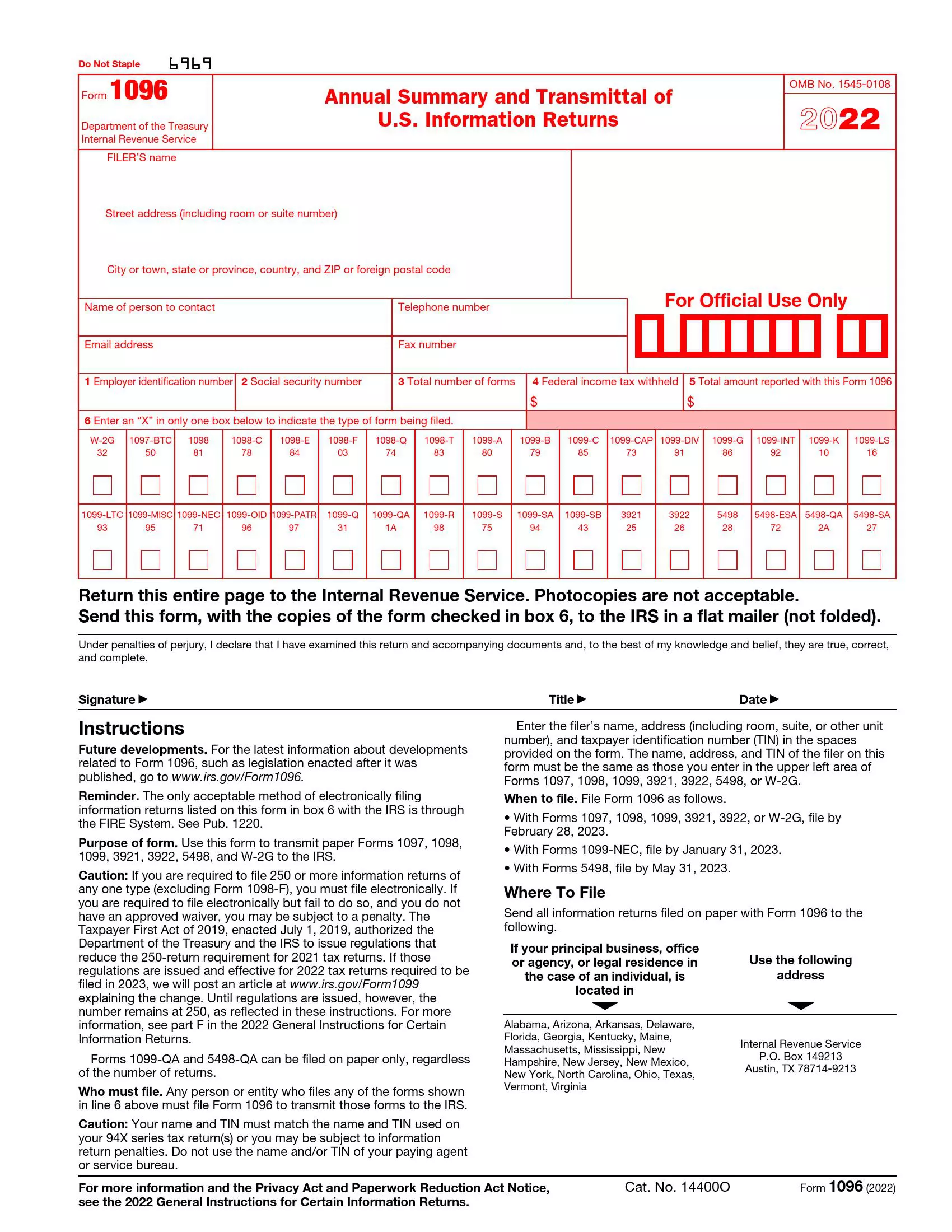

Printable Form 1096: A Comprehensive Guide for Taxpayers

Form 1096, also known as the Annual Summary and Transmittal of U.S. Information Returns, plays a crucial role in tax reporting. This document serves as a summary of various income types reported on Forms 1099, 1098, 5498, and W-2G. In this comprehensive guide, we will delve into the purpose, accessibility, and intricacies of Printable Form 1096, ensuring that you have a thorough understanding of its significance and how to navigate its completion and filing.

Whether you’re a seasoned taxpayer or new to the world of tax reporting, this guide will provide you with the necessary information to accurately and efficiently complete Printable Form 1096. We will explore the types of income reported on this form, provide step-by-step instructions for filling it out, and highlight common mistakes to avoid. By the end of this guide, you will have a firm grasp on the purpose and process of Printable Form 1096, empowering you to fulfill your tax reporting obligations with confidence.

Definition and Purpose of Printable Form 1096

Yo, listen up, cuz Form 1096 is a sick tax form that gives the lowdown on all the bread you’ve made from interest, dividends, and other investments. It’s like a cheat sheet for the taxman, innit?

This form is like a whistleblower, telling the taxman exactly how much you’ve earned from your investments. It covers everything from interest on your savings account to dividends from your stocks and bonds. So, make sure you’ve got it sorted, or the taxman might come knocking.

Accessing and Downloading Printable Form 1096

If you’re a right geezer who needs to get your mitts on a printable copy of Form 1096, here’s the blag.

Official Sources for Downloading Form 1096

Blag your form from the following legit sources, mate:

- IRS website: Head to the Internal Revenue Service (IRS) website, the official hub for all things tax-related. Search for “Form 1096” and download the latest version.

- Free File Alliance: This alliance of tax software providers offers a free, downloadable version of Form 1096. Check their website for details.

- Tax preparation software: If you’re using tax prep software, you can usually download Form 1096 directly from the program.

Completing Printable Form 1096

Filling out Printable Form 1096 is a breeze, bruv. Here’s a step-by-step guide to make it a doddle:

Each field on the form is crucial, so pay close attention to the deets:

Part I – Annual Summary

Kick off by filling in your personal info, including your name, address, and phone number. Then, enter the year for which you’re filing the form.

Part II – Income Information

- Box 1: Gross Proceeds Paid to Attorney – Blag the total amount of moolah you paid to lawyers.

- Box 2: Attorney Fees – Spill the beans on how much you splashed out on attorney fees.

- Box 3: Other Payments – Dish the dirt on any other payments you made, like court costs or expert witness fees.

- Box 4: Federal Income Tax Withheld – Cough up the amount of tax the feds nicked from you.

Part III – Identity of Recipient

Now, let’s get the lowdown on the recipient. Enter their name, address, and Social Security number or Taxpayer Identification Number.

Part IV – Certification

Finally, put your John Hancock on the form and sign it. Don’t forget to include the date.

Common Mistakes to Avoid When Completing Form 1096

Filling out Form 1096 requires accuracy to ensure correct reporting of nonemployee compensation. Here are some common pitfalls to watch out for:

Misidentifying Recipients

- Failing to include all individuals who received nonemployee compensation, such as independent contractors or freelancers.

- Mistakenly reporting nonemployees as employees, leading to incorrect withholding and tax calculations.

Incorrect Reporting of Payments

- Omitting payments made to nonemployees, resulting in underreporting of income and potential penalties.

- Double-counting payments already reported on other forms, causing overreporting of income.

Missing or Incomplete Information

- Failing to provide complete recipient information, such as their name, address, and Taxpayer Identification Number (TIN).

- Leaving out essential details about the nature of the services provided or the amount paid.

Filing Errors

- Submitting the form late, potentially resulting in penalties or interest charges.

- Filing the form with the wrong agency, such as the IRS instead of the Social Security Administration (SSA).

Filing Printable Form 1096

Submitting your completed Form 1096 is crucial to ensure the accuracy and timely processing of your health insurance information. There are several filing options available, each with its own advantages and requirements.

The most common and convenient method is to file electronically through the IRS website or an authorized e-filing provider. This option allows for faster processing and reduces the risk of errors.

Paper Filing

If you prefer to file a paper return, you can mail the completed Form 1096 to the IRS address specified in the instructions. Paper filing typically takes longer to process and may be subject to delays.

Electronic Filing

Electronic filing is the preferred method for submitting Form 1096. It is faster, more accurate, and more secure than paper filing. You can file electronically through the IRS website or an authorized e-filing provider.

- IRS website: You can file Form 1096 electronically through the IRS website using the FIRE (Filing Information Returns Electronically) system.

- Authorized e-filing provider: You can also use an authorized e-filing provider to file Form 1096 electronically. These providers offer a variety of services, including software and support, to help you complete and file your return.

Consequences of Late or Incorrect Filing of Form 1096

Filing Form 1096 accurately and on time is crucial. Failure to do so can result in penalties and other consequences.

Inaccuracies or delays in filing can lead to:

Penalties

– Monetary fines imposed by the IRS

– Interest charges on unpaid taxes

– Penalties for each incorrect or missing form

Reputational Damage

– Negative impact on the business’s reputation

– Loss of trust from customers and partners

Legal Consequences

– Criminal charges in severe cases of willful neglect or fraud

FAQ Summary

Where can I download a printable copy of Form 1096?

You can download a printable copy of Form 1096 from the official IRS website (www.irs.gov) or through tax software providers.

What types of income are reported on Form 1096?

Form 1096 summarizes income reported on Forms 1099 (dividends, interest, nonemployee compensation, etc.), 1098 (mortgage interest), 5498 (IRA contributions), and W-2G (gambling winnings).

What are the consequences of filing Form 1096 late or incorrectly?

Filing Form 1096 late or incorrectly may result in penalties and interest charges imposed by the IRS.

Can I file Form 1096 electronically?

Yes, you can file Form 1096 electronically using IRS-approved e-file providers.

What is the deadline for filing Form 1096?

The deadline for filing Form 1096 is February 28th (March 31st if filing electronically) for the previous calendar year.