Printable Form 1099: A Comprehensive Guide for Accurate Tax Reporting

Navigating the complexities of tax reporting can be a daunting task, but understanding and utilizing Printable Form 1099 can significantly simplify the process. This comprehensive guide will delve into the significance, benefits, and intricacies of Form 1099, providing you with the knowledge and tools to fulfill your tax obligations with precision and ease.

Printable Form 1099 serves as a crucial document for reporting income and expenses, facilitating accurate tax calculations and ensuring compliance with regulations. Its versatility extends to various industries, including freelancing, consulting, and small businesses, making it an indispensable tool for a wide range of professionals and organizations.

Introduction to Printable Form 1099

Yo, check it! Form 1099 is the biz when it comes to keeping track of your bread and butter. It’s like a receipt that tells the taxman how much you’ve earned from gigs that ain’t your main hustle.

There are different flavours of Form 1099, each one tailor-made for specific types of income. Let’s break ’em down, shall we?

Types of Form 1099

- Form 1099-NEC: This one’s for freelancers, independent contractors, and the self-employed crew. It covers payments for services you’ve rendered.

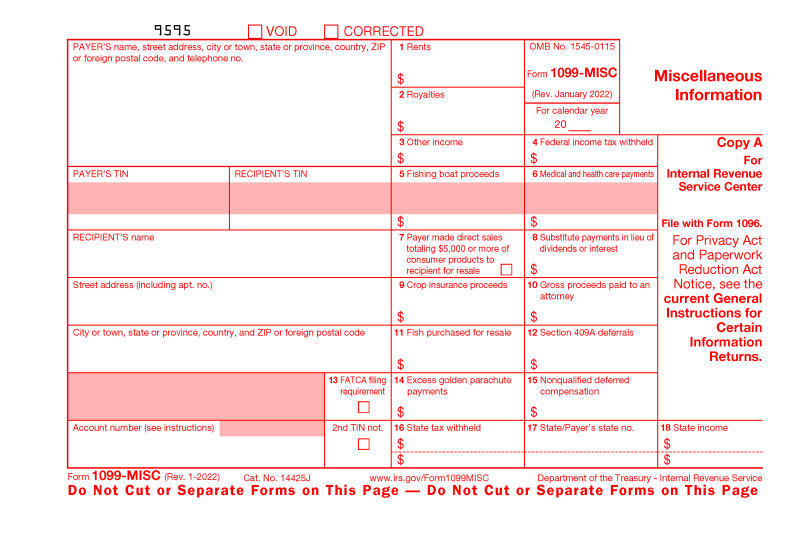

- Form 1099-MISC: This one’s more general and can be used for various types of income that don’t fit into the other categories, like prizes, awards, or royalties.

- Form 1099-DIV: If you’ve been raking in dividends from stocks or investments, this form’s got you covered.

- Form 1099-INT: This one’s for interest you’ve earned on savings accounts, bonds, and other investments.

- Form 1099-B: This form is for proceeds from broker transactions, like when you sell stocks or bonds.

Benefits of Using Printable Form 1099

Yo, bruv! Using a printable Form 1099 is like having a cheat code for tax season. It’s the OG way to report your earnings, and it’s still got plenty of perks.

Convenience

Printable forms are like having a personal assistant for your taxes. You can fill ’em out whenever and wherever, no need for an internet connection or fancy software. Just grab a pen and get to work, innit?

Cost-Effectiveness

Unlike them fancy electronic options, printable forms won’t cost you a bean. You don’t need no subscriptions or downloads, just some paper and ink. Plus, you can print multiple copies for free, so you’ve always got a backup.

Accuracy

Printable forms are like a safety net for your taxes. You can take your time to fill ’em out carefully, double-checking every detail. No more worries about typos or glitches messing up your return.

How to Obtain Printable Form 1099

Yo, getting your mitts on a printable Form 1099 is as easy as pie. First up, let’s suss out the IRS website.

Hit up this cheeky link and you’ll be knee-deep in a treasure trove of 1099 forms. Just click on the one you fancy, and presto, it’s yours for the taking.

But hold your horses, there’s more. You can also score a Form 1099 by sending a letter to the IRS or swinging by their office. Just make sure you’ve got a stamp and some spare time.

Requesting by Mail

Pen down your request and send it to:

Internal Revenue Service

Attn: Forms Distribution Center

P.O. Box 25866

Richmond, VA 23289

Visiting an IRS Office

Fancy a face-to-face? Find your nearest IRS office here and give ’em a visit.

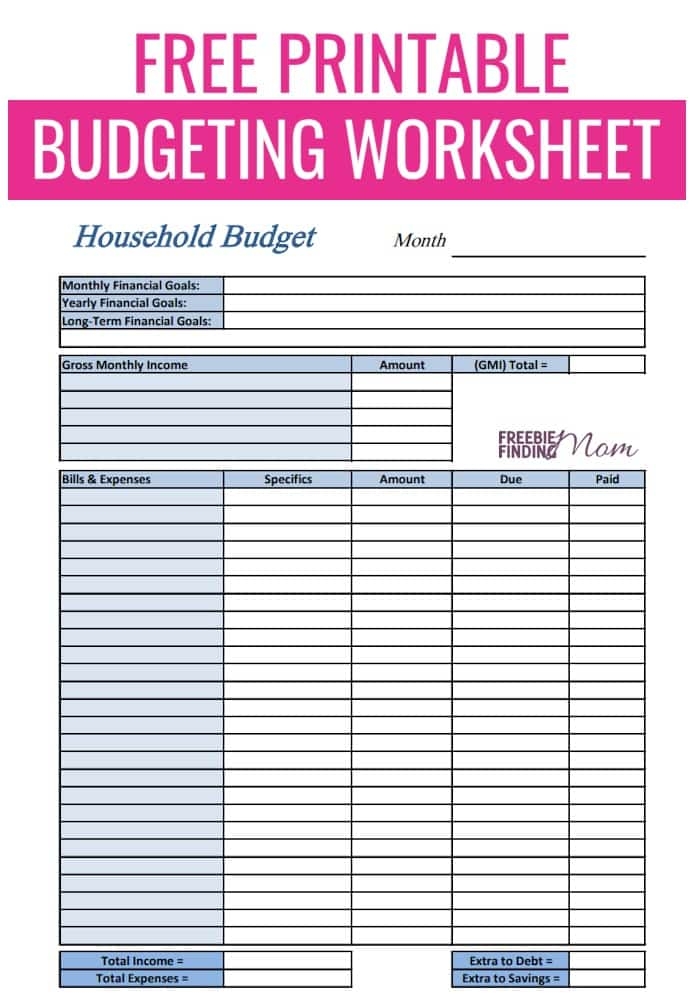

Filling Out Printable Form 1099

Filling out a printable Form 1099 is crucial for accurately reporting income earned from non-employee sources. Here’s a step-by-step guide to help you complete each section with ease.

Personal Information

- Enter your full name, address, and Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN) in the designated fields.

- Provide your occupation or business activity in the space provided.

Income Details

- Indicate the type of income you received, such as nonemployee compensation, dividends, or interest, by checking the appropriate box.

- Enter the total amount of income received from each source in the designated fields.

- If applicable, report any federal income tax withheld by the payer.

Other Relevant Data

- Include any additional information requested on the form, such as your account number or a description of the services provided.

- Review your entries carefully before signing and dating the form.

Tips for Accuracy

- Use the instructions provided with the form for specific guidance.

- Double-check all your entries for any errors or omissions.

- Keep a copy of the completed form for your records.

Filing Printable Form 1099

Filing your printable Form 1099 with the IRS is a crucial step in fulfilling your tax obligations. Here’s a comprehensive guide to help you navigate the process seamlessly:

Mailing Options

The traditional method of filing Form 1099 is by mail. You can download and print the form from the IRS website, fill it out, and mail it to the designated IRS address for your state. Ensure you mail your forms on time to avoid late filing penalties.

E-filing Options

For a faster and more convenient filing experience, consider e-filing your Form 1099. The IRS offers several e-filing options through its website or approved third-party vendors. E-filing allows you to transmit your forms electronically, saving you time and postage costs.

Filing Deadlines

The filing deadline for Form 1099 varies depending on the type of income being reported. For most types of income, the deadline is February 28th. However, if you file by mail, your forms must be postmarked by January 31st. It’s essential to adhere to these deadlines to avoid penalties and ensure timely processing of your forms.

Penalties for Late Filing

Filing your Form 1099 late can result in penalties from the IRS. The penalty amount depends on the length of the delay and the number of forms filed late. To avoid these penalties, prioritize filing your forms on time.

Using Printable Form 1099 for Tax Reporting

Printable Form 1099 is a valuable tool for tax reporting, allowing you to accurately report your income and expenses. It provides a clear and concise record of your financial transactions, making it easier to calculate your tax liability.

Reporting Income

Form 1099 is used to report various types of income, including:

– Wages and salaries

– Dividends

– Interest

– Royalties

– Prizes and awards

The information on Form 1099 is used to fill out your tax return, ensuring that you report all of your taxable income.

Calculating Taxes Owed

The information from Form 1099 is also used to calculate the taxes you owe. By subtracting your allowable deductions and credits from your total income, you can determine your taxable income. The tax rate applied to your taxable income will determine the amount of taxes you owe.

For example, if you earn £10,000 in wages and have £2,000 in allowable deductions, your taxable income is £8,000. If the tax rate is 20%, you would owe £1,600 in taxes.

Printable Form 1099 for Specific Industries

Many industries commonly use printable Form 1099, including freelancing, consulting, and small businesses. Here are some industry-specific tips and considerations for using printable Form 1099:

Freelancing

Freelancers often use Form 1099-MISC to report income from self-employment. When completing the form, be sure to include all income earned from freelancing, including payments from clients, royalties, and prizes. You should also include any expenses incurred in connection with your freelancing work, such as travel, equipment, and supplies.

Consulting

Consultants typically use Form 1099-NEC to report income from their consulting services. When completing the form, be sure to include all income earned from consulting, including fees, commissions, and bonuses. You should also include any expenses incurred in connection with your consulting work, such as travel, equipment, and supplies.

Small Businesses

Small businesses often use Form 1099-MISC to report income from independent contractors. When completing the form, be sure to include all payments made to independent contractors, including payments for services, labor, and materials. You should also include any expenses incurred in connection with your work with independent contractors, such as travel, equipment, and supplies.

Best Practices for Using Printable Form 1099

To ensure accuracy, security, and compliance when using printable Form 1099, it’s essential to follow best practices. These include organizing and storing data effectively, as well as taking steps to safeguard sensitive information.

By adhering to these best practices, you can minimize errors, protect against fraud, and meet your legal obligations.

Organizing and Storing Form 1099 Data

It’s crucial to organize and store Form 1099 data in a secure and efficient manner. This involves establishing a clear filing system, both physically and digitally, to ensure easy retrieval and protection of sensitive information.

- Create a dedicated filing cabinet or folder for physical copies of Form 1099.

- Use a digital filing system to store electronic copies of Form 1099.

- Implement a backup system to protect against data loss.

Safeguarding Sensitive Information

Printable Form 1099 contains sensitive information, such as taxpayer identification numbers and financial data. It’s essential to take steps to safeguard this information from unauthorized access or misuse.

- Limit access to Form 1099 data to authorized individuals only.

- Use encryption to protect electronic copies of Form 1099.

- Shred physical copies of Form 1099 before discarding them.

Q&A

What is the purpose of Form 1099?

Form 1099 is used to report income that you receive from sources other than your employer, such as self-employment income, dividends, or prizes.

How do I obtain a Printable Form 1099?

You can download a Printable Form 1099 from the IRS website or request one by mail.

What are the benefits of using a Printable Form 1099?

Using a Printable Form 1099 is convenient, cost-effective, and accurate. It allows you to complete the form at your own pace and make corrections as needed.

What are some best practices for using a Printable Form 1099?

When using a Printable Form 1099, it is important to be accurate, organized, and secure. Keep your forms in a safe place and make copies for your records.