Printable Form 1098: A Comprehensive Guide to Downloading, Filling, and Submitting

Navigating the complexities of tax season can be daunting, but understanding and utilizing essential forms like the Printable Form 1098 can significantly simplify the process. This comprehensive guide delves into the purpose, benefits, and intricacies of Form 1098, empowering you to confidently manage your tax obligations.

Form 1098 serves as a crucial document in reporting mortgage interest, mortgage insurance premiums, and other related expenses. By leveraging printable forms, you gain the flexibility and convenience of completing and submitting Form 1098 at your own pace and from the comfort of your own space.

Introduction to Printable Form 1098

Yo, check it, Form 1098 is like a secret weapon for tax season. It’s a form that tells you how much money you made from mortgages, student loans, and other types of loans during the year. It’s like a cheat code for filing your taxes, blud.

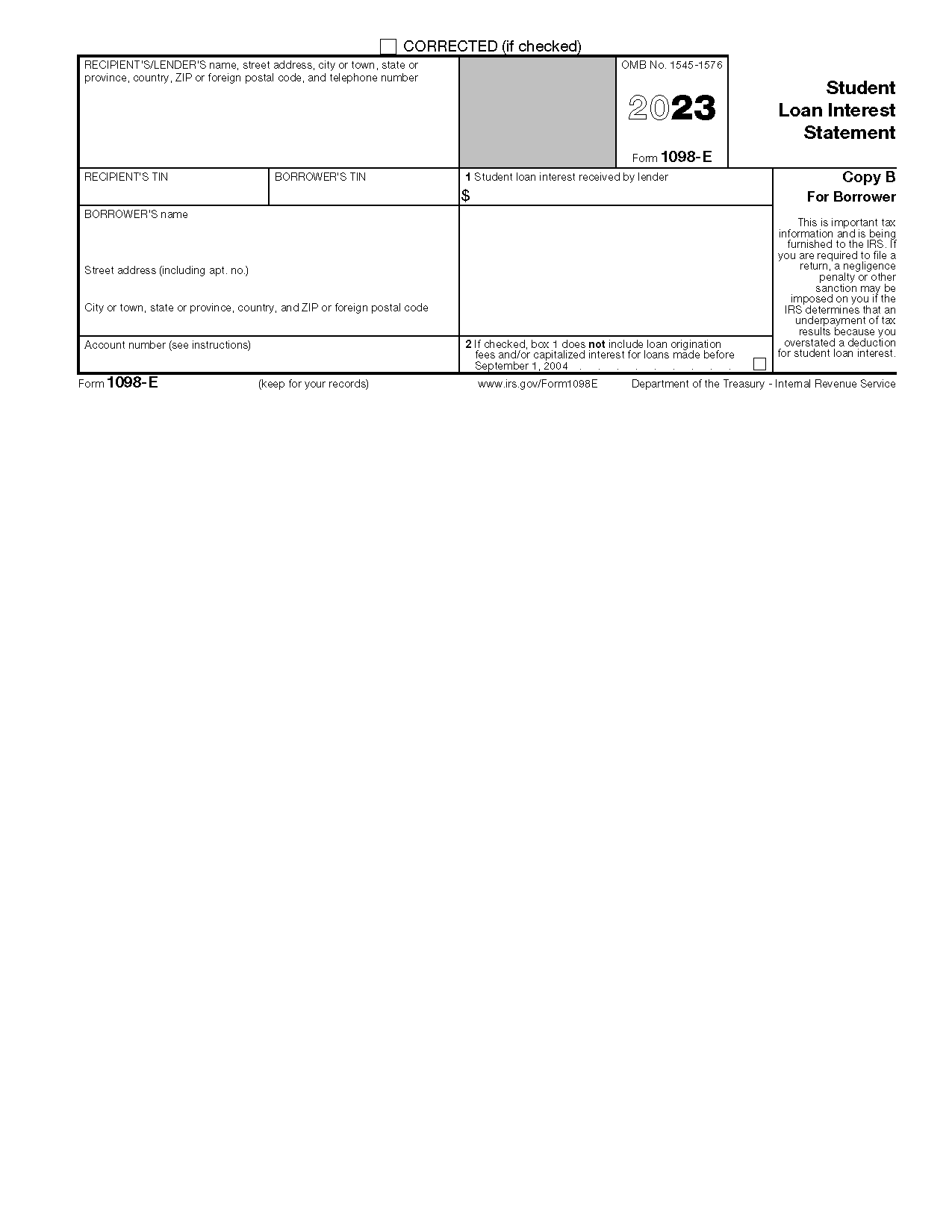

There are a few different types of Form 1098, depending on the type of loan you have. The most common one is Form 1098-INT, which is for interest on mortgages. There’s also Form 1098-T for student loans and Form 1098-E for student loan interest. Don’t worry, you’ll get the right one for your situation.

Form 1098 has all the info you need to file your taxes, like the amount of interest you paid, the amount of principal you paid, and the name and address of the lender. It’s like a one-stop shop for all your tax-related loan info.

Benefits of Using Printable Form 1098

Yo, check it, using a printable Form 1098 is like the bomb diggity! It’s a game-changer, innit? Here’s the lowdown on why it’s the mutt’s nuts:

Convenience and Accessibility

These forms are like your mate that’s always there for you. You can print ’em off whenever, wherever. No need to faff about with waiting for the post or going to some stuffy office. Plus, you can fill ’em out at your own pace, no rush, no fuss.

Time and Effort Saver

Printable forms are a total lifesaver when it comes to saving time and hassle. You don’t have to waste precious hours filling out online forms or trying to decipher your messy handwriting. Just print it out, fill it in, and boom, you’re sorted!

s for Downloading and Printing Form 1098

Sorted, fam! Grabbing and printing Form 1098 is a doddle. Here’s the lowdown:

Download Form 1098

First off, you need to nick the form from the right gaff. Here’s where you can get it:

- IRS website: Head over to the official IRS website and search for “Form 1098.” It’s a cinch to find.

- Tax software: If you’re using tax software, it’ll likely have Form 1098 built in. Just fire it up and search for it.

Print Form 1098

Now that you’ve got the form, let’s get it on paper:

- Choose the right printer: Make sure your printer is up for the job. You’ll need one that can handle letter-sized paper.

- Load the paper: Pop some letter-sized paper into your printer. Make sure it’s facing the right way.

- Open the form: Find the Form 1098 file on your computer and open it.

- Print preview: Before you hit print, check the preview to make sure everything looks kosher.

- Print: Click the print button and wait for your fresh Form 1098 to roll out.

Troubleshooting

If you’re having any dramas printing your form, here’s a few things to try:

- Check your printer settings: Make sure your printer is set to the correct paper size and orientation.

- Try a different browser: Sometimes, different browsers can cause printing issues. Give another one a whirl.

- Contact your printer manufacturer: If all else fails, reach out to the manufacturer of your printer. They might have some wizardry to fix it.

Filling Out Form 1098

Filling out Form 1098 is straightforward, just follow these steps to complete it accurately:

Step 1: Gather your documents. You’ll need your mortgage interest statement and property tax statement.

Step 2: Fill out the top section. This includes your name, address, and Social Security number.

Step 3: Fill out Part I. This section is for mortgage interest. Enter the amount of interest you paid on your mortgage during the year.

Step 4: Fill out Part II. This section is for property taxes. Enter the amount of property taxes you paid during the year.

Step 5: Fill out Part III. This section is for other expenses. Enter any other expenses that you can deduct on your taxes, such as mortgage insurance premiums or private mortgage insurance.

Step 6: Sign and date the form. Once you’ve filled out the form, sign and date it.

Submitting Form 1098

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at1.57.10PM-ab1915c984414b79910a4cbaf41b8003.png?w=700)

Blud, you’ve filled out your Form 1098, now it’s time to get that bad boy submitted. There are a few ways you can do this, so let’s break it down, innit.

First off, you can post it to the taxman like a proper geezer. Make sure you get it in the postbox before the deadline, bruv. Or, if you’re feeling techy, you can e-file it online. It’s a doddle, trust me.

Importance of Timely Submission

Listen up, don’t be a doughnut and miss the deadline. If you do, you could get hit with some hefty fines, man. The taxman doesn’t mess around, so get it sorted ASAP.

Additional Information

If you’re still stuck or have any Qs, there’s a bunch of resources out there. Check out the taxman’s website or give ’em a bell. They’re usually pretty sound at helping out.

Additional Considerations

In certain situations, special circumstances or exceptions may apply when dealing with Form 1098. It’s crucial to be aware of these to ensure accurate and timely filing.

Additionally, various online tools and resources are available to assist you in completing Form 1098. These resources can provide guidance, clarify any complexities, and streamline the process.

Availability of Online Tools and Resources

- The Internal Revenue Service (IRS) website offers a comprehensive online platform with detailed instructions, FAQs, and downloadable forms.

- Tax software providers often include features specifically designed for Form 1098, simplifying calculations and ensuring accuracy.

- Professional tax preparers can provide personalized assistance, ensuring your Form 1098 is completed correctly and submitted on time.

FAQ

What is the purpose of Form 1098?

Form 1098 is used to report mortgage interest, mortgage insurance premiums, and other related expenses to the Internal Revenue Service (IRS) and the taxpayer.

Who is responsible for providing Form 1098?

Mortgage lenders are responsible for providing Form 1098 to borrowers by January 31st of each year.

What information is included on Form 1098?

Form 1098 includes information such as the borrower’s name, address, loan amount, interest paid, and mortgage insurance premiums paid.

How do I download and print Form 1098?

You can download Form 1098 from the IRS website or from your mortgage lender’s website. Once downloaded, you can print the form using a standard printer.

Where can I find additional support or guidance for Form 1098?

You can find additional support or guidance for Form 1098 from the IRS website, your mortgage lender, or a tax professional.