Printable Form 2441: A Comprehensive Guide to Understanding and Filing

Navigating the complexities of tax filing can be daunting, but understanding the purpose and usage of Form 2441 is crucial for individuals and businesses alike. This comprehensive guide will provide a detailed overview of Form 2441, including its purpose, completion instructions, filing methods, and frequently asked questions.

Whether you’re an individual seeking guidance or a business owner ensuring compliance, this guide will empower you with the knowledge and tools necessary to effectively complete and file Form 2441.

Purpose and Use of Form 2441

Form 2441, also known as “Application for Child Tax Credit,” is a crucial document used to claim the Child Tax Credit (CTC) from Her Majesty’s Revenue and Customs (HMRC). This credit is a tax break available to eligible individuals who are responsible for the care of children under the age of 18. It aims to reduce the financial burden of raising children and support families with their expenses.

Individuals should use Form 2441 if they meet the following criteria:

- You have a child under the age of 18 who qualifies for the CTC.

- You are the primary caregiver of the child.

- You have not already claimed the CTC for the child through your tax return.

Failure to file Form 2441 when required can result in missing out on the CTC, which can lead to financial losses for eligible individuals and families. Therefore, it is essential to ensure that you file this form accurately and on time.

s for Completing Form 2441

Yo, listen up! Smashing out Form 2441 ain’t rocket science, innit? Just follow these sick steps and you’ll be a pro in no time.

Before you start, make sure you’ve got all the right info at your fingertips. This includes your NI number, your pay and tax details, and any other bits and bobs that the form asks for. If you’re not sure where to find something, check out the HMRC website or give ’em a bell.

Part 1: Personal Details

This is where you spill the beans on who you are. Fill in your name, address, and NI number. It’s a doddle.

Part 2: Income and Tax Paid

Now, let’s get into the nitty-gritty. This section is where you show off how much you’ve earned and how much tax you’ve paid. Grab your P60 or payslips and get ready to crunch some numbers.

- Income: List all your income from employment, self-employment, and any other sources. Make sure you include any benefits or expenses that are taxable.

- Tax Paid: Enter the total amount of tax you’ve paid during the tax year. You can find this on your P60 or payslips.

Part 3: Deductions

Time to deduct those juicy expenses! This is where you can claim back any money you’ve spent on work-related stuff, like travel, equipment, or training. Check out the HMRC website for a full list of eligible expenses.

- Employment Expenses: List any expenses you’ve incurred while working for your employer.

- Self-Employment Expenses: If you’re self-employed, you can claim back expenses related to your business.

Part 4: Other Information

This is where you can chuck in any other bits of info that HMRC might need to know. This could include details of any benefits you receive, like child benefit or working tax credit.

Filing and Submitting Form 2441

/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png?w=700)

Once you’ve filled out your Form 2441, you’ve got a few options for getting it to the IRS. You can mail it in, file it online, or use a tax professional to do it for you.

If you’re mailing it in, the address you need to use depends on where you live. You can find the correct address on the IRS website.

If you’re filing online, you can use the IRS’s e-file system. You’ll need to create an account and then follow the instructions on the website.

No matter which method you choose, make sure you file your Form 2441 by the deadline. The deadline for filing Form 2441 is April 15th. If you file late, you may have to pay penalties and interest.

Filing Online

Filing Form 2441 online is a quick and easy way to get your return filed. You can use the IRS’s e-file system to file your return for free. You’ll need to create an account and then follow the instructions on the website.

There are a few benefits to filing online. First, it’s faster than mailing in your return. Second, you can get your refund faster if you file online. Third, you can avoid potential errors that can occur when you file by mail.

Filing by Mail

If you prefer to file your return by mail, you can download the Form 2441 from the IRS website. You’ll need to fill out the form and mail it to the IRS address for your state. You can find the correct address on the IRS website.

There are a few things to keep in mind when filing by mail. First, make sure you mail your return in plenty of time to meet the deadline. Second, be sure to include all of the necessary documentation with your return. Third, keep a copy of your return for your records.

Filing with a Tax Professional

If you’re not comfortable filing your return on your own, you can hire a tax professional to do it for you. Tax professionals can help you prepare your return and make sure it’s filed correctly.

There are a few things to consider when hiring a tax professional. First, make sure you find a reputable professional who is experienced in preparing Form 2441. Second, be sure to get a written agreement that Artikels the fees and services that will be provided.

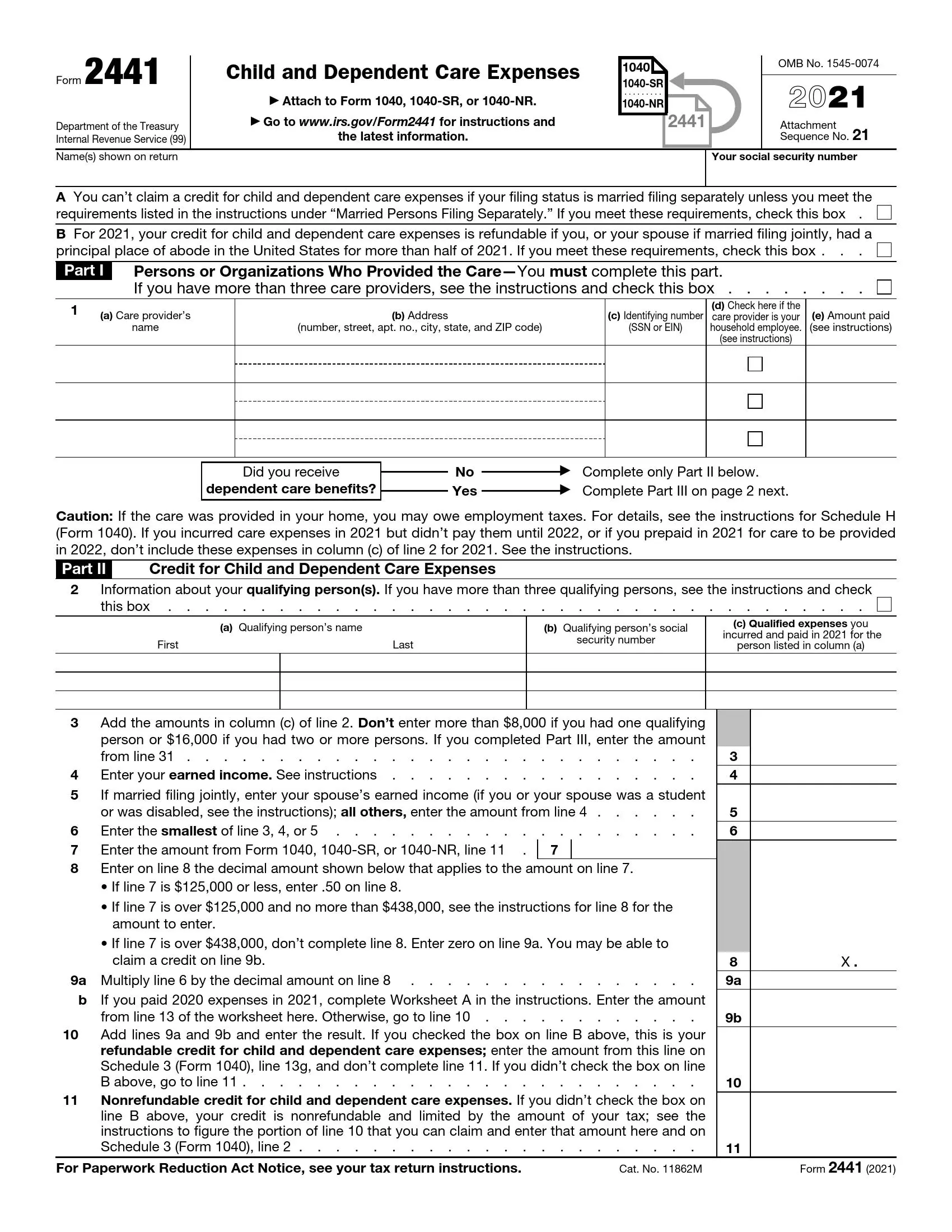

Sample Form 2441 with Explanations

This section provides a sample Form 2441 with detailed annotations to help you understand each field and its significance. The explanations are presented in bullet points for clarity.

Sample Form 2441

| Field | Explanation |

| Part I: Taxpayer Information | Provides basic information about the taxpayer, including name, address, and Social Security number. |

| Line 1: Name | Enter your full legal name as it appears on your Social Security card. |

| Line 2: Address | Enter your current mailing address. |

| Line 3: City, State, ZIP | Enter the city, state, and ZIP code of your mailing address. |

| Line 4: Social Security Number | Enter your Social Security number without hyphens. |

| Part II: Credit for Child and Dependent Care Expenses | Calculates the amount of credit you can claim for child and dependent care expenses. |

| Line 5: Expenses | Enter the total amount of eligible child and dependent care expenses you paid during the year. |

| Line 6: Earned Income | Enter your earned income for the year. This includes wages, salaries, tips, and self-employment income. |

| Line 7: AGI | Enter your adjusted gross income (AGI) from your tax return. |

| Line 8: Percentage Used | Enter the percentage of expenses used to calculate the credit. The maximum percentage is 35%. |

| Line 9: Credit | This line shows the amount of credit you can claim based on your expenses, earned income, and AGI. |

Note: The sample form provided is for illustrative purposes only and may not reflect the latest version of the form.

Frequently Asked Questions about Form 2441

Got a few Qs about Form 2441? Don’t sweat it, mate. We’ve got you covered with this handy FAQ. Check it out and get the answers you need, blud.

Form 2441 can be a bit of a headache, but it’s important to fill it out correctly. Here are some of the most common questions people have about it, along with some quick and easy answers.

Who needs to file Form 2441?

- Anyone who receives a distribution from a qualified retirement plan, such as a 401(k) or IRA.

- Anyone who receives a distribution from an annuity contract.

When is Form 2441 due?

Form 2441 is due on April 15th of the year following the year in which you received the distribution.

Where can I get Form 2441?

You can download Form 2441 from the IRS website or you can request a copy by calling the IRS at 1-800-TAX-FORM (1-800-829-3676).

How do I fill out Form 2441?

You can find detailed instructions on how to fill out Form 2441 on the IRS website. You can also get help from a tax professional if you need it.

What happens if I don’t file Form 2441?

If you don’t file Form 2441, you may have to pay a penalty. The penalty is 10% of the amount of the distribution that you should have reported on the form.

FAQ Corner

What is the purpose of Form 2441?

Form 2441 is used to report the sale or exchange of certain assets, such as real estate, stocks, bonds, and other investments.

When do I need to file Form 2441?

You need to file Form 2441 if you sold or exchanged an asset that resulted in a gain or loss.

What are the consequences of not filing Form 2441?

Not filing Form 2441 when required can result in penalties and interest charges.

Where can I get help completing Form 2441?

You can find instructions and resources for completing Form 2441 on the IRS website or by consulting with a tax professional.