Printable Form 2290: A Comprehensive Guide for Enhanced Convenience and Accessibility

Navigating the complexities of tax and financial reporting can be daunting, but the availability of printable forms like Form 2290 offers a lifeline of convenience and accessibility. This comprehensive guide will delve into the significance, benefits, and intricacies of Printable Form 2290, empowering you to streamline your reporting processes with ease.

Printable Form 2290 is an IRS-issued document designed to simplify the reporting of excise taxes on heavy vehicles. By utilizing a printable version, you gain the flexibility to complete the form at your own pace, without the constraints of online or electronic platforms. The tangible nature of the printable form also allows for easy referencing and storage, ensuring your records are always at your fingertips.

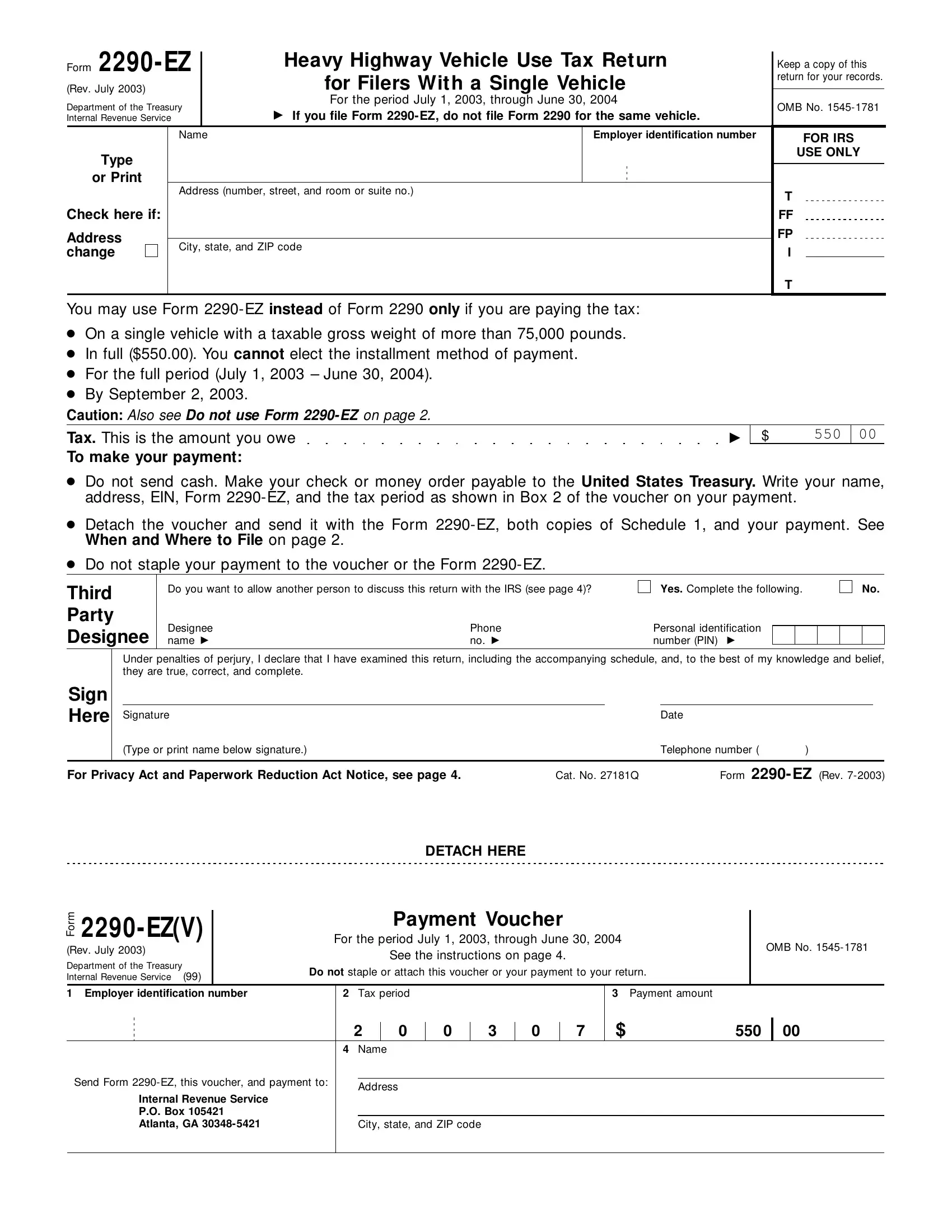

Overview of Printable Form 2290

Form 2290 is a crucial document used to report the use of certain heavy vehicles on public highways. It’s essential for businesses operating such vehicles to comply with the law and avoid hefty fines. Using a printable version of Form 2290 offers several advantages.

Printable Form 2290 allows businesses to fill out and submit the form manually, without the need for specialized software or online platforms. This can be particularly useful for companies that prefer traditional methods or have limited access to technology. Moreover, having a physical copy of the form serves as a tangible record of the information provided.

Importance of Using a Printable Version of Form 2290

- Convenience: Printable Form 2290 provides a simple and straightforward way to complete the form without the need for additional equipment or software.

- Accessibility: It ensures that businesses can comply with the reporting requirements regardless of their technological capabilities or internet connectivity.

- Physical Record: Having a physical copy of the form serves as a tangible record of the information submitted, which can be useful for future reference or audits.

Benefits of Using Printable Form 2290

Printable Form 2290 offers several advantages over its electronic or online counterparts. It provides unparalleled convenience and accessibility, making it a valuable tool for businesses and individuals alike.

Printability empowers users to complete and submit the form at their own pace, without the constraints of internet connectivity or software requirements. This flexibility allows for a seamless and efficient process, regardless of location or time constraints.

Enhanced Accessibility

The printable nature of Form 2290 ensures that it is accessible to a wider audience, including those with limited internet access or those who prefer a physical record for their records. This inclusivity makes it an ideal option for individuals and businesses that may not have the necessary technological resources.

Guide to Completing Printable Form 2290

Navigating the complexities of Printable Form 2290 can be a doddle with our step-by-step guide. Let’s break it down, innit?

Before you start, grab a pen and some bants. We’ll guide you through each section, giving you the lowdown on what to fill in and how to avoid any cock-ups.

Part 1: Taxpayer Information

- Name: Your full monty, please. First name, last name, and any middle names.

- Address: Where you hang your hat. Street, city, postcode, and country.

- SSN or ITIN: Your secret squirrel number. If you don’t have one, leave it blank.

- Daytime Phone Number: Your blower. Include the area code, innit.

Part 2: Tax Information

- Tax Year: The year you’re filing for. It’s usually the year before you’re filling in the form.

- Tax Type: The type of tax you’re paying. For Form 2290, it’s “Highway Use Tax”.

- Tax Period: The period you’re paying tax for. It’s usually a quarter or a year.

Part 3: Vehicle Information

- Vehicle Identification Number (VIN): Your motor’s unique code.

- Gross Vehicle Weight (GVW): How much your motor weighs when it’s fully loaded.

- Taxable Gross Weight (TGW): The GVW minus any exemptions.

- Mileage: How many miles your motor has clocked up since the start of the tax period.

Part 4: Tax Calculation

- Taxable Mileage: The mileage you’re paying tax on. It’s usually the total mileage minus any exempt miles.

- Tax Rate: The amount of tax you pay per mile.

- Tax Due: The total amount of tax you owe.

Tips for Avoiding Errors

- Double-check your info: Make sure everything you fill in is correct.

- Don’t leave anything blank: Fill in all the fields, even if you don’t have all the info.

- Use the instructions: If you’re stuck, check the instructions for help.

Sample and Templates of Printable Form 2290

Printable Form 2290 is readily available online, allowing users to download and customize it to meet their specific requirements.

This printable form provides a convenient and flexible way to complete and submit Form 2290, eliminating the need for manual completion and potential errors.

Downloadable Sample

To get started, you can download a sample of the printable Form 2290 from the official website. This sample provides a clear understanding of the form’s layout, sections, and required information.

Customizable Template

In addition to the downloadable sample, you can also access a customizable template that allows you to enter your specific information and generate a tailored Form 2290. This template simplifies the completion process and ensures accuracy.

Examples of Organization and Presentation

When completing the printable Form 2290, you have the flexibility to organize and present the information in a way that suits your needs. Here are some examples:

- Chronological Order: Arrange the information in the order in which the events or transactions occurred.

- Categorical Order: Group similar information together into categories, such as income, expenses, or assets.

- Importance Order: Prioritize the information based on its significance or relevance to the purpose of the form.

Applications and Use Cases of Printable Form 2290

Printable Form 2290 offers a convenient and efficient solution for various tax-related scenarios. It’s commonly used by businesses and individuals to streamline their tax reporting processes.

Businesses and Organizations

* Businesses that import or export goods

* Organizations involved in excise tax payments

* Companies seeking to claim tax refunds or credits

* Non-profit organizations filing for tax exemption

Individuals

* Taxpayers with self-employment income

* Individuals claiming deductions or credits related to excise taxes

* Travelers seeking a refund of excise taxes paid on goods purchased abroad

Industries and Sectors

* Manufacturing

* Transportation and logistics

* Retail and wholesale trade

* Hospitality and tourism

* Non-profit sector

Printable Form 2290 simplifies tax reporting, ensuring accuracy and timely submission. Its wide range of applications makes it a valuable tool for businesses and individuals alike.

Comparison with Other Forms

Printable Form 2290 stands out among similar forms due to its unique features and benefits. Compared to other alternatives, it offers a comprehensive solution for managing fuel tax reporting and compliance.

One key difference lies in its accessibility and convenience. Printable Form 2290 is readily available online, making it easy to download and print whenever needed. This eliminates the hassle of obtaining physical forms or waiting for mail delivery, ensuring timely filing and avoiding potential penalties.

Similarities and Differences

While Printable Form 2290 shares some similarities with other forms, it also has distinct advantages:

- Comprehensive Coverage: Printable Form 2290 covers a wide range of fuel tax reporting requirements, including heavy highway vehicle use tax, gasoline tax, and special fuels tax. This comprehensive approach simplifies the reporting process and reduces the need for multiple forms.

- Ease of Use: The form is designed with user-friendliness in mind. Its clear instructions and logical layout guide users through the reporting process, minimizing errors and ensuring accurate submissions.

- Flexibility: Printable Form 2290 offers flexibility in terms of filing options. It can be filed electronically or mailed to the IRS, providing users with the convenience of choosing the method that best suits their needs.

When to Use Printable Form 2290

Printable Form 2290 is the ideal choice for businesses and individuals who need to report fuel tax information accurately and efficiently. It is particularly suitable for those who:

- Operate heavy highway vehicles

- Purchase or use gasoline or special fuels

- Are unfamiliar with other fuel tax reporting forms

- Prefer a convenient and user-friendly reporting method

Design and Accessibility Considerations

Printable Form 2290 is meticulously designed with a focus on readability, usability, and inclusivity. It employs clear and concise language, avoiding jargon or technical terms that may hinder comprehension.

The form’s layout is structured to guide users seamlessly through each section, with ample space provided for legible handwriting or typing. High-contrast colours and well-defined typography ensure readability even for individuals with low vision.

Compatibility with Assistive Technologies

To enhance accessibility, Form 2290 is compatible with various assistive technologies. It supports screen readers, allowing visually impaired users to navigate and complete the form independently.

Additionally, the form’s digital format enables users to enlarge text, adjust font sizes, and utilise text-to-speech features for improved readability and comprehension.

Best Practices for Handling Printable Form 2290

Handling printable Form 2290 securely and effectively is crucial. Here are some best practices to follow:

Storing and Managing

- Store the form securely in a designated location, both physically and electronically.

- Maintain an organized system for filing and retrieving forms to ensure easy access.

- Limit access to authorized personnel only to protect sensitive information.

Data Security and Privacy

- Implement robust security measures to prevent unauthorized access, such as encryption and password protection.

- Regularly back up data to prevent loss or corruption.

- Comply with data protection regulations and guidelines to safeguard personal information.

Legal and Compliance

- Understand the legal requirements for handling the form, including retention periods and disposal methods.

- Ensure that the form is used for its intended purpose and not for any illegal or unethical activities.

- Maintain a record of all transactions related to the form for audit purposes.

Answers to Common Questions

Is Printable Form 2290 legally binding?

Yes, Printable Form 2290 is a legally recognized document and has the same validity as its electronic or online counterparts.

Can I use Printable Form 2290 for multiple vehicles?

Yes, you can use a single Printable Form 2290 to report excise taxes for multiple heavy vehicles. However, each vehicle must be listed separately on the form.

Where can I find a sample or template of Printable Form 2290?

You can download a sample or template of Printable Form 2290 from the IRS website or from reputable tax preparation software providers.

What are the common errors to avoid when completing Printable Form 2290?

Common errors include incorrect vehicle identification numbers, missing or incomplete information, and mathematical errors. Carefully review your form before submitting it to avoid any potential issues.

What is the deadline for filing Printable Form 2290?

The deadline for filing Printable Form 2290 is typically April 30th, but it may vary depending on the tax year and your specific circumstances. Consult the IRS website or a tax professional for the most up-to-date information.