, credits, and other financial calculations.

Missed Deadlines

Timeliness is of the essence. Ensure you submit your Form 3911 by the specified deadline to avoid penalties or delays in processing.

Troubleshooting

If you encounter specific issues or have any inquiries, don’t hesitate to reach out to the relevant authorities for guidance and support.

Benefits and Impact of Form 3911

Form 3911 offers several advantages for individuals and businesses, making it a valuable tool in streamlining processes, improving efficiency, and enhancing compliance.

Simplified Reporting Process

Form 3911 simplifies the reporting process by providing a standardized format for recording transactions. This eliminates the need for manual data entry, reducing errors and saving time. The form’s clear instructions and guidance assist users in accurately completing the required information, ensuring data integrity.

Enhanced Efficiency

By using Form 3911, businesses can streamline their operations and improve efficiency. The form’s automated calculations and standardized format allow for quick and accurate processing of data. This reduces the workload for staff, freeing up time for more productive tasks. Additionally, the electronic submission options available for Form 3911 enable seamless data transfer, further enhancing efficiency.

Improved Compliance

Form 3911 plays a crucial role in ensuring compliance with regulatory requirements. The form’s comprehensive nature ensures that all necessary information is captured and reported accurately. This helps businesses avoid penalties and fines associated with non-compliance and demonstrates their commitment to ethical and responsible business practices.

Case Study: Streamlined Tax Reporting for Small Business

ABC Ltd., a small business, struggled with manual tax reporting, leading to errors and delays. After implementing Form 3911, the company experienced significant improvements:

– 50% reduction in reporting time

– 95% accuracy rate in tax calculations

– Enhanced confidence in the accuracy of their tax submissions

Alternatives to Form 3911

If you’re not keen on using Form 3911, there are other ways to report and pay your taxes. Let’s check out some alternatives and see which one’s a better fit for your needs.

Tax Software

- Convenience: Tax software like TurboTax and H&R Block makes filing your taxes a breeze. You can input your info and let the software do the heavy lifting.

- Accuracy: These programs are designed to minimize errors by guiding you through the process and flagging any potential issues.

- Cost: While some basic versions are free, paid versions offer more features and support.

Online Tax Services

- Accessibility: File your taxes from anywhere with an internet connection. No need to download or install software.

- Guidance: Some online services provide expert guidance and support throughout the filing process.

- Fees: Online tax services typically charge a fee for their services.

Professional Tax Preparers

- Expertise: Certified tax preparers have the knowledge and experience to handle complex tax situations.

- Peace of Mind: They take the burden of tax filing off your shoulders, ensuring your taxes are done correctly.

- Cost: Professional tax preparers charge a fee for their services, which can vary depending on the complexity of your tax situation.

Which Option Is Right for You?

Choosing the best alternative to Form 3911 depends on your individual needs and preferences. If you’re comfortable with DIY and want to save some dough, tax software or online services might be a good choice. For more complex tax situations or if you prefer professional assistance, a tax preparer may be a better option.

Q&A

What is the purpose of Form 3911?

Form 3911 is used to report foreign trusts and foreign estates to the IRS, providing detailed information about the taxpayer’s financial transactions and ownership interests in these entities.

Who is required to file Form 3911?

U.S. citizens or residents who have an ownership interest in, or receive distributions from, a foreign trust or foreign estate are required to file Form 3911.

What are the penalties for not filing Form 3911?

Failure to file Form 3911 can result in significant penalties, including fines and potential criminal charges.

Can I file Form 3911 electronically?

Yes, Form 3911 can be filed electronically using the IRS’s FIRE system.

Where can I get help completing Form 3911?

The IRS provides resources and guidance to assist taxpayers in completing Form 3911, including online instructions and professional tax advisors.