Printable Form 1099-NEC: A Comprehensive Guide for Nonemployee Compensation Reporting

Navigating the complexities of tax reporting can be daunting, especially when it comes to nonemployee compensation. Form 1099-NEC plays a crucial role in ensuring accurate reporting of such payments, and this guide will provide you with a comprehensive overview of its purpose, completion process, and electronic filing options.

In this guide, we’ll delve into the intricacies of Form 1099-NEC, empowering you to fulfill your tax reporting obligations seamlessly. We’ll cover everything from understanding the purpose of the form to avoiding common mistakes, ensuring that you meet your tax compliance requirements with confidence.

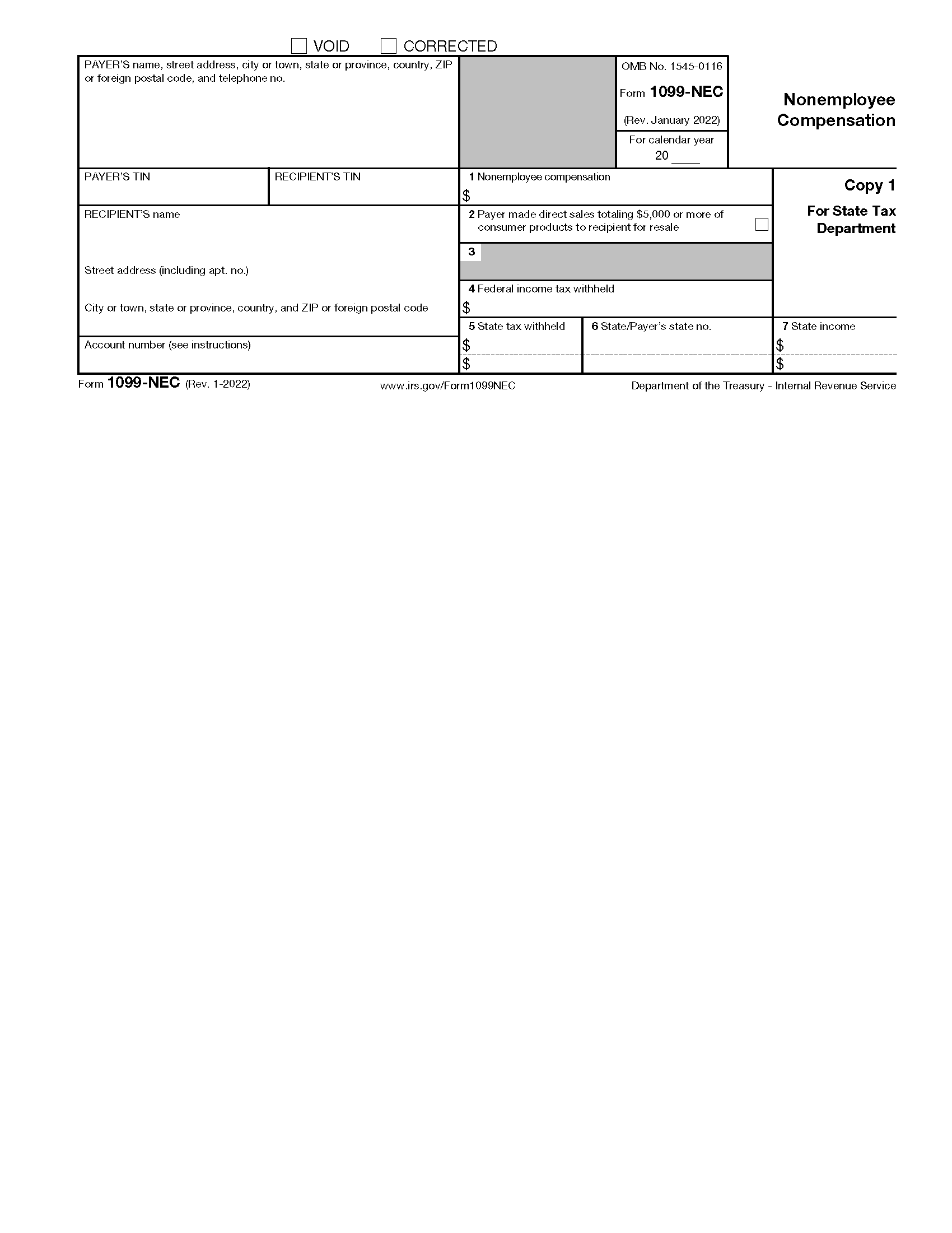

Printable Form 1099-NEC Overview

Blud, listen up! Form 1099-NEC is like a snitch that tells the taxman all about the bread you’ve made from gigging or freelancing. It’s a must-have for anyone who’s not on the payroll, innit?

Now, here’s the lowdown. If you’ve raked in over £400 in a tax year from self-employment, you’re gonna need to file this form. It’s like a legal requirement, fam. If you don’t do it on time, you could get stung with some hefty fines, so don’t be a doughnut.

Penalties for Not Filing Form 1099-NEC on Time

If you’re late with your Form 1099-NEC, the taxman ain’t gonna be happy. Here’s what you could be looking at:

- A £100 penalty for each month you’re late, up to a max of £500.

- A £1,000 penalty if you’re more than 60 days late.

So, don’t mess around with this, alright? Get your Form 1099-NEC filed on time, and avoid the hassle.

How to Fill Out Form 1099-NEC

Filling out Form 1099-NEC is straightforward. Follow these steps to ensure accuracy and completeness:

Payer Information

Enter the business name, address, and contact information of the payer (the person or entity making the payment).

Recipient Information

Provide the recipient’s name, address, and Taxpayer Identification Number (TIN). The TIN is typically a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses.

Income Information

Report the total amount of nonemployee compensation paid to the recipient in Box 1. This includes payments for services performed as an independent contractor or sole proprietor.

Tax Withholding Information

If any federal income tax was withheld from the payment, report the amount in Box 4. This information is used to determine the recipient’s tax liability.

Electronic Filing Options for Form 1099-NEC

Electronic filing is a convenient and efficient way to file your Form 1099-NEC. It’s also the fastest and most accurate way to file, as the IRS will automatically process your return.

There are a number of different software and services available for electronic filing. Some of the most popular options include:

Software and Services for Electronic Filing

- IRS e-file

- TaxSlayer

- H&R Block

- TurboTax

When choosing a software or service, it’s important to consider the following factors:

- Cost

- Ease of use

- Features

- Support

Once you’ve chosen a software or service, you can simply follow the instructions to file your Form 1099-NEC electronically.

Common Mistakes to Avoid When Filing Form 1099-NEC

Filling out Form 1099-NEC accurately is crucial to avoid penalties and ensure timely payments to contractors. Here are some common mistakes to watch out for and tips on how to avoid them:

Incorrect Payer or Recipient Information

- Double-check the accuracy of the payer’s and recipient’s names, addresses, and taxpayer identification numbers (TINs).

- Confirm that the TIN matches the recipient’s Social Security number (SSN) or Employer Identification Number (EIN).

- If the recipient is a non-US citizen, ensure you have their correct foreign tax identifying number.

Missing or Incorrect Income Information

- Ensure that all income paid to the recipient is reported accurately in Box 1, “Nonemployee Compensation.”

- Verify that the income amount matches the amount reported on the recipient’s Schedule C, Form 1040.

- If any backup withholding was applied, report it correctly in Box 4, “Federal Income Tax Withheld.”

Filing Deadlines

- File Form 1099-NEC by January 31st of the year following the tax year in which the payments were made.

- If you file electronically, the deadline is extended to March 31st.

- Late filing can result in penalties, so it’s important to meet the deadlines.

Consequences of Errors

Mistakes on Form 1099-NEC can lead to several consequences:

- Penalties for late or incorrect filing

- Delays in payments to contractors

- Confusion and potential audits by the IRS

By avoiding these common mistakes and following the tips provided, you can ensure accurate and timely filing of Form 1099-NEC.

Resources for Printable Form 1099-NEC

Get official guidance and downloadable forms for Form 1099-NEC from these reliable sources:

Official IRS Resources

- IRS website: https://www.irs.gov/forms-pubs/about-form-1099-nec

- Instructions for Form 1099-NEC: https://www.irs.gov/pub/irs-pdf/i1099nec.pdf

Printable Form 1099-NEC PDFs

- IRS Form 1099-NEC PDF: https://www.irs.gov/pub/irs-pdf/f1099nec.pdf

- Adobe Acrobat Reader (free download): https://get.adobe.com/reader/

Printable Form 1099-NEC Templates

- TaxBandits: https://www.taxbandits.com/forms/1099-nec/

- 1099-Forms: https://www.1099-forms.com/1099-nec/

- BlankForms: https://www.blankforms.org/1099-nec-form-printable/

Q&A

What is the purpose of Form 1099-NEC?

Form 1099-NEC is used to report payments made to nonemployees for services performed. It is essential for tracking and reporting income earned by independent contractors, freelancers, and other self-employed individuals.

Who is required to file Form 1099-NEC?

Businesses and individuals who have paid $600 or more to nonemployees for services rendered during the tax year are required to file Form 1099-NEC.

What are the penalties for not filing Form 1099-NEC on time?

Failure to file Form 1099-NEC on time can result in penalties, including fines and interest charges. It is crucial to meet the filing deadlines to avoid potential consequences.